Self-driving startup HoloMatic closes $140 million Series C funding round

HoloMatic expects its losses to narrow dramatically by 2024 and to break even by 2025, when it will apply for a stock market listing.

(Image credit: HoloMatic)

Chinese self-driving startup HoloMatic closes new funding with continued support from GAC Group.

HoloMatic recently closed a RMB 300 million ($41.8 million) Series C3 funding round, bringing the Series C amount to more than RMB 1 billion ($140 million), the company said today in a press release.

The Series C3 financing was co-led by Guangdong Technology Financial Group and GAC Capital, a subsidiary of GAC Group, according to the release.

This is a further bet by GAC on HoloMatic after the two signed a strategic cooperation agreement in 2021. To date, GAC has invested a cumulative total of nearly RMB 400 million in HoloMatic.

Funds from this round of financing will be used to boost the research and development of HoloMatic's self-driving technology, and promote the mass production of self-driving solutions, the startup said.

Founded in June 2017, HoloMatic received investment from GAC Capital in March last year in a C1 round of financing. In November last year, HoloMatic closed its C2 round and GAC Capital continued to bet on it.

HoloMatic expects its losses to narrow significantly by 2024 and to break even by 2025, when it will apply for a listing on the stock market, local media outlet LatePost today quoted the startup's founder Ni Kai as saying.

GAC currently owns about 13 percent of HoloMatic, making it the top outside shareholder, according to the report.

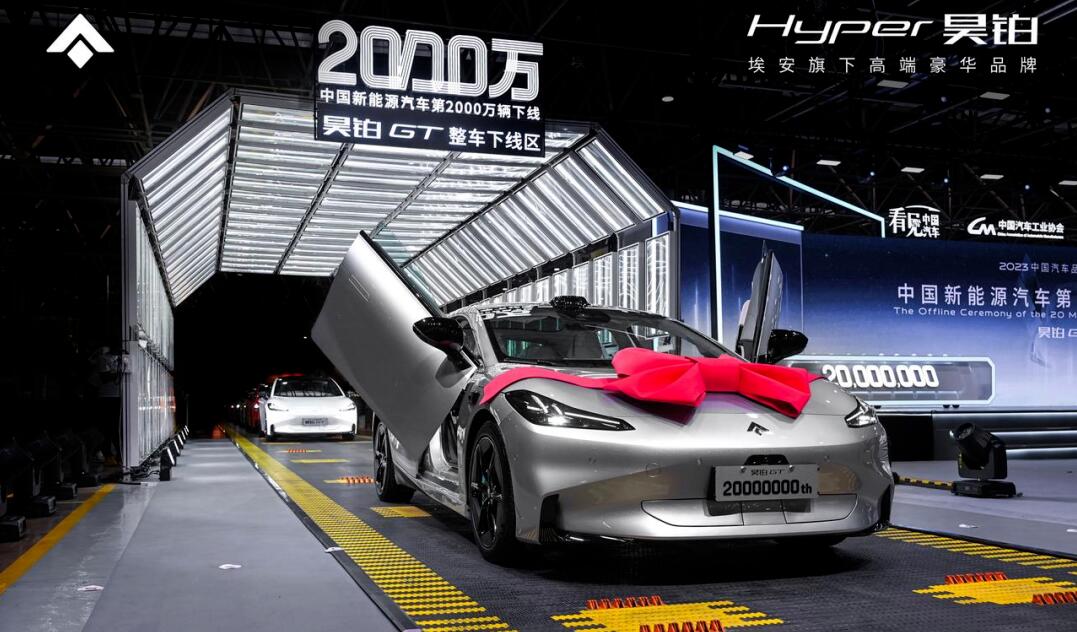

GAC is also HoloMatic's biggest customer, with its assisted driving solutions for brands including Trumpchi, Aion and Hyper developed in collaboration with the two.

HoloMatic will launch the initial version of its city pilot assisted driving solution this year, and production cars with the system will hit the market in the second or third quarter of next year, Ni said.

($1 = RMB 7.1723)

Self-driving chip maker Black Sesame files for HK listing