China's locally-made PV retail sales drop 9.5% YoY in Nov. 2022

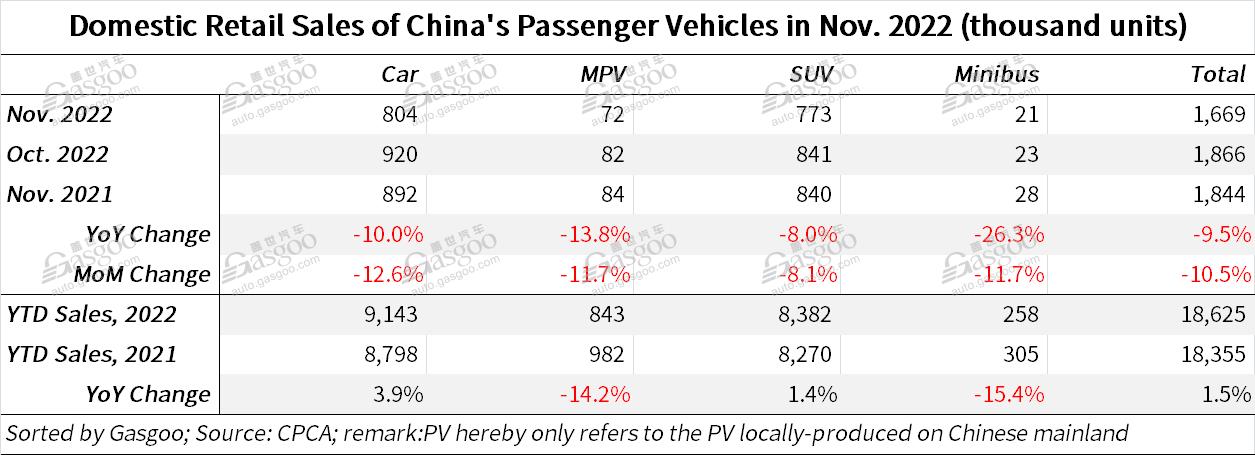

Shanghai (ZXZC)- In Nov. 2022, China's passenger vehicle (PV) retail sales amounted to 1.669 million units, sliding 9.5% compared to the previous year, while also dipping 10.5% from the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the passenger vehicles hereby refer to the cars, SUVs, MPVs, and minibuses locally produced in the world's largest auto market.

The association said there were some tailwinds in last month's PV market such as ample inventories of retail channels and the gradual elimination of the year-ago chip shortage impact.

Nevertheless, the traditional oil-fueled vehicle market is still saddled with quite a high pressure. Last month, there were around 1.05 million oil-fueled PVs retailed across China, representing a year-on-year drop of 27% and a month-on-month dip of 18%. For the first eleven months of 2022, China's retail sales of traditional internal combustion engine vehicles shrank 14% over a year earlier to roughly 13.34 million units.

The CPCA commented that the car consumption demands from lower-/mid-income earners, who incline to choose an oil-fueled vehicle as their first car, remain to be further unleashed. Thus, the association suggests that the government should provide greater policy supports for the consumption of oil-fueled vehicles.

In Nov., many mainstream automakers stepped up sales promotion to make up for the coronavirus-led sales loss and strive to fulfill their annual sales targets, the CPCA added.

There were around 240,000 luxury PVs retailed across China in Nov., representing a 13% year-on-year growth and a 15% month-on-month increase. The car purchase tax cut served as one of the major contributing factors to the premium car shopping.

Chinese indigenous PV brands recorded a combined retail sales volume of 870,000 units in Nov., which was 5% more than that of the year-ago period, while 7% fewer than the previous month.

The CPCA's data show that China's local brands accounted for 53.4% of the country's total PV retail volume in Nov., 7.1 percentage points higher than the prior-year level.

With about 540,000 PVs delivered last month, mainstream joint ventures in China posted a year-on-year decline of 31%, while also logged a month-on-month dip of 23%.

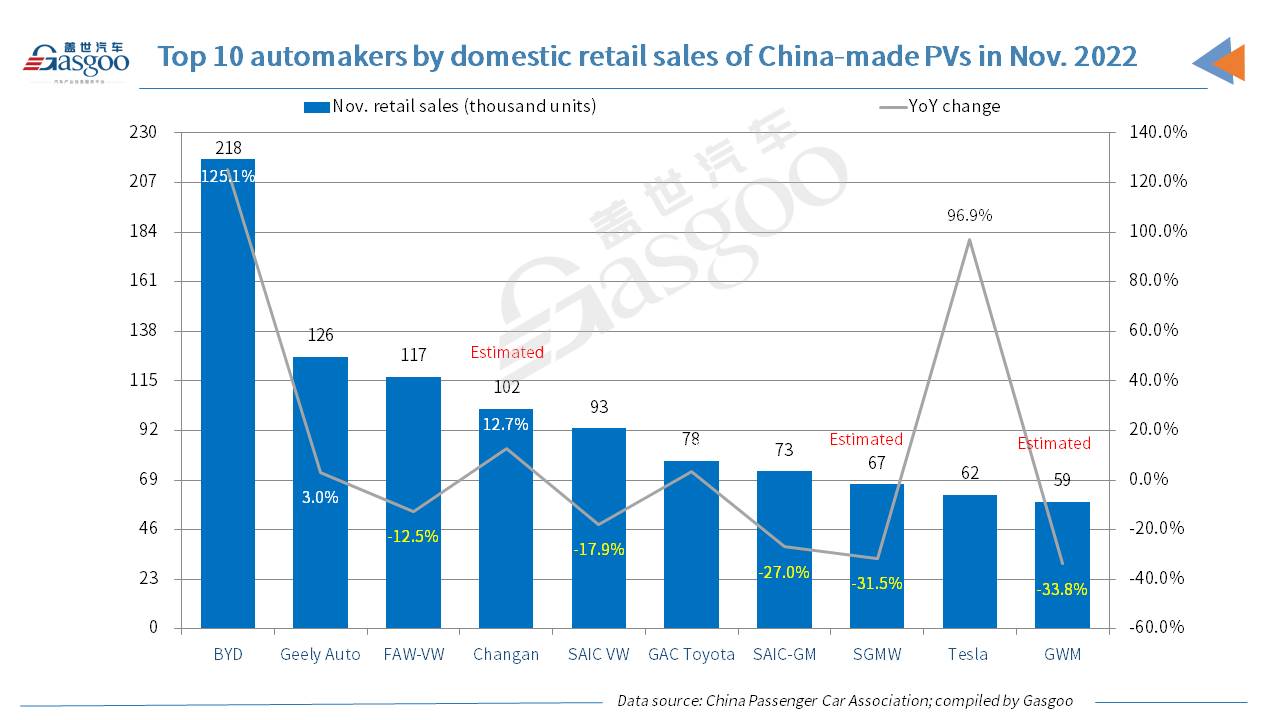

Among the top 10 automakers by Nov. PV retail sales, five companies—FAW-Volkswagen, SAIC Volkswagen, SAIC-GM, SAIC-GM-Wuling (“SGMW”), and Great Wall Motor ("GWM")—faced a downward movement year-over-year. BYD ranked highest in terms of both sales volume and sales growth. Besides, Tesla moved up to the ninth place with a precipitous year-on-year hike of 96.9%.

China's monthly PV wholesale volume reached 2.056 million units in Nov., falling 6.2% year on year, while also dropping 7.5% month on month.

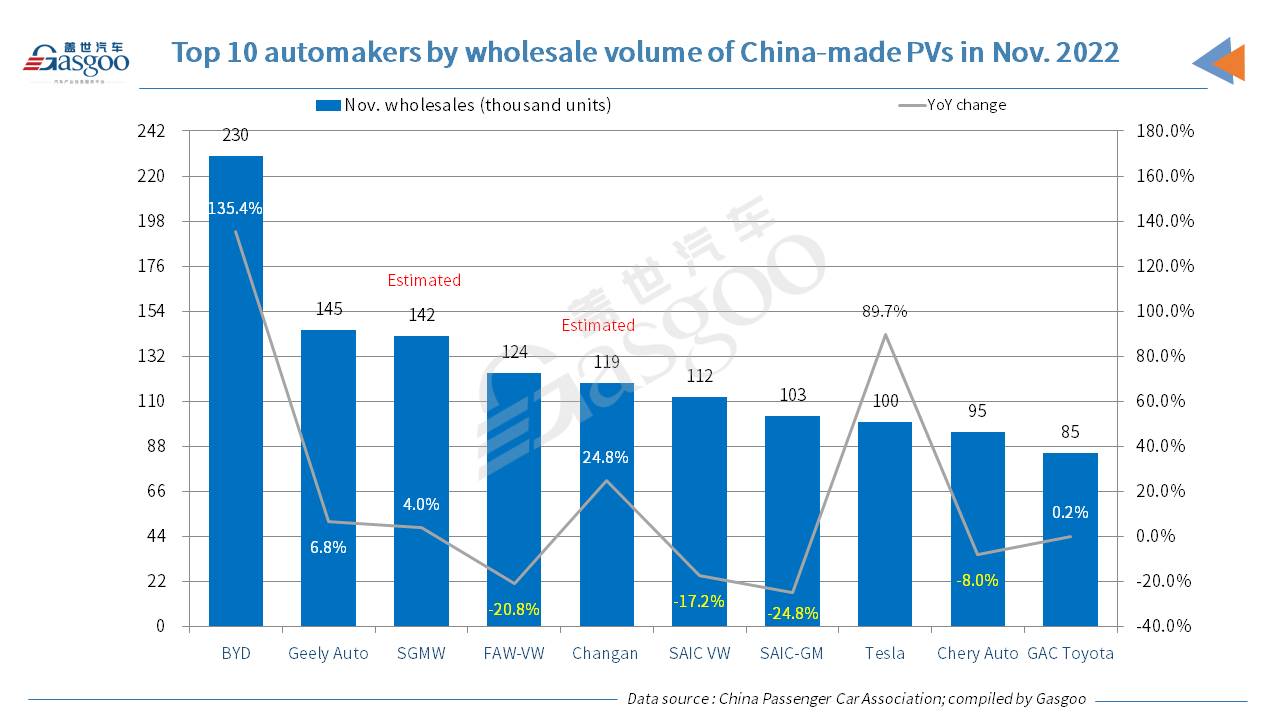

With regard to the PV wholesale volume in Nov., BYD, Geely Auto, and SGMW occupied the first three spots among automakers in China, and all of them attained a year-on-year growth. Changan Auto ranked fifth with a blooming year-on-year growth of 24.8%. Tesla ranked eighth, but it was the runner-up among the top 10 automakers regarding sales growth.

According to the data compiled by the CPCA, China's passenger vehicle export volume (including complete vehicles and CKDs) amounted to 250,000 units last month, surging 54% from a year earlier, but dwindling 4% from the previous month. For the first eleven months of this year, China exported a total of 2.1 million PVs, which leapt 56% from the year-ago period.