Chinese automaker Changan sees auto sales jump 32% YoY in April

Shanghai (ZXZC)- Chongqing Changan Automobile Co., Ltd. (Changan) achieved a double-digit year-on-year growth in April sales, following three consecutive months of downturn.

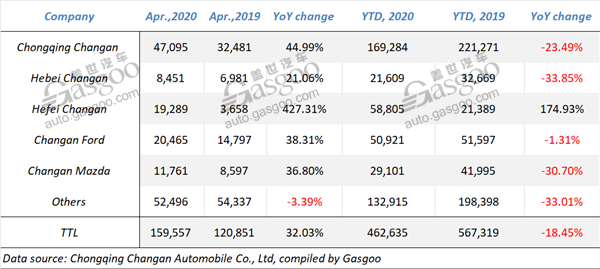

The automaker said its new vehicle sales in April jumped 32.03% from a year ago to 159,557 units. The sales volume of Changan's self-owned brand reached 119,435 units, leaping 37.5% compared the year-ago period.

In the same month, Changan sold 3,485 new vehicles to overseas markets, a year-over-year growth of 3.1%.

For the first four months, the automaker still posted a decrease of 18.45% from a year earlier as its first-quarter sales slumped due to the coronavirus spread.

Most of the subsidiaries achieved remarkable increase. Both Changan Ford and Changan Mazda recorded a year-on-year growth of over 35%. Besides, Hefei Changan was still the fastest-growing one.

(CS75 PLUS, photo source: Changan Automobile)

Changan stated there were four models whose April sales volume exceeded 10,000 units, namely, the CS75 series (20,113 units, +161.6%), the Eado (12,192 units, +87.1%), the CS35 series (10,330 units, +25.3%) and Oshan X7 (10,078 units).

For the first quarter of 2020, the company lifted itself out of the year-ago money-losing status, seeing its net profit attributable to shareholders surge 130.1% to RMB631.078 million.

However, excluding non-recurring gains and losses, Changan still suffered a net loss of RMB1.793 billion, versus the year-ago loss of RMB2.161 billion. The substantial variance may be partly due to the government subsidies of RMB57.408 million recorded into current gain/loss account.

During the same period, its revenue slid 27.76% year on year to RMB11.564 billion. The cash flow from operating activities stood at RMB4.155 billion, jumping 27.51% as a result of the significant decrease in cash paid for purchasing goods and receiving services.