NIO September deliveries expected to top Li Auto, XPeng

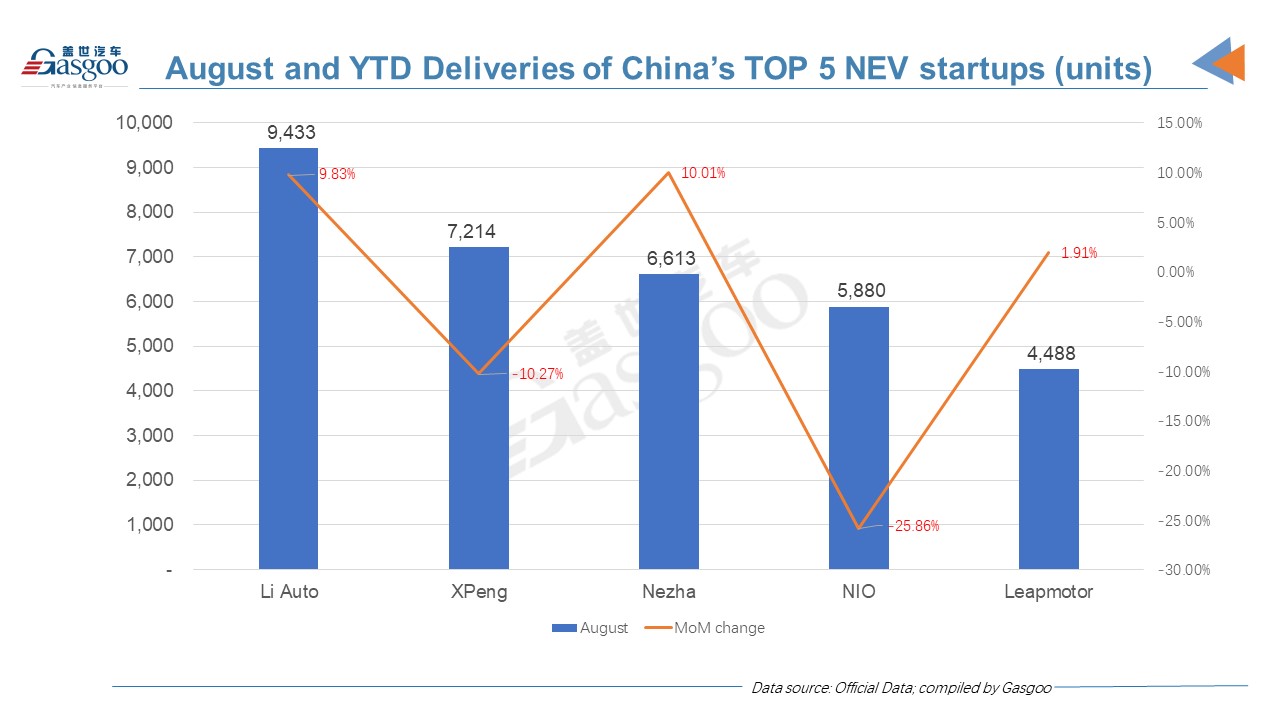

Beijing (ZXZC)- NIO’s August deliveries were outnumbered by Li Auto, XPeng and NETA after it lost monthly delivery championship among China’s new energy electric vehicle startups in July. But the Shanghai-based company is expected to return to the podium positions in September.

In August, two out of the TOP 5 startups saw month-on-month decrease. NIO delivered 5,880 vehicles last month, 25.88% fewer than July deliveries. Auto parts shortage, which resulted from resurgence of COVID-19 cases in Nanjing and Malaysia, was to blame.

An executive from NIO said the region, where its solo A/B pillar trim panel supplier in Nanjing for the ES6 and the EC6, is located, was classified as high infection-risk area. Consequently, the supplier suspended production for some days in August. “The part, a sort of just-in-time components, has limited supplies, and thus had great impact on the production of two models.”

People close to NIO’s factory in Hefei told a local media outlet that the factory’s daily production outlet was about 200 vehicles, and is sparing no efforts to increase output.

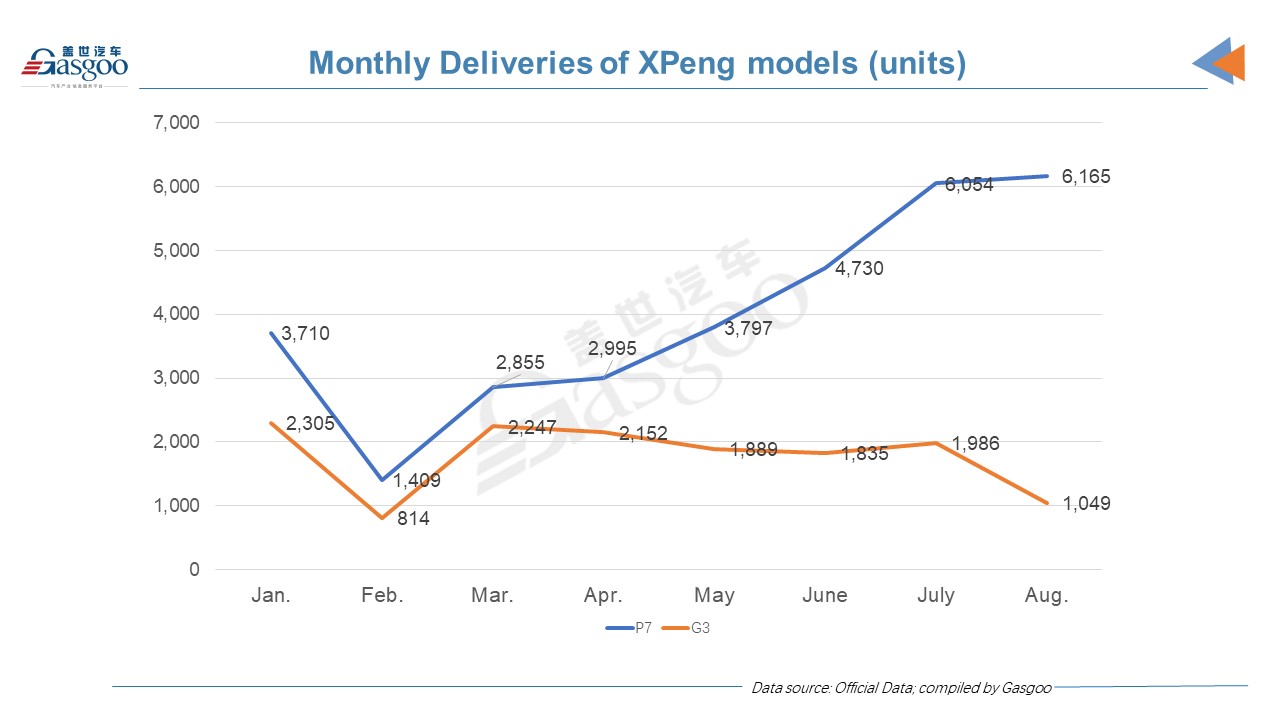

Different from NIO, the main reason for XPeng’s delivery decline, was not challenges in supply chain, but its transition to produce the G3i from the G3, whose August deliveries were nearly halved compared with July. Deliveries of the G3i are expected to commence in September.

Among the other 3 startups, Li Auto delivered the most vehicles in August thanks to its 2021 Li ONE, which boasts outstanding features and performance. NETA gained the biggest month-over-month growth and its ranking on the TOP list surpassed NIO to the third.

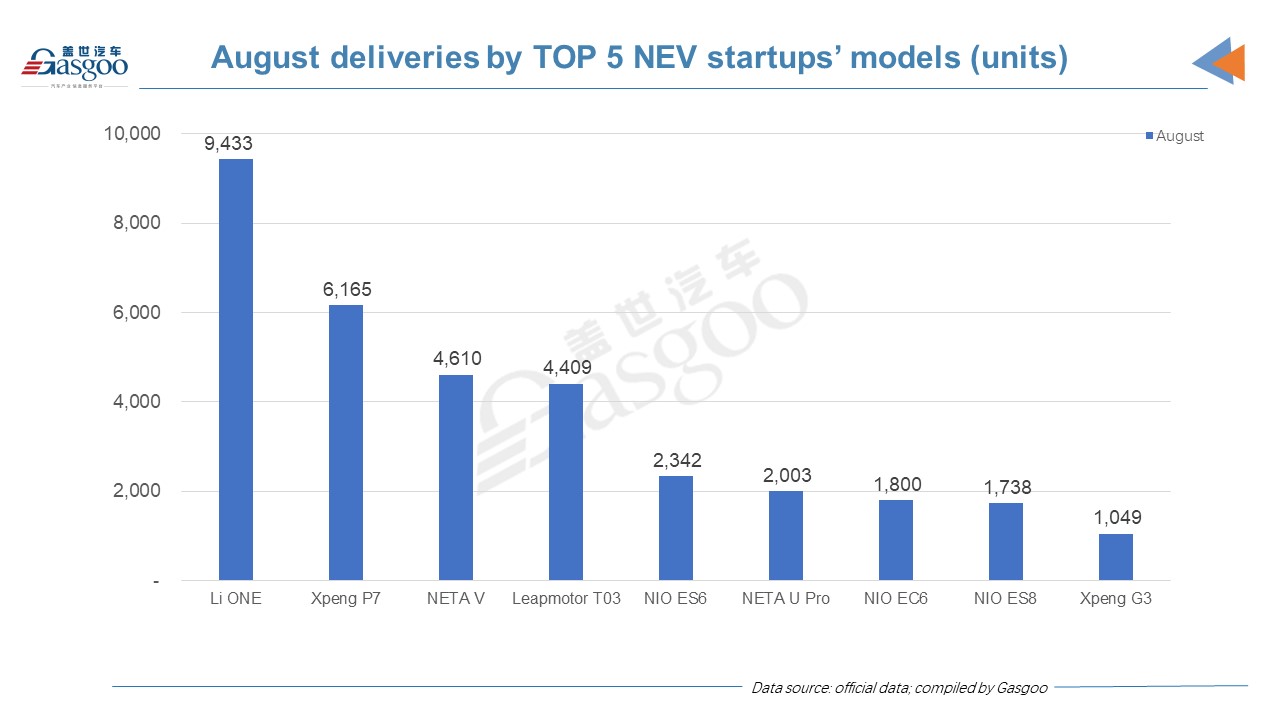

The Li ONE, Li Auto’s single model for sale, was also the most popular one among all NEV startups' models, followed by the XPeng P7. The NETA V and the Leapmotor T03 had a monthly delivery volume of over 4,000 units while the former accounted for more than 90% of its company’s total deliveries. Monthly deliveries of three NIO models were around 2,000 units.

But in terms of year-to-date deliveries, NIO was still an obvious leader over other startup players, followed by Li Auto and XPeng, whose cumulative deliveries of this year were both over 45,000 units.

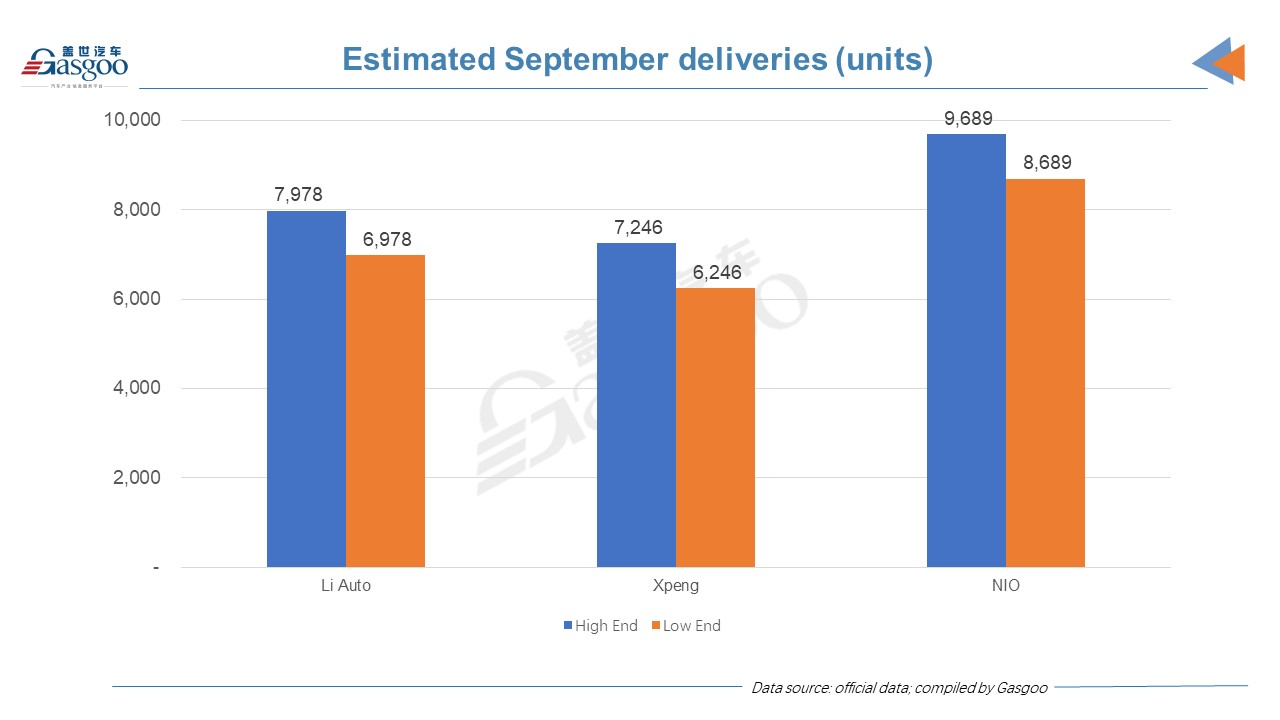

All of the top 3 NEV startups are striving to reach the monthly delivery milestone of 10,000 vehicles as soon as possible to realize economies of scale. Li Auto, whose August deliveries were closer to the target than others, once said it aims to deliver 10,000 vehicles per month from September on, but it seems impossible to achieve the target.

According to the Beijing-based automaker, it expects its third-quarter deliveries to be between 25,000 and 26,000 vehicles, indicating its deliveries in September will be at the range from 6,878 to 7,978 units, after deducting July and August deliveries.

NIO may have a higher delivery volume of about 10,000 vehicles in September. On the basis of its quarterly outlook and the combined deliveries of July and August, we can expect its September deliveries will range from 8,689 vehicles to 9,689 vehicles. People familiar with the matter said, NIO’s new orders in August reached a new high so that its monthly deliveries are expected to set up another new record in September.