China’s locally-made passenger vehicle retail sales in Sept. climb 5% both YoY, MoM

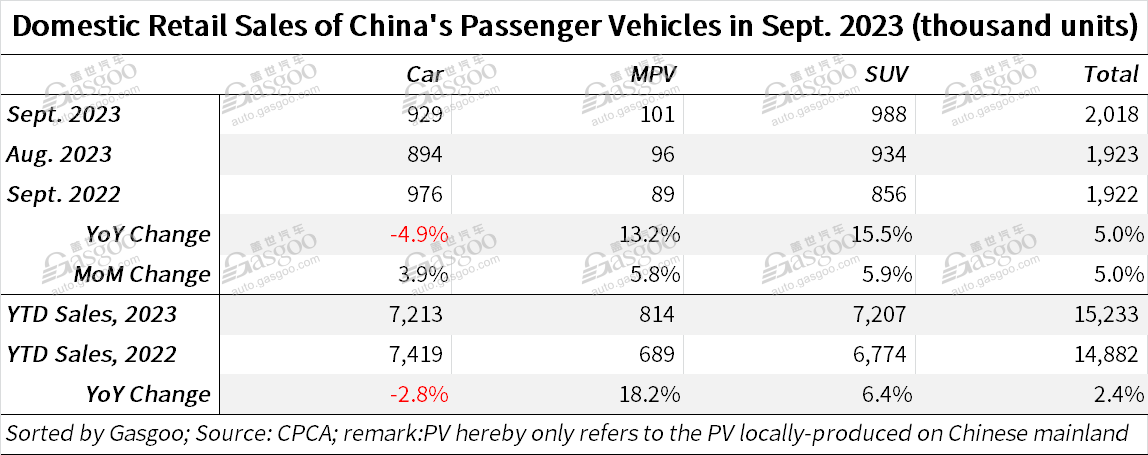

Shanghai (ZXZC)- In the ninth month of 2023, China's passenger vehicle (PV) market recorded a retail sales volume of 2.018 million units, marking a 5% increase from both the previous year and the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the PVs hereby refer to the cars, SUVs, and MPVs locally produced on the Chinese mainland.

In September, China's PV market displayed steady retail performance, following August when the PV sales hit a record high for the corresponding period. However, September's retail figures fell below the historical peak achieved in September 2017 by approximately 9%, which amounted to around 2.19 million units, according to the CPCA's data. The quarter-end sprint in the past month was characterized by robust promotional activities, and driven by automakers' and dealers' efforts who tried to fulfilled their quarterly sales targets. Both oil-fueled and new energy vehicle (NEV) sectors saw greater sales promotions compared to August, further unleashing consumers' car-buying demands.

At the national level, a flurry of policy initiatives aimed at stabilizing and expanding automobile consumption emerged, offering guidance to the automotive industry. The effects of the initiatives such as the "Hundred Cities Collaboration" automobile festival and the "Thousand Counties, Ten Thousand Towns" NEV consumption season, pushed forward by China's Ministry of Commerce, became evident. Colorful measures such as local auto shows and the distribution of consumer vouchers enriched the promotional landscape, contributing to a notable boost in consumer confidence.

In addition, the travel spree remained strong this year, with a significant number of people embarking on road trips during the Mid-Autumn and National Day holidays. As infrastructure improvements in roads, rest areas, and NEV charging facilities progressed, and with the development of a refined and diversified guesthouse system, the media platforms played a role in continually updating and enhancing road trip solutions, the association added. Consequently, there was a growing demand for enhanced safety features and intelligent assistance features. Thanks to better product choices and more affordable pricing in recent years, consumers are exhibiting stronger car-shopping demands, boosting their requirements for renewed and updated car products.

For the first nine months of this year, the cumulative PV retail sales reached 15.233 million units in China, demonstrating a year-on-year (YoY) growth of 2.4%.

In September, China's domestic brands achieved remarkable performance with 1.07 million PVs retailed, showing a 20% YoY increase and a 7.9% month-on-month (MoM) growth. They accounted for 53.4% of the country's overall PV retail volume in the month, up 6.4 percentage points compared to the year-ago period.

Year-to-date, domestic brands have captured 51% share of the market, showing a growth of 4.9 percentage points from the previous period.

The mainstream brands under joint ventures retailed 670,000 locally-produced PVs in September, representing a YoY decrease of 12%, but showing a 4% MoM growth. The market shares of German and Japanese brands fell 0.9 and 1.1 percentage points to 20.2% and 16.6%, respectively, while the American brands' share also dipped 3.3 percentage points to 7.3%。

Luxury auto brands sold 270,000 units in September by retail, indicating a 7% YoY decline and a 4% MoM drop. Improved product supply on a global scale bolstered the domestic retail market in China. The issue of luxury car shortages, which was casued by chip supply constraints last year, has gradually revolved, resulting in a relatively stable performance in recent months.

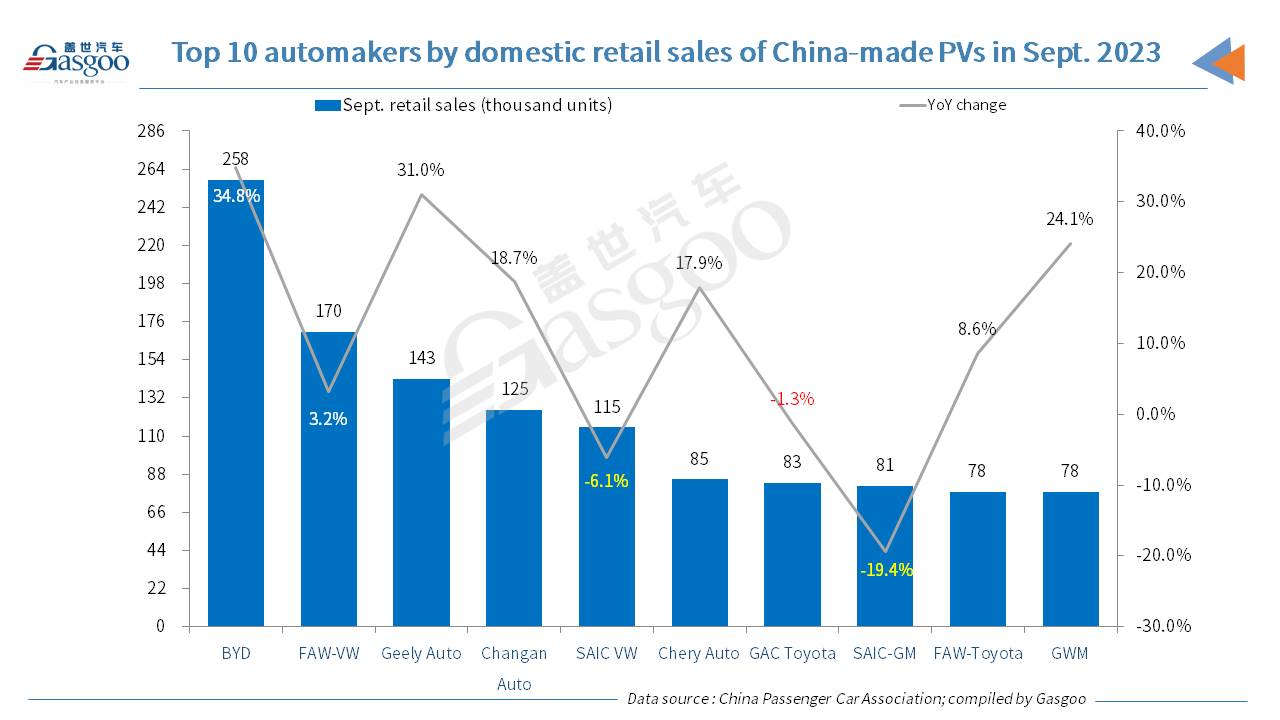

Among the top 10 automakers by September PV retail sales in China, BYD still secured the top position, and it was also the fastest-growing one in terms of YoY change. Apart from BYD, Geely Auto, Changan Auto, Chery Auto, and Great Wall Motor ("GWM") also boasted a two-digit YoY jump in their respective September retail volume. SAIC-GM faced the sharpest decline compared to the year-ago period.

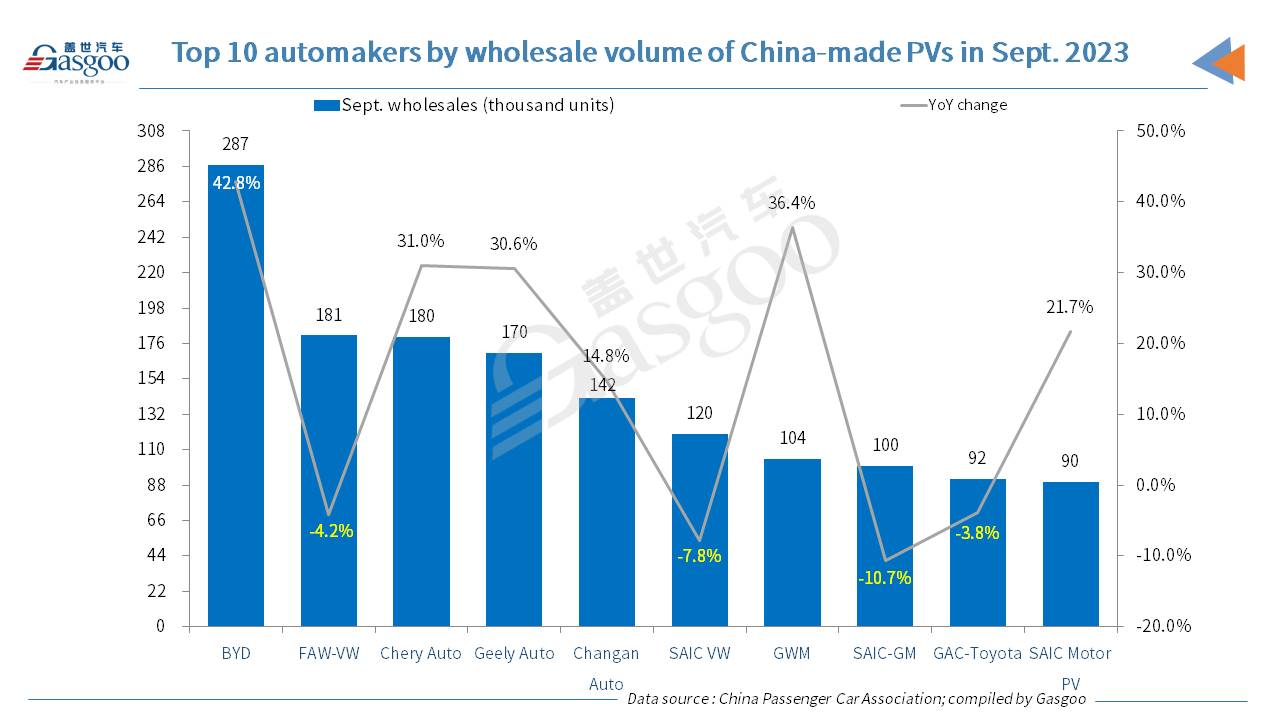

Nationwide, car manufacturers wholesaled 2.449 million PVs in September, a 6.6% YoY increase and a 9.5% MoM growth. Cumulatively for this year, 17.813 million PVs were wholesaled, up 6.6% YoY.

In September, domestic automakers wholesaled 1.38 million PVs, reflecting a 21% YoY jump and an 8% MoM growth. Mainstream joint ventures wholesaled 758,000 units, representing an 8% YoY decrease, but displaying a 16% MoM increase. Luxury carmakers' wholesales amounted to 308,000 units, a 6% YoY decrease but a 2% MoM growth.

Last month, the wholesale performance of major PV manufacturers remained strong, with 34 companies selling over 10,000 units. Among them, 6 companies achieved a YoY growth rate of over 50%, and 18 companies recorded a YoY growth rate exceeding 10%, according to the CPCA's data.

As for the new energy passenger vehicles (NEPV) market, the month of September also witnessed a robust performance in both wholesale and retail volumes. To be specific, its wholesale volume reached 829,000 units, reflecting a 23% YoY increase and a 4.2% MoM growth. Cumulatively for this year, 5.904 million NEPVs were wholesaled, marking a 36% YoY leap. Retail figures for September stood at 746,000 units, a 22.1% YoY jump and a 4.2% MoM growth. Year-to-date retail figures totaled 5.188 million units, a 33.8% YoY increase.

The country's PV production volume amounted to 2.431 million units last month, displaying a YoY increase of 2.8% and a MoM growth of 8.7%.

This year's total auto exports continued the strong growth trend from the end of last year. Under the statistical scope of the CPCA, China’s PV exports (including complete vehicles and CKDs) reached 357,000 units in September, indicating a YoY soar of 50% and a MoM growth of 8%. NEVs accounted for 25.4% of total exports in the month.

From January to September, China's PV exports totaled 2.677 million units, representing a YoY spike of 68%.