China's homegrown PV retail sales rise 4.7% YoY in Feb. 2022

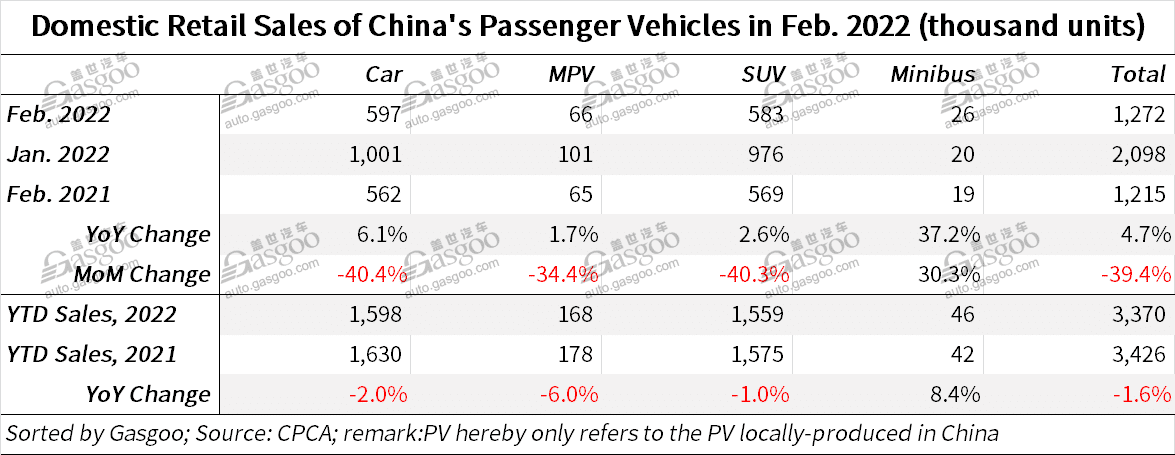

In February 2022, the retail sales of locally-made PVs referring to cars, MPVs, SUVs and minibuses) in China amounted to around 1.272 million units, rising 4.7% from a year earlier, while plunging 39.4% compared to the previous month, according to the China Passenger Car Association CPCA).

For the first two months of 2022, China's homemade PV retail sales edged down 1.6% year on year to 3.37 million units. The CPCA said this was a good performance considering the earlier Spring Festival holiday than that of the previous year.

This year, local governments still called on people to stay where they work and live during the holiday to contain the coronavirus spread, while the public response was clearly weaker over the year-ago period. The larger volume of people returning to their hometowns apparently spurred the car consumption in county-level cities in provinces of Central and Western China.

The sales of new energy vehicles NEVs) were still blooming in February due to the spike in oil prices and the virus resurgence which made consumers pay greater attention to travelling safety.

The four segments all recorded year-on-year growth in Feb. retail sales. Compared to Jan. 2022, only the minibus segment scored an increase.

There were about 160,000 luxury PVs retailed across China last month, representing a 3% year-on-year decline, while also showing a 44% month-on-month jump.

The retail sales of PVs under Chinese indigenous brands reached about 540,000 units in February, growing 14% from a year earlier, while tumbling 42% from a month ago. The market share of China's self-owned brand reached 44% by Feb. retail volume, 4.3 percentage points higher than that of the prior-year period.

The association noted NEVs served as the main driving force to the year-on-year increase in Chinese local brands' Feb. retail sales. Traditional automakers, like BYD, which give great weight to NEV business, generally posted high growth rate.

Mainstream joint ventures saw their combined retail sales stand around 550,000 units in Feb. 2022, sliding 1% over the previous year, while also dropping 36% over the previous month.

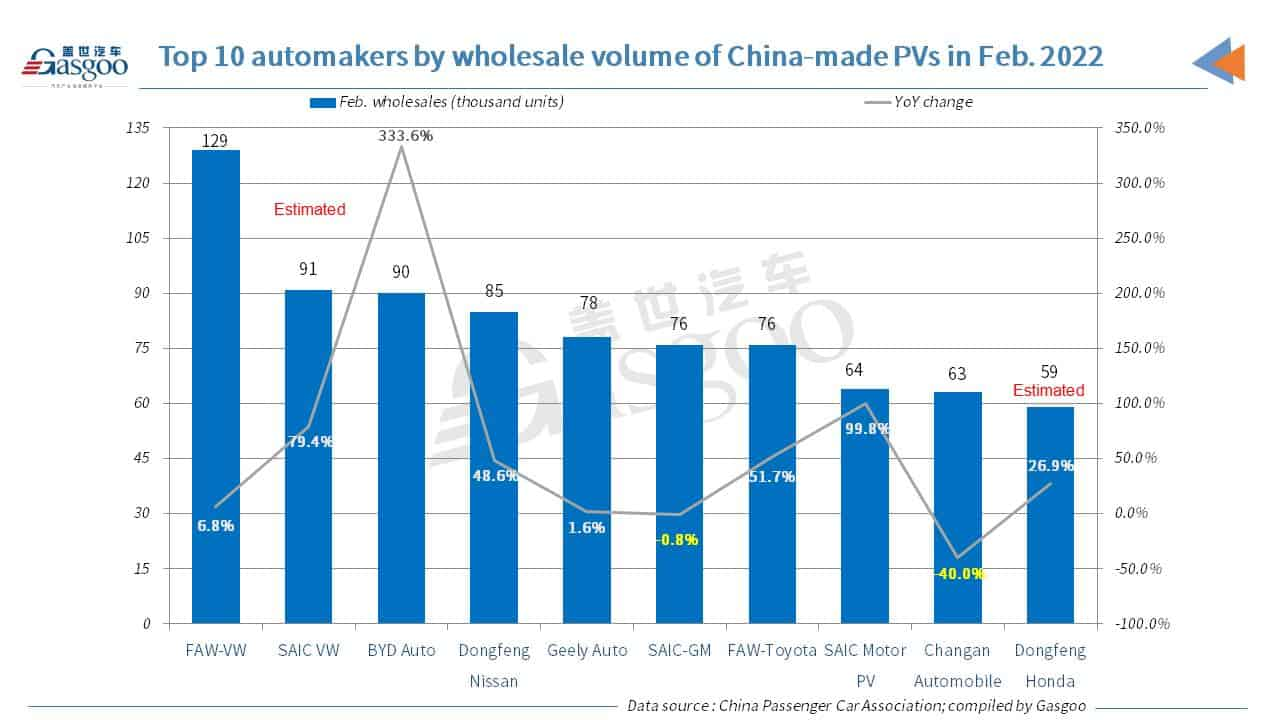

Among the top 10 automakers in China by Feb. 2022 locally-built PV retail sales, only three firms BYD Auto, FAW-Toyota, and Dongfeng Honda) achieved a growth year-over-year. Compared to the previous month, FAW-VW still ranked highest, while BYD Auto moved up 7 spots to the runner-up place and was credited as the fastest-growing one. Changan Automobile not only ranked lowest on the top 10 list, but faced the steepest decline.

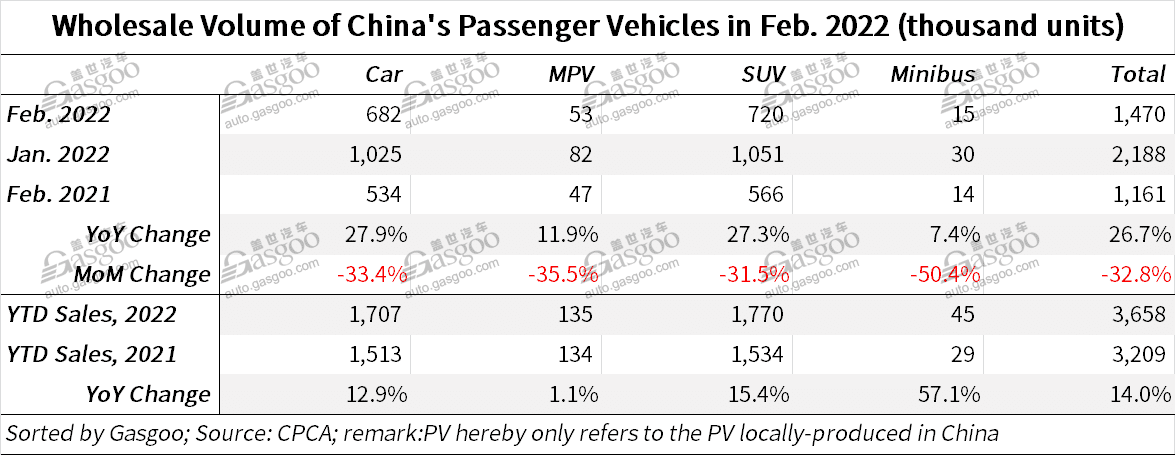

PV wholesale volume in China reached 1.47 million units in Feb. 2022, jumping 26.7% from a year earlier with the four segments all recording an increase. The year-to-date wholesales rose 14% to 3.658 million units.

On the top 10 automakers list by Feb. PV wholesales, eight carmakers logged a year-on-year growth and four were Chinese indigenous firms BYD Auto, Geely Auto, SAIC Motor PV, and Changan Automobile). BYD Auto still boasted the biggest rise. Compared to the previous month, Changan Automobile slid 7 places, while SGMW failed to crack the top 10 rankings.