Toyota, Honda, Nissan see YoY cutback in November China sales

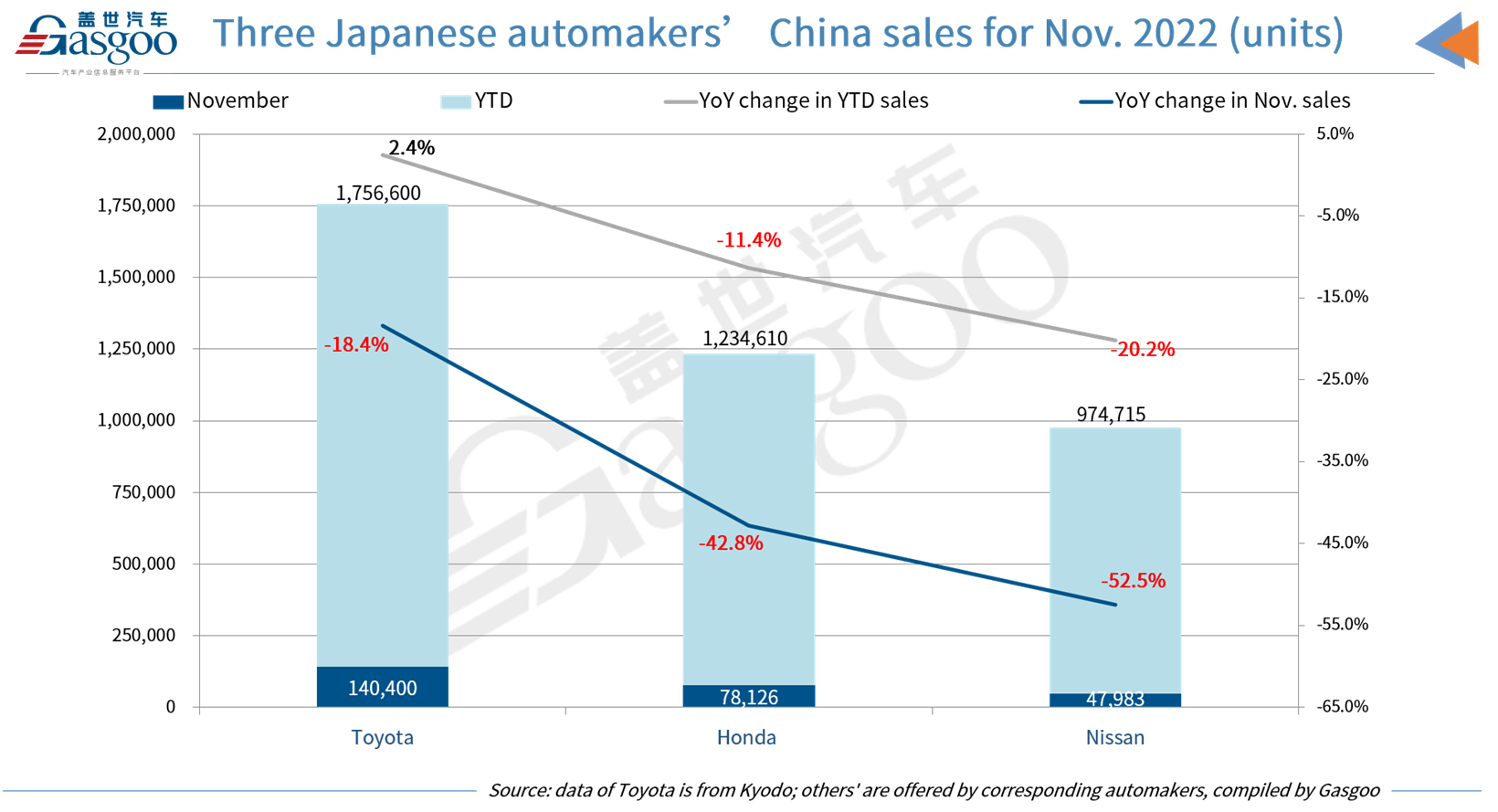

In November 2022, the three major Japanese automakers, namely Toyota Motor, Honda Motor, and Nissan Motor all faced a year-on-year dip in their monthly sales in China, with Nissan Motor taking the biggest hit.

In the first five months of 2022, a continuous year-on-year slip challenged the three Japanese automakers in China, but the situation improved, especially for Toyota Motor when the company saw its year-on-year upturn in its June sales. Toyota managed to sustained the growth for five months straight until November.

Meanwhile, the sales cutback in November marked the respective third and fourth consecutive month for Honda and Nissan to sell less vehicles in China than a year ago.

Toyota Motor sold 140,400 new vehicles in China in the past month, representing a 18.4% decline from a year earlier. November sales of Toyota’s high-end imported brand, Lexus, also encountered a 22% dip year-on-year. Among the auto giant’s Chinese joint ventures, namely, FAW-Toyota and GAC Toyota, the latter was the only one that witnessed a year-over-year sales growth (3.6%) in November.

In the first eleven months of 2022, Toyota Motor sold 1,756,600 vehicles in China, cumulatively. Thanks to the automaker’s robust performance in the Jun.- Oct. period, its year-to-date sales volume still surpassed that of a year ago by 2.4%.

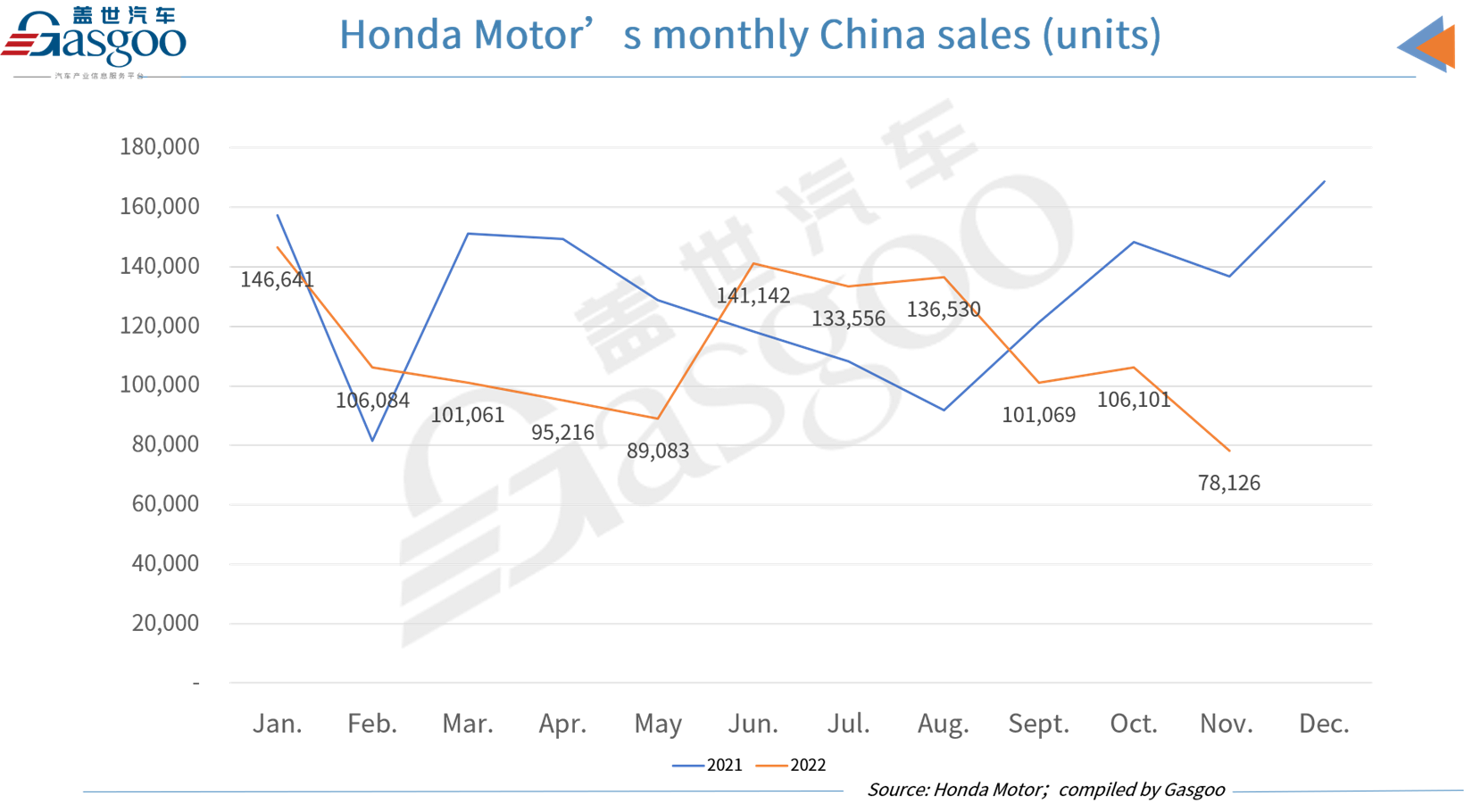

In November, Honda Motor sold 78,126 vehicles in China, which dropped 42.8% from a year earlier while slipping 26.3% from the previous month.

In terms of the separate performance of the company’s two Sino joint ventures, GAC Honda saw its November sales tumbled 34.2% over a year ago to 45,512 units, while Dongfeng Honda clocked a 51.7% year-on-year decline with 32,614 vehicles sold.

For the first eleven months of the year, Honda Motor sold 1,234,610 vehicles across the world’s largest auto market, indicating a 11.4% slip compared to the same span last year.

In the eleventh month of 2022, Nissan Motor sold 47,983 vehicles in China, which tumbled down 52.5% over the previous year while sliding 46% from October. In the Jan.-Nov. period, Nissan Motor’s cumulative sales volume amounted to 974,715 vehicles across China, down 20.2% from a year ago.

With the global transition to electrification going stronger than ever, Nissan Motor and Honda Motor are all actively laying out their new energy vehicle (NEV) deployment in China.

According to data released by the two Japanese automakers’ Chinese partner, Dongfeng Motor, Dongfeng Nissan sold 3,361 NEVs in November, up 27.9% from a year ago. In the first eleven months of the year, a total of 37,889 NEVs were sold by Dongfeng Nissan, skyrocketing 245% year on year.

At the same time, Dongfeng Honda sold 2,039 battery-electric vehicles in the past month, indicating a 262.8% year-on-year increase. In the Jan.-Nov. period, the joint venture sold 16,086 battery-electric vehicles, which zoomed up 194.1% from the year-ago period.