China registers over 1.2 million locally-made passenger vehicles in May

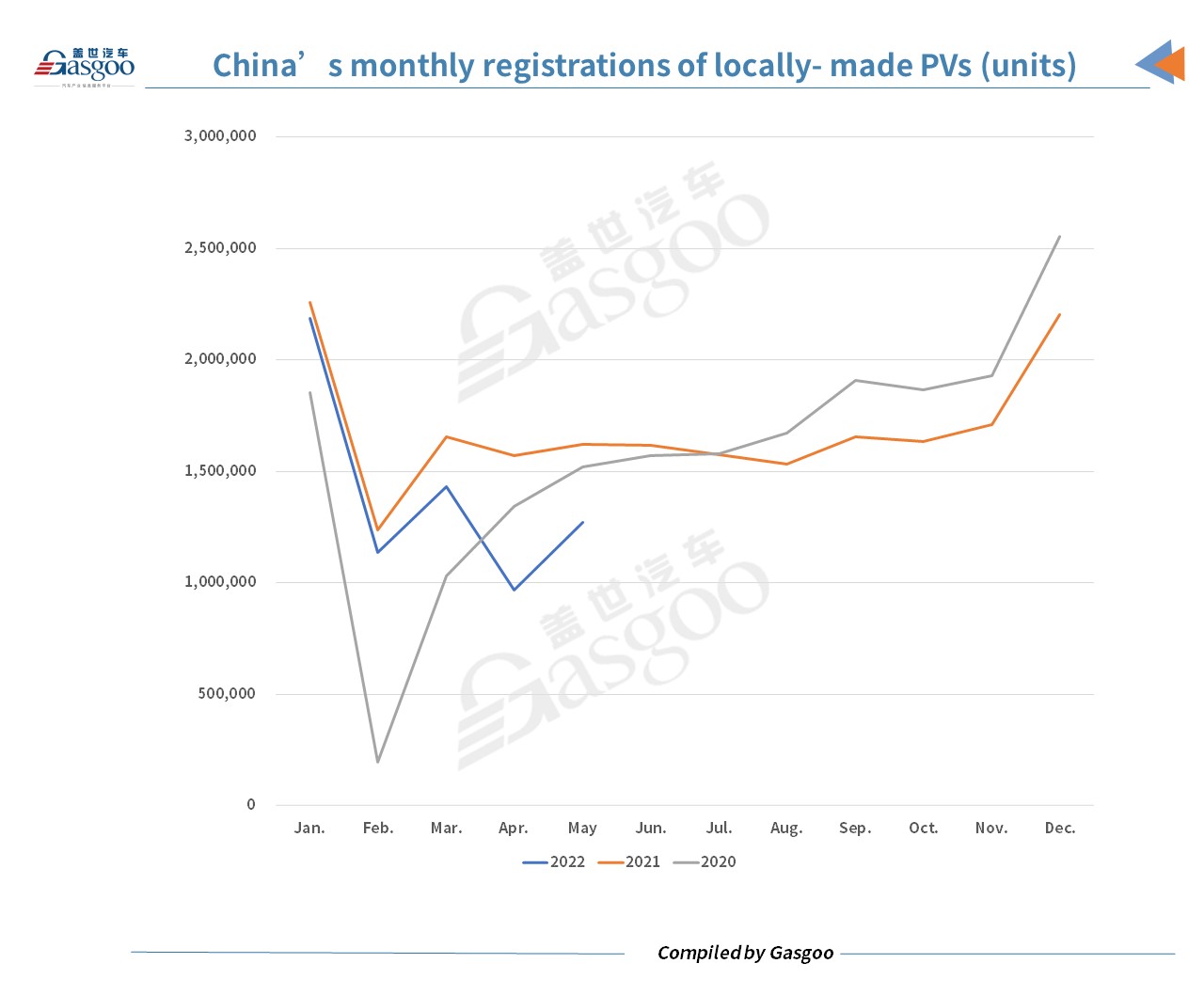

China’s monthly registrations of locally-made passenger vehicles (PVs) surpassed 1 million again in May with a narrowing year-over-year decrease, while the growth of new energy vehicle (NEV) registrations enlarged in the month, according to the data compiled by ZXZC Auto Research Institute (GARI).

The country’s monthly registrations of locally-made PVs amounted to 1,271,097 units, down by 21.65% from a year earlier, 16.7 percentage points fewer than that of the previous month, and representing a jump of 31.2% from a month ago. By the end of May, the country had registered nearly 7 million vehicles, falling 16.2% versus the same period of last year.

All of the top 20 brands by May registrations saw better performance in May. Compared with the previous month, eighteen brands’ year-over-year decrease narrowed while BYD and Chery registered more vehicles than the same month of last year.

Three brands’ registrations surpassed 100,000 units in the month and BYD continued to be the second runner-up with monthly year-over-year growth increasing nearly 160%. With 102,969 vehicles registered, including 101,645 new energy vehicles, May marked BYD’s second highest registration volume this year. In March, the Shenzhen-based company registered 106,827 new vehicles.

In terms of the total registrations of the first five months of this year, Volkswagen, Toyota and Honda remained the top three brands, but BYD, the fourth, narrowed the gap with Honda. Compared with the same span of last year, BYD was the only brand with a three-digit year-over-year growth rate. Apart from BYD, Wuling, Chery, Tesla and Hongqi also had more vehicles registered than a year ago.

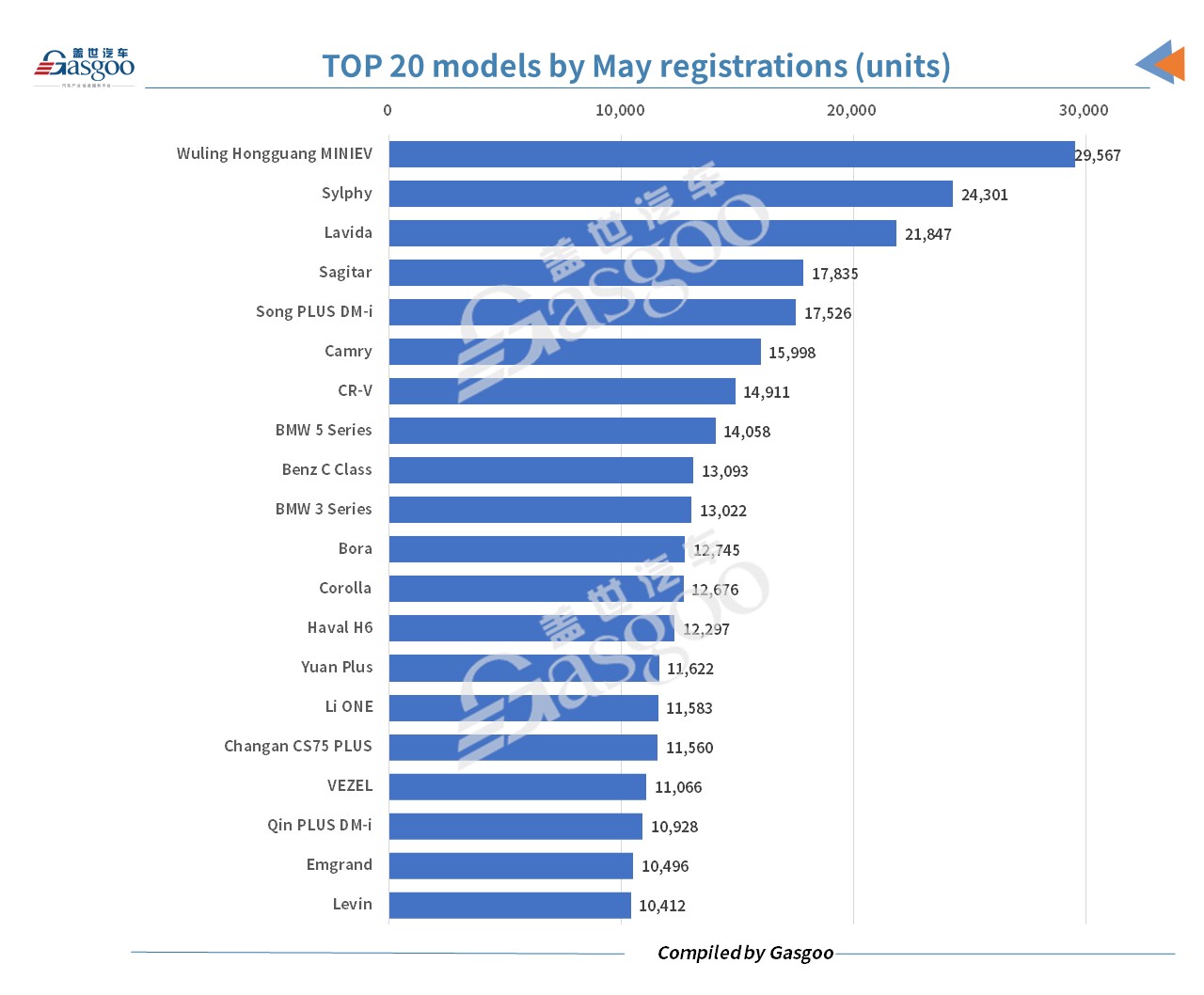

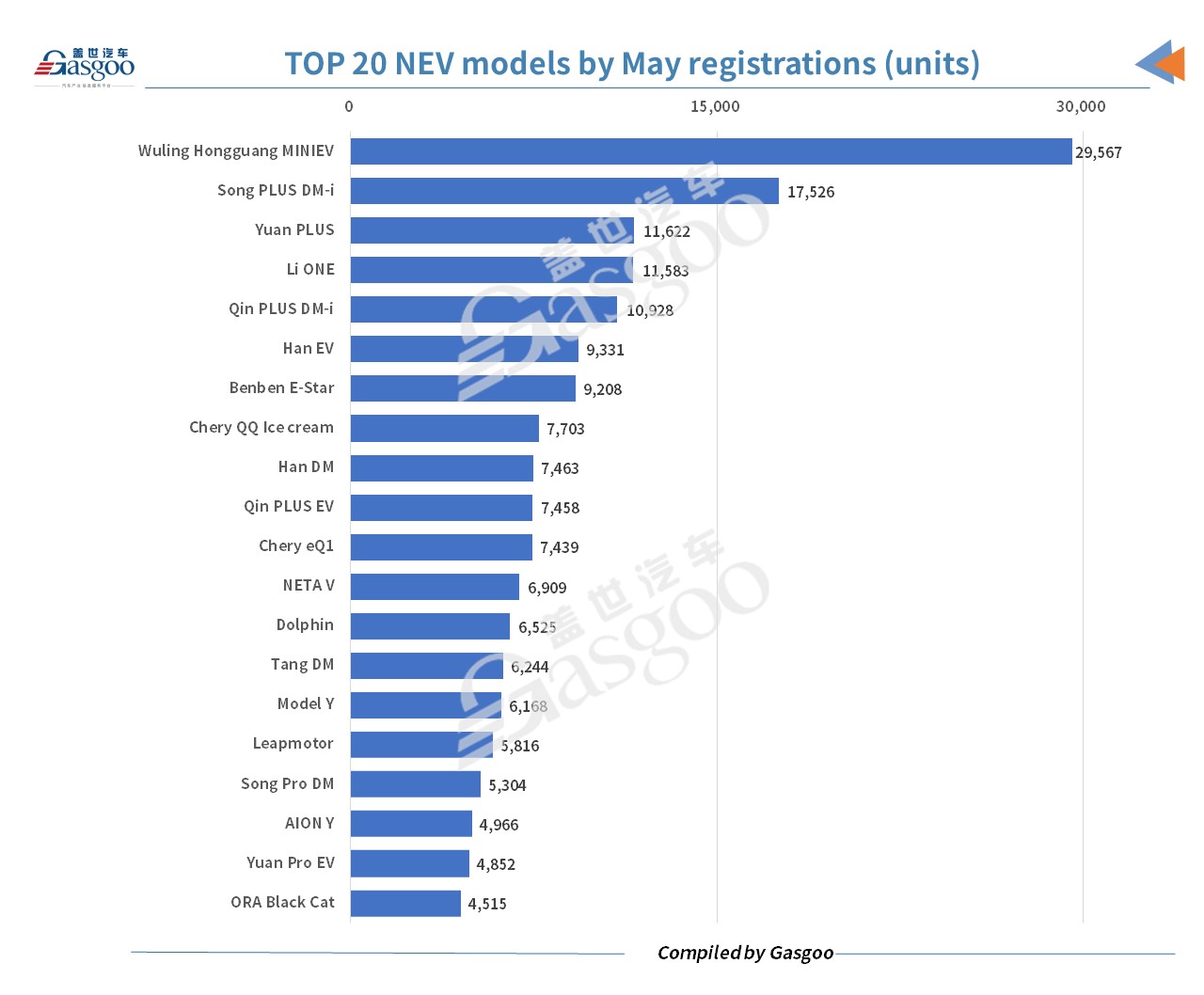

The Wuling Hongguang MINIEV had become the most registered model for four consecutive months. The country registered 29,567 MINIEVs in May, representing a year-over-year increase of 4.72%. The monthly model list included three models from BYD while the ranking of the Song PLUS DM-i was the highest with 17,526 registered. The Li ONE was the only model from local new energy vehicle startups.

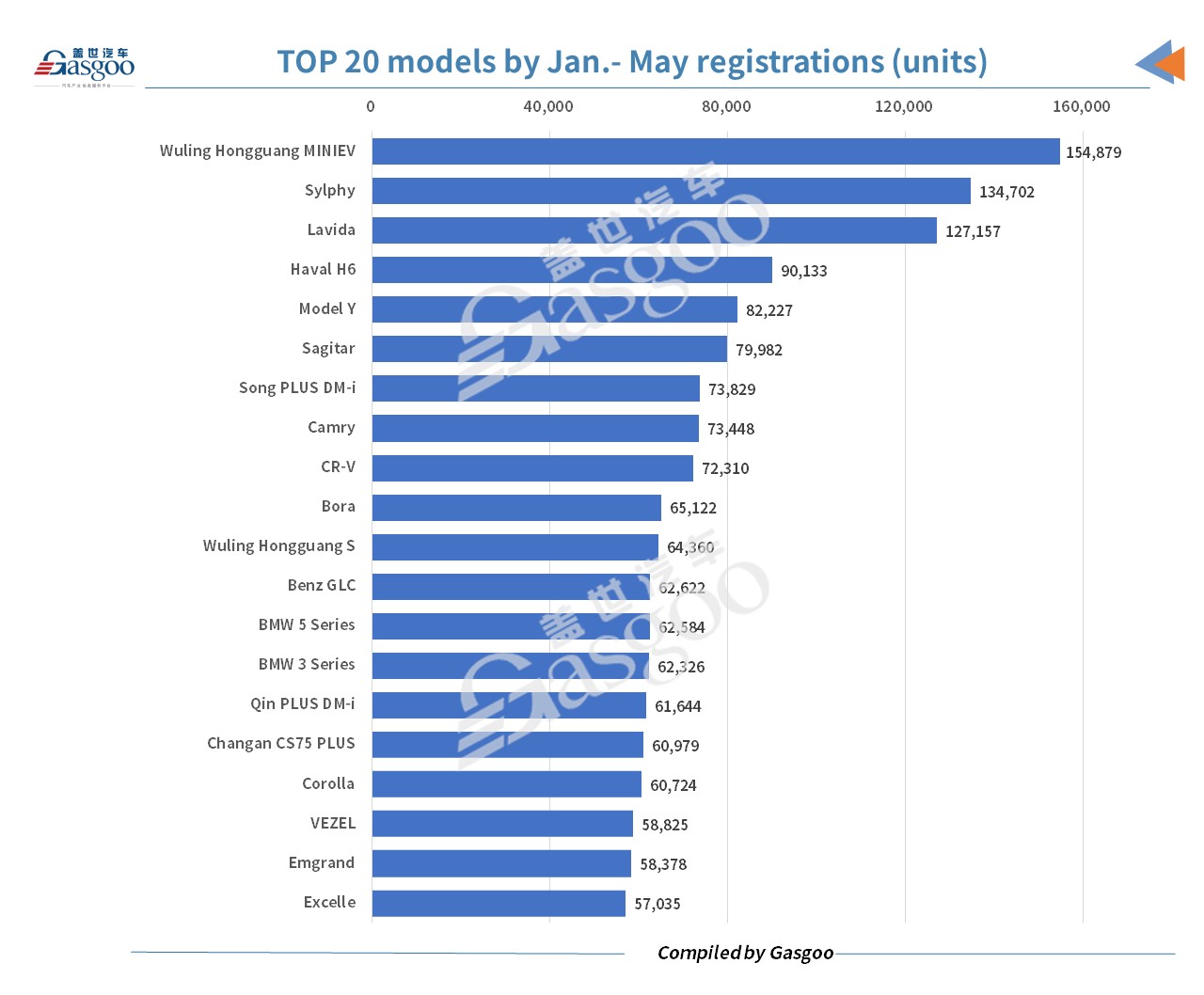

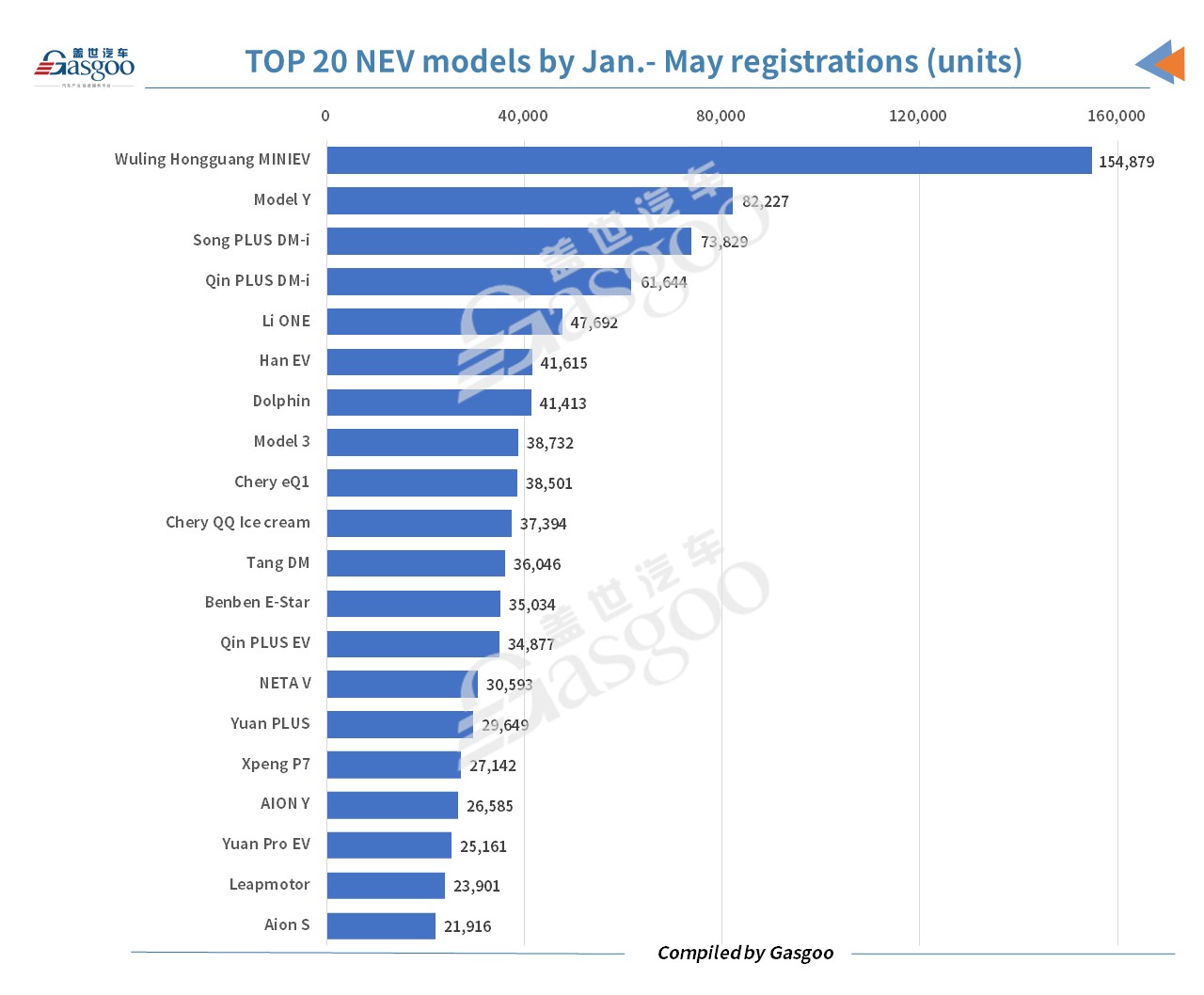

By the end of May, three models’ registrations had exceeded 100,000 units while the Wuling Hongguang MINIEV, the champion, had obvious advantages over the others. The Haval H6 was the other model from Chinese brands among the top 5 models on Jan.-May list, but its monthly registrations fell 42% versus the same month of last year.

The Tesla Model Y occupied the fifth spot with Jan.-May registrations soaring 134.55% year over year to 82,227 units.

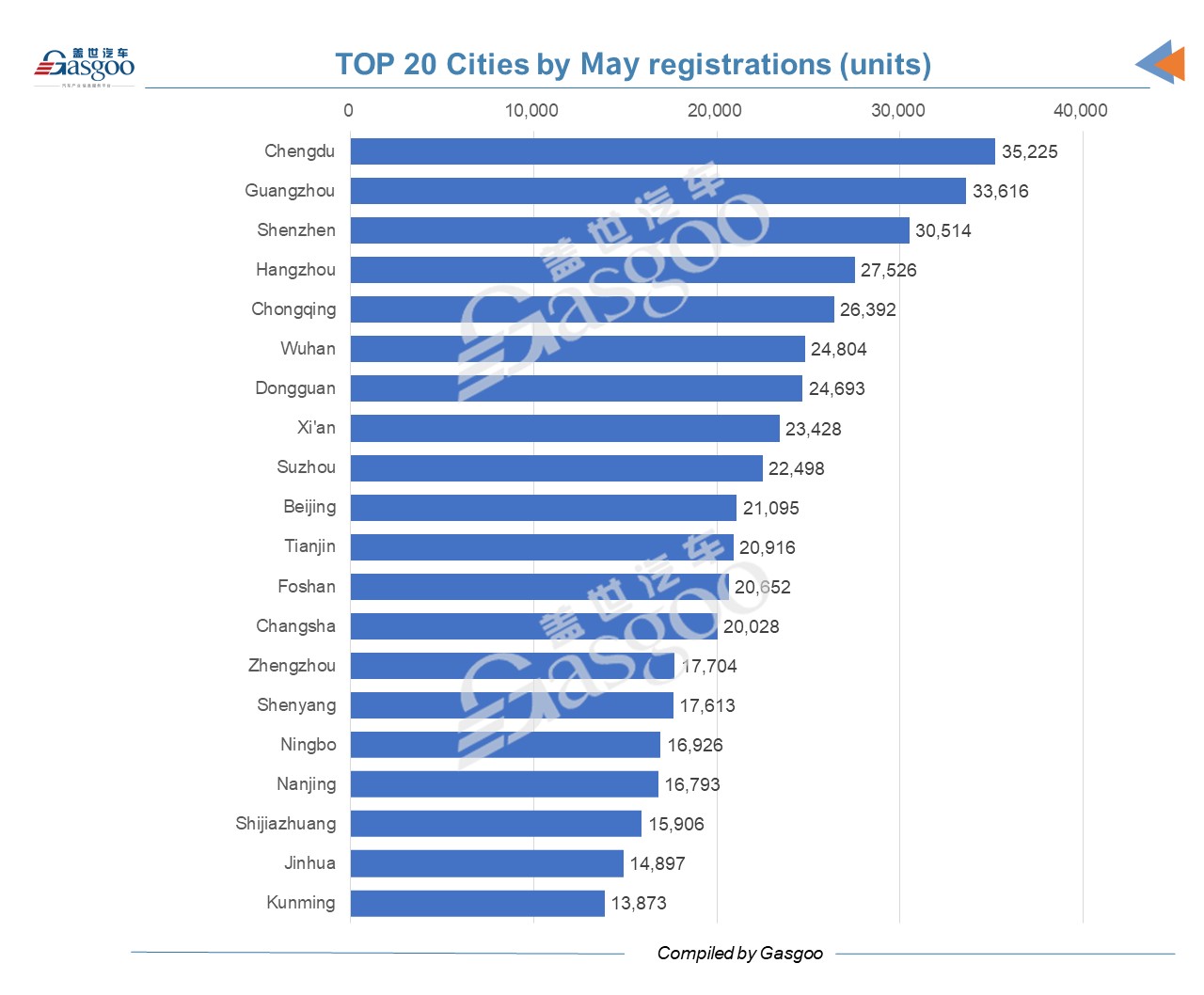

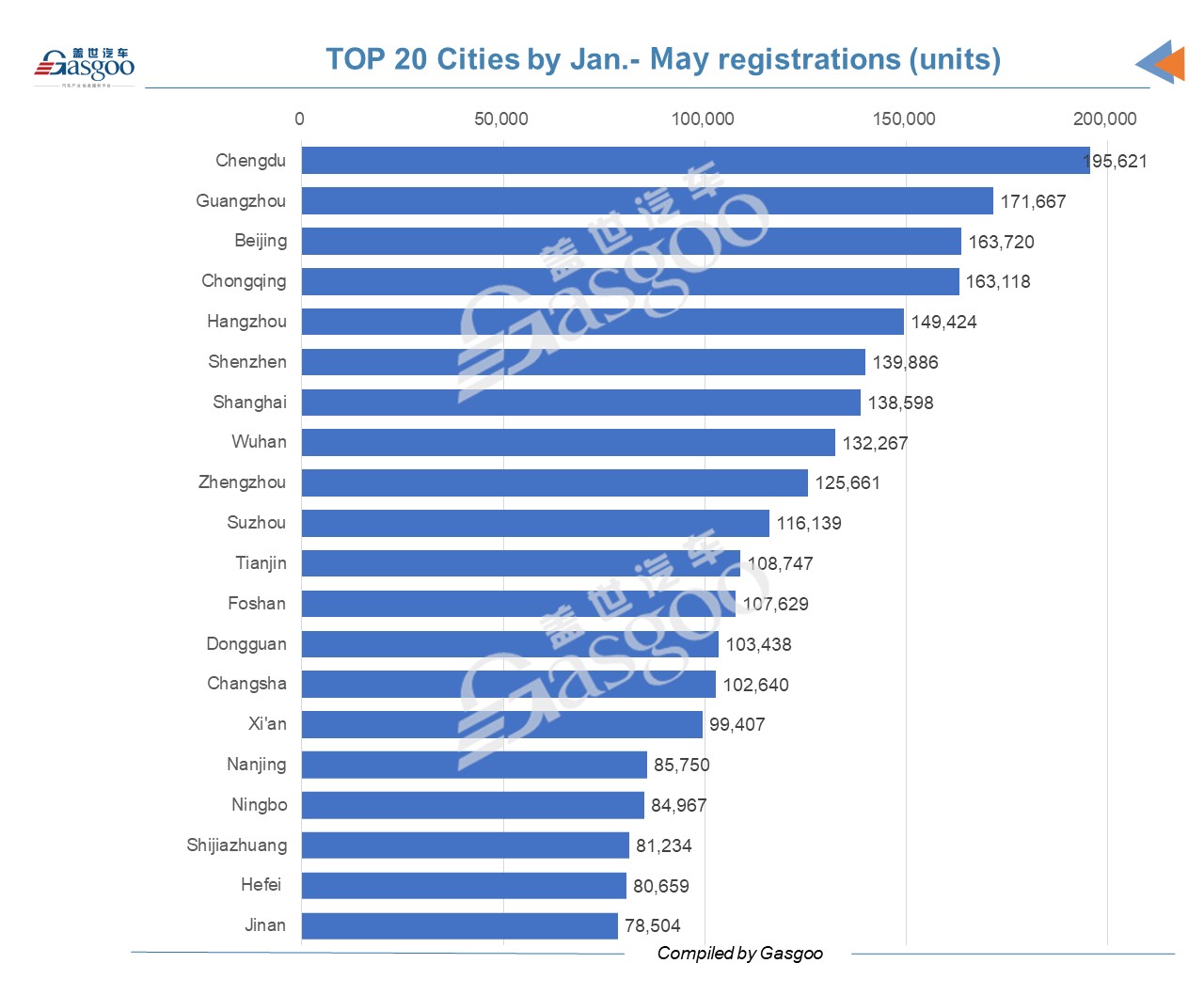

Three cities registered more than 30,000 vehicles in May and Chengdu was still the champion, followed by Guangzhou and Shenzhen. Due to the COVID-19 resurgence in the month, Beijing’s monthly vehicle registrations dropped to the tenth.

Shanghai’s monthly registrations stood at 2,571 units, more than doubling from the previous month, but it was still a member of the top 10 cities by the cumulative registrations of the first five months.

The country’s registrations of new energy vehicles in the fifth month of this year jumped 81.44% from a year earlier to 323,435 units, only second to the volume of March this year.

Monthly battery electric vehicle registrations amounted to 242,985 units while the rest were plug-in hybrid electric vehicles, including 16,958 range-extended electric vehicles. Among those NEVs registered in May, 38,575 were for renting and 28 were for operational purposes.

BYD had absolute leadership among all brands as the only one brand with monthly NEV registrations of over 100,000 units. In May, 2021, BYD only registered 24,550 NEVs. The other brands were all distant followers.

In spite of the challenges posed by COVID-19 and other industry issues, Tesla managed to register 10,338 vehicles in May, ranking eighth while it still occupied the second runner-up spot by the total registrations of Jan.-May period.

Li Auto, NETA from Hozon Auto and XPeng were among the top 10 brands by NEV registrations in May, but NETA fell out of the top 10 by the registrations of the first five months.

Apart from the Wuling Hongguang MINIEV, the BYD Song PLUS DM-i, the BYD Yuan PLUS, the Li ONE and the BYD Qin PLUS DM-I all saw May registrations exceed 10,000 units. There were another seven BYD-branded models on the monthly top 20 list, making BYD models occupy half spots on the list.

There was only one model from foreign brands on the monthly list, namely the Tesla Model Y. After its monthly registrations slumped to only 1,139 units in April, the Model Y’s May registrations grew to 6,168 units, but there was still a gap from its normal performance. After Tesla’s Shanghai factory restored its output, the American electric vehicle brand’s registrations will get back to normal before continuous growth.

The Tesla Model Y was the second most registered model in the biggest electric vehicle market in the world in the first five months of this year, but its volume still had a huge gap from the volume of the Wuling Hongguang MINIEV.

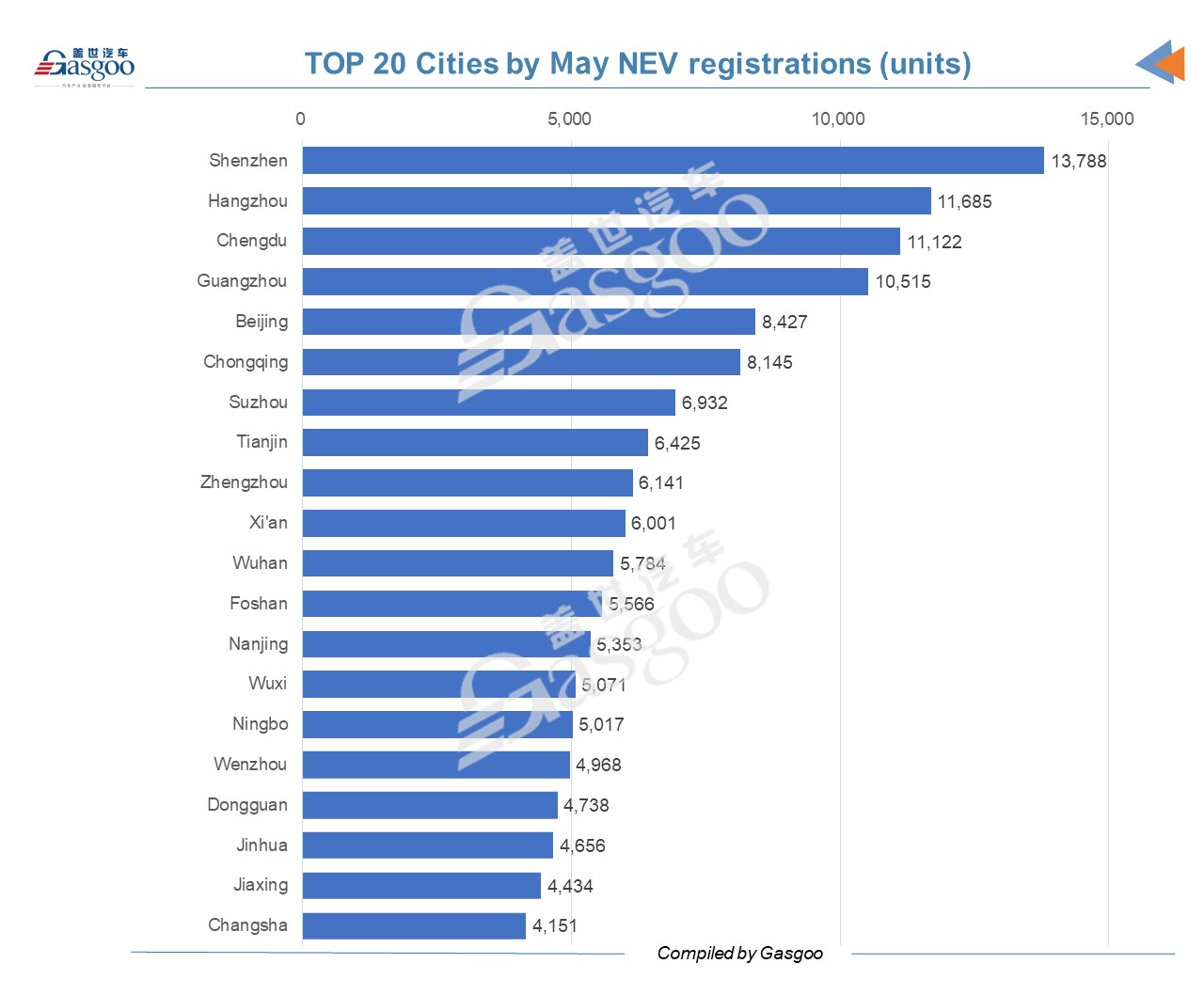

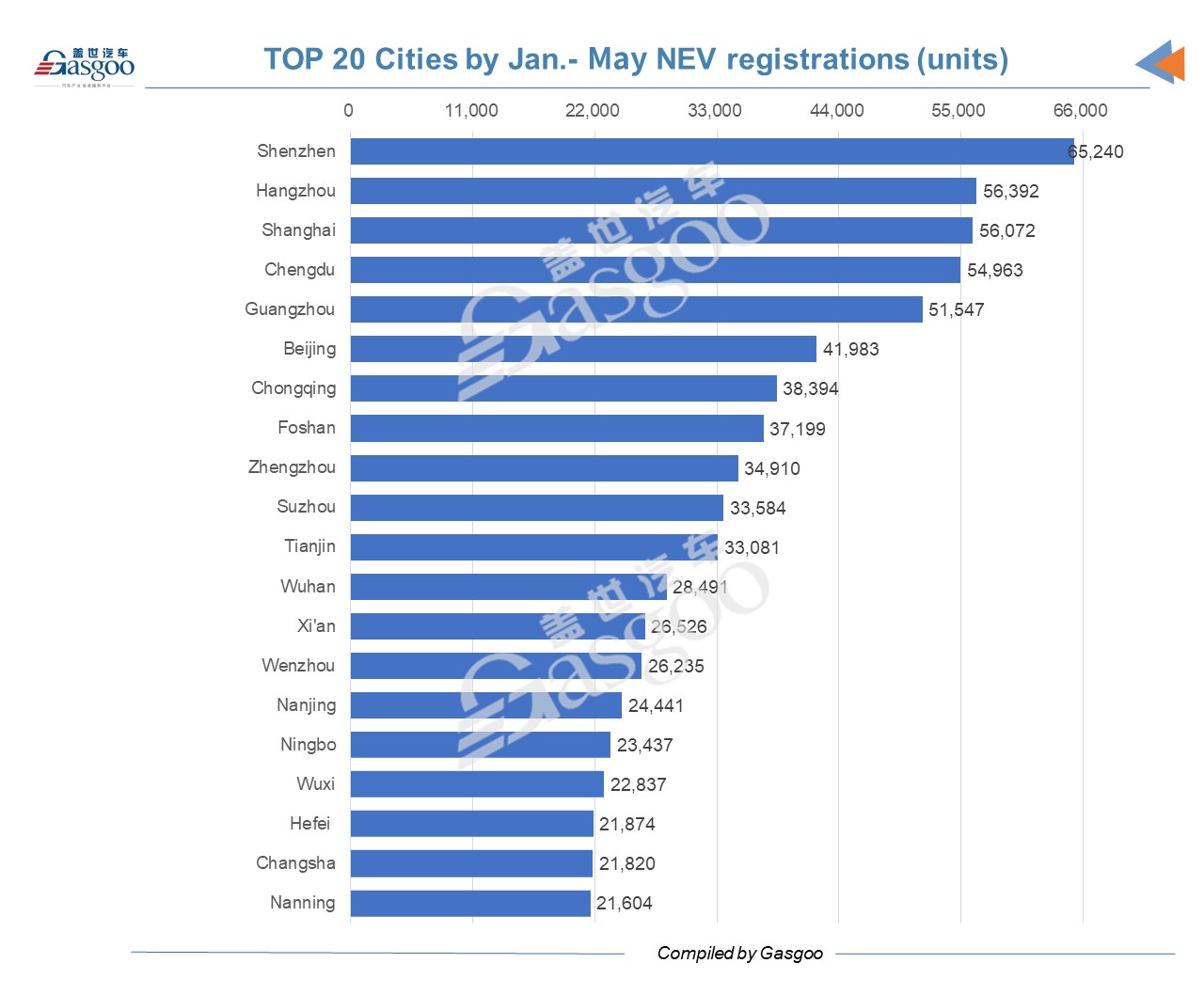

Shenzhen registered the most NEVs in May, followed by Hangzhou, Chengdu and Guangzhou, and all of the four cities’ monthly NEV registrations outnumbering 10,000 units. Consumers in Shanghai registered 1,644 NEVs in the month.

Shenzhen also registered the most NEVs in this year’s Jan.-May period and Shanghai ranked third even though it only registered 331 and 1,644 NEVs in April and May.