China's locally-made PV retail sales drop MoM, YoY in Jan. 2023

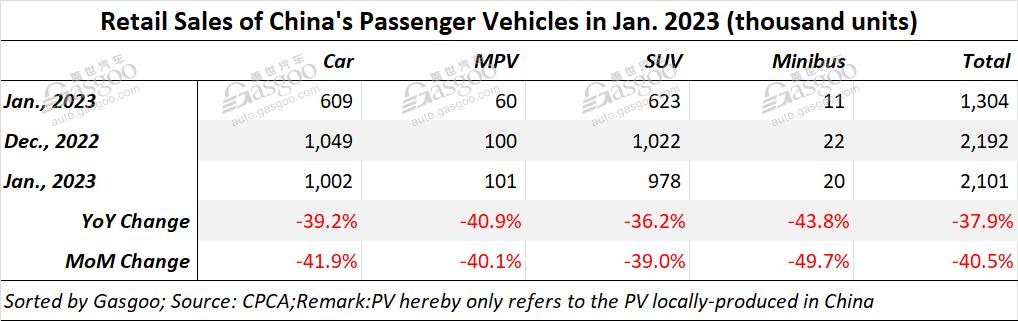

Shanghai (ZXZC)- China's passenger vehicle (PV) retail sales amounted to 1.304 million units in Jan. 2023, sliding 37.9% from the previous year, while also tumbling 40.5% from the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the passenger vehicles hereby refer to the cars, SUVs, MPVs, and minibuses locally produced in the world's largest auto market.

The YoY and MoM decline in China’s Jan. PV retail sales were in line with the industry forecast as both the New Year’s Day and Chinese Lunar New Year holiday fell in the past month.

Despite the overall downturn, the CPCA still noted that the oil-fuel vehicle sales favorably picked up in mid-Jan. partly thanks to the moderate release of consumers’ shopping demands as a result of the travel peak during the Spring Festival holiday and the continuation of local governments’ incentives.

With the decline of international oil prices, some new energy vehicle companies issued price cuts and rolled out a slew of sales promotion measures, contributing to the automotive market recovery as well.

The association also added the conventional fuel-burning vehicle market (excluding new energy vehicles) was still under a high pressure in Jan. after the withdrawal of car purchase tax reduction.

In Jan. 2023, the retail sales of oil-fueled vehicles in China amounted to roughly 960,000 units, sliding 44% and 37% year on year and month on month, respectively.

The CPCA commented that it is currently necessary to boost the consumption confidence of lower-/mid-income earners, who incline to choose an oil-fueled vehicle as their first car. Thus, the association suggests that policies still need to be tilted more towards energy-saving vehicles, and the best balance should be sought between economic effect and environmental protection requirements.

In Jan., many mainstream automakers in China stepped up sales promotion to make up for the coronavirus-led sales loss and strive for the best sales results under their expectations in early 2023.

There were around 190,000 luxury PVs retailed across China last month, representing a 36% year-on-year decline and a 28% month-on-month dip.

Chinese indigenous PV brands recorded a combined retail sales volume of 640,000 units in Jan., which was 31% and 40% fewer than that of the year-ago and month-ago periods, respectively.

The CPCA's data show that China's local brands accounted for 49.4% of the country's total PV retail volume last month, 4.3 percentage points higher than the prior-year level.

With about 470,000 PVs delivered last month, mainstream joint ventures in China posted a 45% decline both year-on-year and month-on-month.

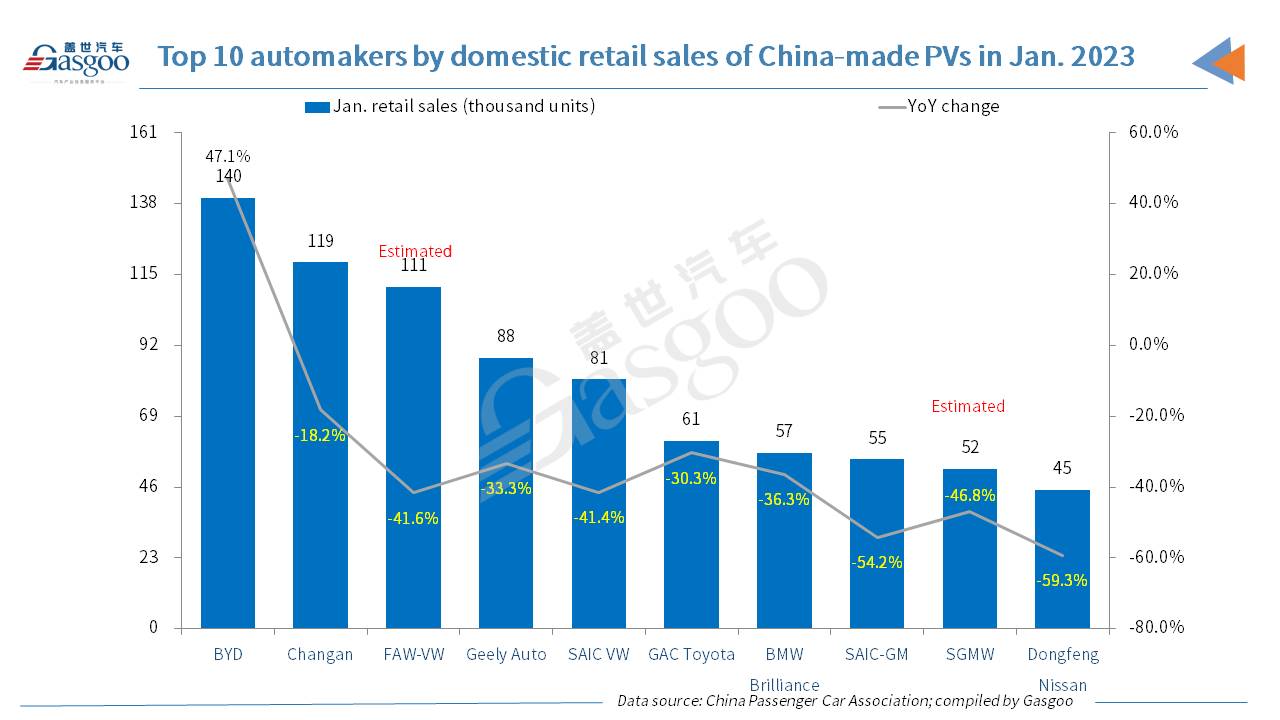

Among the top 10 automakers by Jan. PV retail sales in China, BYD ranked highest in terms of sales volume and was also the only one to record a year-on-year growth. BMW Brilliance moved up to the 7th place.

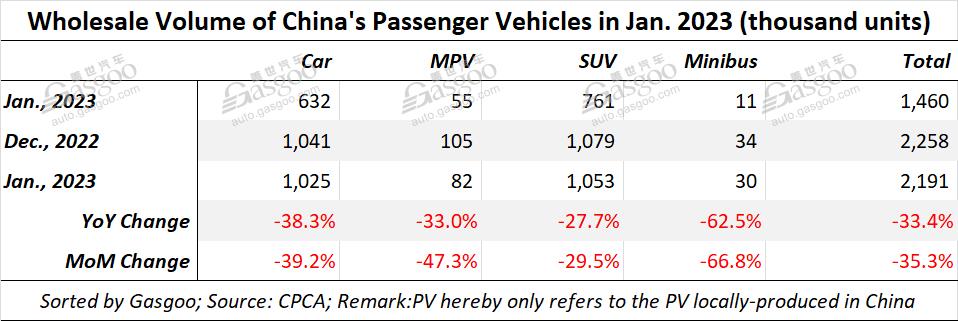

China's monthly PV wholesale volume reached 1.46 million units last month, falling over 30% both year on year and month on month.

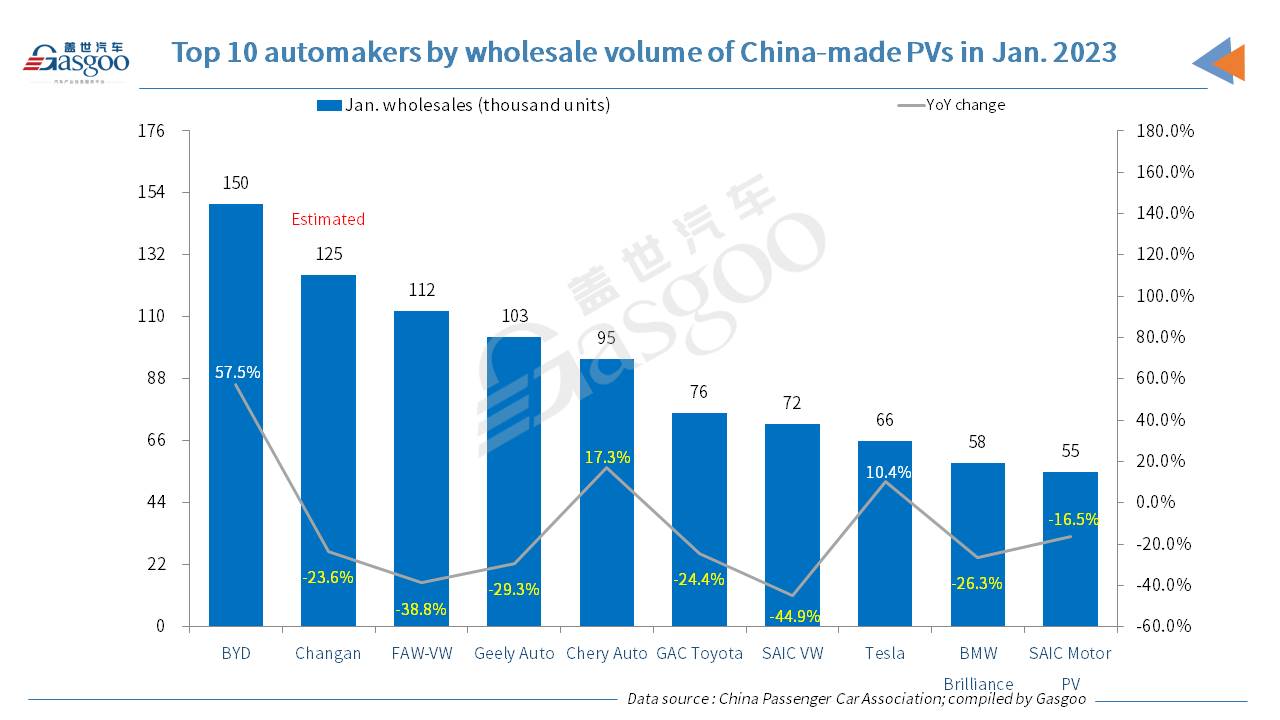

With regard to the PV wholesale volume in Jan., BYD outshone other automakers with a wholesale volume of around 150,000 units. Among the top 10 automakers, BYD and Tesla were the only two to face a year-on-year upward movement.

According to the data compiled by the CPCA, China's passenger vehicle export volume (including complete vehicles and CKDs) amounted to 230,000 units last month, leaping 34% from a year earlier, but dwindling 13% from the previous month.