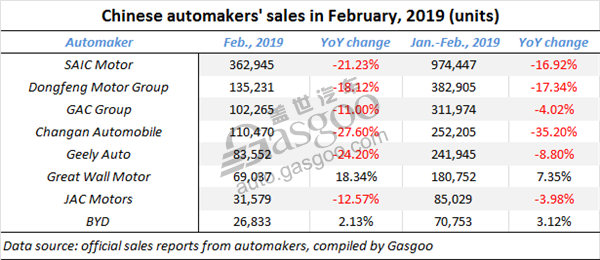

Summary of Chinese mainstream automakers’ sales in February

Shanghai (ZXZC)- China's vehicle saless in February fell 13.77% from a year earlier to 1,481,600 units, according to the China Association of Automobile Manufacturers (CAAM). It seems that quite a few China-based automakers were hit with year-on-year (YoY) decrease last month and most of them partly attributed the sliding performance to the Spring Festival which came earlier than former years.

To ensure a unified data source, we didn't put Chery Holding on the table because it has not announced the sales on its official website yet.

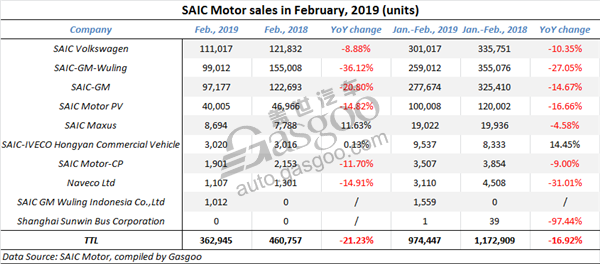

SAIC Motor

SAIC Motor reported on March 12 that its sales in February amounted to 362,945 units, sliding 21.23% compared with the same period a year ago. For the first two months, it sold a total of 974,447 vehicles with an apparent YoY drop of 16.92%.

Aside from SAIC Maxus and SAIC-IVECO Hongyan Commercial Vehicle, the other subsidiaries all posted negative year-on-year growth in Feb. sales. Among four carmakers whose sales exceeded 40,000 units in February, SAIC-GM-Wuling, SAIC-GM and SAIC Motor PV all suffered double-digit drop compared with the year-ago period.

According to data released by the China Passenger Car Association (CPCA), SAIC Motor obtained four places in the list of top 10 PV makers by Feb. wholesale volume, namely, SAIC Volkswagen, SAIC-GM, SAIC-GM-Wuling and SAIC Motor PV. Especially, SAIC Volkswagen was still the sales champion despite its 8.88% year-on-year decrease.

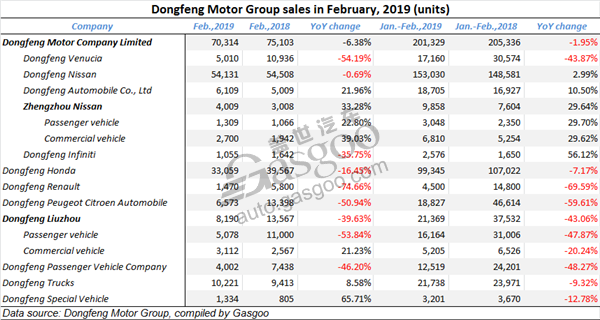

Dongfeng Motor Group

Dongfeng Motor Group posted double-digit decrease in both Feb. sales and YTD sales. PV sales in February remarkably dropped 23.17% to 11,689 units, among which the SUV and MPV sales presented YoY slump up to 33.97% and 57.11% respectively. Besides, both SUV and MPV sectors also faced over 30% decline in Jan.-Feb. sales.

The automaker didn’t dodge the influence brought by the Spring Festival with most PV subsidiaries suffering downturn in that month. Dongfeng Nissan saw its sales edge down 0.69% over a year ago, yet the other Sino-Japanese joint venture Dongfeng Honda got a decline of 16.45%. It is worth mentioning that both Nissan and Honda have so far been topped by Toyota in China sales for two consecutive months.

Two Sino-French joint ventures still failed to get rid of the downward plight. Especially, Dongfeng Renault only sold 1,470 vehicles last month.

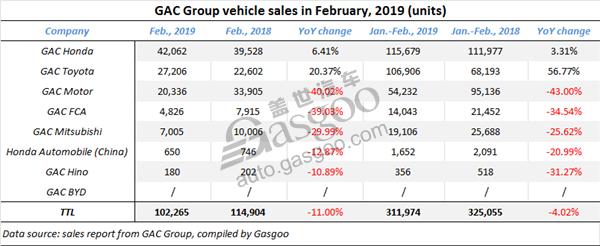

GAC Group

By the end of February, GAC Group has sold a total of 311,974 vehicles in 2019, posting a YoY decline of 4.02%. Of that, its sales in February reached 102,265 units, which was 11% less than that of a year ago.

Aside from two major Sino-Japanese joint ventures—GAC Honda and GAC Toyota, the other subsidiaries all faced year-on-year drop in both Feb. sales and Jan.-Feb. sales. GAC Toyota gained a remarkable growth up to 56.77% in YTD sales and its monthly sales also showed an impressive increase of 20.37%.

GAC Honda has been keeping a stable rising momentum so far this year. In February, its sales climbed 6.41% over the year-ago period to 42,062 units. According to Honda's sales report, the sales of the Fit and the Crider jumped 27.5% and 13.2% year on year to 9,035 units and 7,511 units. The joint venture plans to roll out three new models this year, including the new Vezel, the Odyssey hybrid version and an all-new mid-sized SUV.

Changan Automobile

Chongqing Changan Automobile Co., Ltd (Changan Automobile) announced a YoY sales decrease of 35.2% in its Jan.-Feb. sales for 2019. Meanwhile, its Feb. sales substantially dropped 27.6% over the previous year to 110,470 units.

According to the sales data released by the automaker's official WeChat account, the sales of Changan's China-owned models totaled 94,068 units in February. As to SUV performance, the respective sales of the CS75, the CS55 and the CS35 were 11,297 units, 10,476 units and 10,353 units. The sales of the EADO sedan series totaled 9,121 units. Besides, the automaker saw its NEV sales in February skyrocket 289.7% year on year to 2,038 units.

Changan Ford's sales plunge was still the major reason that led to the group's overall negative growth. Last month, the Sino-U.S. joint venture suffered a year-on-year plunge of 81.4% with only 6,799 vehicles sold. In addition, the subsidiary's cumulative sales in 2019 amounted to 21,535 units, accounting for only 25.26% of the sales for the same period a year ago.

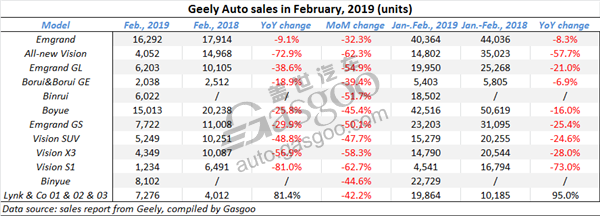

Geely Auto

Geely Auto reported on March 6 that its sales for the first two months reached 241,945 units, dropping 8.8% compared with 265,332 units delivered in the same period a year ago.

Although the automaker didn't announce the sales in February, we can still know that a total of 83,552 vehicles were sold last month with a YoY decline of 24.2% according to the Jan. sales Geely reported before.

The automaker explained that the sales depression in February should be attributed to the earlier Chinese New Year Holiday which made more workdays were struck by the post-Spring-Festival slack season than previous years.

Lynk & Co sold 7,276 vehicles last month with a month-on-month decline of 42.2%. Specifically, the sales of the Lynk 01, 02 and 03 were 3,237 units, 1,686 units and 2,353 units.

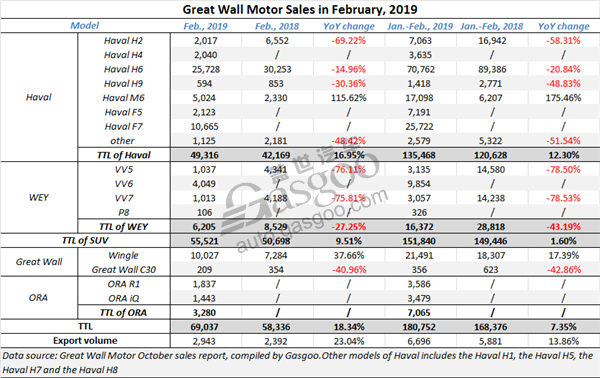

Great Wall Motor

Great Wall Motor (GWM) saw its cumulative sales in 2019 climb 7.35% over the previous year to 180,752 units and Jan.-Feb. export volume total 6,696 units with a YoY growth of 13.86%, the automaker announced on March 7.

Although there are only 21 days available for delivery, GWM achieved a YoY jump of 18.34% in Feb. sales, gaining positive growth for the fifth month in a row.

Last month, SUV sales grew 9.51% from the year-ago period to 55,521 units thanks to Haval's outstanding performance. Although the sales of the Haval H2, H6 and H9 all represented double-digit decline, Haval still gained 16.95% YoY increase powered by the 115.62% sales surge made by the Haval M6 and contribution from such models added after February 2018 as the Haval H4, F5 and F7. Especially, the sales of the Haval F7, which hit the market in last November, reached up to 10,665 units.

JAC Motors

JAC Motors announced that its sales in February slid 12.57% from the same period in 2018 to 31,579 units. For the first two months, it sold 85,029 vehicles, a YoY decline of 3.98%.

In February, both PV and CV sales showed dropping trend over the year ago-period. The PV sales totaled 10,230 units, falling 9.83%. However, the SUV sales jumped 16.27% to 6,096 units.

The MPV sales slump was a significant fact that caused the overall sales downturn. There were only 2,377 MPV delivered in February with a steep decline of 23.89%. As China is relaxing the two-child policy, consumers’ growing demand for larger passenger room gives the MPV market a promising future. Yet, JAC Motors is still confronted with the rival from such models as the Trumpchi GM6, the SAIC Maxus G50 and the Geely Jiaji, which just hit the market on March 11.

The company saw its YTD NEV sales leapt 25.82% to 8,391 units despite a YoY decrease of 23.23% in Feb. NEV sales.

BYD

BYD reported that its Jan.-Feb. sales in 2019 totaled 70,753 units, edging up 3.12% year on year. Of that, the Feb. sales were 26,833 units, only 560 units more than that of a year ago.

For the first two months, NEV sales reached 43,097 units, skyrocketing 174.73% over the year-ago period. The sales of new energy PVs significantly surged 173.02% year on year to 42,010 units, among which 24,179 BEVs were sold with a marvelous leap of 3637.09%, and PHEV sales grew 20.97% from the previous year to 17,831 units.

As to monthly performance, the NEV sales in Feb. were 14,429 units, soaring 72.66% from the year-ago period, while slumping 49.67% month on month and even plunging 69.07% compared with the peak level of 46,650 units for last December.

From January to February, BYD's fuel-burning vehicle sales sharply shrank 47.74% to 27,656 units. Especially, the sales of the sedan and the MPV segments presented YoY slump up to 52.67% and 60.26% respectively.