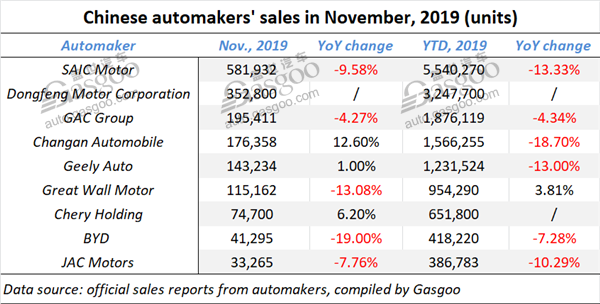

Summary of nine mainstream Chinese automakers’ Nov. sales

Shanghai (ZXZC)- China's auto market posted the 17th-month-in-a-row sales downturn in November, while the decrease was further contracted over the previous months. According to the China Association of Automobile Manufacturers (CAAM), the country's auto sales slid 3.6% year on year to 2.457 million units in November, but apparently rose 7.6% from a month earlier.

In spite of the prolong downturn, some major Chinese automakers still attained sales rebound last month. Changan Automobile and Geely Auto eventually got year-on-year increase after quite a long duration.

However, Great Wall Motor failed to maintain a rising momentum. BYD was still stranded in decrease, while it boasted a significant growth in oil-fueled vehicle sales.

SAIC Motor

SAIC Motor, the Chinese largest automaker posted 9.58% and 13.33% year-on-year decline in November and year-to-date sales.

Compared with the previous month, SAIC-GM-Wuling outsold SAIC-GM in November as the latter was hit by a 33.96% year-on-year slump. It is noteworthy that the sales champion, SAIC Volkswagen, achieved growth after 14-consecutive-month downturn.

Apart from SAIC-GM-Wuling, SAIC-GM, MG Motor India and SAIC Motor-CP, the other subsidiaries all realized increase in November sales, a contrast to the year-to-date sales in which most subsidiaries failed to gain growth.

(Photo source: MG)

SAIC Motor PV, the group's self-owned PV arm, has so far maintained a rising performance in the second half of the year. Nevertheless, its Jan.-Nov. sales still dipped 5.74% over the previous year.

Furthermore, MG Motor India and SAIC GM Wuling Indonesia Co.,Ltd sold 3,172 vehicles and 2,553 vehicles in November. The two subsidiaries focusing on SAIC's overseas market business have the potential to further boost the group's total sales.

Dongfeng Motor Corporation

Dongfeng Motor Corporation sold 3.2477 million new vehicles through November, including 2.6824 million PVs and 565.2 thousand CVs (+7.9%), according to a post on Dongfeng Motor's WeChat account.

Among PVs sold between January and November, 479.9 thousand units came from Dongfeng's self-owned brands and 2.2025 million units were from joint ventures.

Besides, the group said its Nov. sales amounted to 352.8 thousand units, of which PV sales were 2.924 thousand units and CV sales jumped 20.36% year on year to 60.3 thousand units.

(Photo source: Dongfeng Fengshen)

In November, several self-owned brands achieved remarkable growth over a year ago. To be specific, Dongfeng Fengshen, Dongfeng Fengxing and Dongfeng Fengguang sold 112 thousand units (+37.64%), 112 thousand units (+24.23%) and 210 thousand units (+34.66%) respectively. Moreover, the sales of Dongfeng-branded CVs jumped 17.44% to 175 thousand units.

Two Sino-Japanese joint ventures—Dongfeng Nissan and Dongfeng Honda—saw their Nov. sales climb 2.87% and 8.92% respectively to 114.6 thousand units and 81.3 thousand units.

GAC Group

GAC Group reported a year-on-year drop of 4.27% in November wholesale volume, 8.93 percentage points less than the Oct. sales. By the end of November, 2019, the Guangzhou-based automakers had been facing sales downturn for five successive months.

The cumulative sales for the first eleven months fell 4.34% from the year ago. Based on the previous data collected by ZXZC, we found out that the decrease in GAC's year-to-date wholesale volume has been remaining a quite stable level so far this year.

Both GAC Honda and GAC Toyota clocked year-on-year growth in year-to-date sales. The sales volume of the Accord and the Levin series amounted to 204,300 units (+30%) and 203,400 units (+14%) through November.

GAC Motor, the group's self-owned PV unit, saw its Nov. sales slide 12.76% year over year, versus the 36.13% slump in Oct. sales. However, its year-to-date sales still represented a double-digit drop of 28.81% affected by the former dismal performance.

With 6,036 BEVs sold in November, the NEV arm GAC NE boasted a significant hike of 100.3% compared with the same period in 2018. Of those, the sales volume of the Aion S was 5,341 units.

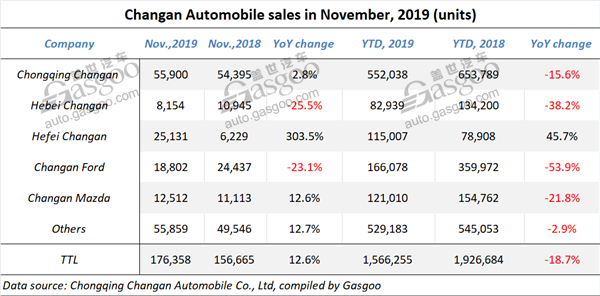

Changan Automobile

Changan Automobile said its auto sales in November jumped 12.6% year on year, for the first time showing increase after 18 consecutive months.

Thanks to the sales rebound in November, the decrease in Changan's year-to-date sales has been contracted to 18.7%. Actually, the number has been successively shrinking after May.

The double-digit growth was a coefficient result from the rising impetus of each subsidiary. Hebei Changan and Changan Ford were the only two whose Nov. sales represented decline over a year ago, while the decrease for both of them was smaller than that of the previous month.

The other subsidiaries all achieved year-on-year growth. Notably, Hefei Changan's Nov. sales zoomed up 303.5% to 25,131 units, and it was also the only one that gained increase in Jan.-Nov. sales. Besides, Changan Mazda saw its sales pick up after a three-consecutive-month year-over-year drop.

The sales volume of Changan's self-developed vehicles totaled 134,736 units in November, climbing 8.9% month on month and leaping 18.1% year on year. The year-to-date volume had exceeded 1 million units as of October, according to a statement posted on Changan's WeChat account.

Geely Auto

Geely Automobile Holding Limited (Geely Automobile or Group) said it achieved its highest-ever Nov. sales with 143,234 new cars sold in total (including the sales of Lynk & Co-branded vehicles), a year-on-year growth of roughly 1% and a month-on-month increase of around 10%.

(Photo source: Geely Automobile's WeChat account)

Among vehicles sold last month, 14,135 units were new energy and electrified vehicles (NEEVs), maintaining a rising trend from a monthly low of 4,476 units in July 2019. Of those, four hotter-selling models—the Emgrand EV, the Xingyue MHEV, the Jiaji MHEV and the Geometry A—together accounted for around 66% of the total NEEV sales volume.

Speaking of the specific models, the Group said the respective sales volume of six models, including the Boyue, the Binyue, the Emgrand and the Emgrand GS, all exceeded 10,000 units in November.

What's more, the Nov. sales volume of Lynk & Co-branded vehicles totaled 14,131 units, the highest monthly sales volume level over the past twelve months.

After 11 months through November, Geely Automobile sold 1,231,524 new vehicles (-13%) in total, completing 91% of its revised annual sales target.

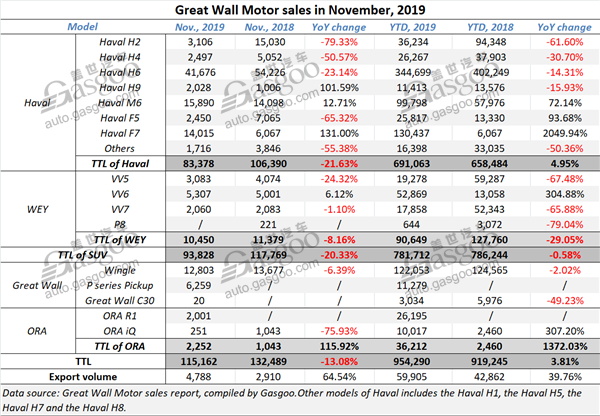

Great Wall Motor

With a total of 954,290 new cars (+3.81%) sold through November, Great Wall Motor (GWM) has already accomplished 89.2% of its 2019 sales target.

In November, the Baoding-based automaker saw its new car sales fall 13.08% over a year earlier, terminating a five-straight-month increase. The dwindling sales should be mainly attributed to the decline in GWM's SUV sales.

To be specific, Haval suffered a 21.63% slump with up to five models, including the best-selling Haval H6, hit by year-on-year drop. Besides, the premium SUV brand WEY witnessed its Nov. sales fall 8.16%, 3.38 percentage points more than that of a month ago. The double-digit decrease in VV5 sales was the primary fact that brought the total sales down.

(Photo source: Great Wall Motor)

Some bright spots are still noteworthy. For instance, the sales of the P Series pickups reached 6,259 units in November, jumping 24.68% compared with the previous month. On December 5, the 10,000th passenger pickup of the P Series officially rolled off the production line at GWM's Chongqing-based smart plant, only three months after the plant started production.

Moreover, the automaker also achieved two-digit growth in both Nov. and year-to-date export volumes.

Chery Holding

Chery Holding, the parent company of Chery Automobile Co. Ltd, announced its auto sales in November rose 6.2% over a month ago to 74,700 units, a new record-breaking figure achieved so far this year.

Among vehicles sold last month, the all-new Tiggo 8, the ARRIZO series and the Jetour family all posted sales exceeding 10,000 units. Notably, the sales volume of the Tiggo 8 reached 13,549 units, topping 10,000 units for four consecutive months. Besides, 12,057 ARRIZO vehicles were sold in November, the third month in a row surpassing 10,000 units.

(Photo source: Chery Auto's WeChat account)

The group said its year-to-date sales volume totaled 651,800 units, of which the volume of its self-owned brands climbed 6.8% compared with the same period in 2018.

Chery's Jetour, a young brand under Chery Commercial Vehicle, sold 14,299 vehicles in November, an impressive year-on-year growth of 50.4% and a month-on-month increase of 2.1%.

Propelled by the special vehicle, recreational vehicle and logistic vehicle sectors, the group boasted a 28.1% year-over-year jump in Jan.-Nov. commercial vehicle sales.

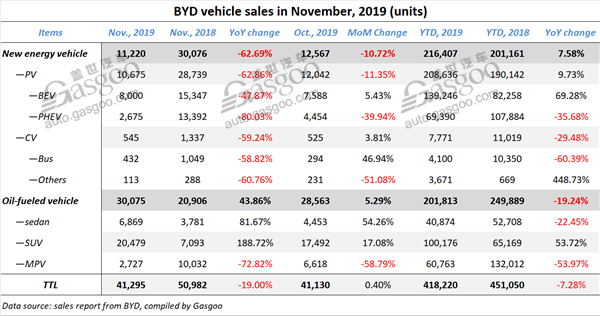

BYD

BYD said its oil-fueled vehicle sales in November reached 30,075 units, surging 43.86% compared with a year ago and climbing 5.29% from a month earlier. Nevertheless, total sales still fell 19% year on year due to the 62.69% plunge in its NEV sales.

As of November, BYD had suffered the fifth-month-in-a-row year-over-year drop in NEV sales. Besides, the decline had been widened 62.69% in November from 11.84% in July. Cumulative NEV sales of 2019 climbed 7.58%, versus 19.93% in Jan.-Oct. sales.

(Photo source: BYD)

Among NEVs sold last month, 10,675 units were PVs, 62.86% less than that of the year-ago period. Of that, the BEV sales sharply slid 47.87%, while the PHEV sales nosedived 80.03% to only 2,675 units.

It is worth noting that year-to-date all-electric PV sales still zoomed up 69.28%, the only segment featuring positive growth that made the NEV sector maintain the increase.

Moreover, BYD said the sales of the BEV-focused e series totaled 2,441 units in November, of which 1,524 units were the e2 cars.

JAC Motors

JAC Motors said its Nov. auto sales dropped 7.76% year on year, 5.32% more than the decrease in Oct. volume.

The PV unit was mired in a year-on-year plunge of 31.69% with 10,886 units sold, directly leading to the overall decrease. However, CV sales jumped 11.19% to 22,379 units, making the overall drop substantially shrunk.

(Photo source: JAC Motors)

As for year-to-date performance, both PV and CV arms were hit with negative growth. Due to the coefficient decrease—17.89% in PV sales and 4.73% in CV sales, JAC Motors witnessed its total sales fall 10.29% to 386,783 units.

The Jan.-Nov. sales of all-electric PVs total 55,163 units (+5.09%), while the volume in November plummeted 66.45% from a year ago.