Data Talk: the landscape of China-owned PV brands

Shanghai (ZXZC)- From now on, ZXZC's Data Talk will start a new series from the perspective of brand origins. The first report will focus on China's self-owned PV brands.

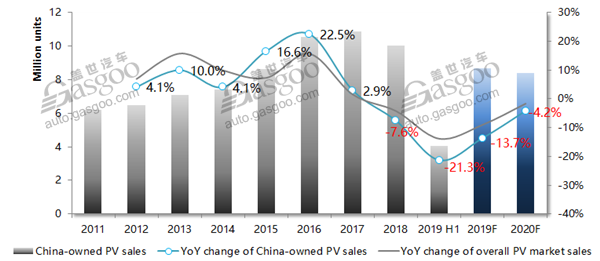

From 2015 to 2017, China’s self-owned PV brands were growing faster than that of the overall PV market thanks to the preferential vehicle purchase tax and the SUV buying spree.

However, this advantage was fading away due to the fierce competition brought by the cooling market climate. Other factors that resulted in the gradual decrease in China-owned PV sales include the internally unbalanced landscape, insufficient preparation for the new emission standard transformation as well as the pretty large amount of inventory.

Considering the relatively weak anti-risk capabilities caused by the aforesaid reasons and the general downward market trend, the year-on-year growth of Chinese indigenous PV sales for both 2019 and 2020 is projected to be below the average level of the overall PV market.

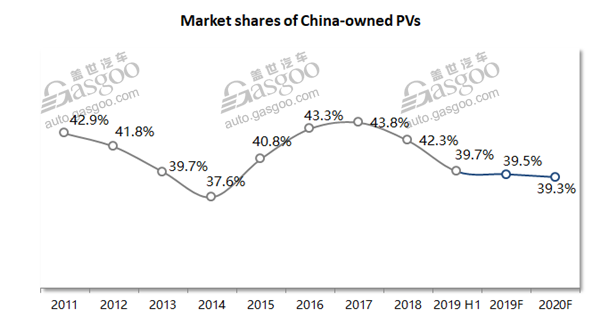

Market shares of China-owned PVs hit the bottom in 2014 and once again reached below 40% for the first half of 2019.

Propelled by some powerful brands and automaker's early deployment in NEV area, China’s self-owned PV brands are expected to maintain the current market shares in the near term.

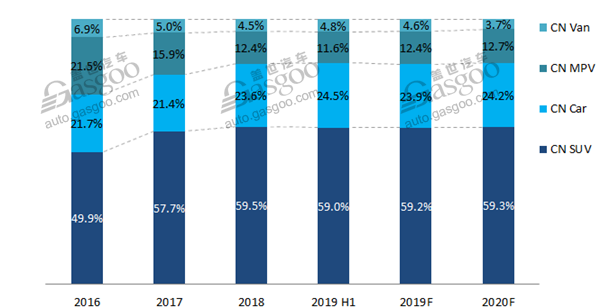

Within the China-owned PV filed, market shares of SUVs are remaining flat after several fast-growing years. The car sector features stable performance in market share change as well thanks to the NEV incentives. Correspondingly, shares of MPVs are being encroached gradually.

With market shares remaining stable, the compact segment still dominates the overall China-owned PV market. In the long run, the medium PV segment will gain more market shares under the trend of consumption upgrades that is promoting PV makers to strengthen roll-out of medium PVs.

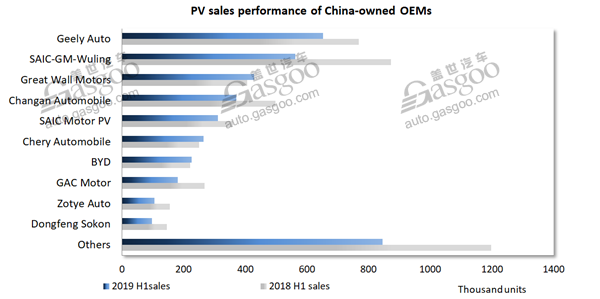

Among top 10 China's self-owned OEMs by PV sales for the first half of 2019 (H1), only three companies achieved year-on-year growth. Moreover, the top 5 vehicle manufacturers accounted for over 50% of the whole China-owned PV sales.

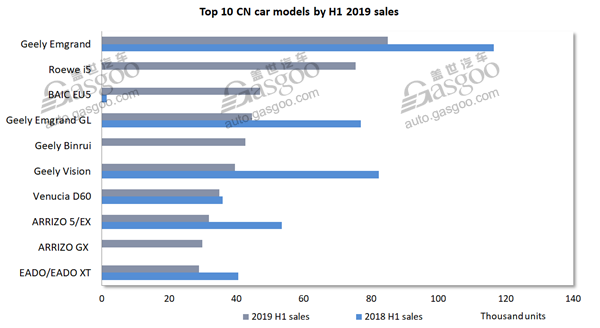

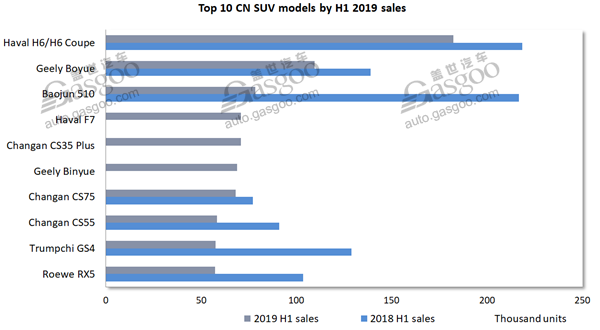

SUVs took 6 places of the top 10 Chinese indigenous PV models by first-half sales. The best-seller was still the Haval H6, netting roughly 40,000 units in sales volume over the runner-up Wuling Hongguang.

However, most models on the above PV list posted substantial decrease in semi-annual sales, primarily due to the market downturn and higher discounts and incentives on China Ⅴ JV-branded PVs which encroached part of market shares.

The Geely Emgrand was crowned the hottest-selling China-owned car model by H1 sales, while was still hit by a double-digit decrease. It was being vexed by a flagging competitiveness since no all-new generation was launched despite some facelifts. Moreover, some consumers were distracted by the Binrui.

The BAIC EU5 took the second runner-up place on the car model list with a splendid growth thanks to automaker’s effort to sell as much as NEVs before the ending date of the three-month grace period for the new NEV subsidy policy.

China's SUV sales in the first half of 2019 dipped 13.4% year on year, according to the China Association of Automobile Manufacturers (CAAM). The cloud also brooded over China's self-owned SUV field. Apart from three SUV models which were not available for sale during Jan.-Jun. period last year, the other models among the top 10 SUV models by H1 sales all chalked up double-digit decrease. Particularly, sales of the Baojun 510 tumbled up to 64%.

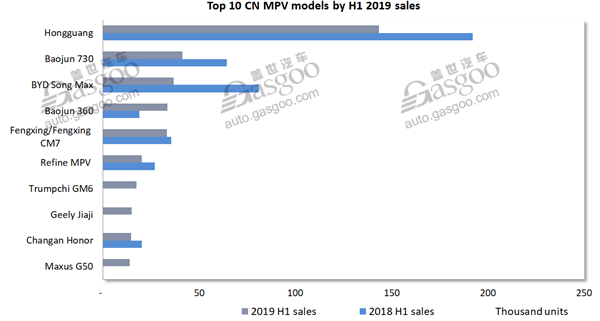

The Wuling Hongguang still held an absolute advantage over the other China-owned MPV models. However, it may bear a huge pressure in the second half of 2019 amid the domestic consumption upgrades and the general downturn trend for MPV market.

Unlike the sluggish climate in traditional PV market, the new energy PV domain displayed a comparatively blooming performance during the first two quarters. The vigor also impinged on the Chinese indigenous NEVs, which made up nearly 90% of the overall NEV sales volume nationwide. The top 10 China-owned new energy PV models by first-half sales all posted significant growth over the year-ago period.