Most foreign automakers see double-digit decrease in third-quarter China sales

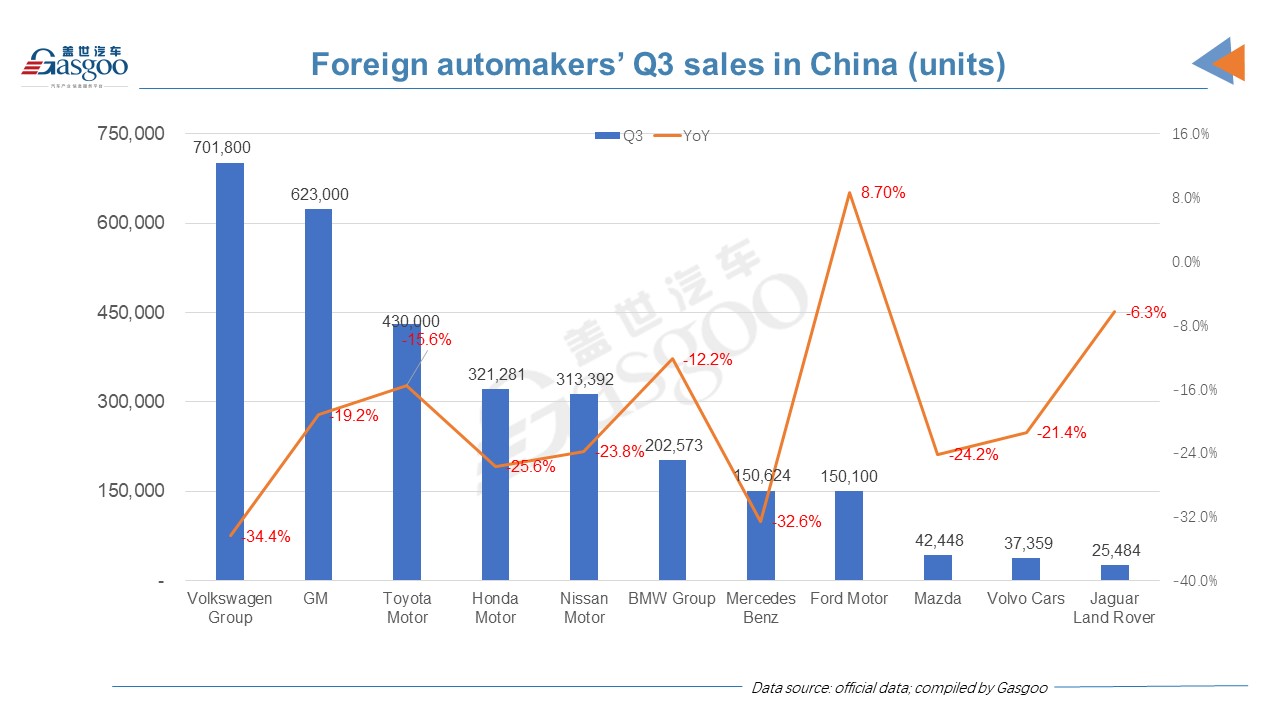

Beijing (ZXZC)- Nine out of eleven major foreign automobile groups saw double-digit year-on-year decrease in the third quarter sales in China, due to various challenges, including worldwide chip supply shortage, Central China floods and pandemic-related restrictions in parts of the country.

Volkswagen Group had the largest decrease in the third-quarter sales, which dropped from 1.06 million units to 701,800 vehicles. The German company explained in a press release that because of COVID-19 outbreaks in Southeast Asia, the chip supply shortage intensified last quarter, significantly affecting its China-specific semiconductors and causing strong understocking and delay of sales.

But the group managed to gain notable momentum in battery electric vehicle (BEV) sales, with a year-on-year growth of nearly 60% in quarterly sales. By the end of September, its new energy vehicle (NEV) sales doubled to over 93,000 vehicles from a year ago. And its ID. family is on track to achieve annual sales target of 80,000 to 100,000 units.

Ford Motor was the only one with a year-on-year growth in quarterly sales. Last quarter, the American group further expanded its product portfolio, including pre-sale of the all-new Ford EVOS and launch of Lincoln Corsair PHEV.

In the first nine months of this year, most foreign automakers had much better performance compared with the same period last year, apart from Volkswagen Group and Mazda Motor. The German Group’s sales during the period fell 4.1% from a year ago while the volume of Mazda declined 9.1% year on year.

In premium vehicle segment, all luxury brands sold more vehicles in the first three quarters than the same span of last year. During the period, BMW’s sales in China (including those of MINI vehicles because the automaker didn’t give respective volume of the two brands) were far ahead of other rivals. Mercedes Benz and Audi were the other two brands whose year-to-date sales exceeded 500,000 units.

Lincoln had the largest increase in cumulative sales of the first nine months with 66,036 vehicles sold. Year-to-date sales of locally built SUVs, including the Corsair, the Nautilus and the Aviator, amounted to 58,300 units, accounting for 88% of the brand’s total sales. In the third quarter, Lincoln’s sales in China jumped 24% year on year to 23,800 vehicles.

Notably, most foreign automakers are accelerating their electrification pace in China, facing much more fierce competition from local rivals. In the third quarter, VW Group launched over 10 new models, including four NEV models. And on Oct. 22, SAIC VW, one of the group’s joint ventures in China, started sales of the ID.3. Also this month, Ford’s first batch of China-made Mustang Mach-Es rolled off the production line and is on track for delivery by the end of the year.

VW ID.3; photo credit: SAIC VW

Honda seems to be the most aggressive Japanese vehicle brand which will only introduce electrified vehicles from 2030 on in China, with first 10 models from new EV brand in the coming five years. In the spring of 2022, the company will start to sell new BEV models from the new brand.

Besides, SAIC GM, the joint venture between SAIC Group and General Motors, announced the operation commencement of its Ultium super factory, which can provide strong support for the production of those battery electric vehicles built on the Ultium platform.