Summary of Chinese mainstream automobile groups’ June sales

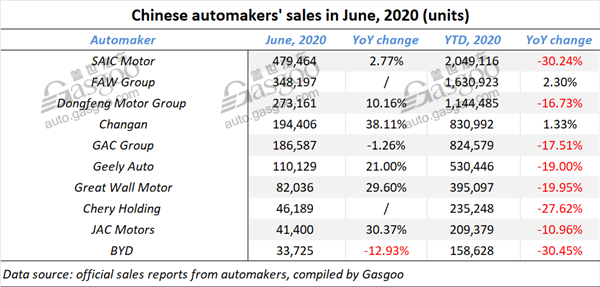

Shanghai (ZXZC)- China's auto sales have showed year-on-year growth for three consecutive months as of June mainly by virtue of the driving force from the CV arm.

Benefitting from the resilient demands coming after the COVID-19 pandemic abating in the country, such mainstream auto groups as Dongfeng Motor Group, Changan, Geely Auto and JAC Motors have also gained their third-month-in-a-row sales growth in June. SAIC Motor, the biggest automaker of China, attained its first-time increase so far this year.

It is noteworthy that for most of the companies hereby listed, the CV unit substantially outpaced their PV unit. One of the major factors was that government's encouragement of infrastructure construction directly spurred the CV sales.

SAIC Motor records 2020's first-time YoY sales growth

SAIC Motor sold 479,464 new vehicles in June, achieving a 2.77% year-on-year growth. This is also the first-time increase the Chinese biggest automaker gained in 2020.

Six of eleven subsidiaries recorded year-over-year sales growth last month, while the biggest two sales contributors—SAIC Volkswagen and SAIC-GM—were still mired in downturn. The two joint ventures saw their sales slide 6.97% and 6.79% over a year ago respectively.

(All New Polo Plus, photo source: SAIC Volkswagen)

Despite the continuous decline in monthly sales, the decrease in year-to-date sales further narrowed for both SAIC Volkswagen and SAIC-GM.

The growth in SAIC's overall sales mainly stemmed from the rising performances made by SAIC-GM-Wuling (SGMW) and SAIC Maxus. SGMW boasted an impressive 24% year-on-year growth in June with 124,000 vehicles sold, while SAIC Maxus' sales surged 54.23%.

SAIC Motor's self-owned PV subsidiary logged a 3.48% decrease in June. The automaker is ready to put the MG 6's fuel-burning version onto the market on July 10 and kick off the presale of its PHEV version at the same time.

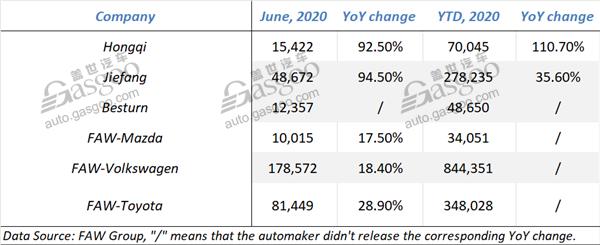

FAW Group boasts 2.3% YoY growth in first-half sales

FAW Group said its cumulative sales for the first half of 2020 climbed 2.3% from a year earlier to 1,630,923 units, defying against the overall downward trend mainly led by the impact of COVID-19 spread.

Hongqi continued to see a sales hike in June. Last month, the premium brand sold 15,422 new vehicles, which represented a 92.5% surge over a year ago. Thanks to the six straight months of increase, Hongqi's first-half sales were more than doubled over the prior-year period to 70,045 units.

(Hongqi HS5, photo source: Hongqi)

According to FAW Group, the sales volume of the Hongqi HS5 SUV has exceeded 9,000 units for two consecutive months, which greatly contributed to the brand's overall sales growth.

Another two indigenous brands—Jiefang and Besturn—sold 278,235 (+35.6%) and 48,650 vehicles respectively from Jan. to Jun. During the past June, Jiefang saw its sales soar 94.5% to 48,672 units, and Besturn had a sales volume of 12,357 units.

As for joint ventures, both FAW-Volkswagen and FAW-Toyota boasted double-digit increase in June.

FAW-Mazda sold 34,051 new cars so far this year. Notably, its sales in June remarkably grew 17.5% to 100,15 units.

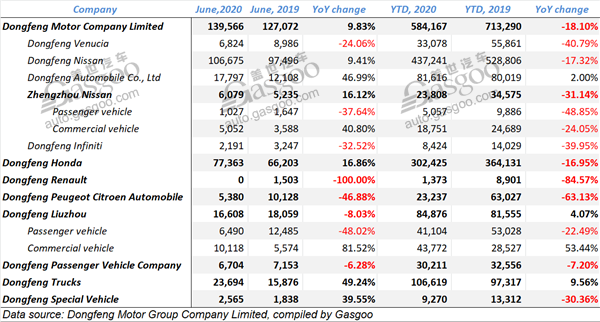

Dongfeng Motor Group's sales rise for three consecutive months

Dongfeng Motor Group Company Limited (Dongfeng) saw its auto sales in June climb 10.16% year on year, the third-month-in-a-row increase it achieved this year.

Thanks to the consecutive rises, the Wuhan-headquartered automaker witnessed the decrease in its year-to-date sales contracted to 16.73%, versus the 46.36% plunge in the Q1 volume.

It is evident that the CV unit played a more important role in pushing the overall sales up. The automaker sold a total of 60,403 CVs in June, soaring 59.97% over a year ago. Regarding the PV unit, MPV sales rose 10.19%, while it was significantly offset by the decline in car and SUV sales.

(Sylphy, photo source: Dongfeng Nissan)

Dongfeng Motor Company Limited posted a 9.83% year-on-year growth which largely resulted from the sales increase achieved by Dongfeng Nissan and Dongfeng Automobile Co.,Ltd. Dongfeng Honda's sales in June jumped 16.86% from a year ago. The joint venture is going to put the hatchback version of the Civic in July.

Dongfeng Renault still logged zero sales last month. Its Wuhan plant is said to be inherited by Dongfeng's yet-to-be-launched “h” brand that targets premium new energy PVs.

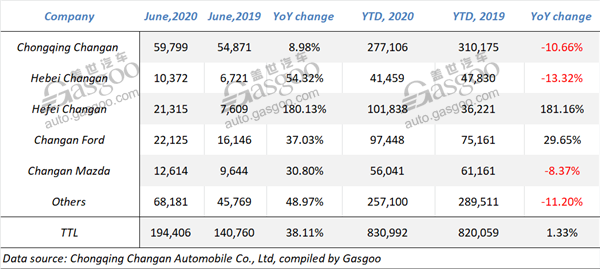

Changan Auto's first-half sales edge up 1.33% year on year

Chongqing Changan Automobile Co., Ltd. (called “Changan” for short) saw its sales surged 38.11% from a year ago to 194,406 units in June, which made its year-to-date sales represent growth for the first time so far this year.

The company gained the blooming growth on account of the upward movement accomplished by all of its subsidiaries. Notably, most of them obtained year-on-year growth of over 30%.

Hefei Changan was still the fastest-growing one. Thanks to its four-consecutive-month year-on-year growth, the Hefei-based subsidiary boasted an impressive leap of 181.16% from a year earlier.

(Escape, photo source: Changan Ford)

Changan Ford continued to see a sales hike in June. Owing to the frequent roll-out of new models and small year-ago base number, the joint venture boasted a 29.65% increase in the first-half sales with the Escape serving as the biggest sales contributor.

The decrease in Changan Mazda's year-to-date sales narrowed to 8.37% as of June. The joint venture put the all-new compact SUV CX-30 onto the market at the end of May, and received orders of 5,000 units by the mid-June.

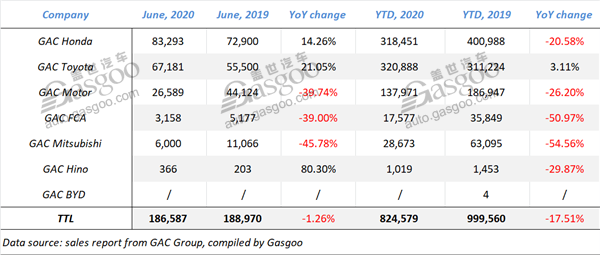

GAC's two major Sino-Japanese joint ventures boasts two-digit growth in June wholesales

GAC Group said its sales in June only edged down 1.26% from a year earlier to 186,587 units, while jumped 12.66% compared to May.

CV sales remarkably grew 80.3% year on year to 366 units last month, but it scarcely produced evident effect due to the small volume. PV sales showed a 1.35% slight drop, which was wholly caused by the 17.96% decline in sedan sales. Nevertheless, both MPV and SUV units gained double-digit growth.

(Avancier, photo source: GAC Honda)

In June, GAC Honda achieved all-time highs in both outputs and sales, said GAC Group. The joint venture saw its June wholesales leap 14.26% year over year to 83,293 units with four models recording sales of over 10,000 units. To be specific, there were 21,100 Accords, 20,003 Breezes, 18,265 Vezels and 12,021 Criders sold respectively last month.

The year-on-year growth in GAC Toyota's year-to-date wholesales returned to positive for the first time this year. Last month, the company boasted a 21.05% jump in June, attaining double-digit growth for the third month in a row. The Sino-Japanese joint venture sold 16,700 Camrys, 15,096 Levins and 11,625 YARiS L cars during the same period.

Geely Auto completes 38% of annual sales target in first half of 2020

Geely Automobile Holdings Limited and its subsidiaries (collectively referred to as the "Group") sold 110,129 new vehicles in June, a year-on-year jump of roughly 21% and a month-on-month increase of 1%, the automaker announced on July 6.

During the same month, the Group's export volume dwindled 34% over a year ago to 4,109 units, while its domestic sales leapt around 25% to 106,020 units.

(ICON, photo source: Geely Auto)

The automaker was still hit by a 19% year-over-year decrease in the first-half sales, versus 25% decline in Jan.-May sales. With 530,446 units sold as of June, the Group has completed 38% of its 1.41 million-unit annual sales target.

Among the vehicles sold last month, 8,750 units were the so-called new energy and electrified vehicles (NEEVs), including the Geometry A, the Emgrand EV and the Emgrand GSe, which soared 43% compared to May.

In the meantime, the automaker sold 37,154 sedans, 70,167 SUVs and 2,808 MPVs respectively. Lynk & Co brand saw its June sales soar around roughly 53% to 13,214 units, hitting a new-high level for the past seven months.

Great Wall Motor's sales in June surge 29.6% YoY

Great Wall Motor (GWM) gained a 29.6% year-on-year surge in June by selling 82,036 new vehicles, the automaker announced on July 8. For the first half of the year, GWM saw its sales dip 19.95% over a year ago to 395,097 units.

In June, the mainstay SUV brand Haval's sales climbed 3.85% year on year to 46,998 units, maintaining a rising momentum from May. Thanks to the growth achieved in May and June, the decrease in Haval's year-to-date sales has narrowed to 25.69%.

WEY, GWM's SUV brand targeting the premium sector, sold 26,639 units during the first six months. Its June sales dwindled 16.31% from the year-ago period, while vigorously climbed 12.7% compared to May.

(ORA iQ, photo source: ORA)

In the new energy vehicle sector, ORA sold 2,635 new cars in June, versus 2,333 units sold in May.

With 95,854 units sold from January to June, GWM's pickup unit recorded a blooming year-on-year leap of 47.7%, grabbing nearly 50% share in China's pickup market. In June, the respective sales of the Wingle and the P series Pickup all surpassed 10,000 units.

Chery Holding posts MoM sales growth for 4th month in a row

Chery Holding sold 46,189 new vehicles in June, a growth of 10.9% over a month ago. The company said it has gained month-on-month increase for the fourth month in a row.

Compared to May, the volume of vehicles exported in June surged 27.3%, and the NEV sales also climbed 3.1%, according to the group's WeChat post.

(Tiggo 7, photo source: Chery Automobile)

For the first half of the year, Chery Holding sold 235,248 vehicles, including 41,799 PVs, which were 42% more than the year-ago level.

During the first two quarters, Chery Holding successively rolled out such new models as the new Tiggo 7, the new Tiggo 8, the Jetour X70M, the Jetour X70 Coupe and the Cowin Xuanjie, which are expected to further drive the groups' sales with the pandemic ebbing in China.

Chery Holding also noted it took Jetour only 18 months to see its 200,000th vehicle roll off the production line.

JAC Motors gains 30.37% surge in June sales

JAC Motors scored an impressive 30.37% surge in June sales, helping the drop in year-to-date sales shrink to 10.96%.

The contributing factor to the sales hike was that the automaker's CV sales skyrocketed 94.37% over the previous year to 28,230 units. Apart from the bus chassis, the other businesses within the CV unit all achieved sales growth.

Nevertheless, PV sales still dipped 23.57% on account of the sinking performances made by the car and SUV businesses.

(iC5, photo source: JAC Motors)

Among the vehicles sold in June, 4,394 units were all-electric PVs, which were more than halved over a year ago.

The Hefei-based automaker recently drew a lot of public attention due to the transaction with Volkswagen Group. The German auto giant agreed to purchase 50% in JAC Motors' parent company, Anhui Jianghuai Automobile Group Holdings Limited, and raise its equity stake in the joint venture JAC Volkswagen to 75% from 25%.

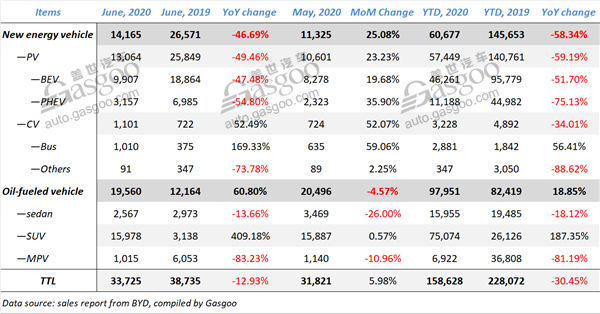

BYD's NEV sales plunge 58.34% in first half of 2020

BYD Company Limited announced a sales volume in June of 33,725 units, which were 12.93% less than that of the year-ago period, while represented a month-on-month growth of 5.98%.

To be specific, BYD's NEV sales amounted to 14,165 units last month, plummeting 46.69% from the previous year, but surging 25.08% compared to May. With 60,677 units sold in total, its NEV sector was hit by a year-over-year decrease of up to 58.34% for the first six months.

(BYD Han EV, photo source: BYD)

Part of the explanations for the NEV sales downturn is that consumers' purchasing power was somewhat whittled down due to their wait-and-see attitude towards the forthcoming BYD Han, an all-new flagship NEV sedan model that is set to hit the market in July, according to a senior analyst from ZXZC Auto Research Institute (GARI). On the other hand, consumers have been distracted by other new products as automakers are scrambling to deploy NEV businesses and put NEV products onto the market, he added.

There were 19,560 oil-fueled vehicles sold by BYD last month, showing an impressive leap of 60.8% from a year earlier. The year-to-date sales of fuel-burning vehicles also vigorously grew 18.85% to 97,951 units, which was entirely attributable to the 187.35% surge achieved by the SUV unit.