China’s locally-produced passenger vehicle retail sales in July edge down both YoY, MoM

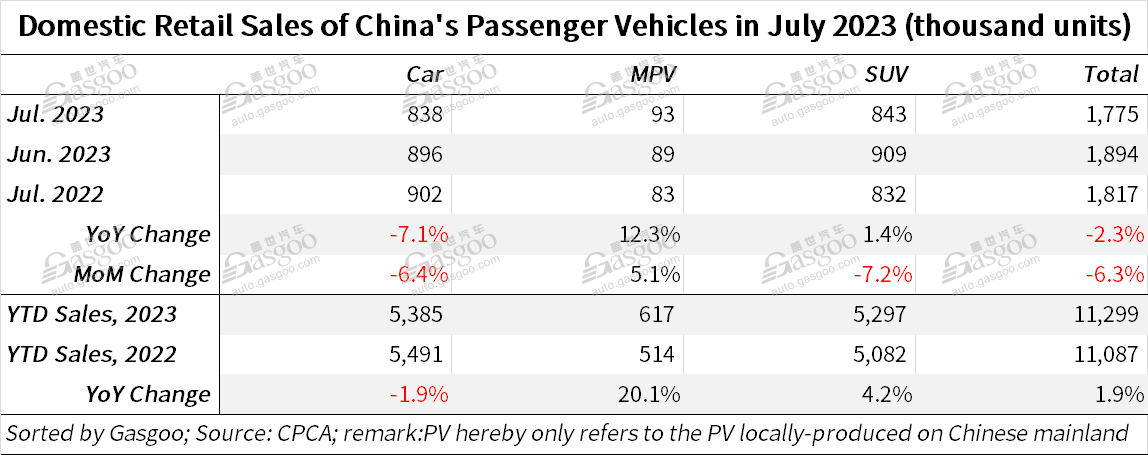

Shanghai (ZXZC)- China's passenger vehicle (PV) retail sales amounted to 1.775 million units in July 2023, edging down 2.3% from the previous year, and also declining 6.3% from the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the passenger vehicles hereby refer to the cars, SUVs, and MPVs locally produced on the Chinese mainland.

July's retail figures hit the second-highest monthly level so far this year, despite the traditional trend of July being a slack season for car shopping, typically only outdoing February. The month showcased a moderate sequential decline from June's peak, underscoring its robust performance.

With July marking the beginning for the implementation of China's VI-b emission standards, the rapid ascent of promotional prices witnessed in the first half of the year has tapered off, said the CPCA. The auto market entered a phase of subdued promotional growth in July, with an overall slight reduction in sales promotion intensity. This trend parallels the pricing patterns seen in 2019, signifying a weakening effect of promotional efforts on the automotive market.

At the national level, guiding policies have been frequently introduced to bolster and expand consumer automobile purchases. Initiatives such as the "Hundred-City Coordination" Auto Festival and the "Thousands of Counties and Ten Thousands of Towns" New Energy Vehicle Consumption Season, which promote the use of new energy vehicles, have yielded positive outcomes. Diverse promotional activities like regional auto shows and consumer voucher distribution, coupled with manufacturers' stronger efforts in the semi-annual sprint, have collectively boosted consumer confidence, the association added.

Besides, taking into account such factors as an earlier-than-usual Spring Festival, the ebb and flow of anticipated stimulus policies, the surge in sales promotion for China VI-a car inventories, and the lower base for the year-ago period, the cumulative PV retail sales for the Jan.-Jul. period in China rose 1.9% from a year earlier to 11.299 million units.

In July, China's indigenous brands recorded combined retail sales of around 940,000 units, a YoY growth of 15% and a MoM growth of 1%. These brands accounted for 53.2% of domestic PV retail sales in July 2023, an increase of 5.8 percentage points over the previous year.

Mainstream joint-venture brands retailed 590,000 locally-produced PVs in July, a decrease of 28% YoY, but an 11% growth MoM. The market shares of German and Japanese brands fell 0.8 and 5 percentage points to 20.8% and 15.8%, respectively, while the American brands’ share climbed 0.7 percentage points to 7.7%。

Luxury auto brands sold 240,000 units in July by retail, indicating a 22% YoY decrease and a 20% MoM increase. The previous chip supply constraints last year has gradually been resolved, partly resulting in an 11% YoY growth in the year-to-date luxury PV retail sales in China.

Among the top 10 automakers by July PV retail sales in China, BYD still secured the top position, and was also the fastest-growing one in terms of YoY change. Among the No.2 to No.10 carmakers, only Geely Auto and Changan posted a rising movement over a year earlier.

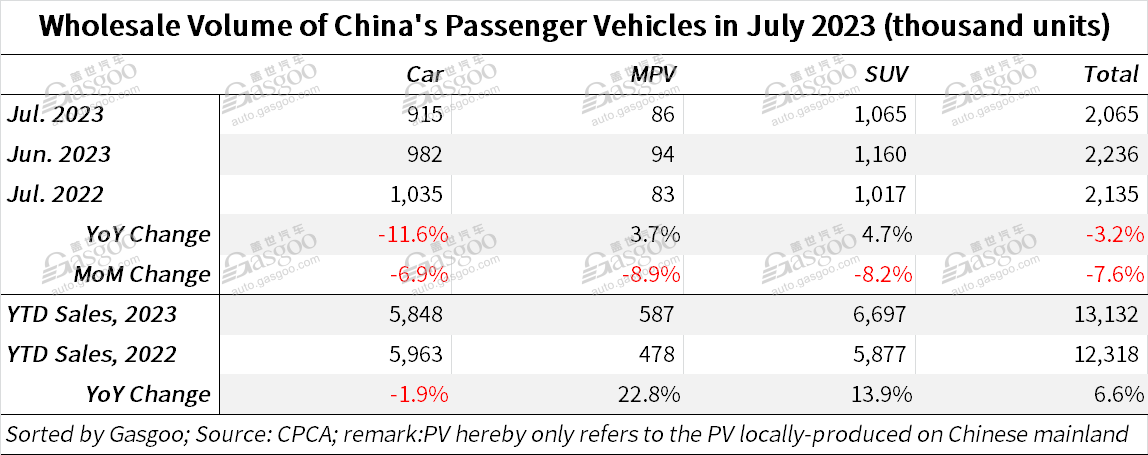

China's PV wholesale volume in July 2023 reached 2.236 million units, down by 3.2% compared to the prior-year period and 7.6% from the previous month. The accumulated wholesales have amounted to 13.132 million units so far this year, reflecting a 6.6% YoY growth.

In July, China’s local brands wholesaled 1.19 million units, up 22% YoY, but down 1% MoM. Mainstream joint-venture brands wholesaled 590,000 units, marking a 34% YoY decline and a 1% MoM decrease. Luxury brands wholesaled 280,000 units, up 13% YoY, but down 15% MoM.

There were 31 companies with a wholesales volume of over 10,000 units in July, 2 companies fewer than that of the previous month. According to the CPCA’s data, 7 of these companies reported a MoM growth rate of over 30%, while 4 saw a growth rate of over 10%.

With regard to the PV wholesale volume in July, BYD still outdid other automakers with a volume of around 261,000 units and it was immediately followed by Chery Auto. Besides, the three major Chinese automakers—Geely Auto, Changan Auto, and Great Wall Motor—all scored a year-on-year increase in their July wholesales. Tesla didn't appear on the top 10 automakers list.

The production volume of locally-manufactured passenger vehicles in July amounted to 2.101 million units in the country, displaying a YoY decrease of 2.6% and a MoM drop of 4.3%. Due to the emission standard upgrades, enterprises have been extremely cautious in production.

This year's total auto exports continued the strong growth trend from the end of last year. Under the statistical scope of the CPCA, passenger vehicle exports (including complete vehicles and CKDs) reached 310,000 units in July, indicating a YoY surge of 63% and a MoM growth of 4%. From January to July, China's passenger vehicle exports totaled 1.99 million units, representing a YoY spike of 81%. New energy vehicles accounted for 28% of total exports in July.