Li Auto Inc. Announces Unaudited Third Quarter 2021 Financial Results

BEIJING, China, Nov. 29, 2021 (GLOBE NEWSWIRE) -- Li Auto Inc. ("Li Auto" or the "Company") (Nasdaq: LI; HKEX: 2015), an innovator in China’s new energy vehicle market, today announced its unaudited financial results for the quarter ended September 30, 2021.

Operating Highlights for the Third Quarter of 2021

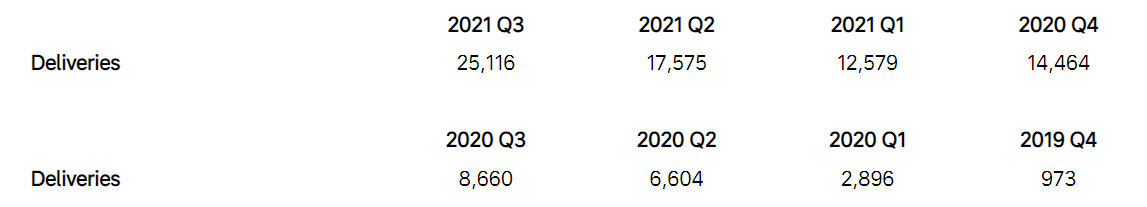

Deliveries of Li ONEs were 25,116 vehicles in the third quarter of 2021, representing a 190.0% year-over-year increase.

As of September 30, 2021, the Company had 153 retail stores covering 85 cities and 223 servicing centers and Li Auto-authorized body and paint shops operating in 165 cities.

Financial Highlights for the Third Quarter of 2021

Vehicle sales were RMB7.39 billion (US$1.15 billion) in the third quarter of 2021, representing an increase of 199.7% from RMB2.46 billion in the third quarter of 2020 and an increase of 50.6% from RMB4.90 billion in the second quarter of 2021.

Vehicle margin was 21.1% in the third quarter of 2021, compared with 19.8% in the third quarter of 2020 and 18.7% in the second quarter of 2021.

Total revenues were RMB7.78 billion (US$1.21 billion) in the third quarter of 2021, representing an increase of 209.7% from RMB2.51 billion in the third quarter of 2020 and an increase of 54.3% from RMB5.04 billion in the second quarter of 2021.

Gross profit was RMB1.81 billion (US$281.2 million) in the third quarter of 2021, representing an increase of 264.8% from RMB496.8 million in the third quarter of 2020 and an increase of 90.2% from RMB952.8 million in the second quarter of 2021.

Gross margin was 23.3% in the third quarter of 2021, compared with 19.8% in the third quarter of 2020 and 18.9% in the second quarter of 2021.

Loss from operations was RMB97.8 million (US$15.2 million) in the third quarter of 2021, representing a decrease of 45.7% from RMB180.0 million in the third quarter of 2020 and a decrease of 81.8% from RMB535.9 million in the second quarter of 2021. Non-GAAP income from operations3 was RMB259.4 million (US$40.3 million) in the third quarter of 2021, compared with RMB45.0 million Non-GAAP loss from operations3 in the third quarter of 2020 and RMB365.5 million Non-GAAP loss from operations in the second quarter of 2021.

Net loss was RMB21.5 million (US$3.3 million) in the third quarter of 2021, representing a decrease of 79.9% from RMB106.9 million in the third quarter of 2020 and a decrease of 90.9% from RMB235.5 million in the second quarter of 2021. Non-GAAP net income3 was RMB335.7 million (US$52.1 million) in the third quarter of 2021, compared with RMB16.0 million Non-GAAP net income in the third quarter of 2020 and RMB65.1 million Non-GAAP net loss in the second quarter of 2021.

Operating cash flow was RMB2.17 billion (US$336.7 million) in the third quarter of 2021, representing an increase of 133.3% from RMB929.8 million in the third quarter of 2020 and an increase of 54.1% from RMB1.41 billion in the second quarter of 2021.

Free cash flow was RMB1.16 billion (US$180.8 million) in the third quarter of 2021, representing an increase of 55.4% from RMB749.9 million in the third quarter of 2020 and an increase of 18.6% from RMB982.1 million in the second quarter of 2021.

Recent Developments

Deliveries Update

In October 2021, the Company delivered 7,649 Li ONEs, representing a 107.2% increase from October 2020. As of October 31, 2021, the Company had 162 retail stores covering 86 cities, in addition to 223 servicing centers and Li Auto-authorized body and paint shops operating in 165 cities.

Extraordinary General Meeting

On November 16, 2021, the Company held an extraordinary general meeting (the "EGM") of shareholders together with the respective class meetings of holders of Class A ordinary shares and Class B ordinary shares (the "Class Meetings") in Beijing, China. Following the EGM and the Class Meetings, the Fifth Amended and Restated Memorandum of Association and Articles of Association was adopted by special resolution, and general unconditional mandates were granted to the directors of the Company by ordinary resolution to issue and repurchase shares.

Updates on Manufacturing Facilities

Beijing Manufacturing Base

In October 2021, the Company officially commenced construction of its Beijing manufacturing base which is scheduled to be operational in 2023. It will serve as an important manufacturing base for Li Auto’s premium BEVs, allowing the Company to meet rising market demand with a more diversified product lineup.

Aligned with the Company’s ESG goals, the Beijing manufacturing base will be built on and leverage the existing site’s infrastructure to achieve high reutilization. It will also adopt leading environmentally friendly production processes in addition to being highly automated, intelligent, and flexible.

Changzhou Manufacturing Base

In November 2021, the Company acquired from Changzhou Wunan New Energy Vehicle Investment Co., Ltd. 100% of the equity interest in Changzhou Chehejin Standard Factory Construction Co., Ltd. (“Chehejin”), which owns the land use rights and plants that previously had been leased to the Company for the current Changzhou manufacturing base. This transaction strengthens the Company’s control of the Changzhou manufacturing base.

CEO and CFO Comments

Mr. Xiang Li, founder, chairman, and chief executive officer of Li Auto, commented, "Amidst the industry-wide chip supply shortage, we delivered 25,116 vehicles during the third quarter, growing 190.0% year over year and recording a new quarterly high, highlighting once again the compelling appeal of our 2021 Li ONE to family users. To mitigate on-going supply chain risks, we will continue to find solutions together with our supply chain partners. In light of our strong order intake and users’ rising acceptance of smart electric vehicles, we remain as enthusiastic as ever about our growth prospects. With the tremendous opportunities that lay ahead, we are committed to deploying more R&D capital to drive parallel development in EREVs and BEVs and advancements in smart cockpit and ADAS technologies. Meanwhile, we will further increase our production capacity through the addition of the Beijing manufacturing base, and consistently expand our sales and servicing network to prepare our business growth."

"On the heels of the successful 2021 Li ONE launch in May, we delivered strong results in the third quarter, achieving revenue growth of 209.7% year over year, a robust vehicle margin of 21.1%, and operating cash flow at a historical high of RMB2.17 billion. Our gross margin reached 23.3%, further boosted by sales of regulatory credits in the quarter," added Mr. Tie Li, Li Auto’s chief financial officer. "We are also excited to raise over HK$13 billion net proceeds through our dual primary listing, including the issue of over-allotment shares, further strengthening our capital base for future growth. We will build upon our recent success to further expand our business, and remain focused on R&D to make progress in electrification, smart cockpit, and ADAS technologies simultaneously."

Financial Results for the Third Quarter of 2021

Revenues

Total revenues were RMB7.78 billion (US$1.21 billion) in the third quarter of 2021, representing an increase of 209.7% from RMB2.51 billion in the third quarter of 2020 and an increase of 54.3% from RMB5.04 billion in the second quarter of 2021.

Vehicle sales were RMB7.39 billion (US$1.15 billion) in the third quarter of 2021, representing an increase of 199.7% from RMB2.46 billion in the third quarter of 2020 and an increase of 50.6% from RMB4.90 billion in the second quarter of 2021. The increase in revenue from vehicle sales over the third quarter of 2020 and the second quarter of 2021 was mainly attributable to the increase of vehicle delivery in the third quarter of 2021.

Other sales and services were RMB389.4 million (US$60.4 million) in the third quarter of 2021, representing an increase of 745.1% from RMB46.1 million in the third quarter of 2020 and an increase of 187.0% from RMB135.7 million in the second quarter of 2021. The increase in revenue from other sales and services over the third quarter of 2020 and the second quarter of 2021 was mainly attributable to sales of automotive regulatory credits as well as increased sales of charging stalls, accessories and services in line with higher accumulated vehicle sales.

Cost of Sales and Gross Margin

Cost of sales was RMB5.96 billion (US$925.5 million) in the third quarter of 2021, representing an increase of 196.1% from RMB2.01 billion in the third quarter of 2020 and an increase of 45.9% from RMB4.09 billion in the second quarter of 2021. The increase in cost of sales over the third quarter of 2020 and the second quarter of 2021 was in line with revenue growth, which was mainly driven by the increase in vehicle delivery in third quarter of 2021.

Gross profit was RMB1.81 billion (US$281.2 million) in the third quarter of 2021, representing an increase of 264.8% from RMB 496.8 million in the third quarter of 2020 and an increase of 90.2% from RMB952.8 million in the second quarter of 2021.

Vehicle margin was 21.1% in the third quarter of 2021, compared with 19.8% in the third quarter of 2020 and 18.7% in the second quarter of 2021. The increase in vehicle margin over the third quarter of 2020 and the second quarter of 2021 was primarily driven by higher average selling price attributable to increasing deliveries of 2021 Li ONE in the third quarter of 2021.

Gross margin was 23.3% in the third quarter of 2021, compared with 19.8% in the third quarter of 2020 and 18.9% in the second quarter of 2021, mainly driven by the increase in vehicle margin.

Operating Expenses

Operating expenses were RMB1.91 billion (US$296.4 million) in the third quarter of 2021, representing an increase of 182.2% from RMB676.7 million in the third quarter of 2020 and an increase of 28.3% from RMB1.49 billion in the second quarter of 2021.

Research and development expenses were RMB888.5 million (US$137.9 million) in the third quarter of 2021, representing an increase of 165.6% from RMB334.5 million in the third quarter of 2020 and an increase of 36.0% from RMB653.4 million in the second quarter of 2021. The increase in research and development expenses over the third quarter of 2020 and the second quarter of 2021 was primarily attributable to increased employee compensation as a result of growing research and development staff as well as increased costs associated with new products developments.

Selling, general and administrative expenses were RMB1.02 billion (US$158.5 million) in the third quarter of 2021, representing an increase of 198.5% from RMB342.2 million in the third quarter of 2020 and an increase of 22.3% from RMB835.3 million in the second quarter of 2021. The increase in selling, general and administrative expenses over the third quarter of 2020 was primarily driven by increased marketing and promotional activities, as well as increased employee compensation and rental expenses associated with the expansion of the Company’s distribution network. The increase in selling, general and administrative expenses over the second quarter of 2021 was primarily driven by increased employee compensation and rental expenses associated with the expansion of the Company’s distribution network.

Income/Loss from Operations

Loss from operations was RMB97.8 million (US$15.2 million) in the third quarter of 2021, representing a decrease of 45.7% from RMB180.0 million in the third quarter of 2020 and a decrease of 81.8% from RMB535.9 million in the second quarter of 2021. Non-GAAP income from operations was RMB259.4 million (US$40.3 million) in the third quarter of 2021, compared with RMB45.0 million Non-GAAP loss from operations in the third quarter of 2020 and RMB365.5 million Non-GAAP loss from operations in the second quarter of 2021.

Net Income/Loss and Earnings/Loss Per Share

Net loss was RMB21.5 million (US$3.3 million) in the third quarter of 2021, representing a decrease of 79.9% from RMB106.9 million in the third quarter of 2020 and a decrease of 90.9% from RMB235.5 million in the second quarter of 2021. Non-GAAP net income was RMB335.7 million (US$52.1 million) in the third quarter of 2021, compared with RMB16.0 million Non-GAAP net income in the third quarter of 2020 and RMB65.1 million Non-GAAP net loss in the second quarter of 2021.

Basic and diluted loss per ADS6 attributable to ordinary shareholders were both RMB0.02 (US$0.00) in the third quarter of 2021. Non-GAAP basic and diluted earnings per ADS attributable to ordinary shareholders3 were RMB0.36 (US$0.06) and RMB0.34 (US$0.05), respectively in the third quarter of 2021.

Cash Position, Operating Cash Flow and Free Cash Flow

Balance of cash and cash equivalents, restricted cash, time deposits and short-term investments was RMB48.83 billion (US$7.58 billion) as of September 30, 2021.

Operating cash flow was RMB2.17 billion (US$336.7 million) in the third quarter of 2021, representing an increase of 133.3% from RMB929.8 million in the third quarter of 2020 and an increase of 54.1% from RMB1.41 billion in the second quarter of 2021.

Free cash flow was RMB1.16 billion (US$180.8 million) in the third quarter of 2021, representing an increase of 55.4% from RMB749.9 million in the third quarter of 2020 and an increase of 18.6% from RMB982.1 million in the second quarter of 2021.

Business Outlook

For the fourth quarter of 2021, the Company expects:

Deliveries of vehicles to be between 30,000 and 32,000 vehicles, representing an increase of 107.4% to 121.2% from the fourth quarter of 2020.

Total revenues to be between RMB8.82 billion (US$1.37 billion) and RMB9.41 billion (US$1.46 billion), representing an increase of 112.7% to 126.9% from the fourth quarter of 2020.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.