China’s homegrown new energy PV wholesales down by 36% year on year

Shanghai (ZXZC)- The wholesale volume of locally-made new energy PV (NEPV) in China reached 58,768 units in April, dipping 36% year on year, while edging up 6% over the previous month, according to Cui Dongshu, secretary-general of the China Passenger Car Association (CPCA).

With 42,317 units sold, BEVs accounted for 72% of the April NEPV wholesales, posting a 36% slump from a year ago. The downshift entirely resulted from the decrease in car and SUV sales, which fell 31% to 31,059 units and 48% to 11,163 units respectively. All-electric MPV sales represented a sizeable increase thanks to its small year-ago base number.

(Leading Ideal One, photo source: Leading Ideal)

The PHEV sector took up the other 28% share, remaining flat compared with the prior-year period. Its wholesales dwindled 35% to 16,451 units, but were more than doubled over a month earlier.

According to the CPCA, 55,752 consumers in China took delivery of locally-made NEPVs in April, a year-over-year drop of 34.5%. Although the growth still remained negative, the NEV market has bottomed out the record-low level in February when the country was devoted to fighting against the COVID-19.

To revive the NEV consumption that took hit due to the viral spread, China's government decided to extend the NEV subsidies for two years to 2022, which was supposed to be stopped by the end of this year, and phase out them at a slower pace after three-month grace period (from April 23 to July 22).

(BYD all-new Qin EV, photo source: BYD)

Nevertheless, the extended incentive is only available to NEV models priced below RMB300,000 and the products equipped with a swappable battery. The CPCA deems the price threshold reasonable because it takes account of Chinese consumers' average consumption power and will help improve the stimulus efficacy by subsidizing the purchase of mainstream NEVs and somewhat curbing the shopping of luxury products. Besides, it is also good for enhancing NEVs price competitiveness and making them geared up to the price system of traditional fuel-burning vehicles.

For the month of April, Tesla's deliveries of the China-built Model 3 slumped by 64% to 3,635 units in April from 10,160 units in March. The decrease may be partly attributable to consumers choosing to delay car purchase until May, when the price of the Standard Range Plus version is lowered.

Tesla reduced the price of the homegrown Model 3's the Standard Range Plus on May 1 to RMB291,800 from RMB323,800 before subsidy. The adjustment equates to around a 10% discount over the vehicle's previous value, making the model priced below the government’s subsidy threshold. With the cash handout applied, the locally-made Model 3's price at present stands at RMB271,550.

The EV manufacturer said on May 14 the price of the locally-produced Model 3's Long-range RWD version will remain unchanged, which implies it will dig into its pockets for offsetting the price gap rather than transferring the burden to consumers. Current post-subsidy price of the long-range model is at RMB RMB344,050, above the aforementioned price threshold.

BYD's all-new Qin EV moved up to the No.1 place by April retail sales. Two startup-made models—the NIO ES6 and the Leading Ideal One—were ranked fourth and fifth respectively. The price threshold will bring no impact on NIO's sales as its entire lineup comes standard with swappable battery pack.

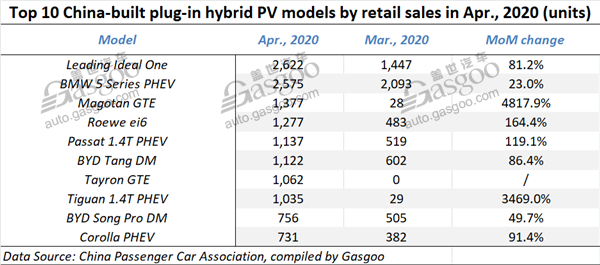

The Leading Ideal One was the best-selling plug-in hybrid PV model in April. The product, which was defined as a REEV (range-extended electric vehicle) model, has been recently repositioned as a PHEV since the REEV is classified as a PHEV by the MIIT, and is generally regarded by consumers as a PHEV product as well, according to Li Xiang, founder and CEO of Leading Ideal.

Although China's NEV sales have bottomed out in April, the global market is still facing a tough challenge. “At the beginning of the year, we expected the annual NEV sales to stand at around 1.3 million units,” said Xu Haidong, vice-chief engineer of the China Association of Automobile Manufacturers (CAAM), “but now, shocked by the pandemic, it will be good enough to see the number exceed 1 million units including Tesla's.”

To revive the flagging NEV sales, China's policy makers have extended the vehicle purchase tax and subsidies on NEVs for two years to 2022. Besides, some local authorities, such as Shanghai, Guangzhou and Shenzhen, have determined to subsidize NEV purchase, in a bid to drive the sales using the most straightforward incentive. The CAAM also proposed “a vigorous effort in developing new energy automobile industry.”