China's homegrown PV retail sales in Nov. drop 12.5% YoY, while rise 6.2% MoM

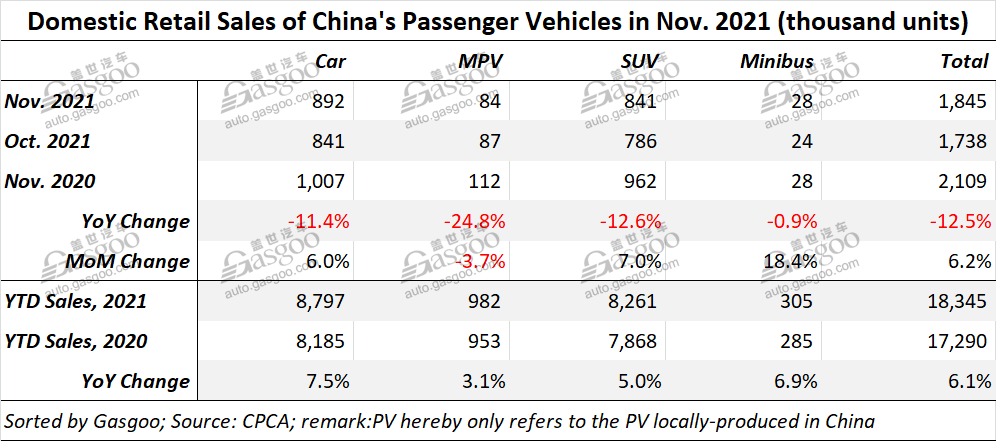

Shanghai (ZXZC)- In November 2021, the retail sales of locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) in China amounted to around 1.845 million units, dipping 12.5% from the previous year, while climbing 6.2% compared to October, according to the China Passenger Car Association (CPCA).

In November, about 2.27 million PVs were produced in China, representing a 2% decline year-over-year, while vigorously rising 14.2% month-over-month, according to the CPCA's data.

The month-on-month growth in PV outputs and sales benefitted from the efficient prevention and control of the coronavirus pandemic that safeguarded a general stable market climate and the gradual recovery of chip supply, said the association.

Nonetheless, some factors still told against the PV sales growth. The occurrence of sporadic and cluster cases not only adversely affected the dealer showroom traffic and the recovery of automotive service industry, but also piled pressure on supply chain operation and economic growth. Besides, people's weak confidence in employment and the tepid growth in market demands also worked against the sales performance for low- and mid-end vehicle models.

The CPCA noted the lack of car inventories overall and the imbalance of car sales structure caused by chip shortage still remain as troubles to both automakers and dealerships, and the supplies of hotter-selling models are still very tight. It still needs take time to entirely erase those negative impacts.

The car, MPV, and SUV segments all recorded two-digit year-on-year decline in Nov. retail sales. However, compared to the previous month, the MPV unit was the only one which failed to achieve growth.

The retail sales of locally-made luxury PVs reached roughly 210,000 units in November, sliding 19% year on year, but jumping 17% from a month earlier and growing 4% compared to Nov. in 2019. The performance indicated robust consumer demands of replacing old cars with premium ones and had little effect on the current competition landscape of the overall PV market.

The retail sales of PVs under Chinese indigenous brands reached about 830,000 PVs last month, representing a 2% growth year on year, an 8% increase month on month, and an 11% rise compared to November in 2019. The market share of China's self-owned brands reached 46.3% in Nov. by retail sales, 6.9 percentage points higher than that of the year-ago period.

The retail sales of mainstream joint-venture brands also totaled about 780,000 units in Nov., down 23% and 21% compared to the same period in 2020 and 2019 respectively, while ticking up 1% over a month earlier.

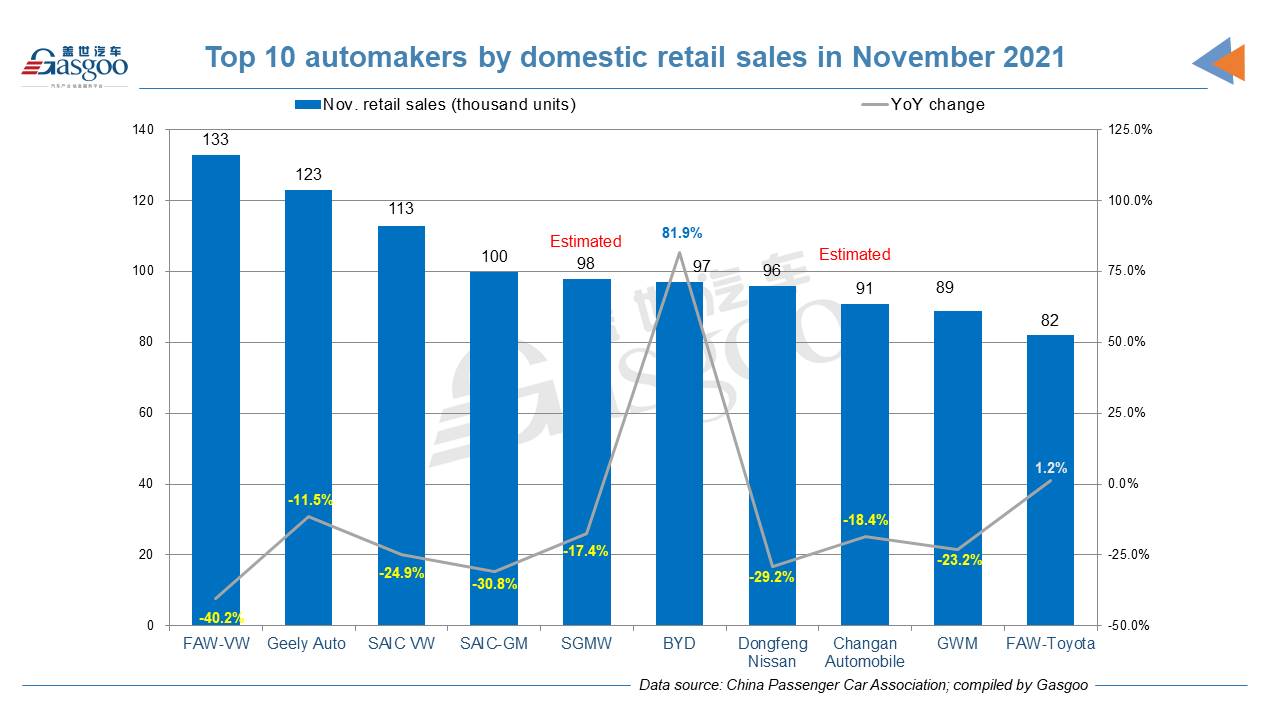

Among the top 10 automakers by domestic PV retail sales in November, four were China's indigenous ones, namely, Geely Auto, BYD, Changan Automobile, and GWM. Notably, Geely Auto moved to the runner-up place and BYD boasted the biggest year-on-year growth.

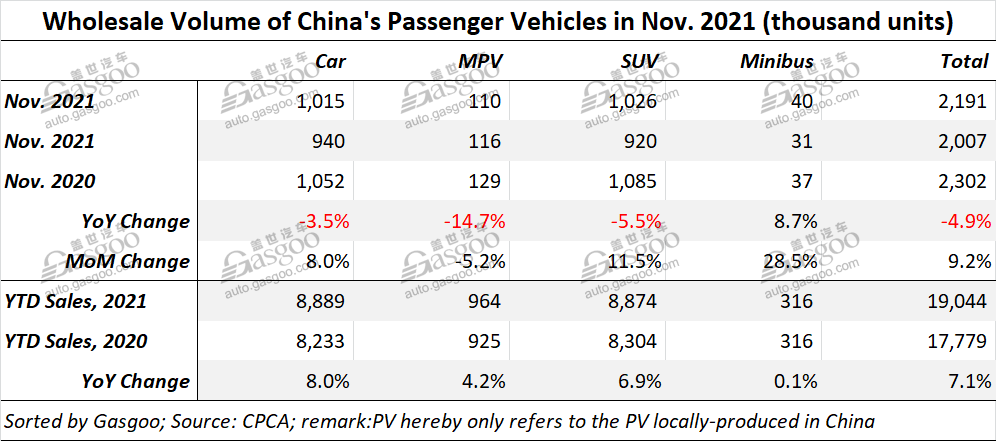

PV wholesale volume in China reached 2.191 million units in November, sliding 4.9% from a year earlier with the car, MPV, and SUV segments all recording decline. Nevertheless, compared to the previous month, the aforesaid three as well as minibus segments all attained growth to result in a 9.2% increase in the country's overall PV wholesales.

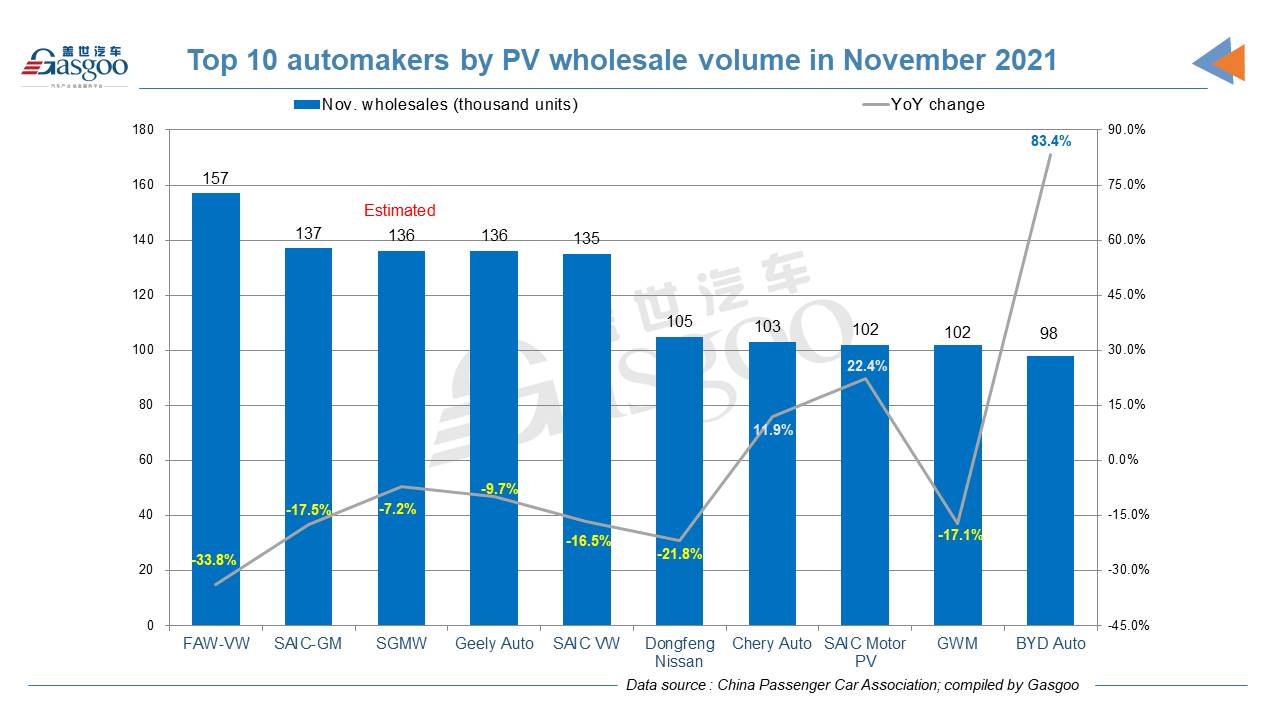

On the top 10 list of automakers by Nov. PV wholesales, Chery Auto, SAIC Motor PV and BYD Auto were the only three scoring year-on-year growth and they are all Chinese local OEMs. FAW-VW ranked highest, while posted the steepest decrease.