China’s auto sales edge up both YoY, MoM in August 2024

Beijing (ZXZC)- Due to factors such as recent high temperatures, heavy rainfall, and seasonal slowdowns in some industries, China’s manufacturing production and market demand have both weakened in August. In the automotive market, since the issuance of the measures to further support large-scale equipment upgrading and replacement of consumer goods by the National Development and Reform Commission and the Ministry of Finance on July 25, subsidies for vehicle scrappage and renewal have been increased, with daily applications exceeding 10,000 in August.

In the meantime, some provinces and cities have also introduced replacement and upgrade policies, boosting market enthusiasm, especially for new energy vehicles (NEVs), which have shown strong performance and significant contributions to the market vitality, driving growth in vehicle production and sales month-over-month.

As the positive impact of the central vehicle scrappage and renewal policy gradually emerges, along with local replacement subsidy policies coming into effect, China’s automotive market is expected to see a positive boost in the next four months.

Additionally, China’s auto industry is about to enter the traditional peak sales season of "Golden September and Silver October," with numerous autumn auto shows scheduled across various regions. Major automakers are also continuously launching new products, which will help further unleash market consumption potential.

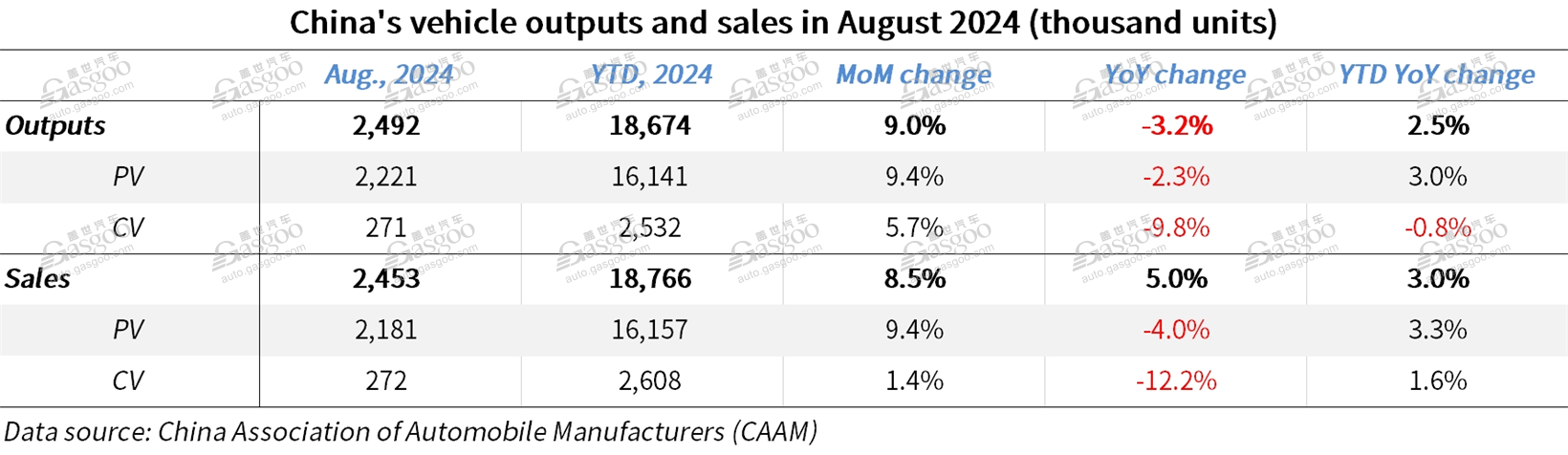

In August 2024, China’s auto production reached 2.492 million vehicles, up 9% month on month but dipping 3.2% year on year. In the meantime, the country’s auto sales stood at 2.453 million vehicles, indicating a rise of 8.5% and 5% from both the previous month and year, according to data from the China Association of Automobile Manufacturers (CAAM).

In the first eight months of this year, China’s auto output totaled 18.674 million vehicles, which edged up 2.5% from that of the previous year. During the period, China’s auto sales grew 3% year over year to 18.766 million vehicles.

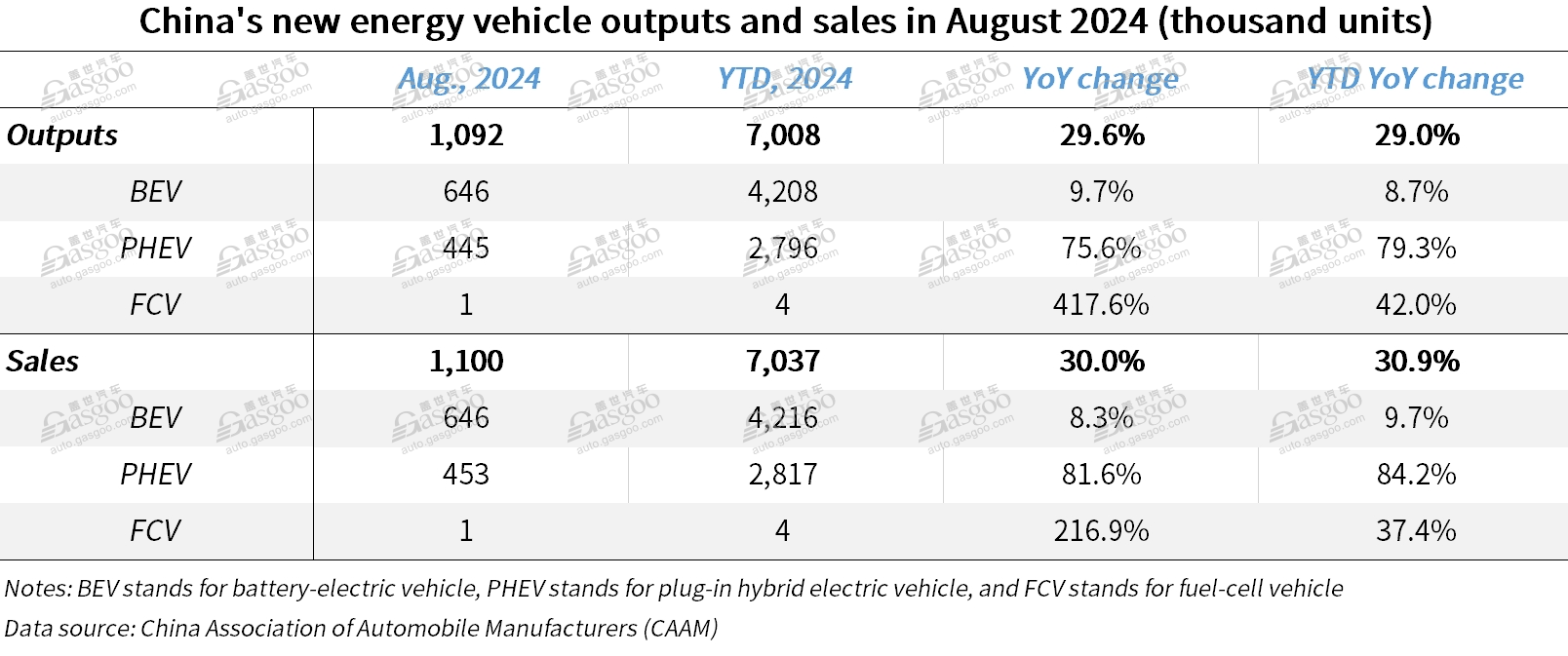

On the other hand, China’s NEV market continued to demonstrate robust performance in the past month. In August 2024, a total of 1.092 million NEVs were produced in China, representing a 29.6% year-on-year jump. Monthly NEV sales amounted to 1.1 million units, surging 30% from a year ago. NEVs constituted 44.8% of China’s combined auto sales last month.

Of the NEVs sold in August, 990,000 units were consumed domestically in China, representing a 11.6% month-on-month increase and a 30.9% year-on-year hike. Monthly exports of NEVs stood at 110,000 units, up 6.1% from the previous month and 22% from a year ago.

China’s year-to-date NEV production volume summed up to 7.008 million units by August this year, leaping 29% year over year. In the period, sales of NEVs reached 7.037 million units, representing a 30.9% year-on-year increase.

Domestically, roughly 6.219 million NEVs were sold across China in the Jan.-Aug. period, which jumped 33.8% compared to the same period last year. Meanwhile, 818,000 NEVs were shipped to overseas markets, climbing up 12.6% from the year-ago period.

Seagull; photo credit: BYD

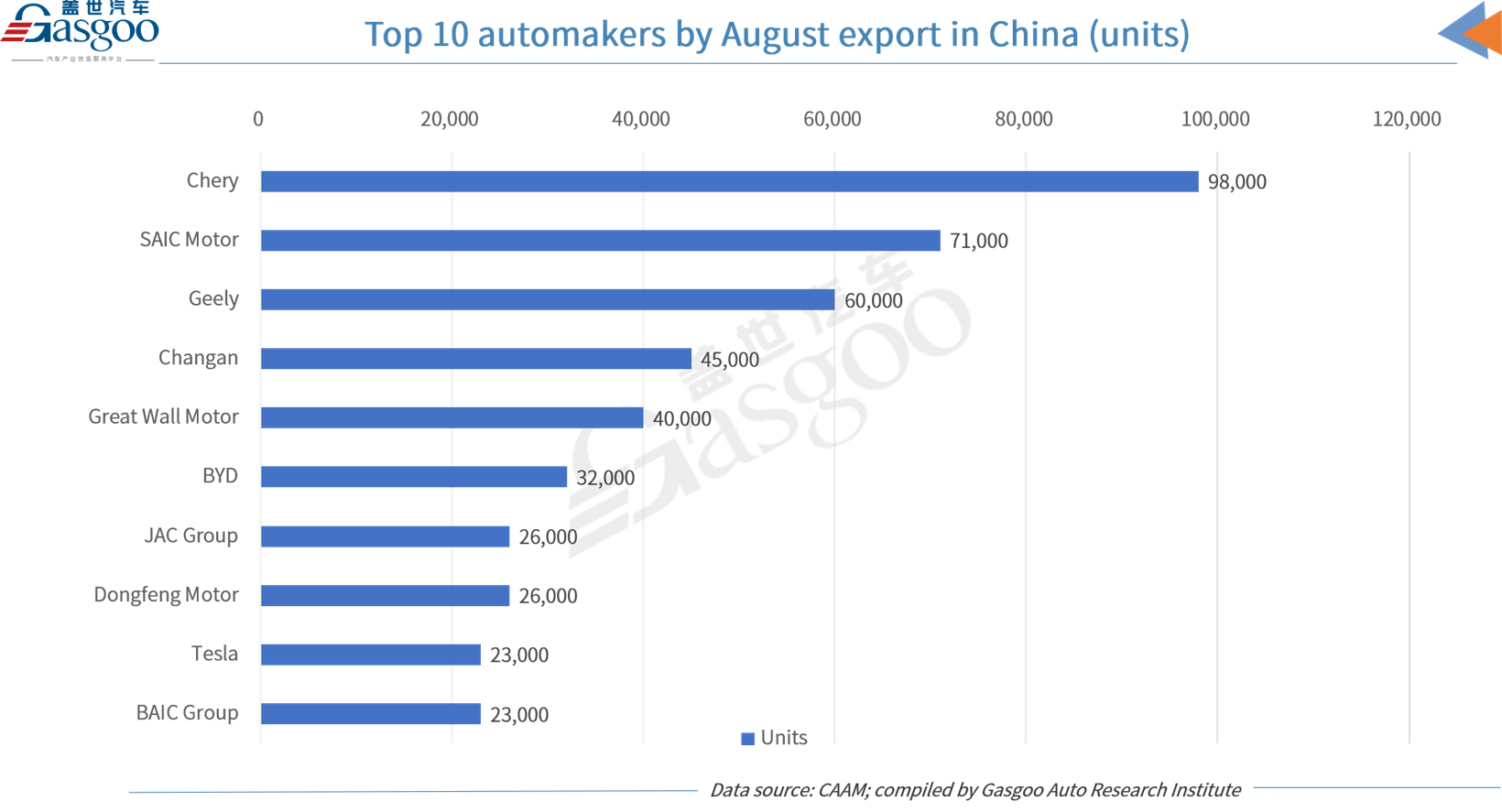

Automakers in China exported 511,000 vehicles in August this year, up 9% month-on-month and 25.4% year-on-year. Of which, 438,000 units were passenger vehicles (+9.7% MoM, +25.6% YoY), and 74,000 units were commercial vehicles (+4.7% MoM, +24.7% YoY).

In the first eight months of 2024, China’s auto exports amounted to 3.773 million vehicles, surging 28.3% from a year ago. Passenger vehicle export volume stood at 3.176 million units (+29.4% YoY), while commercial vehicle exports reached 597,000 units (+22.8% YoY).

In August, among the top ten vehicle exporters in China, Chery led the pack with 98,000 vehicles exported, up 12.7% year-on-year, and accounting for 19.1% of the country’s total auto exports. Geely showed the most significant growth among the top ten list, with monthly exports reaching 60,000 units, which more than doubled year over year.

In the first eight months of this year, among the top ten vehicle exporters, BYD realized the most prominent growth with 270,000 vehicles shipped overseas (+120% YoY).