The Big Read: Story of Great Wall Motor (part 2)

Of all the Chinese automakers, Great Wall ‘s history is perhaps the easiest to understand, as it most closely resembles what we’re used to in our regions. It is not a story about an old arms factory looking for new opportunities, not a strategic government venture and not a local employment project, but the history of the Wei family. We ended last week with Great Wall’s foray into passenger car production, with a line-up that lacked a certain originality.

The odd one out

In between all the copycat cars Great Wall puts on the road around 2010, the company also introduces a model that can be called quite original. The Haval H6, that’s what we’re talking about, may not be very exciting to look at, but at least it’s not a blatant copy of an existing model. The Haval H6 is a mid-sized SUV/crossover, about the size of a VW Tiguan, and it becomes Great Wall ‘s next big hit. This car will be the best-selling Chinese SUV in the sales charts for years to come and the counter has now well passed the three million units.

The Haval H6 is obviously the right car at the right time. It’s a spacious family car for the rapidly growing middle class citizens and it comes with Great Wall’s better than average build quality. Where the Wuling Hongguang MPV is the number one choice for rural China, the Haval H6 sells well all over the country, but especially in the higher developed urban and coastal areas. Since its inception the H6 is steadfast occupant of the national sales top ten.

Due to the great success of the Haval H6, Wei Jianjun realizes two important things. Firstly, it is not necessary at all to copy designs from other brands to be successful and secondly, Great Wall should focus on crossovers and SUVs for the passenger car market. The company is one of the first that dares to fully concentrate on this segment, just as the popularity of it starts to grow. Great Walls introduces elevated variants based on the existing range of passenger cars, with the well-known plastic cladding around the wheel arches, sturdy bumpers, roof rails and a slightly raised chassis, all of which are on the market with Haval in the name. That is also the impetus for Haval as a sub-brand.

Calculated growth

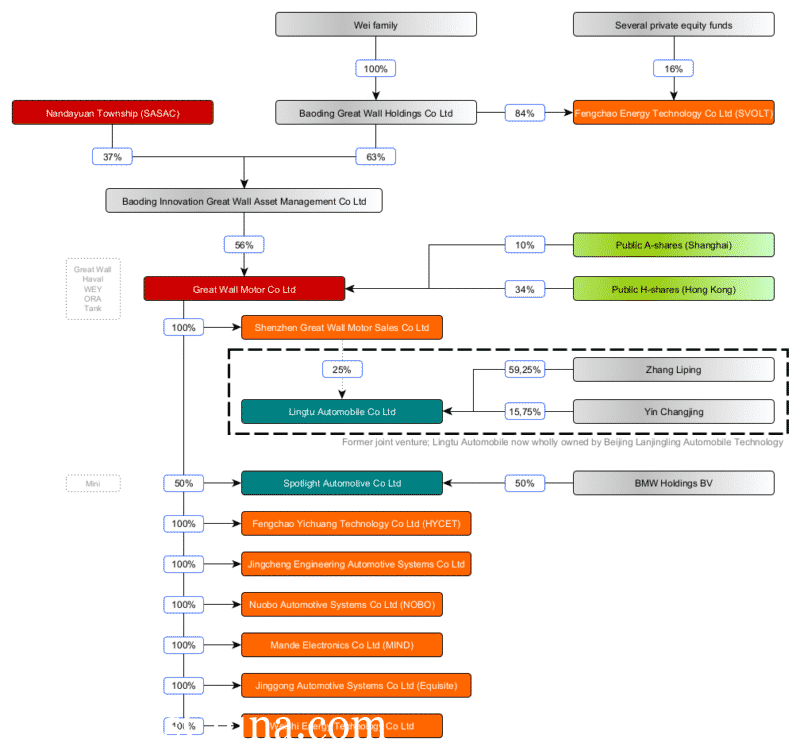

Before that happens, Great Wall goes public again, this time on a domestic exchange. In September 2011, Great Wall Motor is listed on the Shanghai Stock Exchange and the equity portfolios of the Wei family and Nandayuan Township are merged into a single investment fund. In later transaction the shareholding ratios change by a few percent, but with the IPO the company reaches its current corporate structure. For details, see the business diagram below.

Haval is launched as a brand in March 2013. From then on, Great Wall markets pickup trucks under its own brand and passenger cars as Haval. The ordinary sedans and hatchbacks are all phased out rather quickly, except for the Voleex C30 that survives a few more years as Great Wall, and only SUVs and crossovers remain on the program. The strategy pays off very well. After years of steady growth, Great Wall now produces more than one million cars a year under all its brands.

Haval introduces several new models, both position above and below the H6. Great Wall capitalizes on the success of that model by introducing a staggering number of variants. In 2018 there are at least ten slightly differently styled cars for sale as H6, H6 Coupe, M6 or F5, all of which share the same technology. As usual in China, Haval then sells the first and second generation of the H6 side by side. It adds a third generation in 2020, when finally a number of older variants are retired.

In 2017 Great Wall presents a third brand, WEY. The attentive reader will of course immediately see that the brand name is an English version of the family name Wei. WEY is positioned as the premium brand of the group and will deliver slightly more exuberant crossovers than Haval. In particular, the VV7 GT is one of the most remarkably designed SUVs of the moment.

The Linktour fiasco

China’s environmental legislation for cars distinguishes between regular combustion cars and hybrids on one side and New Energy Vehicles (plug-in hybrids and electric vehicles) on the other. For combustion cars the rules are comparable to EU legislation. A fleet average consumption of all cars sold must not exceed a certain value. If a manufacturer fails to do so, it can compensate with credits earned by the sale of NEVs or trade credits with competitors. If this all fails, the government will issue a fine. It is clear that Great Wall’s range of pickups and SUVs does not score very well on fuel consumption and so the company has to look for a solution.

Great Wall links up with one of country’s many LSEV manufacturers. These low-speed electric vehicles are extremely popular in certain regions of China, and as a result there is no shortage of manufacturers. Some of them want to climb up to ‘real’ car manufacturer, which aligns well with car manufacturers looking for NEV credits. One of these LSEV makers is Hebei Yujie Vehicle Industry, better known by the trade name Yogomo . Yogomo is the brainchild of entrepreneur Zhang Liping and one of the larger players in the LSEV field. In 2017 Great Wall acquires an 25% stake in Yogomo.

The start of the collaboration is energetic. Yogomo sets up a car Department, divests of LSEV assets (they’re sold back to Zhang Liping as the new company Yujie Shidai Vehicles) and changes its name to Lingtu Automobile (Linktour in English). Construction of a new factory commences in the city of Wuxi. At first Linktour converts some Yogomo LSEVs to automobiles, but in less than a year the all new K-One, an electric compact crossover, appears on the market. And that’s pretty much the final piece of good news about the brand.

The K-One does very little in the market and all the ambitious plans drain the company’s bank account with the usual consequences: defaulted loan payments, unpaid bills from suppliers and overdue salaries of the staff. Production comes to a complete halt in 2019 and the new factory in Wuxi has to be sold out of necessity. Great Wall moves its shareholding to a subsidiary and doesn’t put much effort in saving the operation. In January of this year Linktour enters bankruptcy and reorganization proceedings. The company is saved by Beijing Lanjingling Automobile (an entity I have no further information of), that wholly acquires Linktour. Since then the situation improves, with the company revealing a new line of small EVs under the Pocco brand.

Plan B

Great Wall’s investment doesn’t work out as planned and compliance with the environmental regulations remain a burden. Fortunately, there is a backup plan. In 2018 Great Wall creates its own own electric vehicle startup. They call the new brand ORA and the first model is called iQ, a curiously designed crossover coupe, which could have been the inspiration for the Polestar 2. The success of the car is limited and ORA quickly shifts attention to the segment of the city cars.

The second product, the R1, clearly refers in its appearance to the current generation Smart and Renault Twingo , but Great Wall this time manages to prevent the car from being seen as a direct copy. Initially, sales are reasonable, but with clever marketing (directly aimed at young women, for instance), ORA manages to steadily boost sales.

“It doesn’t matter if it’s a black cat or a white cat, as long as it catches mice, it’s a good cat.” This is a well-known statement by China’s former Prime Minister Deng Xiaoping. He said it to explain his experiments with capitalism. Great Wall lends the saying to reshape the image of ORA. The R1 is renamed “Black Cat” (Heimao) and two new products are called “White Cat” (Baimao) and “Good Cat” (Haomao). Not often a car brand has caused so much commotion with the choice of a few model names. And it is successful, in the course of 2020 sales of the ‘Black Cat’ more than triple. Finally the electric efforts are reaping the much needed results.

The ORA Good Cat is a car to keep an eye on anyway. In 2018, Great Wall signs a joint venture agreement with BMW. The two parties establish Spotlight Automotive with the prospect of producing electric Minis for the Chinese market. Construction of a new factory went starts in 2019 and the first cars should be assembled in late 2021 or early 2022. BMW plans to build to Mini Electric, but has already suggested that Spotlight will developed China-specific models as well. Most probably the Good Cat will lend its platform for these Chinese Minis.

Always change a winning team

I already briefly mentioned Great Wall invests in a R&D department since the early 2000s. It covers a wide range of activities and in 2018 and 2019 it’s neatly rearranged in a number of subsidiaries. Review the corporate chart for the full names. Fengchao Yichuang makes drive units (both ICE and electric motors), Jingcheng Engineering makes steel parts (platforms, bodies), Nuobo makes assembly components (interiors, chairs, rubber), Mande makes electrical and thermal systems, Jinggong mainly makes molds and Weishi makes fuel cells. The best-known of all those subsidiaries, the battery-making company SVOLT, is separated from the Great Wall group and is now directly controlled by the Wei family. All car factories fall directly under Great Wall itself and a whole range of sales and service organizations are left out of the diagram.

In its international expansion Great Wall recently acquired plants in Thailand and India from General Motors and a Brazilian plant from Mercedes-Benz. The company has already established its own factory in Russia. Great Wall has a presence in South-East Asia, Australia, South America and Russia. Next pin on the map is probably Western Europe.

Early in 2020 Great Wall celebrates its thirtieth anniversary (Wei Jianjun considers the day he took over as the company’s birthdate) with a remarkable video of the CEO. The central question Jianjun asks, is ‘how do we survive 2020?’ A remarkable message for the occasion and for a company that is clearly doing well.

The recorded speech is the start for an avalanche of product news and a subtle repositioning of the company. Great wall attempts to convert from legacy automaker into a modern mobility brand. The brand strategy is summarized in the ‘Lemon’, ‘Coffee’ and ‘Tank’ technology platforms. Lemon and Tank are modular platforms for crossovers and body-on-frame pickups and SUVs respectively. Coffee is an advanced software platform, including autonomous functions and internet connectivity.

Then the company launches a string of signature products, starting with the aforementioned ORA Good Cat and the new pickup truck Pao. Haval gets the Big Dog (Dagou), a tough looking crossover. WEY shows the Tank 300 and gets a favorable welcome. Shortly after Great Wall spins off Tank as a separate brand. In early 2021 WEY renews its entire lineup with coffee-flavoured models. In between a new plug-in hybrid driveline with the world’s most efficient combustion engine (according to Great Wall itself) debuts. In another technology breakthrough, SVOLT brings its cobalt-free NMx battery to the market.

If this isn’t enough, Great Wall prepares the introduction of yet another brand. Like many of its competitors Great Wall is working a premium all-electric halo brand. For the time being the project is known as Shalong Zhixing, but a much hipper brand name will surely be used, once the first cars will be revealed in 2022.

With the introduction of the ORA Good Cat, the WEY Tank 300, the Haval Big Dog and the ‘Futurist’ concept vehicle, Great Wall has four of the most talked about cars of the last year. And with some controversial design of its future production cars, the company keeps itself firmly in the spotlights. Wei Jianjun seized his chance at Great Wall as a 26-year-old boy. Thirty years later, he proves that he has built the brand into one of the strongest names in the Chinese car industry.