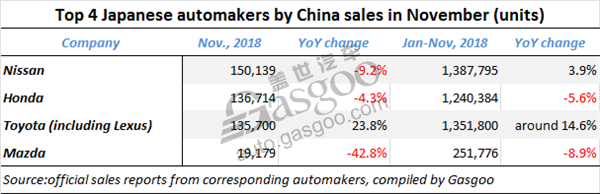

Top 4 Japanese automakers’ China sales in November

Shanghai (ZXZC)- Although there is still half a month before 2018 ends, it is almost settled that China's auto sales will go downhill this year compared with 2017. However, two major Japanese carmakers, namely, Nissan and Toyota, still gained positive year-on-year (YoY) growth in terms of the sales for the first eleven months. Honda posted a YoY drop of 5.6% in year-to-date (YTD) sales, yet this is not a bad performance since the company has been stuck with the engine oil issue for most days of the year.

Nissan

Nissan saw its sales in China fell 9.2% YoY to 150,139 units (including PVs, light CVs and imported vehicles) in November, while still climbed 3.9% over a year ago in terms of YTD sales. It is expected that its annual sales will hit a new high this year, exceeding the 2017 sales of 1,519,714 units if the rising momentum continues in December.

The PV unit logged a YoY decline of 10.6% with 122,105 vehicles delivered in November. To be specific, Dongfeng Nissan sold 111,097 vehicles. Its best seller was still the Sylphy Series whose Nov. sales rose 9.4% to 48,186 units. The sales of the X-TRAIL and the Qashqai compact SUV reached 18,428 units and 13,658 units, climbing 6.2% and shrinking 10.2% respectively from the year-ago period.

The other PV brand Dongfeng Venucia had a sales volume of 11,008 units in November. The sales of several core models—the Venucia D60, T70 and &90 reached 5,528 units, 3,299 units and 1,602 units respectively.

In November, the sales of light CVs dropped 4.5% from a year earlier to 23,025 units. However, this unit achieved a YoY growth of 4.1% with the YTD sales amounting to 192,542 units.

Honda

Honda delivered a total of 1,240,384 vehicles in China from January to November with a year-on-year (YoY) decline of 5.6%. As for the performance in November, the Japanese automaker saw its sales in China fall 4.3% YoY to 136,714 units, among which 67,735 units from GAC Honda (shrinking 7.8% YoY) and 68,979 units from Dongfeng Honda (edging down 0.7% YoY).

This is the fifth month in a row for GAC Honda to see YoY sales decline. Last month, a total of 66,596 Honda branded vehicles were handed over. Three models—the Accord, the Fit and the CRIDER whose Nov. sales exceeded 10,000 units all gained positive YoY growth, yet they still failed to offset the negative downturn caused by other models.

The Acura brand has suffered consecutive YoY sales decline of over 40% since July. What is noteworthy that the Nov. sales of the RDX skyrocketed 160.4% from the previous year to 237 units.

Dongfeng Honda Nov. sales basically remained steady compared with the same period a year ago. Two major sales drivers—the CIVIC and the XR-V both saw an evident YoY increase exceeding 20% in Nov. sales. The sales of the INSPIRE, the company's latest flagship sedan model hitting the market on October 25, reached only 943 units last month, limited by less sufficient production capacity.

Toyota

Last month, Toyota is the only one Japanese automaker on the list that realized positive YoY growth thanks to the vigorous sales performance made by the Corolla. According to the China Passenger Car Association (CPCA), the wholesale volume of the Corolla evidently grew 12.4% to 35,037 units, the second runner-up among sedan models delivered in China by Nov. sales. In the meantime, the sales of the Levin sedan reached 19,911 units, up by 9.5% over a year ago.

Toyota-owned premium car brand Lexus saw its China sales substantially climb 28.6% over a year ago to 16,587 units, achieving positive YoY growth for 5 straight months. The monthly sales of hybrid models reached 4,673 units, accounting for 29% of the brand's total sales in this country. China's tariff slash policy over imported vehicles has continued benefitting Lexus's China marketing performance.

Mazda

Mazda Motor (China) Co., Ltd. reported a year-on-year (YoY) retail sales drop of 8.9% with a total of 251,776 vehicles delivered in China from January to November. As for the Nov. sales performance, the Japanese automaker witnessed its sales in China tumble 42.8% over the year-ago period to 19,179 units, the seventh month in a row that faced YoY sales dwindle in this country.

Changan Mazda's year-to-date (YTD) sales reached 151,310 units, declining 7.6% over the same period a year ago when the sales were significantly growing thanks to the launching of the second-generation Mazda CX-5 and soon-to-be-cancelled vehicle purchase tax exemption. The joint venture will launch the Mazda CX-8—a brand-new large-sized 7-seater SUV model on December 7, which is expected to further increase the overall sales.

The other joint venture FAW Mazda delivered 100,466 vehicles through November, a YoY decrease of 10.8%. The company has only three models up for sale, including two locally-produced models—the Mazda ATENZA and the Mazda CX-4, as well as an imported model Mazda MX-5 RF. The less abundant product mix may somewhat curb the sales growth.