Car and City: BYD’s Seagull honored highest-ranking PV model in China by Oct. 2023 registrations

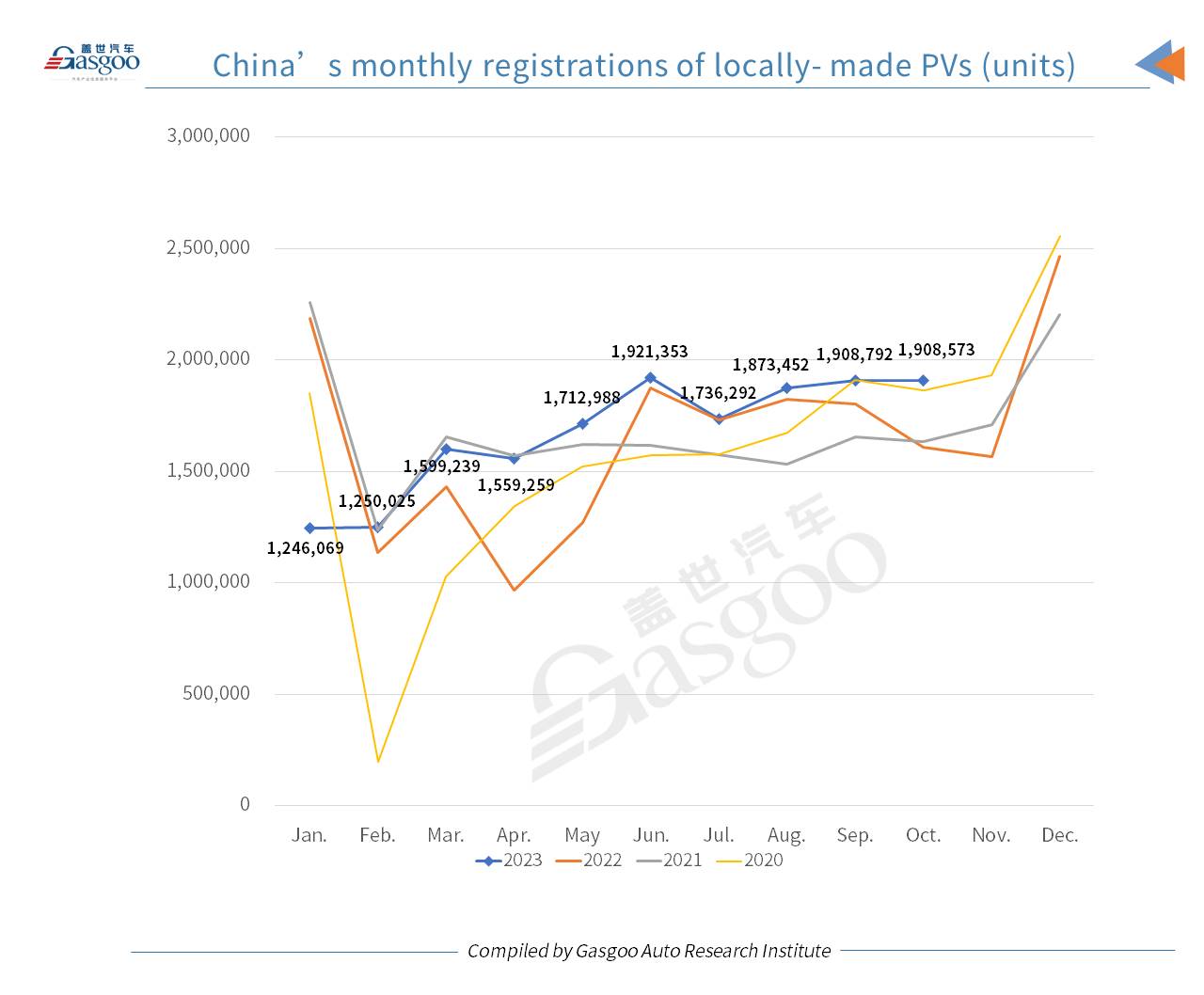

China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,908,573 units in October 2023, growing 18.81% from the previous year, but edging down 0.01% from the previous month, according to the data compiled by the ZXZC Auto Research Institute ("GARI").

For clarity, the PVs hereby refer to the vehicles locally produced and registered on the Chinese Mainland.

In October, China's PV market saw its sales performance remain flat over the previous month, following the usual trend of a strong performance during the "Golden September" and "Silver October", the traditional peak season for car shopping in China. The robust year-on-year growth was partly due to the low base for the year-ago period and the increasing demands for new energy vehicles (NEVs). The continuous sales promotions for both conventional oil-fueled and NEVs contributed to the unleashing of consumer demands.

At the national level, a series of policies aimed at stabilizing and expanding automobile consumption were introduced. Initiatives such as the "Hundred Cities Initiative" for automobile shopping festivals and the New Energy Vehicle Consumption Season in the massive rural area have yielded positive results. Moreover, diverse local events and promotional policies continue to be announced, paired with the regular release of local subsidies. These measures, coupled with corporate sales promotion efforts, are providing steady support to the automotive market in the year-end sprint.

However, persistent price reductions have heightened consumers' hesitation, resulting in diminishing marginal benefits from terminal sales. Approaching the end of October, there was an observable increase in consumer's "wait-and-see" sentiment, likely related to the anticipation of events like the "11.11" shopping festival.

For the first ten months of this year, China's cumulative PV registrations summed up to 16,716,042 units, growing 5.59% from the previous year.

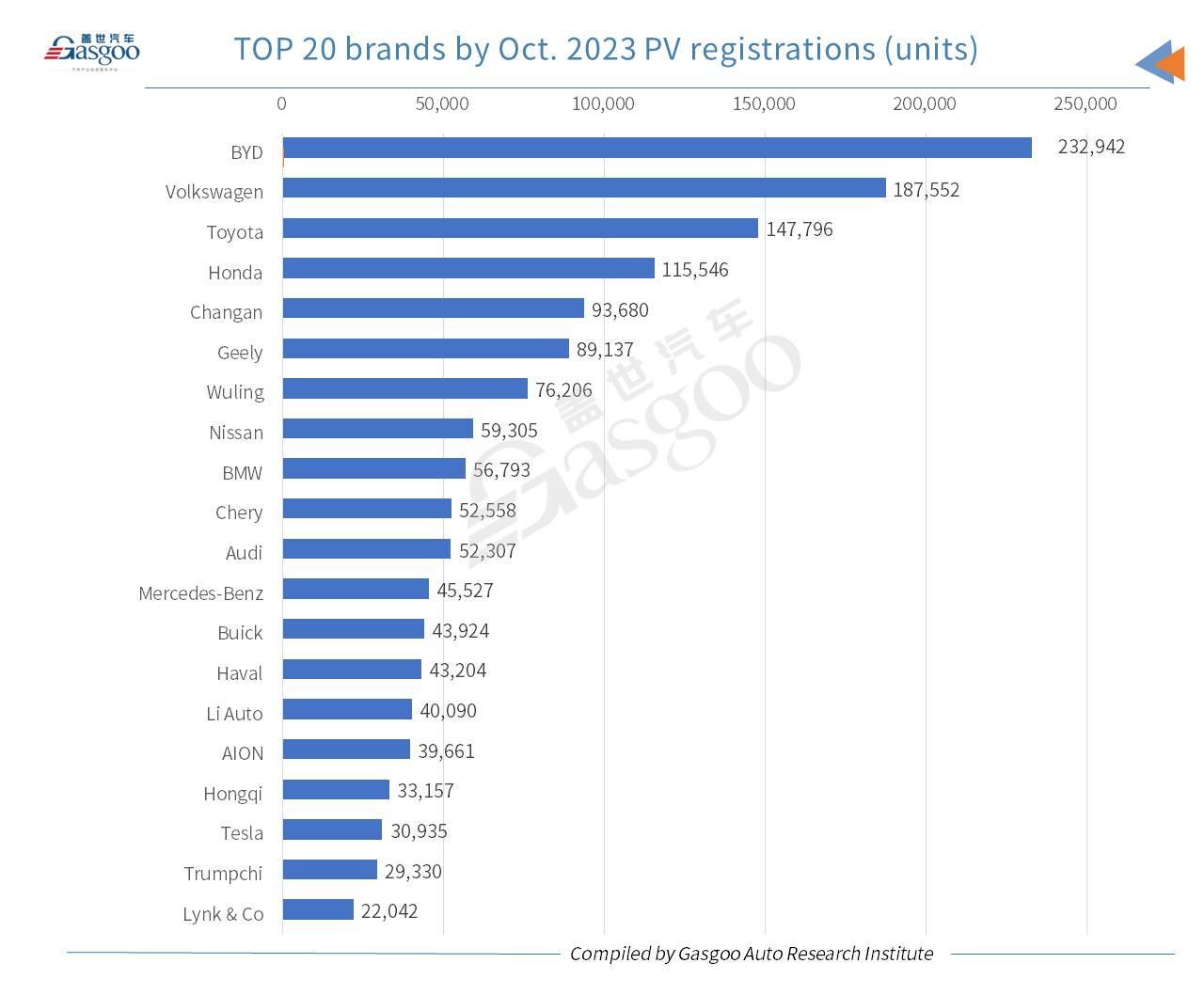

Among all brands in China, BYD was the only one to have over 200,000 homemade PVs registered in Oct. 2023. By Oct. registrations of locally-made PVs, Volkswagen, Toyota, and Honda secured the 2nd to 4th places, all of which recorded a registration volume exceeding 100,000 units.

The three major China's domestic brands—Changan, Geely, and Wuling—ranked 5th to 7th among all brands by Oct. PV registrations, while the German trio—BMW, Audi, and Mercedes-Benz—held the 9th, 11th, and 12th spots.

There were two BEV (battery electric vehicle)-dedicated brands shown in the second half of the top 20 PV brands list by Oct. registrations, namely, AION and Tesla. Li Auto ranked 15th with only REEVs (range-extended electric vehicles) sold.

Besides, some regulars in the top 20 brands rankings, such as Chery, Haval, Hongqi, and Trumpich, still made appearances last month, displaying the improved presence of China's indigenous brands.

As for the hotter-selling PV models by Oct. registrations, the highest-ranking one was BYD's Seagull, which just hit the market in late April this year and won the champion honor for the first time.

By Oct. registrations, the runner-up among all models was the Nissan Sylphy, and it was also the best-performing oil-fueled model. The 3rd to 5th places—the Yuan PLUS, the Dolphin, and the Model Y—were all taken by battery electric vehicle (BEV) products.

The list of the top 20 PV models by Oct. registrations was evenly split by NEVs and oil-fueled ones.

Among cities on the Chinese Mainland, Shanghai, Chengdu, and Guangzhou took the first three seats by Oct. PV registrations, and only Shangai had over 50,000 PVs registered in the month.

According to the registration data compiled by the GARI, the most popular models in Shanghai, Chengdu, and Guangzhou were the Model Y, the JETTA VS7, and the AION Y Plus in Oct.

Beijing, Shenzhen, and Zhengzhou ranked 4th, 5th, and 6th, respectively, all of which logged an Oct. registration volume of over 40,000 units.

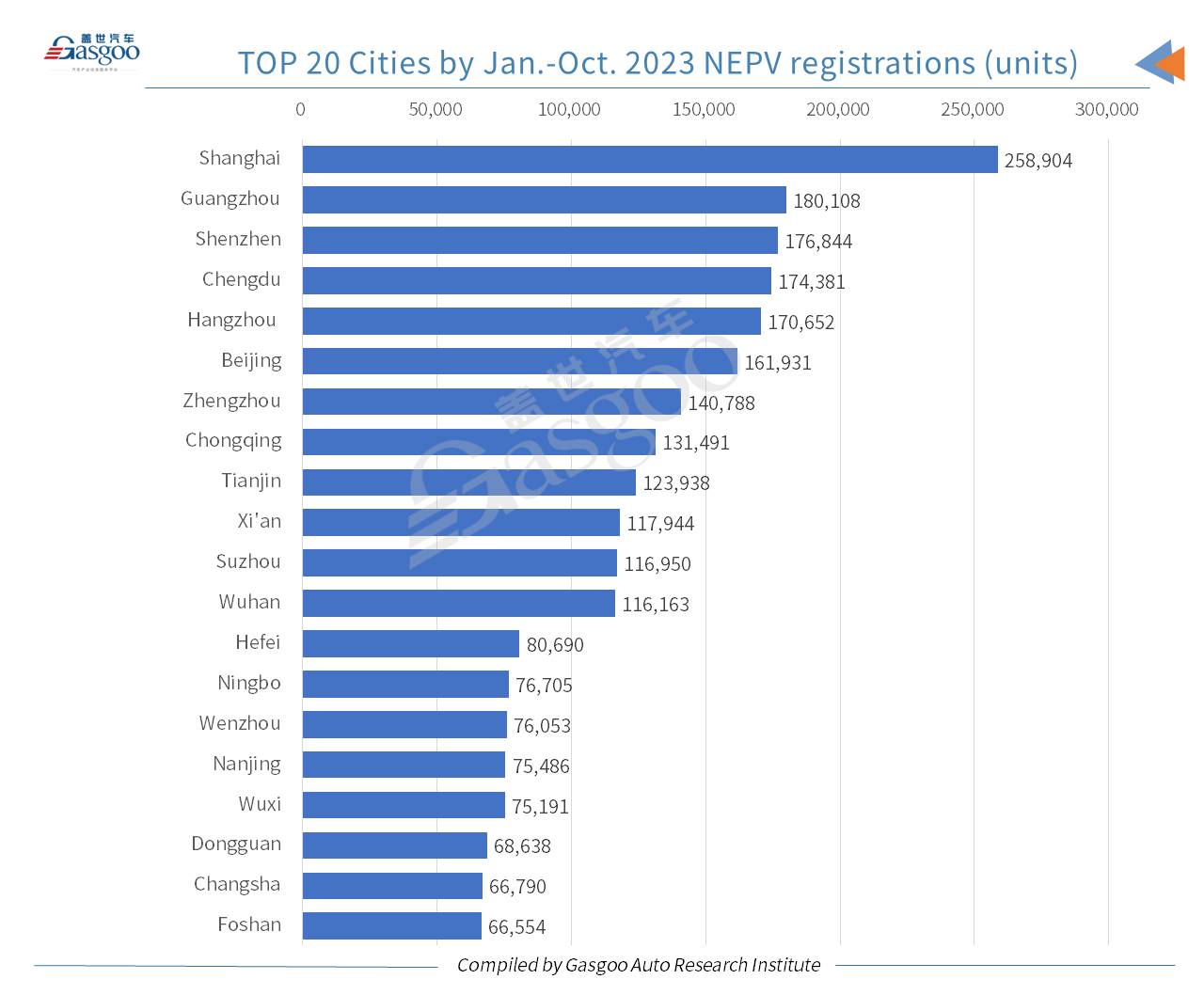

Judging from the registrations through the first ten months of this year, Shanghai, Beijing, Chengdu, and Guangzhou held the top 4 positions among all cities on the Chinese Mainland. Besides, there were 8 cities whose respective Jan.-Oct. registrations all stood between 300,000 units and 400,000 units.

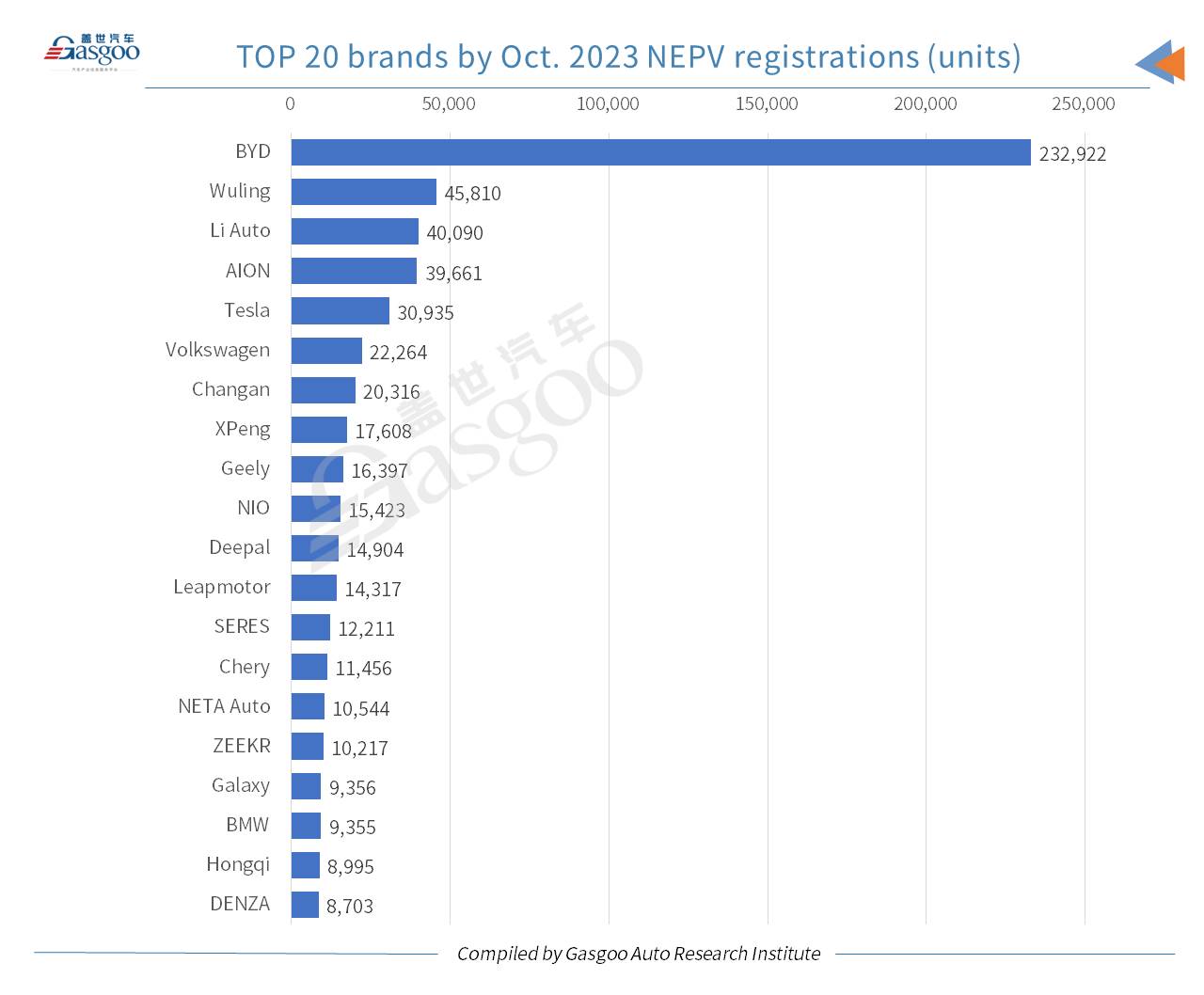

The new energy passenger vehicle (NEPV) sector in China recorded a registration volume of 709,564 units last month, soaring 59.14% from the year-ago period, rising 3.28% from a month earlier, and accounting for 37.18% of the country’s total PV registrations.

For the first ten months of this year, the cumulative NEPV registrations across the Chinese Mainland leapt 39.96% year on year to 5,588,247 units, which represented 33.43% share in the overall PV market.

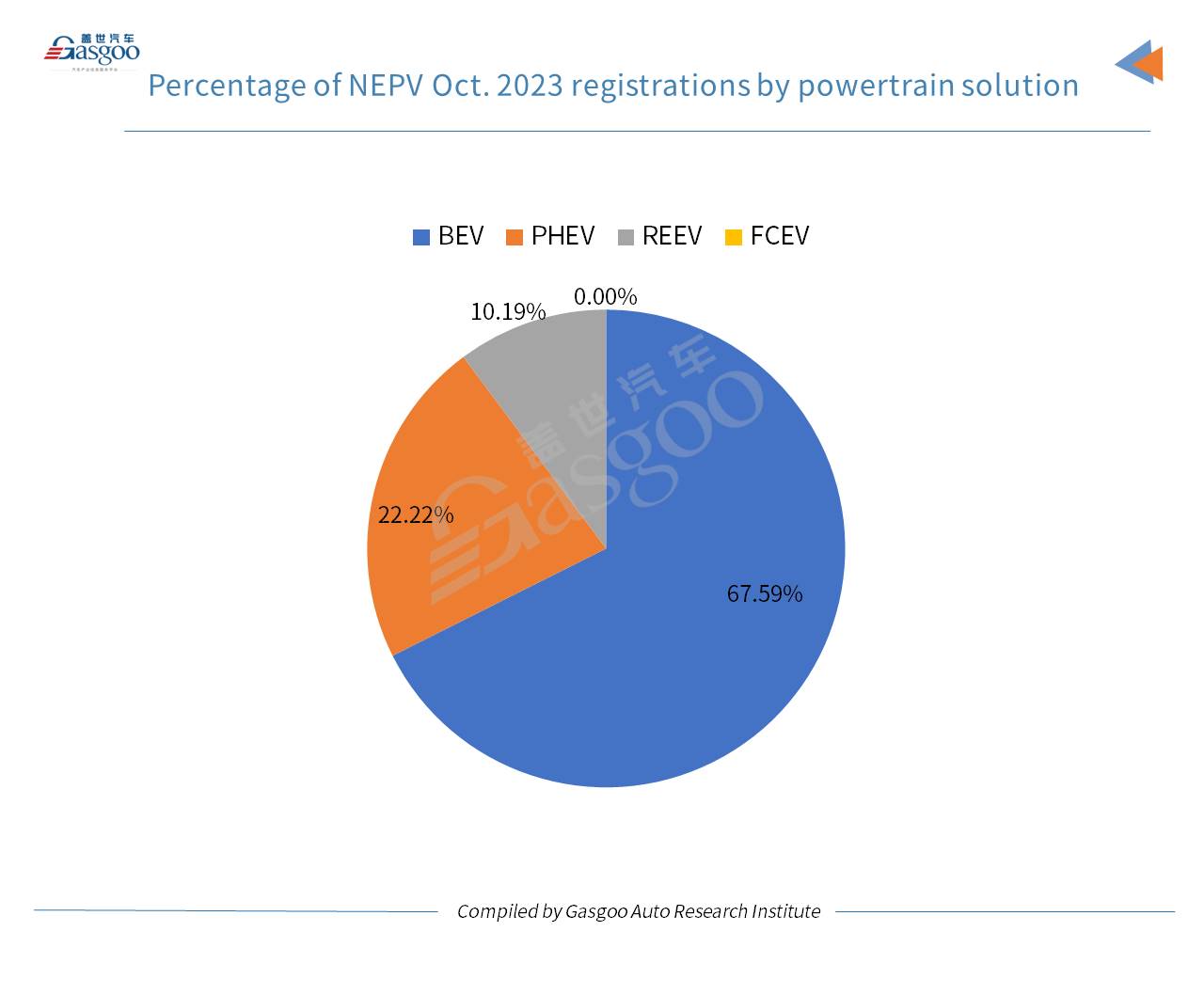

Speaking of the proportion of each powertrain solution, BEVs made up 67.59% of China's NEPV registrations in Oct. The plug-in hybrid electric vehicle (PHEV) registrations reached 229,923 units (including 72,283 REEVs) last month, accounting for 32.4% of the country's total NEPV registrations.

Of the NEPVs registered in Jan.-Oct. 2023, 69.11% were contributed by BEVs. Meanwhile, the FCV (fuel cell vehicle) segment registered a year-to-date volume of only 347 units, 15 units of which were recorded last month.

Regarding Oct. registrations by locally-produced NEPVs, BYD topped other brands with registrations exceeding 230,000 units, reinforcing its significant lead. To achieve its annual sales target of 3 million units, BYD implemented promotional campaigns, including discounts of up to 18,000 yuan, for popular models such as the Qin, Song, Han, Tang, and Yuan from Nov. 1st to 30th.

Capitalizing on the popularity of the Wuling Binguo, the Wuling brand once again broke through the 40,000-unit mark, reaching 45,810 units with a month-on-month growth of nearly 26%. This achievement catapulted Wuling back into the top three, securing the second position. With the recent launch of the Wuling Hongguang MINIEV Fast Charging Edition, Wuling anticipates a further boost in sales.

Outselling by 429 units, XPeng surpassed AION, which fell to the 4th position in Oct.

Tesla experienced a month-on-month decline of 27.5% in October. The decline is primarily attributed to the majority of new cars being allocated for export. According to data from the China Passenger Car Association, Tesla's exports of Shanghai-made vehicles reached 43,489 units in October, marking a significant 42.3% increase month-on-month.

Furthermore, other notable changes occurred on the sales charts, with considerable month-on-month increases for XPeng, Geely, NIO, and SERES (mostly contributed by AITO). Notably, propelled by the launch and delivery of the new AITO M7, SERES achieved a triple-digit month-on-month growth, with its Oct. registrations exceeding 12,000 units.

In October, BYD's Seagull surpassed Tesla's Model Y for the first time, securing the top spot with nearly 35,000 units registered. Meanwhile, the Model Y experienced a 32.7% month-on-month decline in Oct. registrations due to a substantial portion being allocated for export, causing it to drop from the 1st position in Sept. to the 4th.

The Wuling Binguo witnessed a 28.6% month-on-month jump in Oct. registrations, approaching 24,000 units and claiming the 5th spot on the list. This achievement was attributed to the launch of the Wuling Binguo 410km-range version on Sept. 25. Additionally, Wuling's iconic "People's Car," the Hongguang MINIEV, saw a gradual recovery, surpassing 20,000 units in Oct. registrations, marking a 26.1% month-on-month increase and a return to the top 10.

Compared to the previous month, notable declines were observed in the monthly registrations of Tesla's Model Y, GAC AION's AION S, and four popular models from BYD, including the Song PLUS DM-i, the Qin PLUS DM-i, the Song PLUS EV, and the Yuan PLUS.

Throughout the year, major automakers in China have launched multiple models to challenge the dominance of BYD's Qin, Song, and Yuan PLUS models. Models such as the Galaxy L6/L7, the Haval Xiaolong MAX, the Haval Menglong, the Deepal S7, and NEVO A05 have joined the competition. The decline in sales for BYD's main sales contributors suggests that these contenders have begun to impact their market share.

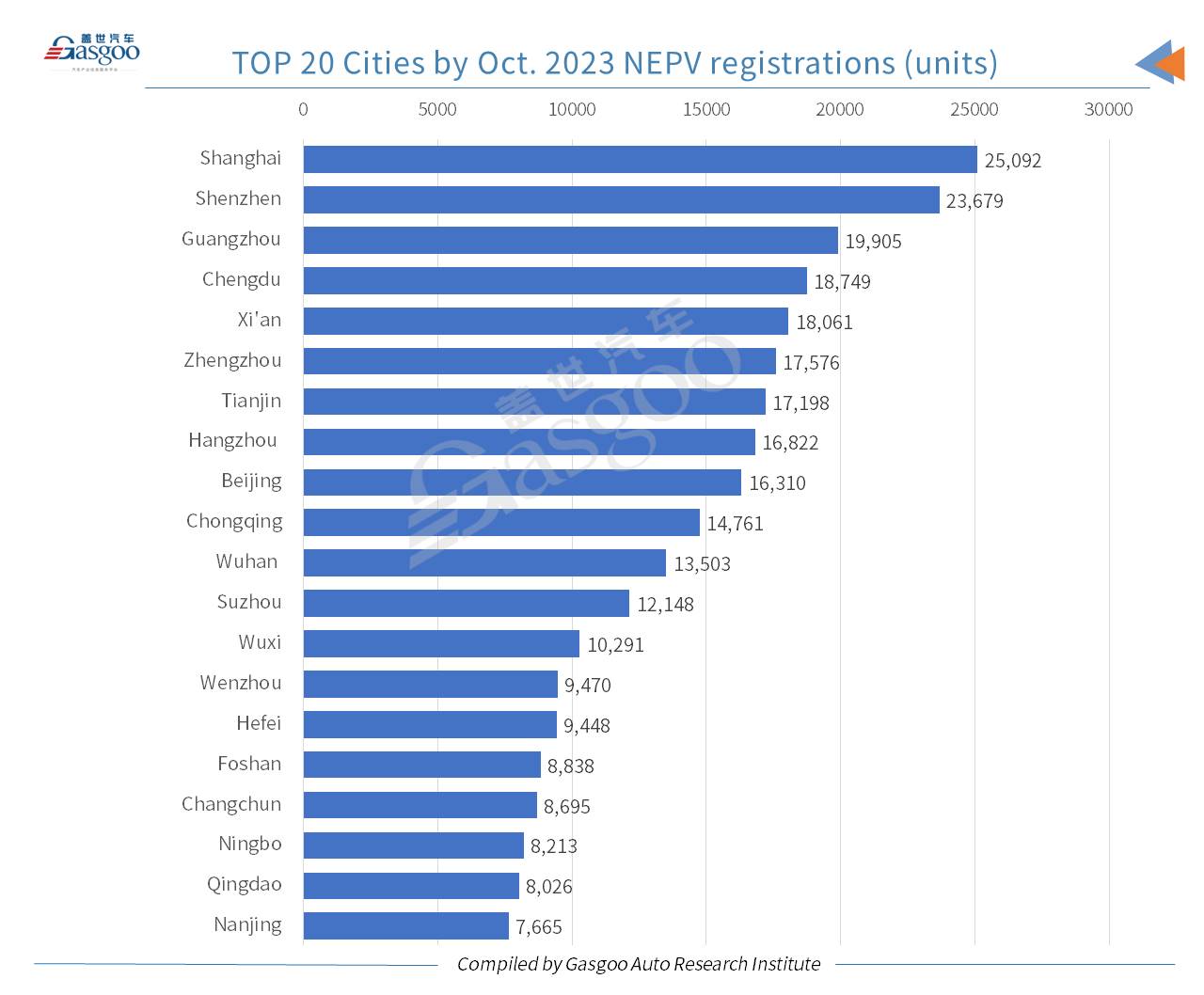

In October, Shanghai still outdid other cities with 25,092 locally-made NEPVs registered, which accounted for 35.36% of the city's overall PV registrations. During this period, the top five NEPV models in Shanghai were the Tesla Model Y, the Yuan PLUS, the Dolphin, the ID.3, and the NIO ES6.

Shenzhen saw its NEPV registrations also surpass 20,000 units last month as well, but Guangzhou failed to reach this mark.

During this year's first ten months, there were 12 cities on the Chinese Mainland with over 100,000 domestically-built NEPVs registered each.