China’s vehicle sales decline narrows in May, YTD NEV sales over 2 million units

Thanks to the government’s effective control over COVID-19 and relevant policies to boost consumption, China’s vehicle production and sales saw an obvious recovery in May. New energy vehicle (NEV) segment maintained its growth momentum with cumulative sales and production volume in the first five months both exceeding 2 million units. Besides, the monthly export volume in May also set a new high this year.

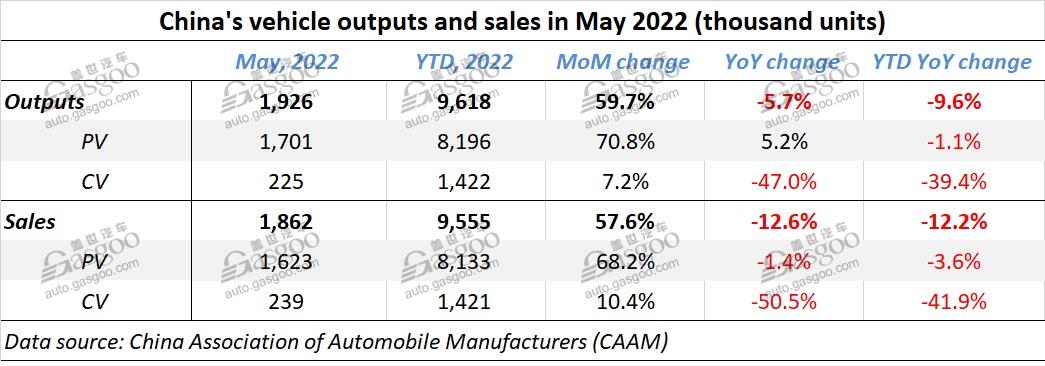

Last month, the biggest auto market in the world produced 1.926 million vehicles, representing a month-over-month jump of 59.7% but a year-over-year decrease of 5.7%, 40.4 percentage points fewer than the decline of the previous month. Monthly vehicle sales amounted to 1.862 million units, up by 57.6% from a month ago but down by 12.6% from a year ago.

In the first five months of this year, China’s vehicle output and sales totaled 9.618 million and 9.555 million units, falling 9.6% and 12.2% respectively versus the same span of last year.

Exclusive of export volume, the May domestic sales of locally-made vehicles grew 55.5% from a month ago but fell 18.3% from a year ago to 1.617 million units, including 404,000 NEVs. By the end of May, locally-made vehicle sales in China dropped by 15.9% to 8.586 million units this year, inclusive of 1.829 million NEVs.

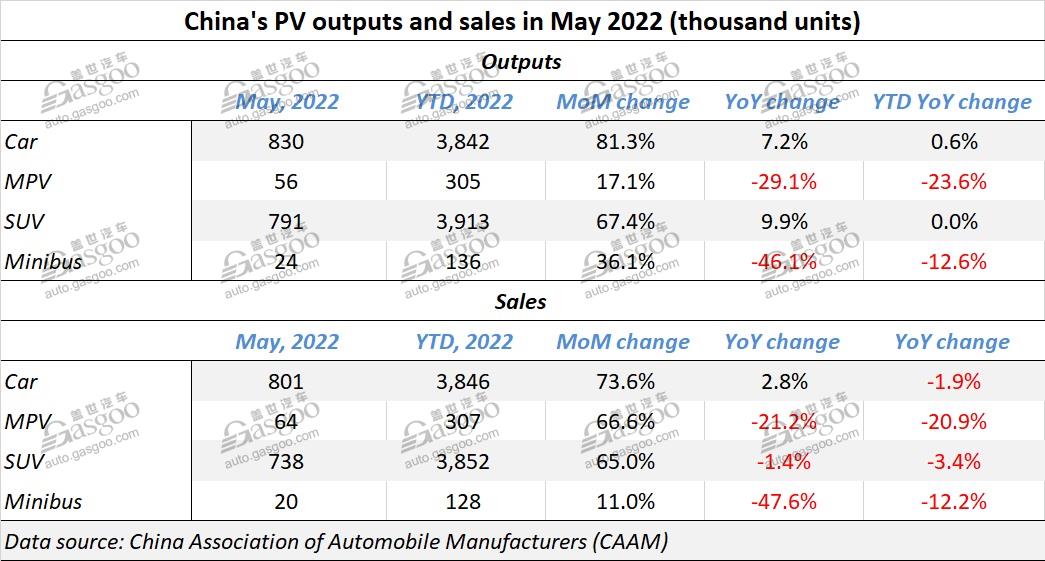

Passenger vehicle (PV) production returned to a slight year-over-year increase in May, and monthly sales decrease narrowed significantly to 1.4%. Those results can be owed to companies’ own production arrangement and the recovery of supply chain. The association added that some companies have returned to double shifts.

The market sold 271,000 China-made premium PVs in the fifth month of this year, 6.7% fewer than the same month last year. In the January-May period, sales of locally-made premium PVs came in at 1.313 million units, falling 9.4% compared with the same span of last year. The decrease in premium PV segment is larger than that of the overall PV segment. The reason is that Shanghai and Beijing, where premium consumers mainly come from, had COVID-19 resurgences.

Chinese brands continued to take shares from foreign rivals. According to the association, Chinese brands sold 799,000 PVs in May, representing a year-over-year growth of 17.5% and accounting for 49.2% of the whole PV sales, 7.9 percentage points more than that of May 2021. The year-to-date sales of Chinese-branded PVs rose 11.3% from a year earlier to 3.897 million units, with a market share of 47.9%.

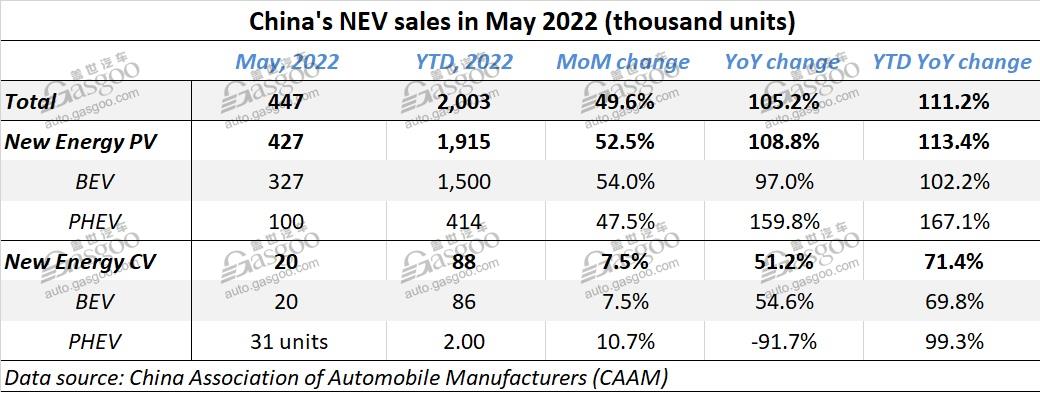

NEV sales obtained a share of 24% in the market in May. Both monthly sales and output of the segment more than doubled over the previous year. NEV sales came mostly from battery electric vehicles at 347,000 units, along with 100,000 plug-in hybrid electric vehicles. The month also saw the sales of 103 fuel cell electric vehicles.

By the end of May, China had sold and produced over 2 million NEVs this year. The sales volume included 1.586 million battery electric vehicles and 416,000 plug-in hybrid electric vehicles. The year-to-date fuel cell electric vehicle sales were 9,000 units. The association is optimistic about accomplishing the annual NEV sales target of 5 million.

The vehicle export recorded a new high of this year in May despite various headwinds. Local companies shipped 245,000 vehicles to other markets, representing a month-over-month jump of 73% and a year-over-year growth of 62.3%. The total export volume included 196,000 PVs and 43,000 NEVs.

Benefitting from various favorable industry policies, vehicle sales and production are expected to get better in June, the association concluded.