Four Pain Points of Chinese Automobile Finance; Returning Rate is Lower than 3%

ZXZC.com (Shanghai March 1st, 2017) – China has continued to keep a top auto sales around the world in 2016 for the 8th year. According to data from CAAM, car sales of China in the last year has reached 24376.9 thousand units, 14.93% increased year on year. And automobile finance also showed its vigorous development prospects. Wang Xin, a global partner of Frost&Sullivan and managing director of its Greater China region said that, by the end of 2015, number of automobile financial brands has grown from 3 to 25, including Ford Automotive Finance (China) Ltd (FAFC), sino-foreign joint ventured GMAC SAIC and Chery HuiYin Motor Finance Service Co., Ltd, with a market overall scale reaching 900 billion yuan. However, the pain points of automobile finance also appeared.

Returning Rate Lower than 3% with Credit Reference System Block the Way

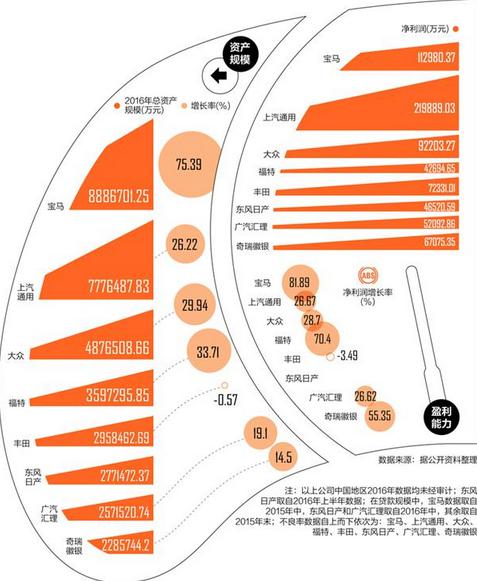

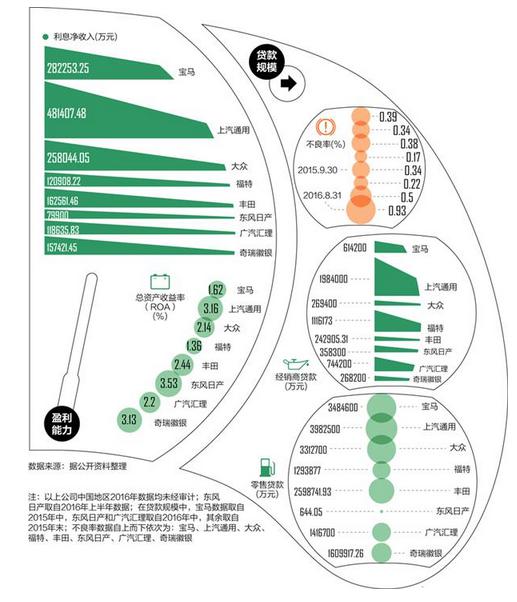

Data from reporters of CBN showed that, the overall return on assets of most automobile financial companies established by OEM are lower than 3%, the rate of return of automobile finance is as low as a one-year fixed-term deposit rate.

Wang Xin also pointed out that, China is more obviously to have a low automobile financial returning rate. It is firstly because our automobile finance is still in its primary stage of development, and secondly because our credit reference system hasn’t been competed yet. Although China has started automobile consumption credit since 1998, the credit reference system began to operate not until 2005. There is still a long time to go if China wants to surpass European countries.

Automobile Finance Transformed to be Tools to Reduce Capacity

According to the research from reporters of CBN, some of the automobile financial companies even gave out an interest rate lower than that of the banks in order to attract buyers. Behind this, the automakers and dealers pay out of their own pockets, which maybe related with the heavy pressure from inventory. However, more and more automakers began to consider if this interest subsidy can lead to direct results, so some changes occurred since 2016.

Internet Automobile Finance hasn’t Formed Closed-loop

Internet financial found business opportunities in automobile financial market. Data from Yingcan consulting company showed that, the main business modes of Chinese internet automobile finance include P2P lending, consumer finance, crownd funding and online insurance. The total scale of P2P lending, crownd funding and online insurance was 127.78 billion yuan in 2015, 100% surged compared with the same period of 2014; the total scale in the first half year of 2016 was about 85 billion yuan and was expected to surpass 200 billion yuan.

Finance Lease and Used-car Finance haven’t Broken out

According to China Automobile Dealers Association, the percolation rate of China’s automobile finance was only about 20% in 2014, while the average percolation rate of global automobile finance has reached 70% that year. Although the index of China grew up to 35% in 2015, it still had a large gap with the world average level. The percolation rates of developed countries were as high as 70%-80% because their finance lease and used-car finance have a big proportion, thus lagged China behind.