BYD reportedly to supply batteries for SAIC-GM's PHEV models

The partnership could involve the supply of tens of GWh of blade batteries.

(Image credit: BYD)

As China's largest maker of new energy vehicles (NEVs), BYD is also one of the largest makers of power batteries, and is continuing to expand its customer base.

BYD's battery business subsidiary FinDreams Battery's previously rumored No. 56 customer could be SAIC Motor's joint venture with General Motors, according to a report today by local auto media outlet Xchuxing.

Citing a leaked image, the report said the customer appears to be "Pan-Asia PHEV," which means FinDreams will supply batteries for SAIC GM's plug-in hybrid models.

Pan-Asia refers to Pan-Asia Technical Automotive Center, which was established on June 12, 1997 as the first Sino-foreign joint venture automotive design and development center in China by GM and SAIC.

It was previously reported that BYD's No. 56 customer in the battery business has demand for blade batteries of up to tens of GWh, according to the report, which provided no further details.

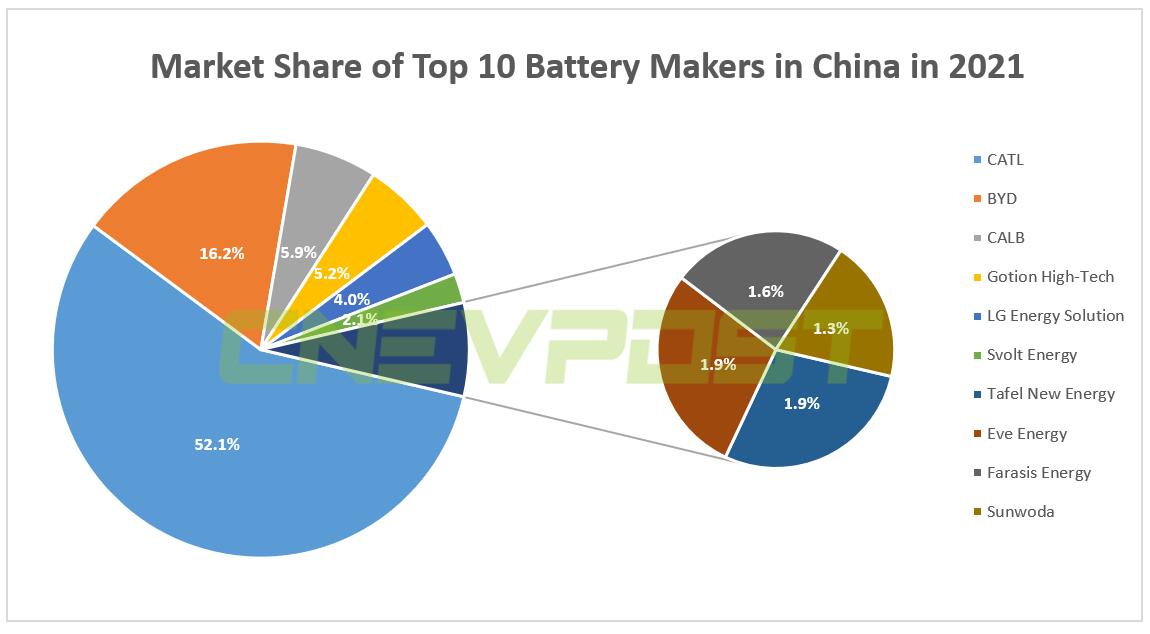

BYD is the second-largest maker in China's power battery industry.

The company ranks second with 25.06 GWh of power batteries installed in 2021 and a 16.2 percent market share in China, according to data released earlier this month by the China Automotive Battery Innovation Alliance.

CATL's power battery installation in China for the full year 2021 was 80.51 GWh, ranking first with a 52.1 percent market share.

(Graphic by CnEVPost)

BYD's power cells are not only supplied to the company's own production models, but are also being supplied to the outside world. Li Yunfei, BYD's general manager of brand and PR, said last year that FinDreams is open to all industry players, not just BYD.

Ford reached an agreement with BYD on a battery partnership in 2020 and was using BYD's batteries in the Ford Escape PHEV.

When it launched the Mustang Mach-E EV in China last year, Ford announced that the model was powered by BYD's batteries, making it the first international car company to publicly adopt BYD's batteries.

However, Ford did not use BYD's signature blade battery based on lithium iron phosphate technology, but rather the latter's 811 ternary lithium battery.

In October last year, local media Cailian reported that BYD had received 10 GWh of LFP battery orders from Tesla.

BYD never confirmed nor denied this.

At the end of last month, 36kr reported that Nio staff had recently appeared frequently at BYD, and the two sides were negotiating business cooperation.

Nio was in deep contact with BYD, and the two sides have already reached the end of the discussion about the cooperation of the former's sub-brand, the report said, citing people familiar with the matter.

The report did not provide more information on the Nio sub-brand or what the partnership would look like, but suggested the move comes at a time when several Chinese car companies are looking to diversify their battery suppliers.