Car and City: China’s homemade passenger vehicle registrations in Jan. surge YoY, but shrink MoM

In the first month of 2024, there were a total of 2,156,849 locally-produced passenger vehicles (PVs) registered across the Chinese Mainland, representing a 73.09% year-on-year (YoY) surge, but exhibiting a 12.68% month-on-month (MoM) decline, according to the data compiled by the ZXZC Auto Research Institute ("GARI").

For clarity, the PVs hereby refer to the vehicles locally produced and registered on the Chinese Mainland.

The YoY growth in overall PV registrations in Jan. was partly attributed to the low base for the year-ago period that embraced the Spring Festival. As this year's Chinese New Year holiday fell in Feb., some purchase demands from users who need cars to return to their hometowns were unleashed in Jan., contributing to the YoY increase as well. Additionally, the predicted price rebound for certain vehicle models and a reduction in local consumption incentives, such as regional consumer vouchers, collectively hindered the strong sales momentum in the month.

Compared to the previous month, China's PV registrations in Jan. showed a decrease as multiple automakers heightened their sales promotion in Dec. last year to fulfill their annual sales targets.

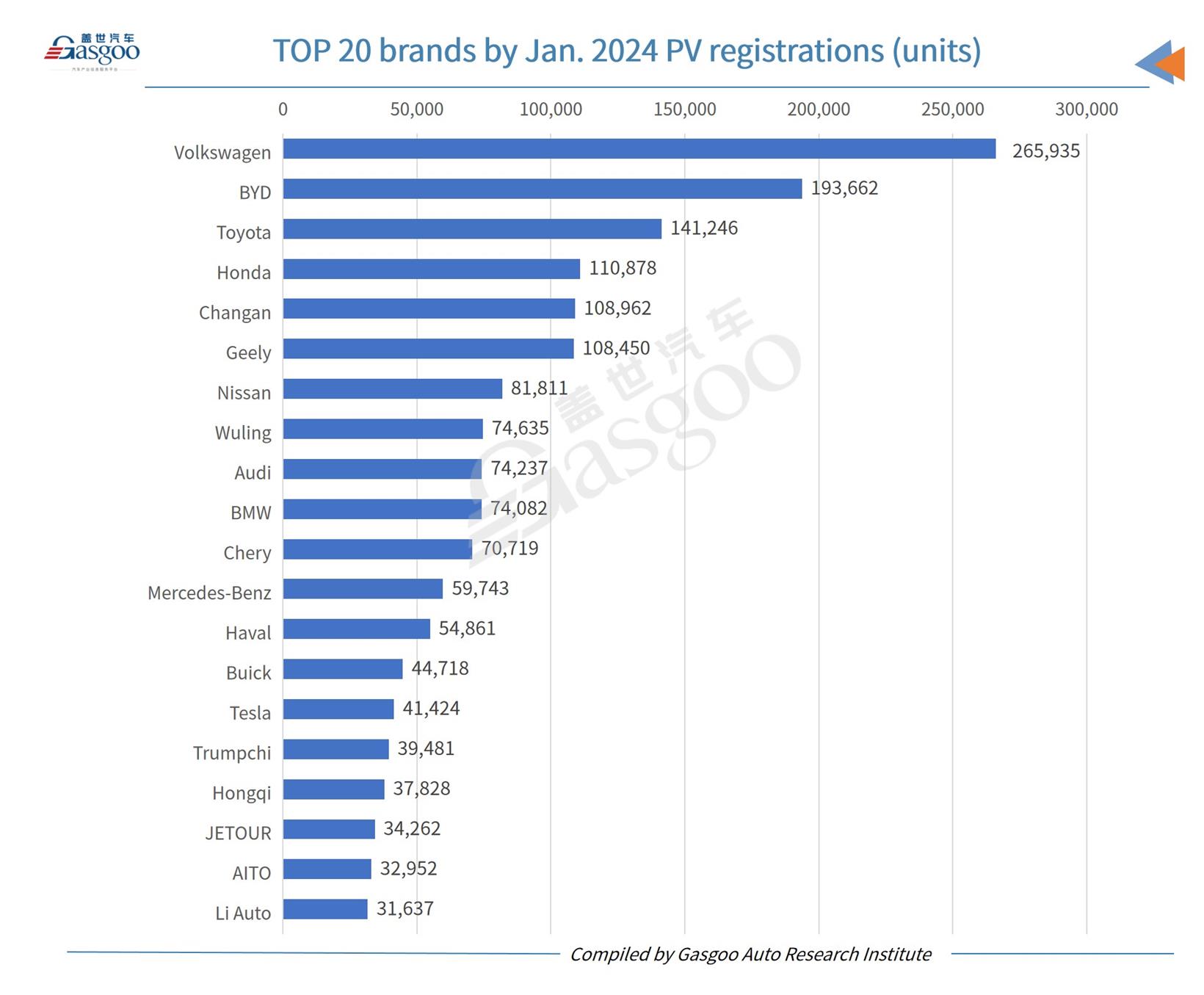

As for the rankings of brands judged by their locally-made PV registrations in Jan., Volkswagen surpassed BYD to take the champion crown. It was also the only brand to record registrations exceeding 200,000 units. Of the new Volkswagen-branded vehicles registered last month, gasoline-powered vehicles accounted for 249,138 units, while plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) logged a volume of 2,051 units and 14,746 units, respectively.

BYD dropped to the runner-up place with 193,662 vehicles registered in Jan., but it still scored a YoY spike of 64.14%. Breaking down BYD brand’s monthly registrations by specific vehicle types, 102,212 units were cars, 89,311 units were SUVs, while the other 2,139 units were from MPVs. Regarding powertrain solutions, PHEVs and BEVs registered a respective 94,387 units and 99,275 units, indicating a balanced sales structure within the brand.

The two main Japanese brands--Toyota and Honda--ranked 3rd and 4th, respectively. They were closely followed by the two indigenous brands-- Changan and Geely. Nissan failed to surpass the monthly registrations of 100,000 vehicles, ranking 7th. Wuling held the eighth spot with 74,635 units registered last month, 40,958 units of which were contributed by new energy vehicles (NEVs), including 10,224 PHEVs and 30,734 BEVs.

Moreover, the German trio-- Audi, BMW, and Mercedes-Benz--stood at the 9th, 10th, and 12th places. Tesla, as the unique brand with only BEVs available for sale, ranked 15th.

Additionally, several China's domestic brands, such as Chery, Haval, Trumpchi, Hongqi, JETOUR, AITO, and Li Auto, made appearances on the top 20 brands list by Jan. registrations, displaying the improved presence of China's local brands.

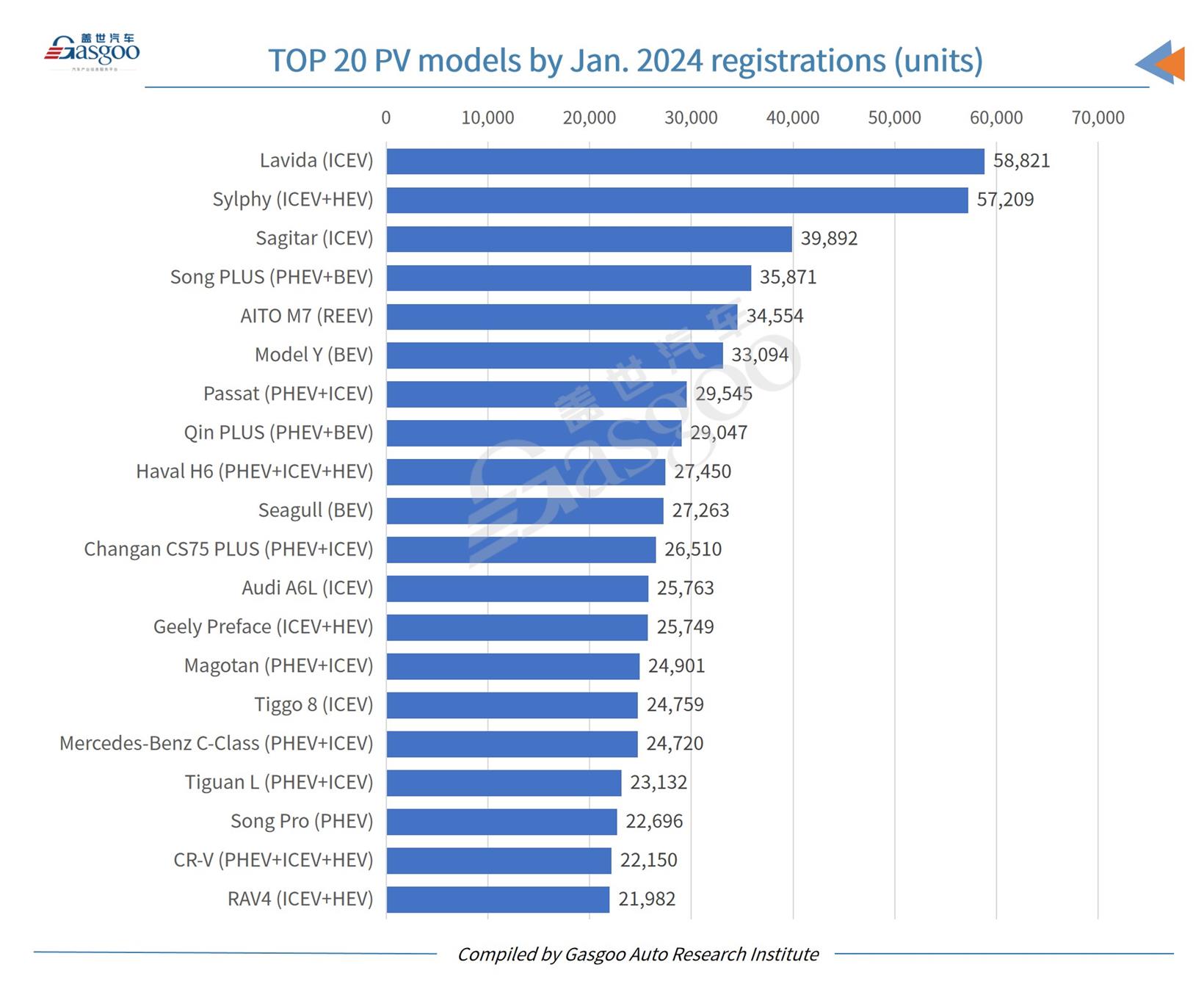

Among the top 20 locally-built PV models by Jan. registrations, the Lavida was credited the highest-ranking one with only internal combustion engine vehicles (ICEVs) registered. The Sylphy ranked 2nd with a total of 57,209 vehicles registered last month, which consisted of 42,718 ICEVs and 562 hybrid electric vehicles (HEVs). The second runner-up, the Sagitar, was still from a joint venture.

BYD's Song PLUS was the best-performing model under a Chinese domestic brand, ranking 4th among all models. To be specific, the PHEV version made up 73.97% of the model's total registrations in Jan., while the BEV version got 8,462 vehicles registered.

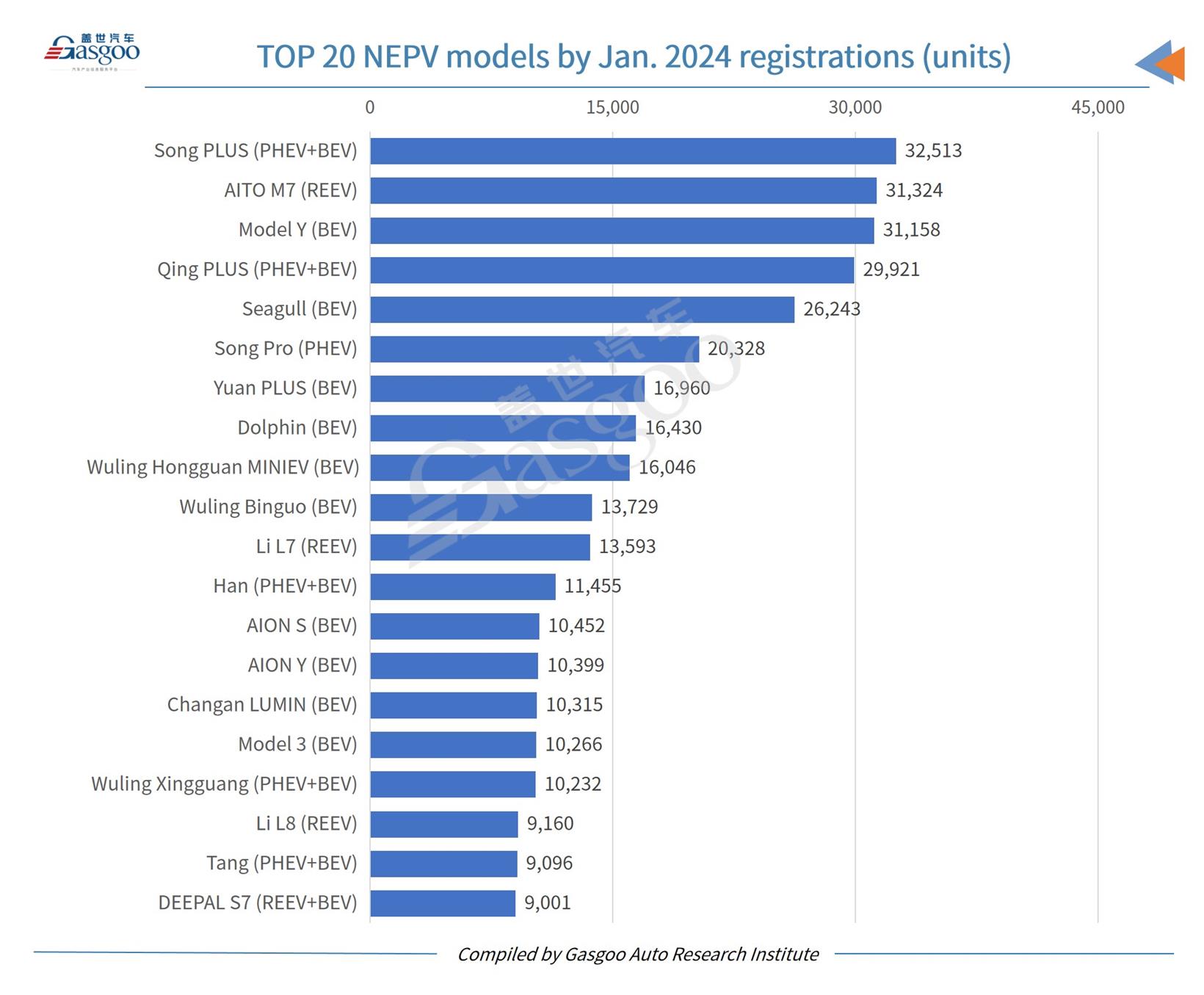

Apart from the BYD Song PLUS, the brand still had three models listed in the top 20 models rankings, namely, the Qin PLUS, the Seagull, and the Song Pro. Among them, the Seagull had only BEVs sold on the market, while the Song Pro’s registrations were 100% composed of PHEVs.

It is worth noting that the AITO M7, with only range-extended electric vehicles (REEVs) sold on the market, secured the 5th place among all PV models, even outselling Li Auto’s entire L series (31,569 units). Its popularity should be mainly credited to its multiple premium features with a competitive price range and the Huawei tech-powered nature.

Moreover, Tesla's Model Y ranked 6th with 33,094 vehicles registered in Jan. On Jan. 12, Tesla's official Chinese website showed significant price cuts for the Model 3 and Model Y, which also stand as the US electric vehicle maker's inaugural price adjustments for the year 2024. After this price change round, the Model Y now starts at 258,900 yuan, seeing a price drop of 7,500 yuan in China.

Among cities on the Chinese Mainland, Shanghai, Guangzhou, and Chengdu secured the top 3 places regarding Jan. homemade PV registrations. Regarding customers' preference to products, the Golf (ICEV) was honored the best-selling model in Shanghai last month, while the Sylphy (ICEV+HEV) and the AITO M7 (REEV) posted the highest registration volume in Guangzhou and Chengdu, respectively.

It is noteworthy that NEVs took up 25.85%, 38.46%, and 33.65% of the Jan. locally made PV registrations of Shanghai, Guangzhou, and Chengdu, respectively.

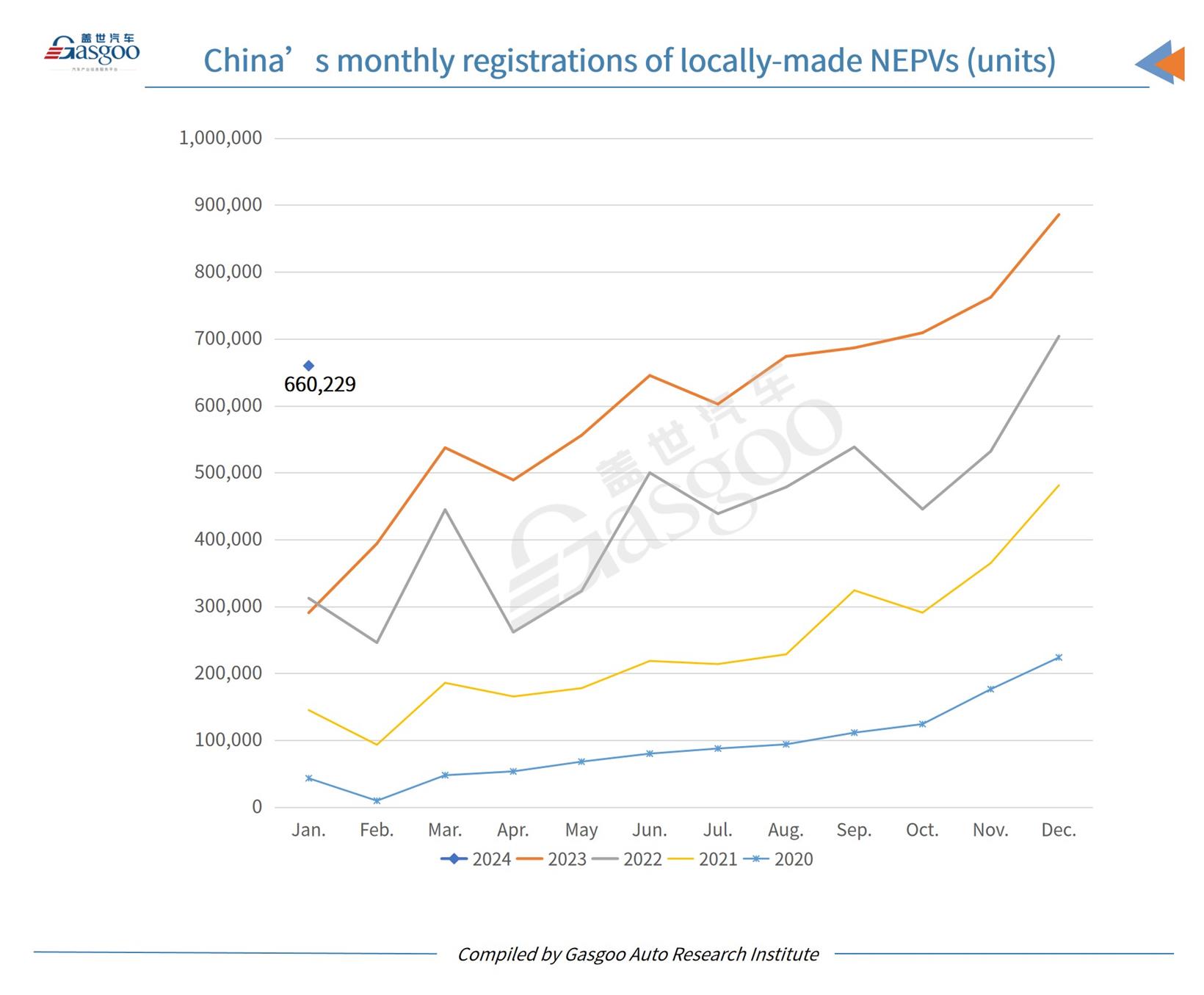

In Jan. 2024, the new energy passenger vehicle (NEPV) sector on the Chinese Mainland saw its monthly registrations reach 660,229 units, which zoomed up 126.97% from the year-ago period, but declined 25.52% from a month earlier. It accounted for 30.61% of the total nationwide PV registrations, sliding 9.17 percentage points over the previous month.

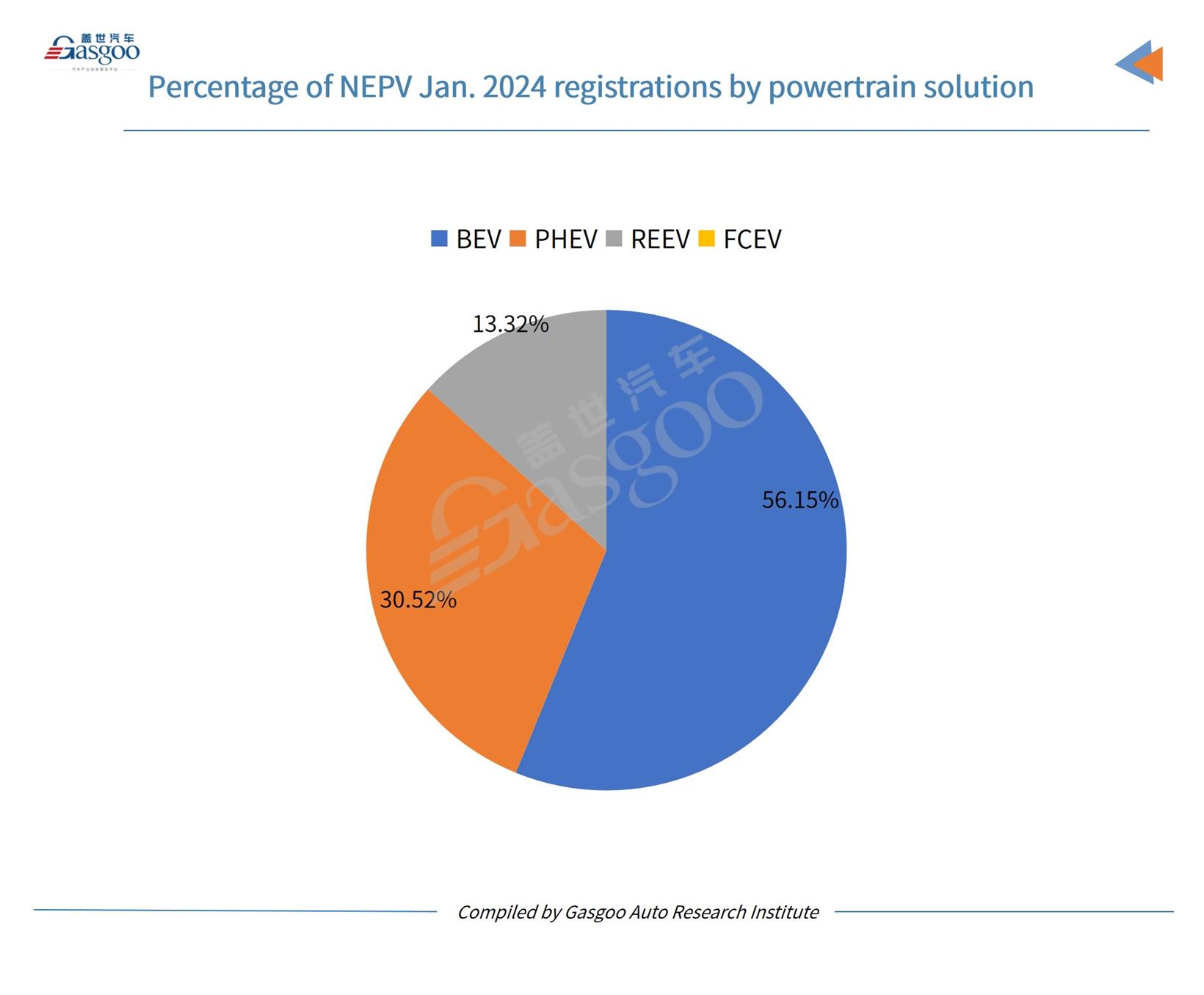

In terms of the distribution of various powertrain solutions, BEVs constituted 56.15% of China's NEPV registrations in Jan. Meanwhile, PHEV registrations totaled 289,493 units during the month (encompassing 87,959 REEVs), comprising 43.84% of the country's overall NEPV registrations.

As for the landscape of vehicle brands by Jan. NEPV registrations, BYD still led the chart with over 190,000 vehicles registered in Jan., outperforming the sum of the No.2 to No. 7 spots' occupants. Both Tesla and Wuling recorded a registration volume of over 40,000 units in the same period. Thanks to the robust performance of the AITO M7, AITO surpassed Li Auto to take the 4th seat. GAC Group's AION brand ranked 6th, with majority of its Jan. registrations contributed by the AION S (10,452 units) and the AION Y (10,399 units).

Moreover, Volkswagen also took a seat on the top 10 brands list by Jan. NEPV registrations. Last month, its ID. series had a total of 14,746 units registered across the Chinese Mainland. Notably, the ID.7 VIZZION, the mid-sized sedan model hitting the market in mid-Dec. last year, recorded a registration volume of 793 units.

Galaxy and ZEEKR, both of which are under Geely Auto, ranked 10th and 11th, respectively. With a frequent pace in expansion of product lineup, they are grabbing increasing attention from potential NEV buyers. In the first month of this year, Galaxy put its first all-electric vehicle model, the Galaxy E8, onto the market. ZEEKR, which is dedicated to premium BEVs, started delivering its first sedan model, the ZEEKR 007, on Jan. 1, and the 2024 ZEEKR X went on sale on Jan. 10.

It is worth mentioning that NEVO, a fresh NEV sub-brand under Changan Automobile, cracked the top 20 brands list by Jan. NEPV registrations. It is ambitious to roll out 10 new models by the end of 2025.

Regarding Jan. registrations, there were three NEPV models with over 30,000 vehicles registered across China, namely, the Song PLUS, the AITO M7, and the Model Y. Of them, the Song PLUS contained both PHEVs and BEVs.

Aside from the Song PLUS, BYD brand still had 7 models in the top 20 NEPV models ranking by Jan. registrations.

In Jan., Guangzhou climbed to the top position with 23,878 homemade NEPVs registered, closely followed by Chengdu (20,809 units) and Suzhou (20,513 units). Sandwiched by Hangzhou and Chongqing, Shanghai dropped to the 6th spot with a NEPV registration volume of 16,595 units.