Chinese automakers announce 2023 annual sales targets

Despite multiple headwinds facing the automotive industry, many Chinese automotive groups managed to outpace China’s overall industry in 2022 sales.

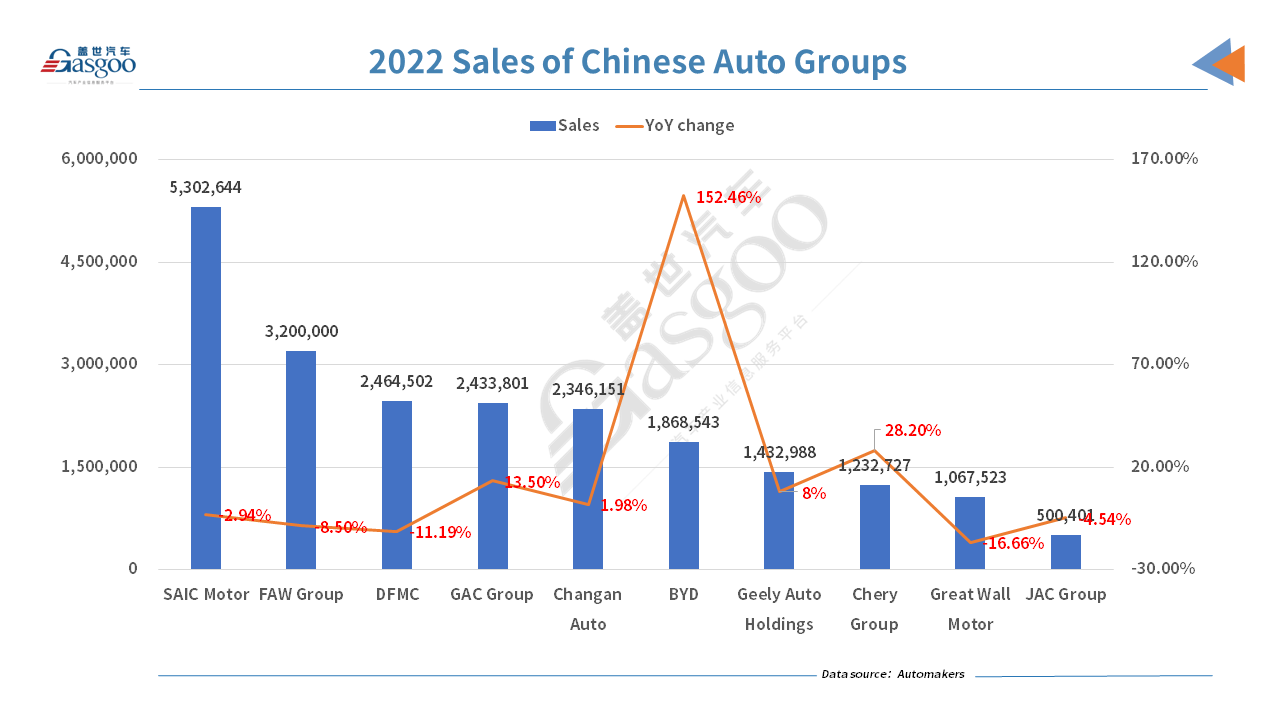

According to the China Association of Automobile Manufacturers (CAAM), the biggest vehicle market in the world sold 26.864 million vehicles last year, representing a growth of 2.1% from a year earlier.

Major local new energy vehicle (NEV) startups all grew much faster than the average, even though some companies’ growth slowed down. Among the top five startups, Hozon Auto, which owns NETA brand, and Leapmotor showed a blistering pace with three-digit increase. The other three also boasted a respective sales jump of over 20%.

2022 sales changes of legacy Chinese auto groups were mixed. BYD’s sales soared over 150% in 2022 while Great Wall Motor saw an annual sales decrease of 17% versus the previous year. SAIC Motor remained the most sold automaker in the market last year, but its annual sales fell by 3% year on year. GAC Group and Chery Group also achieved double-digit growth.

BYD was an obvious winner last year with 1.87 million NEVs sold in total, outnumbering Tesla and overfulfilling its annual sales target, 1.5 million, as well. The whole year saw the company’s sales break records continuously. BYD’s monthly sales achieved the milestone of 100,000 units for the first time in March, surging to over 200,000 in September before closing the year with 235,200 units sold in the last month.

BYD’s embrace of vertical integration, which differentiated it from other rivals, was the main reason behind its explosive sales growth, analysts of ZXZC Auto Research Institute said. On the one hand, the approach helps to guarantee vehicle deliveries with self-supplied parts when the industry-wide supply chain is disrupted. On the other hand, vertical integration will bring cost competitiveness when raw material price fluctuates for BYD masters certain core technologies of NEVs.

Great Wall Motor failed to achieve its 2022 annual sales target. As to the reasons, apart from industry-wide challenges such as COVID-19 and supply chain issues, the sales suspension of the Black Cat and the White Cat from the ORA brand was also contributing to the loss.

On the list ZXZC compiled, BYD was the only established automaker which realized its annual sales target of 1.5 million units. Among the startups, only Hozon sold more vehicles than expected (150,000). GAC Toyota, the joint venture between Japanese automaker Toyota Motor and GAC Group, also accomplished its sales goal with 1,005,000 sold in the year.

Since some automakers were unable to realize sales target in 2022, they seem more realistic in this year’s sales target.

GAC Group is perhaps the most conservative in sales forecast. The Guangzhou-based group said it expects annual sales of this year to go up by 10% year over year, lower than the 15% target and the 13.5% growth of last year. Based on the group’s 2022 sales volume, we can know that the group is expected to sell nearly 2.68 million vehicles in 2023.

FAW Group has set up an annual sales goal of 4 million units for this year, which represents a growth of 25% when compared with 2022 sales. What’s more, the volume is also dropping from the target of 2022, which stood at 4.1 million units.

Dongfeng Motor Corporation (DFMC) aims to sell 3.5 million vehicles this year, indicating a jump of 42.3%, an ambitious target for the automaker whose 2022 sales declined 11% versus the previous year.

Among those private automakers, Geely Automobile Holdings maintained its 2022 sales target of 1.65 million, which it didn’t realize last year. The volume will be 15% higher than the company’s 2022 annual sales, surpassing the 8% rise of last year.

Great Wall Motor has lowered its annual sales target from 2.8 million units to 1.6 million units. Last year, the automaker has carried out numerous adjustments in brands, integrating the organizations and channels of ORA, WEY, and Tank, while enhancing the branding of Haval.

The whole industry is waiting to see BYD’s 2023 sales target, but the company itself hasn’t announced any number yet. The Warren Buffett-backed NEV maker said it is not easy to give an outlook, citing various uncertainties in market, demand, and supply system, as a response to the report that the automaker targets annual sales of 4 million units.

Startups are always ambitious in their future, including their sales target. After the five major startups joined the 100,000 annual sales club, they start to aim for 200,000 annual sales landmark.

XPeng Motors needs to achieve a total cumulative sales volume of 450,000 by the end of this year, He Xiaopeng, its Chairman and CEO said in an internal email. As of December 31, 2022, the company’s total cumulative deliveries had reached 258,710, meaning it aims to deliver 191,290 vehicles this year. That is a growth of nearly 60% from a year ago.

NIO didn’t provide a specific sales goal. But Li Bin, the company’s founder, chairman and CEO once said in an interview at the end of last year that his company wants to overtake Lexus in 2023. According to the Japanese brand, its sales in China amounted to 227,000 units in 2021. So we can imagine the startup expects to sell more than 200,000 vehicles this year as well.

Hozon Auto aims to win again the sales championship among all startups in 2023. Last year, the automaker sold the most vehicles with deliveries at 152,073 units. This year, it wants to nearly double its annual sales with a target of 300,000 vehicles.

Li Auto is another automaker which hasn’t announced annual sales target. But on the first workday after the Spring Festival, the startup said in a letter to staff members that it aims to be a global leader in artificial intelligence by the year 2030. In the first month of this year, the Beijing-based automaker delivered over 15,000 vehicles, the most among startups and the only one having year-over-year growth among the five major startups.