Tesla’s China insurance registrations surge in Sept., exceeding totals of top 6 local startups

In September 2021, China's monthly insurance registrations of locally-made new energy passenger vehicles (NEPVs) stood at 324,474 units, rocketing 191% year on year and for the first time exceeding 300,000 units, according to the China Banking and Insurance Regulatory Commission (CBIRC).

The NEPV registrations for the month of September was composed of 270,612 battery electric vehicles (BEVs) and 53,862 plug-in hybrid electric vehicles (PHEVs), which include 9,333 range-extended electric vehicles (REEVs).

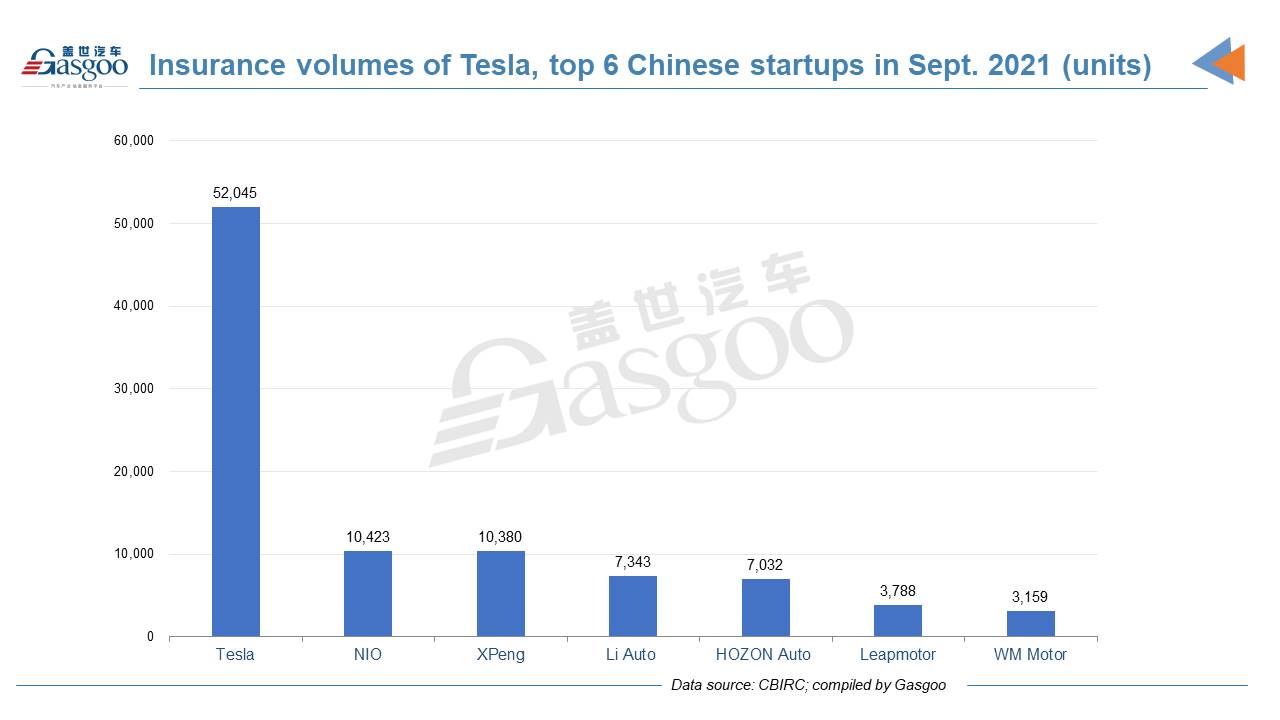

Last month, Tesla amazed the auto industry with its monthly registrations of China-made vehicles hitting new highs of 52,045 units. It even beat the joint efforts of the top 6 Chinese NEV startups by Sept. registrations, rendering a sharp contrast with that of in August, when Tesla failed to outsell WM Motor, the lowest spot's occupant of the 6 Chinese rivals.

Both the Model Y and the Model 3 cracked the top 3 China-made NEV models list by Sept. registrations. Notably, the Model Y's monthly volume surpassed 30,000 units for the first time.

Model Y; photo credit: Tesla

One of the requisite conditions, on which the surging registrations were based, was the sufficient production capacity. Although Tesla didn't disclose sales by region, CEO Elon Musk said at an annual shareholder meeting in early October that the company is now producing more cars in its Shanghai Gigafactory, opened in October 2019, than it is in its Fremont factory in California.

Among Chinese NEV startups by monthly registrations, the winners of the first three places for September were as same as that of August, while the rankings were different. Li Auto dropped two spots to be the No.3, while NIO was re-honored the champion after three months.

Li Auto failed to maintain the upward impetus due to the prolonged chip supply shortage. Actually, the revised delivery outlook for the third quarter the company released on Sept. 20 portended the month-on-month decrease in September registrations.

“We are taking multiple measures to ensure the supply of the auto parts, aiming to shorten the waiting time of delivery for our users,” said Yanan Shen, co-founder and president of Li Auto.

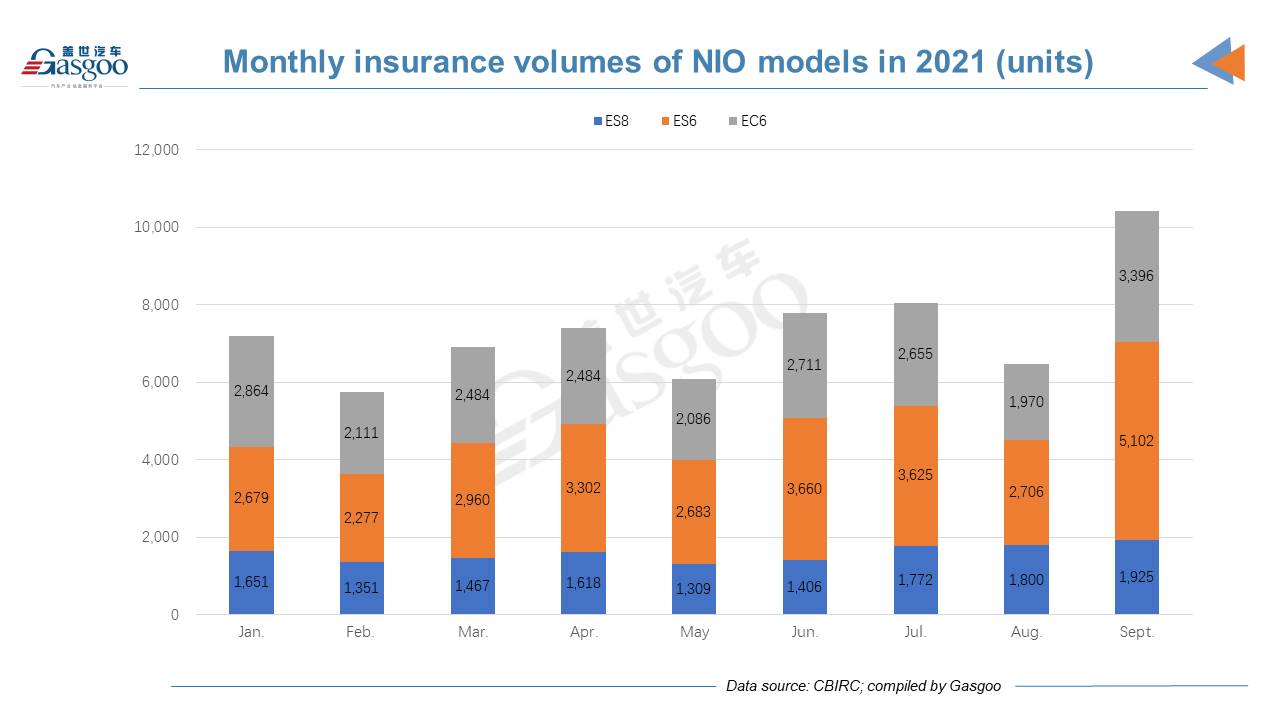

Under the industry-wide pressure of chip crunch as well, both NIO and XPeng saw their monthly registrations for the first time surpass 10,000 units in September.

The remarkable month-over-month rise in NIO's and XPeng's registrations partly flowed from the two companies' efforts to compensate for the production loss in August.

Due to the pandemic-led component supply shortage, NIO's new vehicle production was significantly disrupted, therefore its registrations declined to only 6,476 units in August.

After releasing Aug. sales results, NIO said it planned to adjust the manufacturing schedule after its interior trims supplier in Nanjing resumes production, so as to make up the vehicle loss.

Photo credit: XPeng P7; photo credit: XPeng

XPeng's car deliveries in August dipped month-on-month as its car production was affected by the production transition for the G3 SUV to the G3i, the mid-cycle facelift version of the G3, and the removal of the G3i's manufacturing base from Zhengzhou to Zhaoqing. After going through those changes, the automaker stabilized production works, and correspondingly, its deliveries remarkably increased in September.

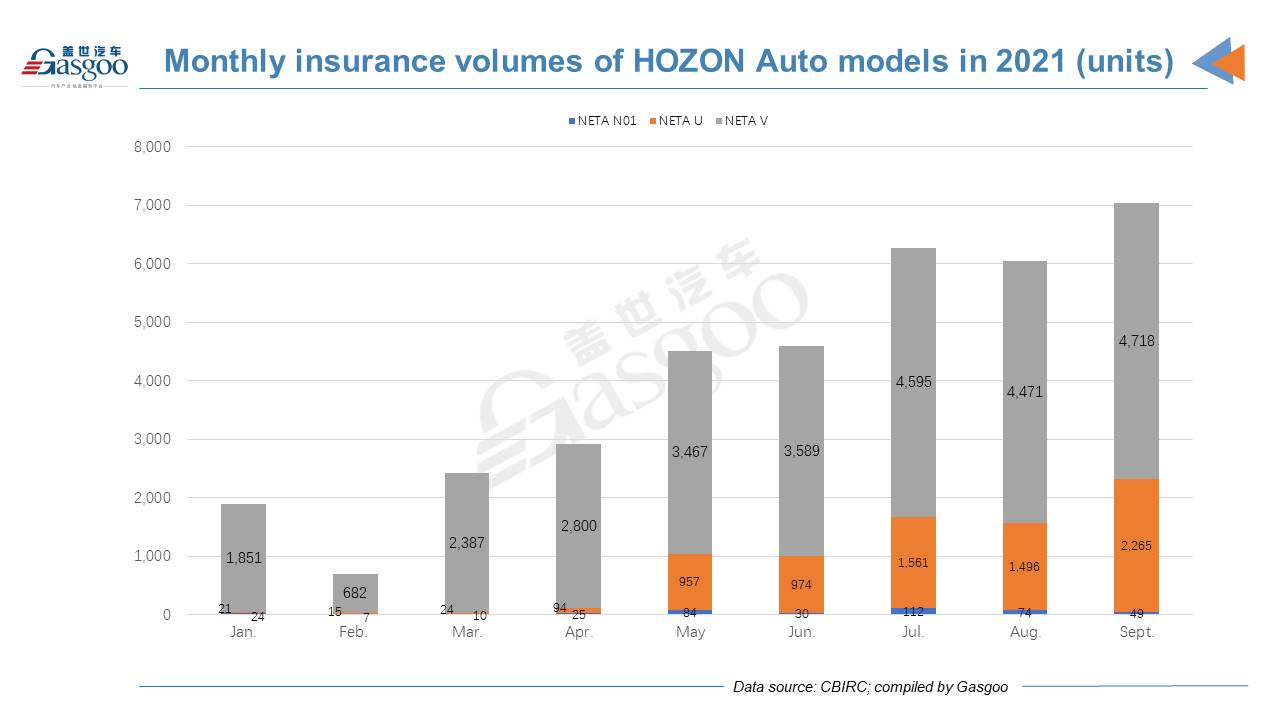

In terms of Sept. registrations, HOZON Auto can also be classified as a member of the so-called “first-tier” local startup group, which is usually composed of NIO, XPeng, and Li Auto. Notably, its monthly insurance volume for the first time exceeded 7,000 units.

Focusing on the products much cheaper than that of the top 3 firms, HOZON Auto's robust sales growth can well prove its reliable NEV manufacturing capability. However, on the way towards automotive intelligent and connectivity, the company has been lagged behind the three peers.

Among the selling points HOZON Auto touts for its vehicles, those related to intelligent features only take very little proportion. The L2+ driver assistance system for the NETA U Pro and the AI-enabled voice interaction function for the NETA V are two of the few highlights.

HOZON Auto is making greater efforts to enhance its intelligence capability by introducing 360 Security as the second largest shareholder, and forging partnerships with tech developers like Huawei and Horizon Robotics. However, its endeavors mainly rely on seeking exterior cooperation, rather than in-house R&D which NIO and XPeng have been underscoring.

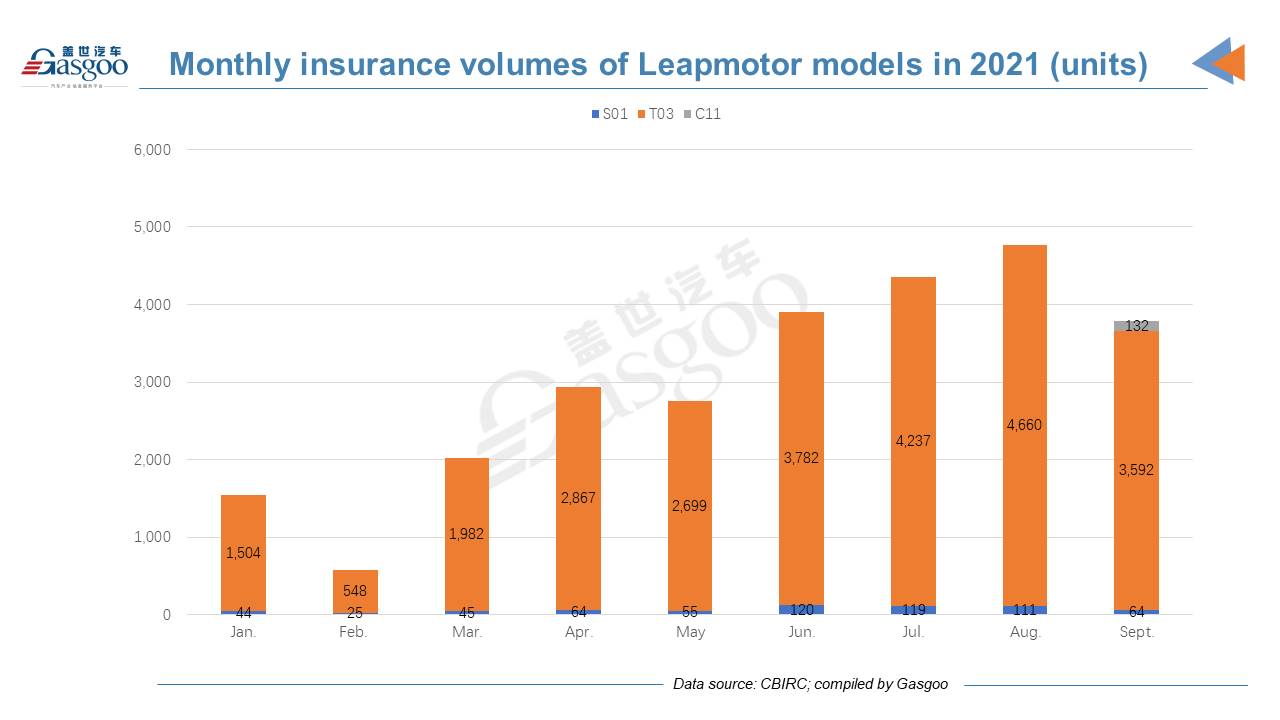

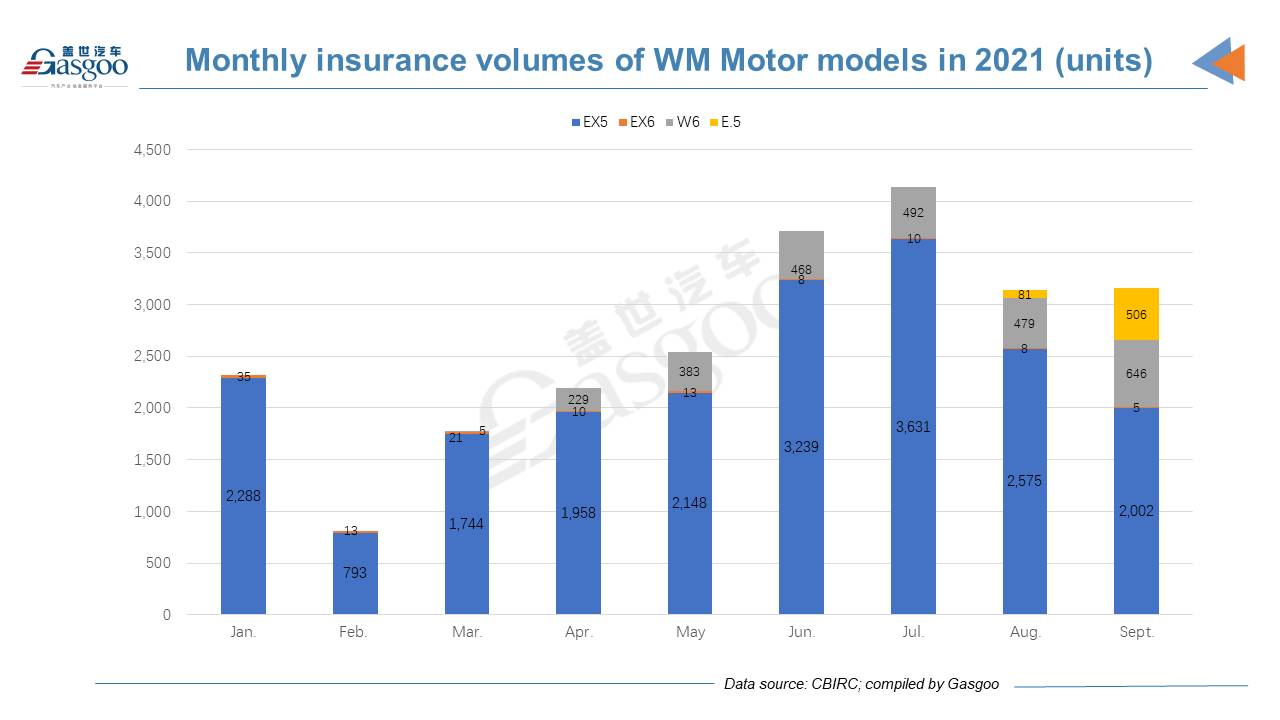

Both Leapmotor and WM Motor recorded Sept. registrations between 3,000 units and 4,000 units. Leapmotor logged a 20.6% month-on-month decrease due to the chip shortage as well, while WM Motor faced a slight growth over the previous month.

It is noteworthy that the E.5, WM Motor's first vehicle designed for mobility services, saw its registrations surge to 506 in Sept. from 81 in August, serving as a main driver to the growth in overall volume. Besides, those for car rental services accounted for 49% of the Sept. registrations of the biggest sales contributor, the EX5.