China’s locally-produced passenger vehicle retail sales edge up 2.7% in H1 2023

Shanghai (ZXZC)- China's passenger vehicle (PV) retail sales amounted to 1.894 million units in June 2023, edging down 2.6% from the previous year, but rising 8.7% from the previous month, according to the China Passenger Car Association (CPCA).

From January to June this year, retail sales have continued to grow month by month, a trend of consecutive monthly growth that has not been seen in this century.

With the low sales volume base from the previous year and the influence of various policies and sales promotions, the cumulative retail sales from January to June reached 9.524 million units, achieving a positive year-on-year growth of 2.7%.

For clarity, the passenger vehicles hereby refer to the cars, SUVs, and MPVs locally produced on the Chinese mainland.

At the national level, Chinese government has introduced policy guidelines aimed at stabilizing and boosting automobile consumption. China’s Ministry of Industry and Information Technology and Ministry of Commerce have promoted the use of new energy vehicles (NEVs) in rural areas, launching a slew of activities, which have yielded good results. Various local auto shows and the distribution of consumer vouchers have enriched the colorful promotional activities. Automakers have made strong efforts in the second half of the year, which have had a positive impact on boosting consumer confidence.

Why did the retail sales of the automobile market show a continuous monthly increase from January to June? In the first six months of the year, several factors contributed to this trend, including the earlier occurrence of the Spring Festival, an intense price war in March, consumer anticipation of the promotion trend of China VI B emission standards, the launch of numerous new products and low-priced models, and the "618" mid-year shopping festival. These series of expectations and policy announcements in the first half of the year ultimately led to a booming car market in late June.

In June, China's indigenous brands recorded combined retail sales of around 930,000 units, a YoY growth of 14% and a MoM growth of 7%. These brands accounted for 49.3% of domestic PV retail sales in June 2023, an increase of 6.7 percentage points over the previous year.

Mainstream joint-venture brands retailed 660,000 locally-produced PVs in June, a decrease of 19% YoY, but a 6% growth MoM. While the market shares of German, Japanese, and American brands fell 1.6, 3.7, and 0.9 percentage points from the previous year, respectively.

Luxury vehicle brands sold 300,000 units in June by retail, indicating a 3% YoY decrease, but marking a 22% MoM increase. The previous chip supply constraints last year has gradually been resolved, leading to a robust market climate.

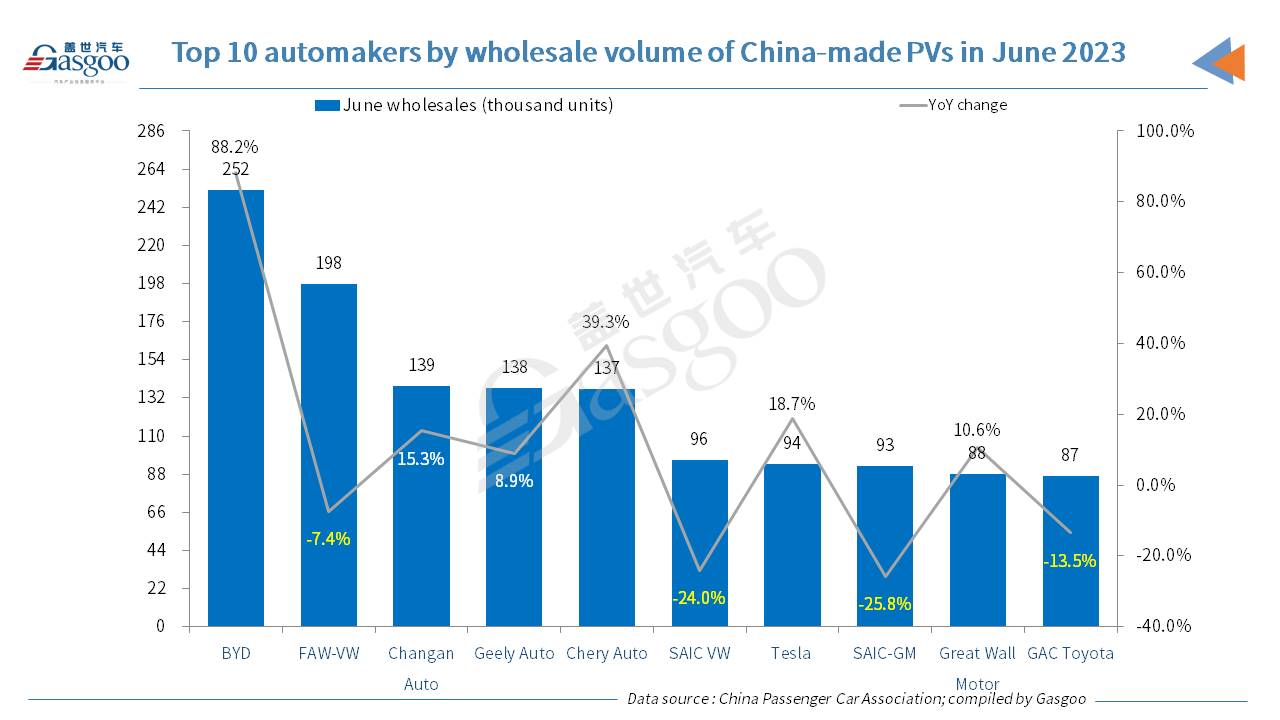

Among the top 10 automakers by June PV retail sales in China, BYD still ranked highest, and was also the fastest-growing one in terms of YoY change. Among the No.2 to No.10 carmakers, only Changan Auto and Geely Auto posted a rising movement over a year earlier.China's PV wholesale volume in June 2023 reached 2.236 million units, up by 2.1% compared to last year and 11.7% from the previous month. The accumulated wholesales have amounted to 11.066 million units so far this year, reflecting an 8.7% YoY growth.

In June, China’s local brands wholesaled 1.2 million units, up 21% YoY and 9% MoM. Mainstream joint-venture brands wholesaled 700,000 units, marking a 21% YoY decline, but reflecting a 13% MoM growth. Luxury brands wholesaled 330,000 units, up 2% YoY and 19% MoM.

There were 33 companies with a wholesales volume of over 10,000 units in June, an increase of 3 companies compared to the previous month. Seven of these companies reported a MoM growth rate of over 30%, while 20 saw a growth rate of over 10%.

With regard to the PV wholesale volume in June, BYD still outdid other automakers with a volume of around 252,000 units. The occupants of the third to fifth spots—Changan Auto, Geely Auto, and Chery Auto—all scored a year-on-year increase in June wholesales. Tesla saw its China-made vehicle wholesales jump 18.7% from a year earlier to roughly 940,000 units last month, making it rank 7th among carmakers in China.

The production volume of locally-manufactured passenger vehicles in June amounted to 2.195 million units in the country, displaying a YoY decrease of 0.5%, but marking a MoM increase of 10.3%. Due to the China VI emission standard upgrades, enterprises have been extremely cautious in production.

This year's total auto exports continued the strong growth trend from the end of last year. Under the statistical scope of the CPCA, passenger vehicle exports (including complete vehicles and CKDs) reached 290,000 units in June, a YoY surge of 56%, but a MoM dip of 4%. From January to June, China's passenger vehicle exports totaled 1.68 million units, representing a YoY spike of 92%. New energy vehicles accounted for 28% of total exports in June.