Toyota sees Q2 2022's first YoY increase in China monthly sales

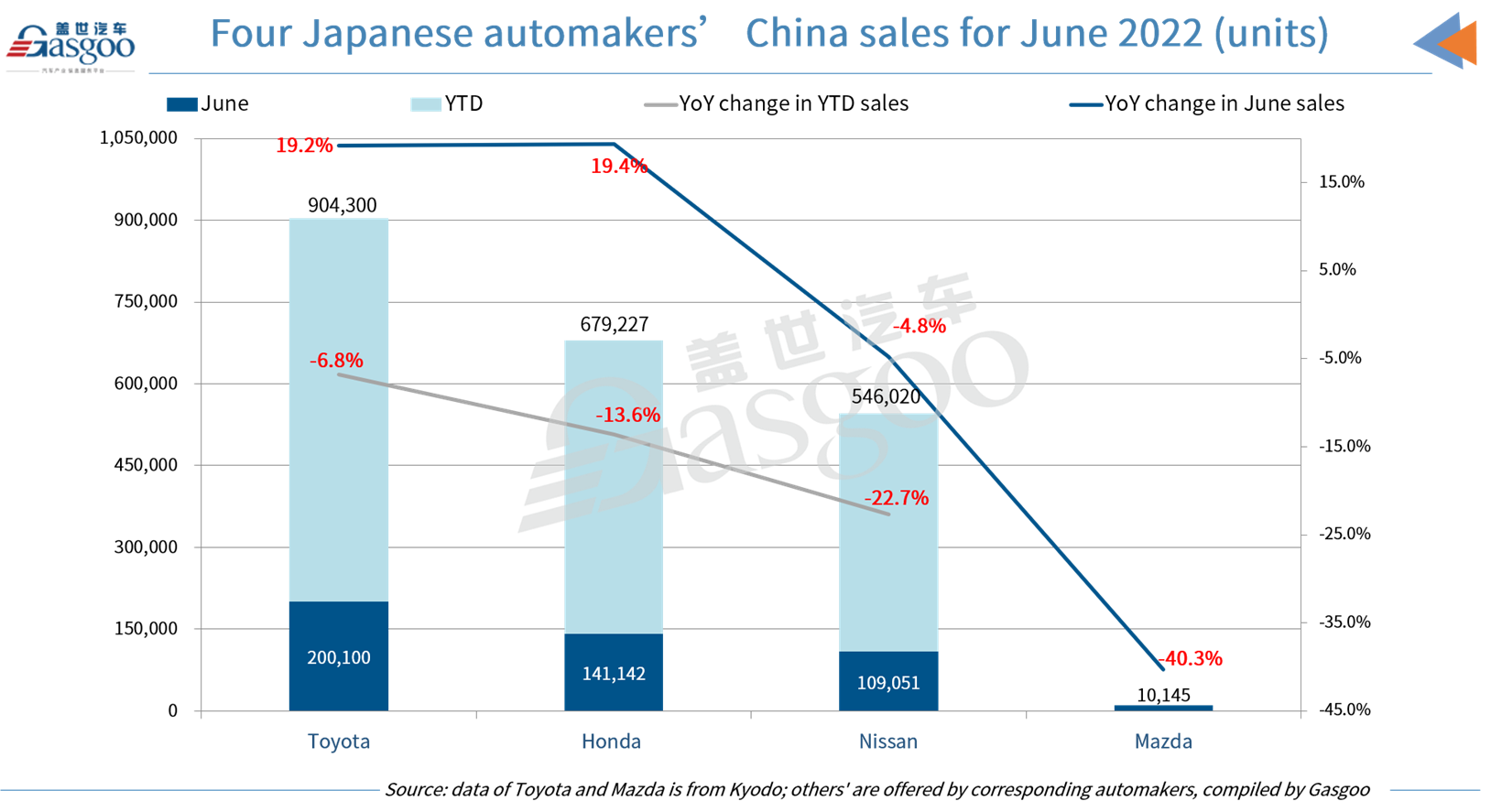

In the sixth month of 2022, the four major Japanese automakers, namely Toyota Motor, Honda Motor, Nissan Motor, and Mazda Motor all witnessed their monthly sales volume recover over the previous month. Except for Nissan Motor and Mazda Motor, the other two automakers all posted two-digit year-on-year growth in monthly sales.

In the Jan.-Jun. period, the cumulative China sales volume of Toyota, Honda, and Nissan all saw a year-on-year downward slope, with Toyota embracing the least impact while Nissan the most. With 546,020 vehicles sold in the first half of this year, Nissan Motor reported the widest decline of 22.7% over the year-ago period.

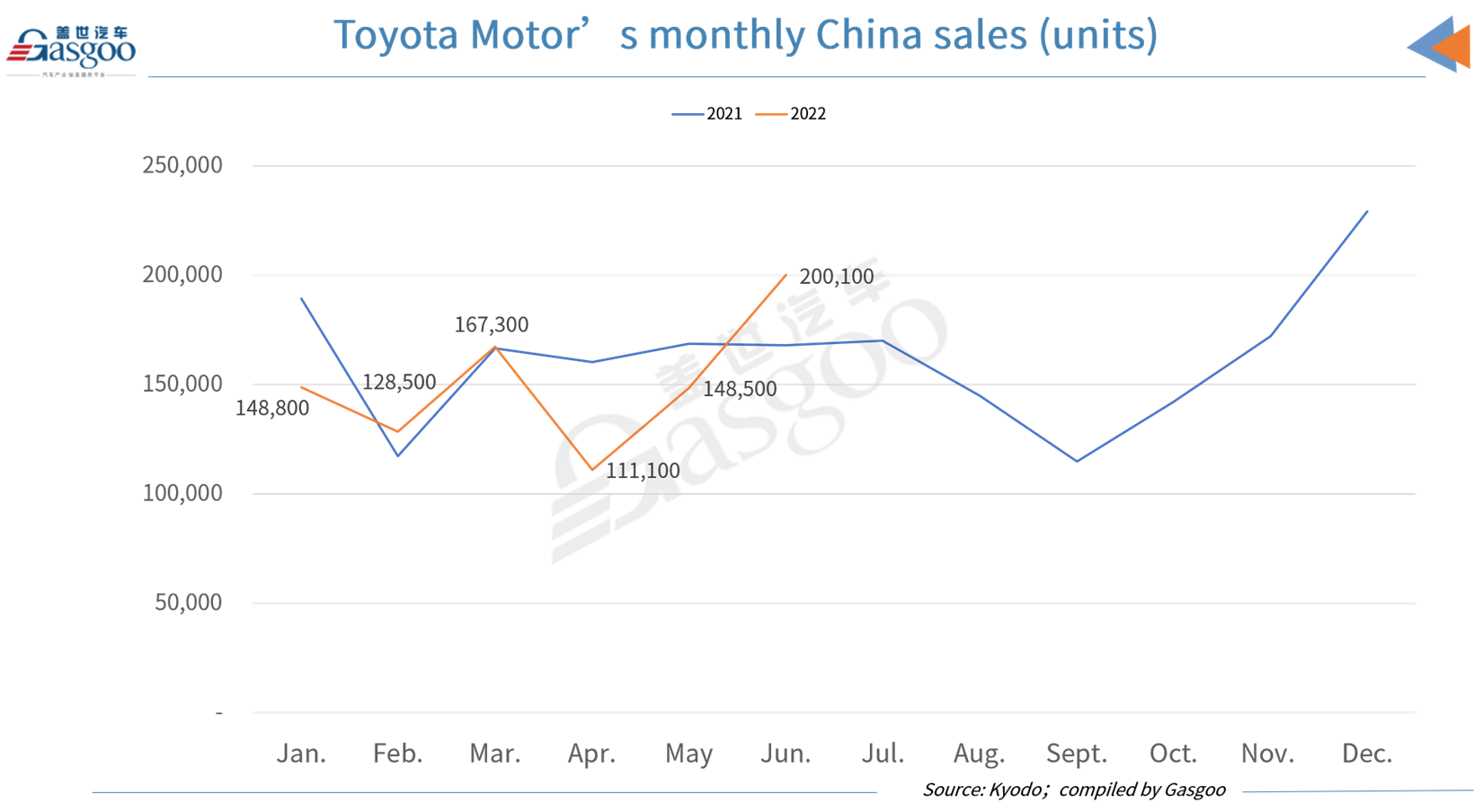

In June, Toyota sold 200,100 vehicles in China, recovering greatly from May with a 34.75% jump. Notably, the number signified that Toyota has regained its momentum under the COVID impact and saw its monthly sales surpass the same period last year for the first time in the second quarter of 2022. Compared to a year ago, Toyota managed to achieve a 19.2% year-on-year growth in June sales.

Toyota commented that its June performance was mainly driven by the Corolla and Camry sedans. However, with the continuously crimped supply of semiconductors, in June, the automaker’s high-end brand, Lexus, endured a 38.4% decline in China sales from a year ago.

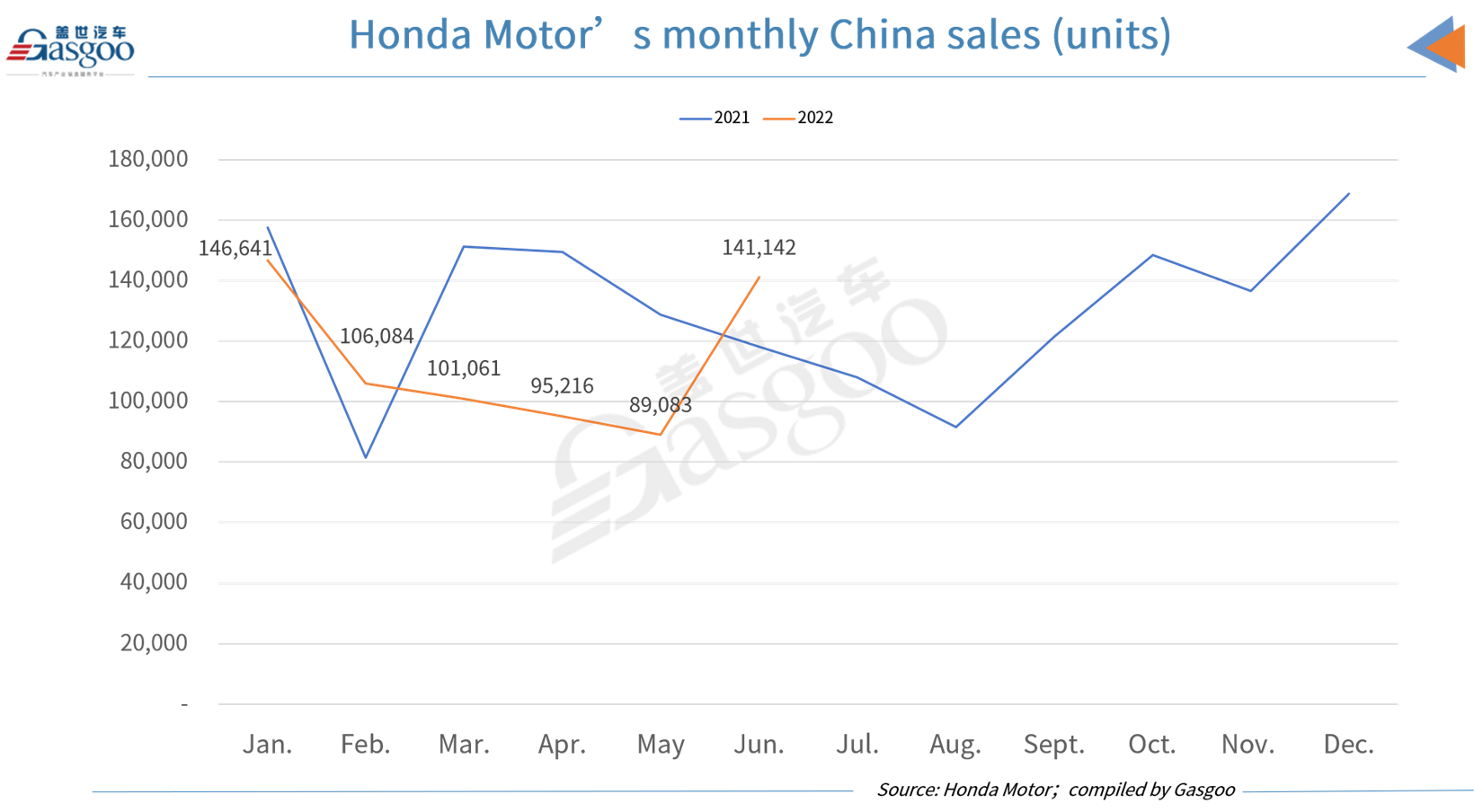

As to Honda, the company sold 141,142 vehicles in China in June, indicating a 19.4% growth from a year ago, marking the first year-on-year increase in monthly sales in four months.

Honda said that the boost in sales should thank Shanghai’s effective control over the pandemic with the automotive supply chain recovering to the normal level. Meanwhile, the several tax cut and governmental subsidy incentives also helped nudge the company’s performance in the month.

Among Honda’s rich product mix, the Accord sedan and the CR-V SUV models contributed to the automaker’s sales growth in the month. In addition, the conditioned purchase tax cut policy from the Chinese government incentivized the demand for Honda’s hybrid vehicle models that falls into the subjective category.

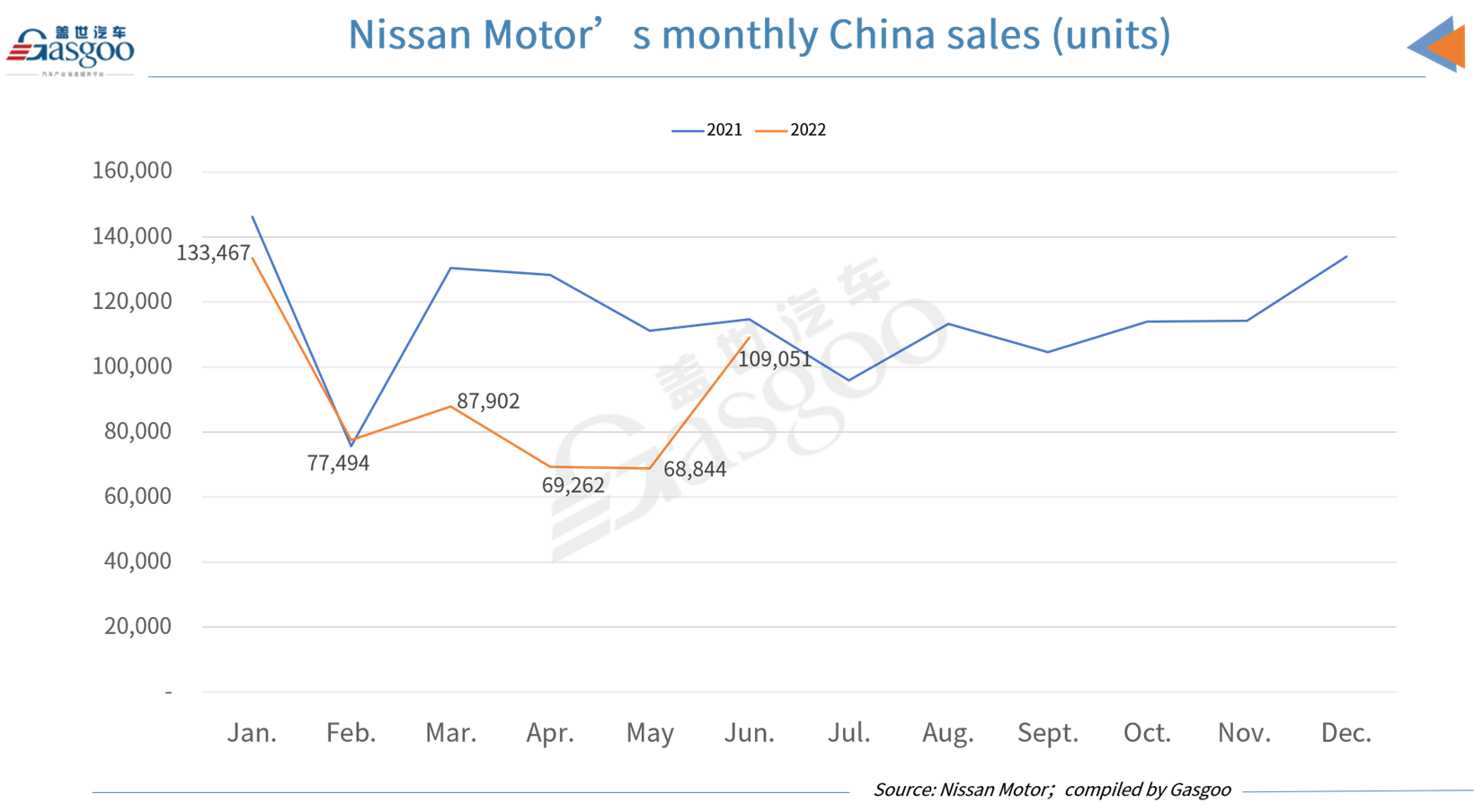

In the first half of 2022, Nissan Motor sold 546,020 vehicles in China, representing a year-over-year drop of 22.7%. The automaker attributed the decline to the global auto part shortages.

Nonetheless, in June, the company sold 109,051 vehicles in the country, surging 58.4% from a month earlier but notching down 4.8% over a year ago. Nissan Motor’s passenger vehicle joint venture, Dongfeng Motor Co. & Ltd. (DFL), sold 91,867 vehicles (including Nissan, Venucia, and Infiniti brands), greatly jumping 64.6% from May while also edging up 0.6% year on year.

The company added that DFL’s sales growth in June was contributed by Venucia and Infiniti. To be specific, the Venucia brand sold 10,046 vehicles, indicating a respective hike of 79.1% and 71% from the previous month and the previous year. At the same time, there were 655 Infiniti vehicles sold in China, jumping 48.9% month over month.

With its April sales volume under the cover, Mazda’s semi-annual sales volume was not made public. However, according to data provided by Kyodo, Mazda saw its June China sales slash down 40.3% from the previous year to 10,145 units.