NIO Inc. Reports Unaudited Second Quarter 2021 Financial Results

NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer and a leading company in the premium smart electric vehicle market in China, today announced its unaudited financial results for the second quarter ended June 30, 2021.

Operating Highlights for the Second Quarter 2021

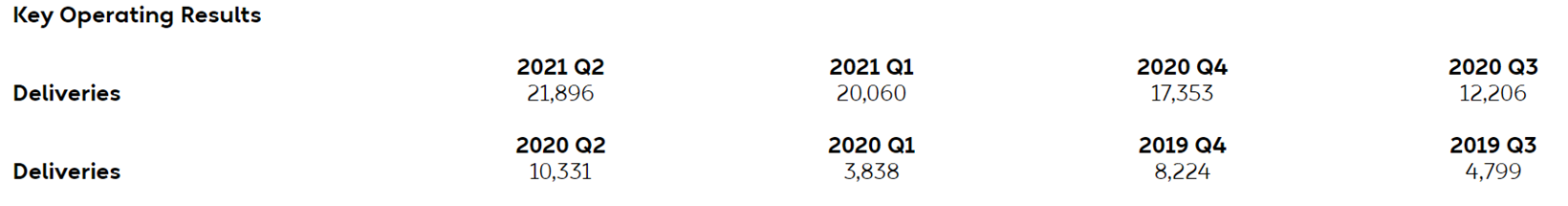

Deliveries of vehicles were 21,896 in the second quarter of 2021, including 4,433 ES8s, 9,935 ES6s and 7,528 EC6s, representing an increase of 111.9% from the second quarter of 2020 and an increase of 9.2% from the first quarter of 2021

Financial Highlights for the Second Quarter of 2021

Vehicle sales were RMB7,911.8 million (US$1,225.4 million) in the second quarter of 2021, representing an increase of 127.0% from the second quarter of 2020 and an increase of 6.8% from the first quarter of 2021.

Vehicle marginii was 20.3%, compared with 9.7% in the second quarter of 2020 and 21.2% in the first quarter of 2021.

Total revenues were RMB8,448.0 million (US$1,308.4 million) in the second quarter of 2021, representing an increase of 127.2% from the second quarter of 2020 and an increase of 5.8% from the first quarter of 2021.

Gross profit was RMB1,573.9 million (US$243.8 million) in the second quarter of 2021, representing an increase of 402.7% from the second quarter of 2020 and an increase of 1.2% from the first quarter of 2021.

Gross margin was 18.6%, compared with 8.4% in the second quarter of 2020 and 19.5% in the first quarter of 2021.

Loss from operations was RMB763.3 million (US$118.2 million) in the second quarter of 2021, representing a decrease of 34.2% from the second quarter of 2020 and an increase of 158.0% from the first quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB511.9 million (US$79.3 million) in the second quarter of 2021, representing a decrease of 54.1% from the second quarter of 2020 and an increase of 156.7% from the first quarter of 2021.

Net loss was RMB587.2 million (US$90.9 million) in the second quarter of 2021, representing a decrease of 50.1% from the second quarter of 2020 and an increase of 30.2% from the first quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB335.8 million (US$52.0 million) in the second quarter of 2021, representing a decrease of 70.3% from the second quarter of 2020 and a decrease of 5.3% from the first quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders was RMB659.3 million (US$102.1 million) in the second quarter of 2021, representing a decrease of 45.4% from the second quarter of 2020 and a decrease of 86.5% from the first quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB335.7 million (US$52.0 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB0.42 (US$0.07) in the second quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.21 (US$0.03).

Cash and cash equivalents, restricted cash and short-term investment were RMB48.3 billion (US$7.5 billion) as of June 30, 2021.

| Key Financial Results |

Recent Developments

Deliveries in July 2021

NIO delivered 7,931 vehicles in July 2021, representing a strong 124.5% year-over-year growth. As of July 31, 2021, cumulative deliveries of the ES8, ES6 and EC6 reached 125,528 vehicles.

Renewal of Joint Manufacturing Arrangements

In May 2021, NIO entered into renewed manufacturing agreements regarding the joint manufacturing of NIO vehicles and related fee arrangements with Jianghuai Automobile Group Co., Ltd., or JAC and Jianglai Advanced Manufacturing Technology (Anhui) Co., Ltd., or Jianglai. Pursuant to the renewed joint manufacturing arrangements, from May 2021 to May 2024, JAC will continue to manufacture the ES8, ES6, EC6, ET7 and potentially other NIO models in the pipeline. In addition, JAC will expand its annual production capacity to 240,000 units (calculated based on 4,000 work hours per year) in order to meet the growing demand for NIO vehicles. NIO will be in charge of vehicle development and engineering, supply chain management, manufacturing techniques and quality management and assurance. Jianglai will be responsible for parts assembly and operation management.

Extraordinary General Meeting

NIO held an extraordinary general meeting (the "EGM") of shareholders at our office in Shanghai, China on June 3, 2021 at 10 a.m. (Beijing Time), for the purposes of approving the proposals to amend and restate our memorandum and articles of association. At the EGM, shareholders of the Company adopted the resolutions to amend and restate the Eleventh Amended and Restated Memorandum and Articles of Association by the deletion in their entirety and by the substitution in their place of the Twelfth Amended and Restated Memorandum and Articles of Association.

Appointment of Independent Director

On July 12, 2021, the board of directors of the Company appointed Ms. Yu Long as a new independent director, effective July 12, 2021. Ms. Long also serves as a member and the chairperson of the nominating and corporate governance committee of the board of directors while Mr. William Bin Li, the Company's founder, chairman of the board of directors and chief executive officer, resigned from the nominating and corporate governance committee of the board of directors on July 12, 2021.

CEO and CFO Comments

"We achieved a record-high quarterly delivery of 21,896 vehicles in the second quarter of 2021, followed by 7,931 vehicles in July, bringing the cumulative deliveries of NIO vehicles to 125,528 as of July 31, 2021," said William Bin Li, founder, chairman and chief executive officer of NIO. "While the global supply chain still faces uncertainties, we have been working closely with our partners to improve the overall supply chain production capacity. Encouraged by the growing user demand, we remain committed to further expanding our power network, increasing our service and sales coverage, and more importantly, accelerating our product and technology development.

"We aim to deliver three new products based on the NIO Technology Platform 2.0 in 2022, including ET7, a flagship premium smart electric sedan. As the EV adoption begins to reach a tipping point worldwide, we believe it is imperative to speed up the launch of new products to provide more premium smart EV offerings with superior holistic services to the growing user base in the global market."

"Driven by another record-high quarterly deliveries in the second quarter of 2021, we have achieved solid financial performance with vehicle margin and gross margin reaching 20.3% and 18.6% respectively," added Steven Wei Feng, NIO's chief financial officer. "As we expand our horizon to more markets, we will continue to make decisive investments in product and core technology development and sales and service network expansion while improving our overall organizational efficiency and capabilities to support the long-term vision of NIO."

Financial Results for the Second Quarter 2021

Revenues

Total revenues in the second quarter of 2021 were RMB8,448.0 million (US$1,308.4 million), representing an increase of 127.2% from the second quarter of 2020 and an increase of 5.8% from the first quarter of 2021.

Vehicle sales in the second quarter of 2021 were RMB7,911.8 million (US$1,225.4 million), representing an increase of 127.0% from the second quarter of 2020 and an increase of 6.8% from the first quarter of 2021. The increase in vehicle sales over the second quarter of 2020 was mainly attributed to higher deliveries achieved from more product mix offered to our users. The increase in vehicle sales over the first quarter of 2021 was mainly due to higher deliveries.

Other sales in the second quarter of 2021 were RMB536.2 million (US$83.1 million), representing an increase of 130.3% from the second quarter of 2020 and a decrease of 7.0% from the first quarter of 2021. The increase in other sales over the second quarter of 2020 was in line with the incremental vehicle sales in the second quarter of 2021. The decrease in other sales over the first quarter of 2021 was mainly due to the less revenues derived from 100kWh battery upgrade service.

Cost of Sales and Gross Margin

Cost of sales in the second quarter of 2021 was RMB6,874.1 million (US$1,064.7 million), representing an increase of 101.8% from the second quarter of 2020 and an increase of 6.9% from the first quarter of 2021. The increase in cost of sales over the second quarter of 2020 and the first quarter of 2021 was in line with revenue growth, which was mainly driven by the increase of vehicle delivery volume in the second quarter of 2021.

Gross Profit in the second quarter of 2021 was RMB1,573.9 million (US$243.8 million), representing an increase of 402.7% from the second quarter of 2020 and an increase of 1.2% from the first quarter of 2021.

Gross margin in the second quarter of 2021 was 18.6%, compared with 8.4% in the second quarter of 2020 and 19.5% in the first quarter of 2021. The increase of gross margin compared to the second quarter of 2020 was mainly driven by the increase of vehicle margin in the second quarter of 2021. Gross margin remained relatively stable compared to the first quarter of 2021.

Vehicle margin in the second quarter of 2021 was 20.3%, compared with 9.7% in the second quarter of 2020 and 21.2% in the first quarter of 2021. The increase of vehicle margin compared to the second quarter of 2020 was mainly driven by the increase of vehicle delivery volume, higher average selling price, as well as lower material cost. Vehicle margin remained relatively stable compared to the first quarter of 2021.

Operating Expenses

Research and development expenses in the second quarter of 2021 were RMB883.7 million (US$136.9 million), representing an increase of 62.1% from the second quarter of 2020 and an increase of 28.7% from the first quarter of 2021. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB800.9 million (US$124.0 million), representing an increase of 50.1% from the second quarter of 2020 and an increase of 23.2% from the first quarter of 2021. The increase of research and development expenses over the second quarter of 2020 and the first quarter of 2021 was mainly attributed to the incremental design and development costs for new products and technologies as well as the increased number of employees in research and development functions.

Selling, general and administrative expenses in the second quarter of 2021 were RMB1,497.8 million (US$232.0 million), representing an increase of 59.9% from the second quarter of 2020 and an increase of 25.1% from the first quarter of 2021. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB1,337.5 million (US$207.2 million), representing an increase of 47.9% from the second quarter of 2020 and an increase of 17.2% from the first quarter of 2021. The increase in selling, general and administrative expenses over the second quarter of 2020 was primarily due to the increased marketing activities as well as the increased number of employees in sales and service functions in the second quarter of 2021. The increase in selling, general and administrative expenses over the first quarter of 2021 was primarily due to the increased marketing and promotional activities and professional services.

Loss from Operations

Loss from operations in the second quarter of 2021 was RMB763.3 million (US$118.2 million), representing a decrease of 34.2% from the second quarter of 2020 and an increase of 158.0% from the first quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB511.9 million (US$79.3 million) in the second quarter of 2021, representing a decrease of 54.1% from the second quarter of 2020 and an increase of 156.7% from the first quarter of 2021.

Share-based Compensation Expenses

Share-based compensation expenses in the second quarter of 2021 were RMB251.4 million (US$38.9 million), representing an increase of 455.0% from the second quarter of 2020 and an increase of 160.5% from the first quarter of 2021. The increase in share-based compensation expenses over the second quarter of 2020 and the first quarter of 2021 was primarily attributed to additional options and restricted shares granted.

Net Loss and Earnings Per Share

Net loss was RMB587.2 million (US$90.9 million) in the second quarter of 2021, representing a decrease of 50.1% from the second quarter of 2020 and an increase of 30.2% from the first quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB335.8 million (US$52.0 million) in the second quarter of 2021, representing a decrease of 70.3% from the second quarter of 2020 and a decrease of 5.3% from the first quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders in the second quarter of 2021 was RMB 659.3 million (US$102.1 million), representing a decrease of 45.4% from the second quarter of 2020 and a decrease of 86.5% from the first quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB335.7 million (US$52.0 million) in the second quarter of 2021.

Basic and diluted net loss per ADS in the second quarter of 2021 were both RMB0.42 (US$0.07). Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.21 (US$0.03).

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB48.3 billion (US$7.5 billion) as of June 30, 2021.

Business Outlook

For the third quarter of 2021, the Company expects:

Deliveries of the vehicles to be between 23,000 and 25,000 vehicles, representing an increase of approximately 88.4% to 104.8% from the same quarter of 2020, and an increase of approximately 5.0% to 14.2% from the second quarter of 2021.

Total revenues to be between RMB 8,913.0 million (US$1,380.4 million) and RMB9,631.1 million (US$1,491.7 million), representing an increase of approximately 96.9% to 112.8% from the same quarter of 2020, and an increase of approximately 5.5% to 14.0% from the second quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.