Chinese indigenous brands score YoY rise in March retail sales despite drop in China's overall PV sales

Shanghai (ZXZC)- In March 2022, the retail sales of locally-made PVs (referring to cars, MPVs, SUVs and minibuses) in China amounted to around 1.608 million units, dropping 10.9% from a year earlier, while jumping 25.3% compared to the previous month, according to the China Passenger Car Association (CPCA).

For the first quarter of 2022, around 4.99 million consumers in China took delivery of locally-made PVs, representing a 4.6% year-on-year decrease. The downward movement flew from the decline in both Jan. and Mar. retail sales.

There were still some tailwinds for China's PV market in March. The retail sales were more than that of the previous month, partly thanks to the recovery of chip supply. The roll-out of new vehicle models after the Spring Festival holiday and greater discounts also attracted quite a few new buyers.

The four sectors all posted a year-on-year drop, of which the MPV unit encountered the biggest decline. However, compared to the previous month, the car, SUV and minibus sectors all scored a double-digit growth in March, while the MPV retail volume also rose 8.2%.

There were about 230,000 locally-built luxury PVs retailed across China last month, representing a 14% year-on-year decline, while showing a 43% month-on-month leap. According to the CPCA, the luxury PV retail sales showed a blooming month-over-month upward impetus in early March, but they failed to maintain the movement in the remaining time.

The retail sales of the PVs under Chinese indigenous brands reached about 750,000 units in March, growing 17% from a year earlier, while also jumping 37% from a month ago. The market share of China's self-owned brands reached 48.2% by Mar. retail volume, 11.5 percentage points higher than that of the prior-year period.

The association noted that the rising performance of Chinese local PV brands should significantly be owed to the strong momentum they gained in the new energy vehicle (NEV) field. Traditional automakers, like Changan Automobile and BYD, posted high growth rate.

Mainstream joint ventures witnessed their combined retail sales reach about 590,000 units last month, tumbling 30% over the year-ago period, while growing 9% from a month earlier.

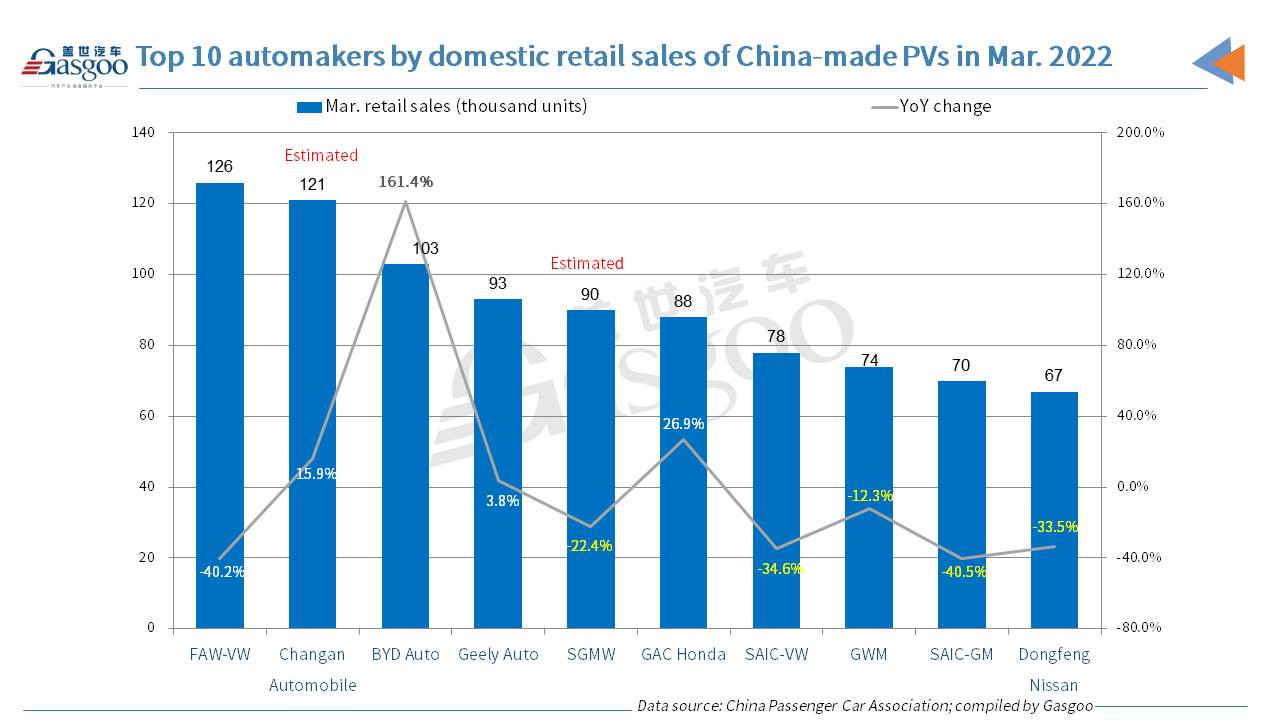

In terms of the domestic homemade PV retail sales in March 2022, FAW-Volkswagen still ranked highest despite the 40.2% year-on-year plunge. Compared to February, Changan Automobile jumped eight spots to the runner-up place. Among the top 10 automakers, BYD still boasted the biggest year-on-year increase even though it dropped one spot. Both SAIC-VW and SAIC-GM fell four spots and logged a decline of over 30%.

The PV wholesale volume in China reached 1.859 million units in March 2022, edging down 0.8% from a year earlier with the car, MPV and SUV segments all recording a decrease. Nonetheless, the year-to-date wholesales rose 8.8% to 5.53 million units thanks to dealership’s demands for inventory replenishment and NEV sales boom.

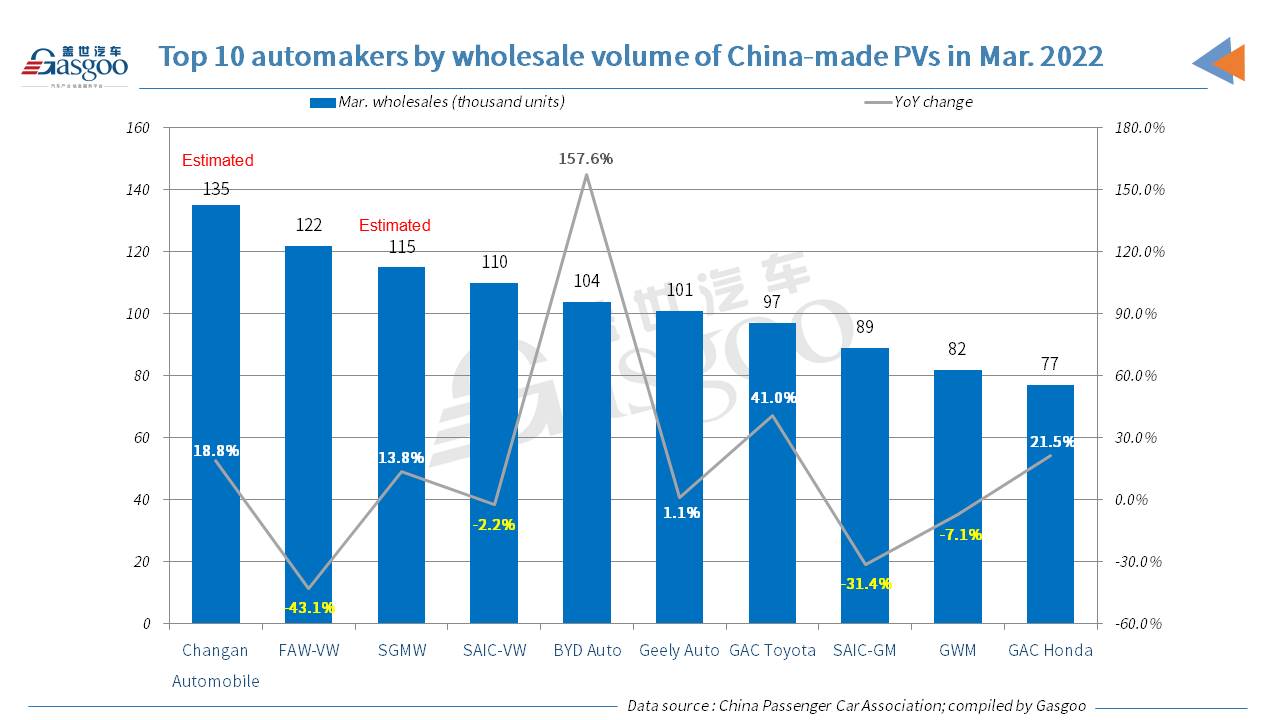

On the top 10 automakers list by March PV wholesales, six carmakers logged a year-on-year growth and four were Chinese indigenous players (Changan Automobile, BYD Auto, Geely Auto, and Great Wall Motor). BYD Auto still boasted the biggest rise. Compared to the previous month, Changan Automobile leapt 8 spots to the highest place, while SAIC Motor PV failed to crack the top 10 rankings.