Honda, Nissan, Mazda posts 2-digit drop in Mar. China sales, but Toyota gains growth

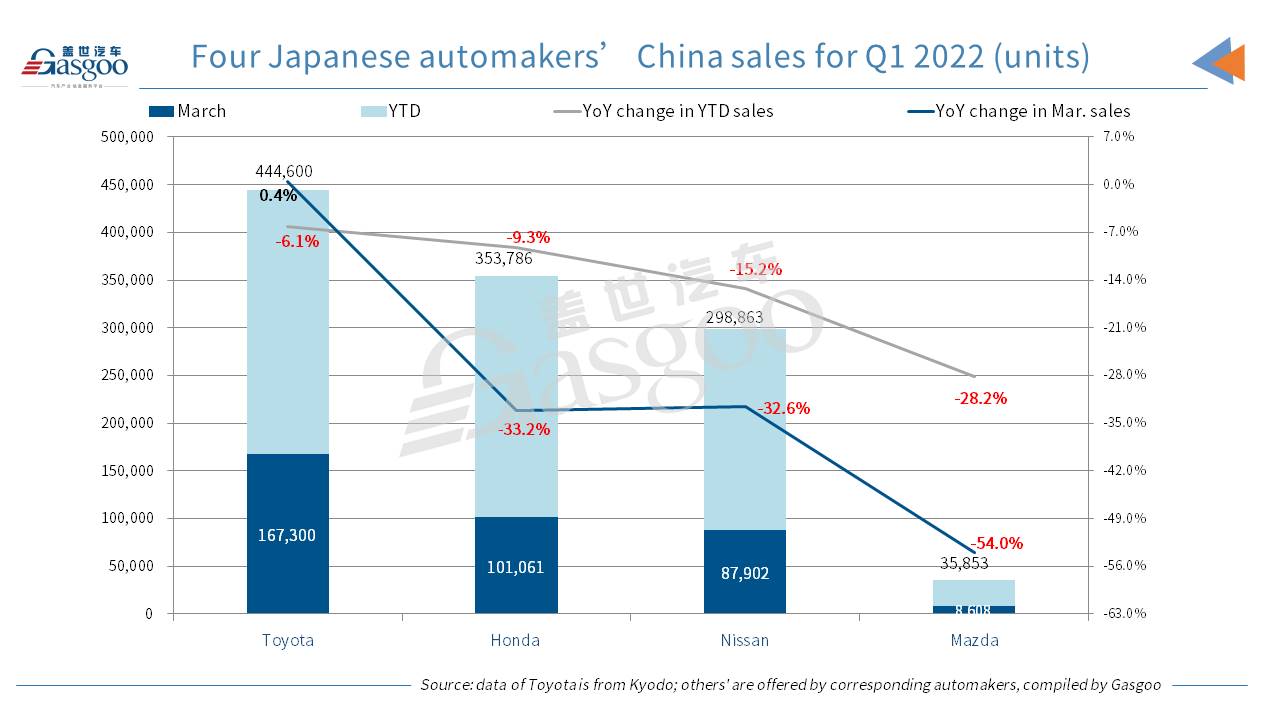

In the first quarter of 2022, the top 4 Japanese automakers all posted decrease on their China sales. Of them, Honda Motor (“Honda”), Nissan Motor (“Nissan”), and Mazda Motor (“Mazda”) all recorded a year-on-year decrease of over 30%.

Toyota Motor (“Toyota”) logged the smallest drop in its first-quarter China sales thanks to the positive impetus it gained in both February and March. Notably, it was the only one to attain a year-on-year sales growth last month.

Although Toyota's China sales only edged up 0.4% in March, the slight growth is a particularly inspiring performance as one of its main joint ventures, FAW Toyota, shut its factory in Changchun city, Jilin province in mid-March.

According to Kyodo's report, the March sales of the Camry and the Wildlander were pretty impressive. Both models come from Toyota's another joint venture in China, GAC Toyota. Data from GAC Toyota's WeChat account show that the joint venture last month sold over 97,000 vehicles to gain a 41% year-on-year surge, which served as a powerful driving force to the Japanese carmaker's overall China sales.

Honda saw its first-quarter China retail sales dip 9.3% from a year ago to 353,786 units. As for monthly sales, the carmaker only posted a year-on-year upturn in February.

The Japanese carmaker has appealed to plentiful consumers in China with its advanced HEV (hybrid electric vehicles) technologies and products. In the Jan.-Mar. period, it delivered a total of 54,034 vehicles armed with the hybrid powertrain system “Sport Hybrid”.

As for the recent headways in the all-electric vehicle development, GAC Honda launched on March 29 the new all-electric vehicle brand “e:NP” (named “Ji Pai” in Chinese), the first joint venture in China to have a standalone BEV marque. Besides, Dongfeng Honda has already kicked off the presale of the Honda-branded BEV, the e:NS1. Those moves indicate that Honda is striving to speed up its transition towards electrification.

Nissan's China retail sales in March tumbled 32.6% from the year-ago period, which partially resulted in the 15.2% decrease in the year-to-date sales.

The automaker still ascribed the decline to the supply chain disruption caused by the pandemic and chip shortage. “In the short run, the supply chain will still face uncertain situations and increasingly fierce competition. However, we are upbeat about the robust growth potential of China’s auto market for the long term,” said Shohei Yamazaki, President of Dongfeng Motor Company Limited (DFL).

Dongfeng Nissan, the passenger vehicle business unit of the joint venture Dongfeng Motor Company Limited (DFL), saw its Mar. retail sales dwindle 33.5% to 67,910 units, 60,008 and 7,151 units of which were under Nissan and Venucia brands respectively. Notably, Venucia reaped a 44.2% year-on-year surge despite the downturn in overall sales.

As to key models, the first-quarter sales of the seventh-generation ALTIMA and the Qashqai jumped 14% and 3% year over year respectively to 40,686 and 41,675 units, both of which hit the best-ever level for the corresponding quarter.

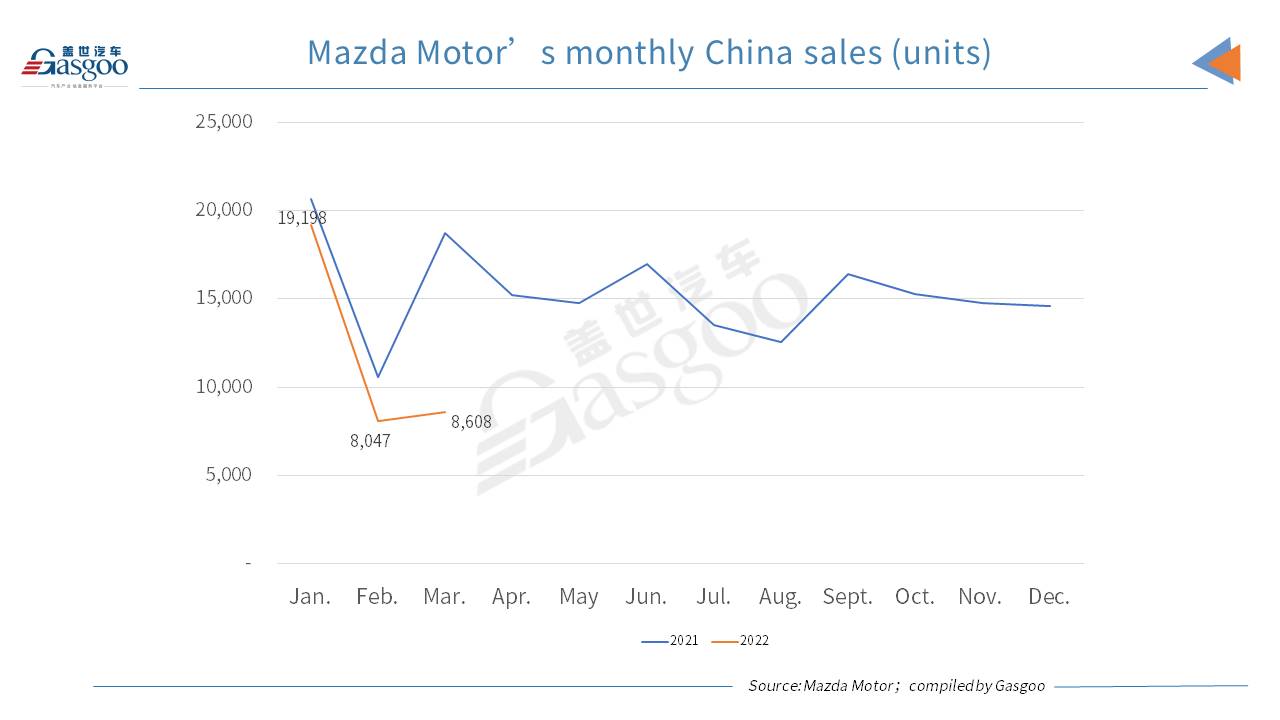

Last month, Mazda's China retail volume plunge 54% from the prior-year period, representing a downward movement for 12 consecutive months. For the first three months of the year, the automaker sold 35,853 vehicles in the country, a year-on-year drop of 28.2%.

Its best-selling model for the first quarter was the Mazda3 Axela, with 21,347 vehicles sold. The company also announced the Jan.-Mar. sales volume of the Mazda CX-5 and CX-30 reached 5,837 units and 3,704 units respectively.