China’s passenger vehicle sales dip YoY in June amid growth in exports

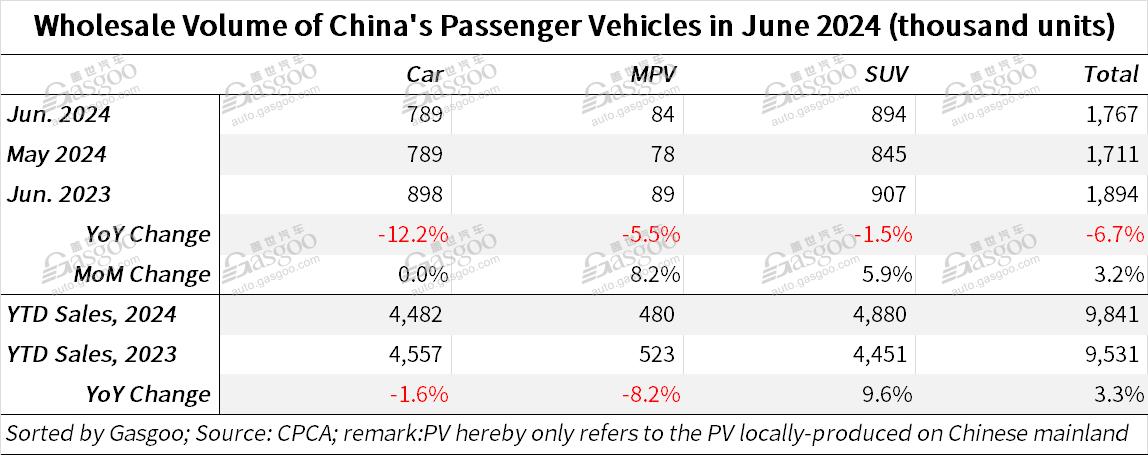

Shanghai (ZXZC)- In June 2024, China's domestic passenger vehicle (PV) market retailed 1.767 million vehicles, marking a year-over-year decrease of 6.7% but a month-over-month increase of 3.2%, according to data from the China Passenger Car Association ("CPCA").

For the first half of this year, the country's PV retail sales totaled 9.841 million units, an increase of 3.3% compared to the same period last year.

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

In June, conventional oil-fueled vehicle retail sales totaled 910,000 units in China, a year-on-year decrease of 27% and remaining flat compared to the previous month. From January to June, retail sales of conventional fuel vehicles amounted to 5.73 million units in the country, a 13% decrease year-on-year.

With the first six months accounting for 43% of the total annual sales made for 2023, the annual figure is expected to surpass 22 million units in 2024, said the CPCA.

According to the CPCA, the external economic environment in China showed significant uncertainty in June, with internal effective demand still insufficient and weak expectations from businesses and residents. However, with the gradual impact of the country trade-in policy, the introduction and follow-up of various local policies, Beijing's license plate issuance boosting consumption, a temporary cooling of the price war on new car models, and the "618" shopping festival driving mid-year-end sales, the consumer enthusiasm among previously hesitant buyers was ignited. As a result, China's passenger car market maintained relatively good momentum in June this year. The June in 2023 saw an sales increase due to the handling of non-RDE models, while this June's higher-quality retail growth was aided by the expiration of the tax exemption policy for micro electric vehicles with a range under 200 km at the end of May.

In recent years, the technological innovation and competitiveness of China's new energy vehicles (NEVs) have continued to grow, while the introduction of new conventional oil-fueled vehicle models has lagged. This year's price war in the car market started early, with some popular NEV models seeing price reductions of nearly 20%, extending from February after the Chinese New Year holiday to the end of April. The number of models participating in price cuts approached the total for the entire previous year, leading to a period of extreme consumer caution regarding prices in the spring and temporarily suppressing the spring car market. With different taxes and policies for oil-fueled vehicles and NEVs, the gap between the high growth of NEVs and the negative growth of oil-fueled vehicles has become increasingly apparent. The release of detailed national-level trade-in policy implementation, continued local NEV subsidy policies, and accumulated consumer purchasing power in May and June all bolstered NEV market strength.

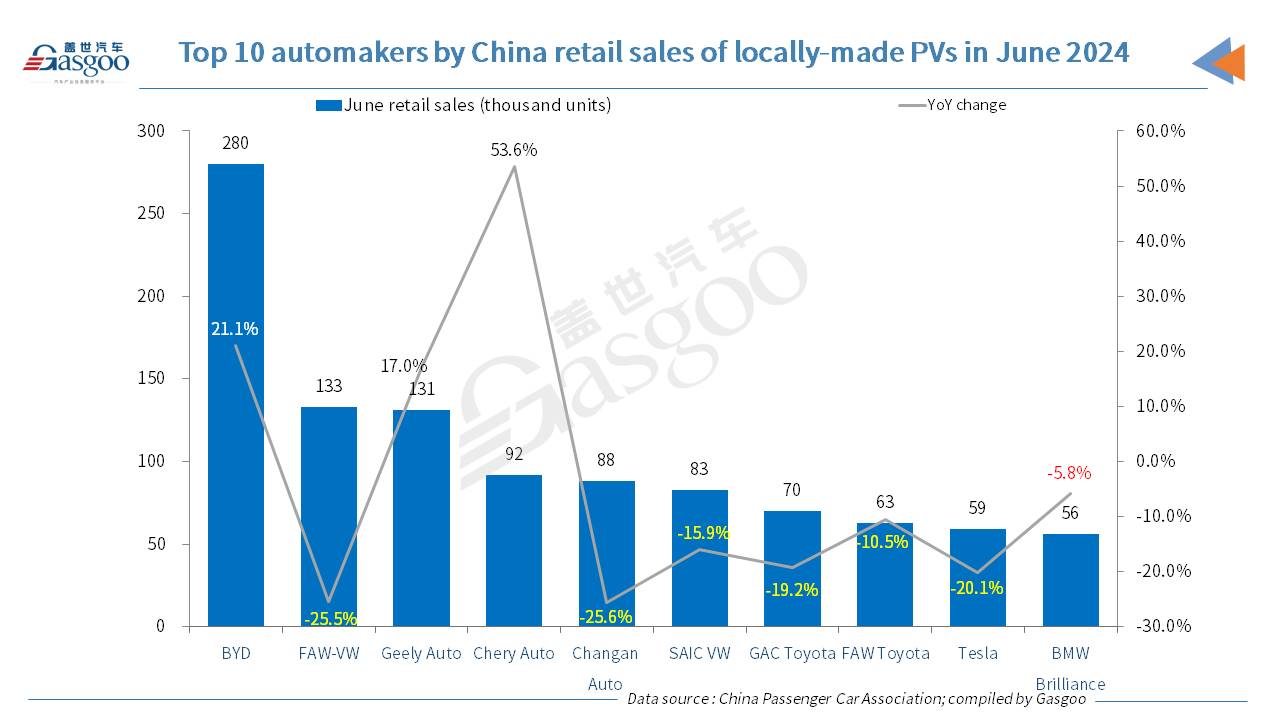

In June this year, retail sales of China's self-owned brands reached 1.03 million units, a year-on-year increase of 10% and a month-on-month increase of 5%. The market share of domestic retail for indigenous brands was 58.5%, up 9.3 percentage points year-on-year. For the first half of 2024, China’s self-owned brands have a total share of 57%, up 7 percentage points from the same period last year.

Mainstream joint-venture brands recorded retail sales of 480,000 units in June, a year-on-year decrease of 27% and a month-on-month decrease of 1%. German brands had a retail share of 18.6%, down 2.6 percentage points year-on-year; Japanese brands had a share of 14.3%, down 3.5 percentage points year-on-year; and American brands held a 6.3% share, down 2.9 percentage points year-on-year.

China's premium car retail sales in June reached 250,000 units, a year-on-year decline of 17% but a month-on-month increase of 4%. Premium brands accounted for 14.2% of the country's total passenger vehicle retail sales in the month, up 0.2 percentage points year-on-year, with the traditional premium car market share remaining relatively stable.

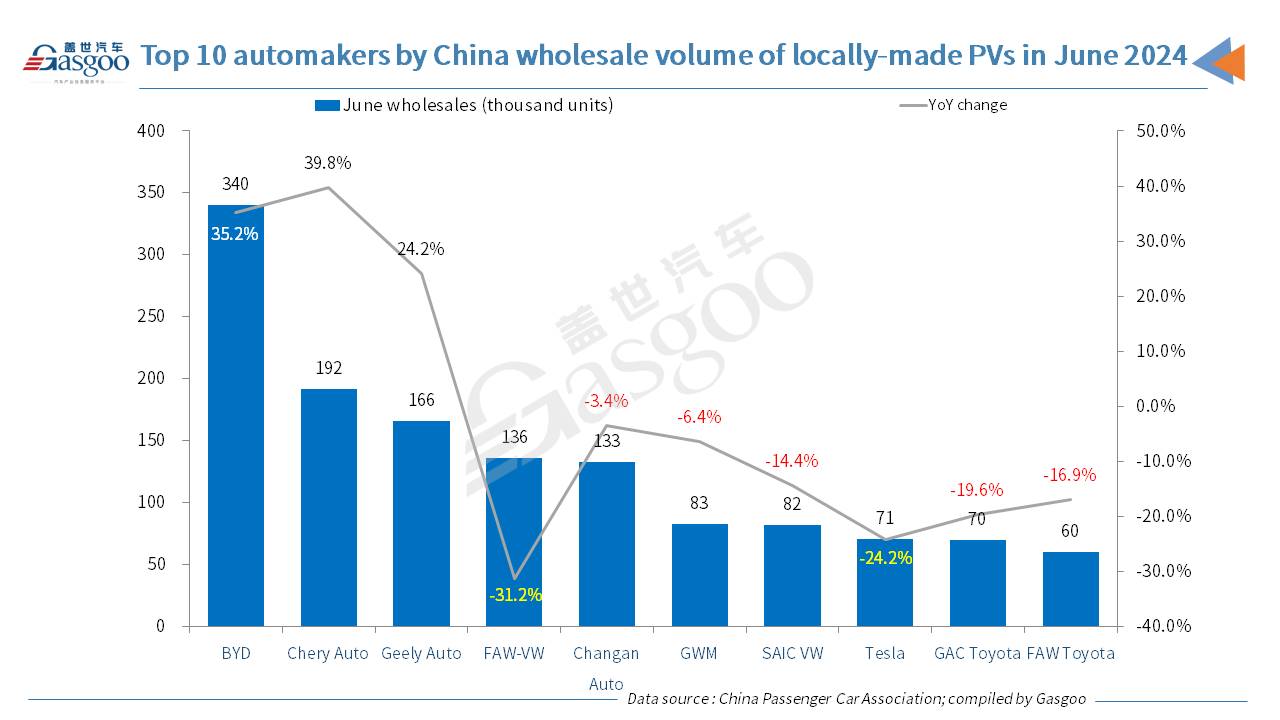

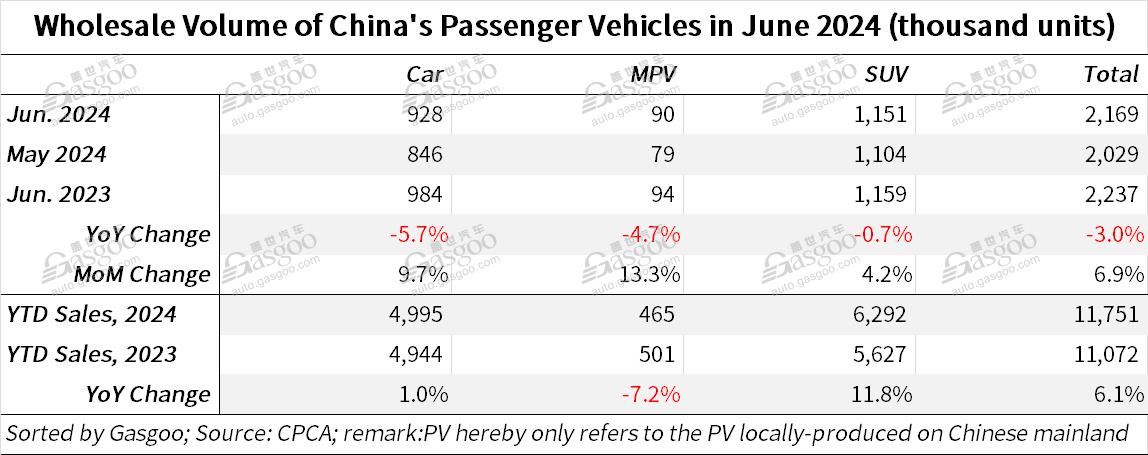

In June, China's passenger vehicle manufacturers wholesaled 2.169 million units, a year-on-year decrease of 3% but a month-on-month increase of 6.9%, according to the CPCA's data. Due to the flat overall passenger car exports over a month earlier and the month-on-month decline in joint-venture car companies' retail sales, China's passenger vehicle wholesale volumes did not reach a new high in the month.

Last month, the wholesale volumes of China's wholly-owned carmakers were 1.406 million units, up 17% year-on-year and 8% month-on-month. Mainstream joint-venture car companies had wholesale volumes of 496,000 units, down 30% year-on-year and up 4% month-on-month. Meanwhile, premium car wholesales were 267,000 units, down 18% year-on-year but up 5% month-on-month.

In June, there was a clear divergence in wholesale performance among major passenger car manufacturers. Companies such as BYD, Chery, Geely, Changan, and Volkswagen performed relatively strongly. There were 35 passenger car manufacturers with sales exceeding 10,000 units in June (compared to 32 in May and 30 in the same period last year), accounting for 96.4% of China's overall passenger vehicle wholesales. Among them, three companies had a year-on-year growth rate exceeding 50%, ten exceeded 10%, and 22 experienced negative growth. A total of 26 manufacturers with sales exceeding 10,000 units saw month-on-month growth, with seven exceeding 30% increase.

Passenger car production volume in June totaled 2.134 million units in China, a year-on-year decrease of 2.8% but a month-on-month increase of 6.9%. Premium car brand production fell by 9% year-on-year but rose by 8% month-on-month; joint ventures’ production decreased by 29% year-on-year but increased by 4% month-on-month; and China’s self-owned brand production rose by 14% year-on-year and 8% month-on-month.

Generally, vehicle exports in China continued strong growth from last year. According to passenger car manufacturers who submitted data, passenger vehicle exports (including complete vehicles and CKD) reached 378,000 units in June, a year-on-year jump of 28% and remaining flat month-on-month. For the first half of this year, China’s cumulative passenger car exports reached 2.247 million units, a year-on-year leap of 33%.

In June, NEVs accounted for 21% of total exports, down 3 percentage points year-on-year. As markets like South America recover, exports of China’s self-owned brands reached 325,000 units in the month, up 31% year-on-year and 2% month-on-month. In the same month, export volume of joint ventures and premium brands totaled 54,000 units, up 12% year-on-year but down 7% month-on-month.