Calls for policy to grow country's vehicle sales

China's top auto trade association is calling for favorable government policies to stimulate sales, saying domestic demand for new vehicles is one of the most important issues to be addressed this year.

"We hope that the central government can create a favorable policy environment, including rolling out details as soon as possible regarding such policies as trade-ins of consumer goods to stabilize the sector's expectations," said the China Association of Automobile Manufacturers last week.

The CAAM's estimate earlier this year said that sales will grow by around 3 percent year-on-year from 2023 to 31 million units of which new energy vehicles will number 11.5 million units.

The automotive sector had a good start though, with the best first quarter sales since 2019, according to the association.

Its statistics show that vehicle sales stood at 6.72 million units from January to March, up 10.6 percent year-on-year, while their production reached 6.61 million units, an increase of 6.4 percent year-on-year.

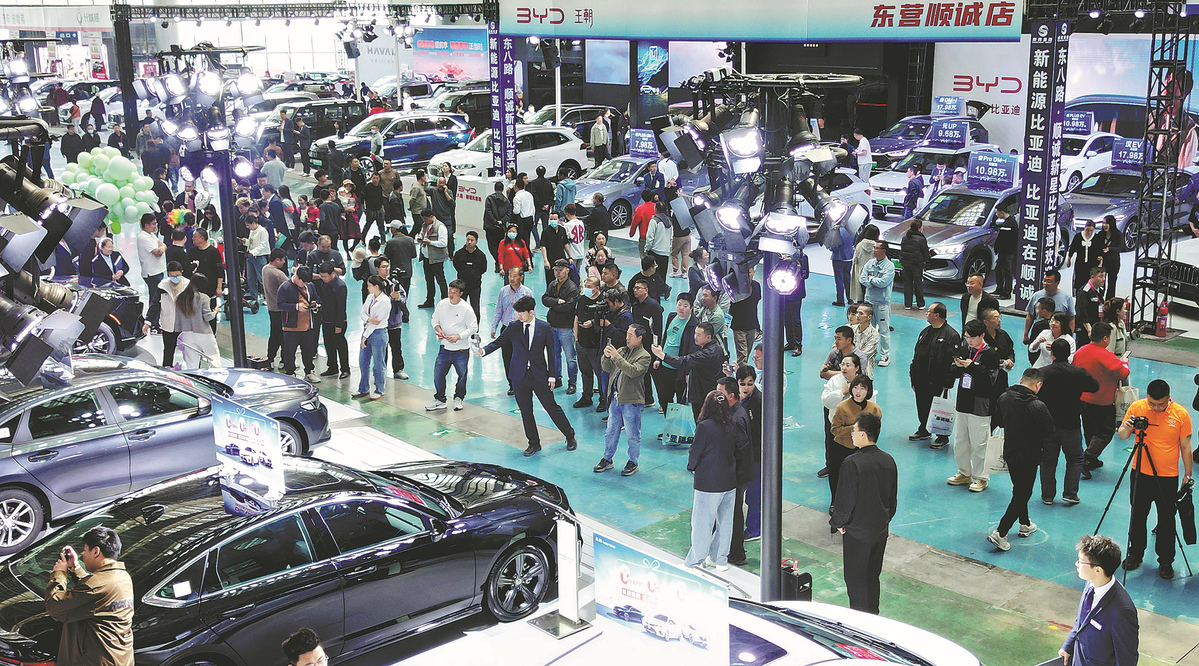

Chen Shihua, deputy secretary-general of the CAAM, said the quarter was a good start for the year, fueled by carmakers' new vehicle launches as well as auto fairs and promotional policies.

Tens of new models, both NEVs and gasoline ones, from Chinese and global carmakers have hit the market after the week-long Spring Festival holiday that ended in February.

Some garnered extensive attention, including the first vehicle from smartphone maker Xiaomi, whose vehicle launch attracted around 100 million views online.

BYD have launched a series of new iterations of their existing models. Last week, IM Motors, a joint venture between SAIC and Alibaba, rolled out a model with semi-solid-state batteries, which promise a longer driving range compared with ordinary batteries.

The new choices are creating cutthroat competition including waves of price cuts that hurt carmakers' profits. Such deals are to the delight of some car buyers but also entice others to wait for more bargains to emerge.

Under these circumstances, the CAAM has called for continuous policy support, including details of some of the central government's policies released earlier this year.

In March, the State Council released a plan to encourage trade-ins. Carmakers including Nio and Chery and local authorities in some cities have offered subsidies of up to thousands of yuan per vehicle to encourage drivers to place orders.

Earlier this month, the country's central bank and the National Financial Regulatory Administration released a plan to relax the loan ratios for personal vehicle purchases.

Financial institutions can independently determine the upper limits of loan ratios for gasoline cars and NEV purchases, according to the plan.

Currently, the highest loan ratios for personal gasoline car and NEV purchases stand at 80 percent and 85 percent, respectively.

Financial institutions are encouraged to step up innovation in financial products and services to adapt to the trade-in of vehicles as well as other new scenarios, and better support the demand for automobile consumption, said the plan.

Carmakers including FAW Toyota are among the first to announce financial plans to woo car buyers. In one scheme, they can drive home a car without a down payment as long as they repay the loan in eight years.

Vehicle exports were reassuring in the first quarter, said the CAAM.In March, over 500,000 units were shipped from China to overseas markets, up 37.9 percent year-on-year and 33 percent month-on-month.

They brought the first quarter figures to 1.32 million, up 33.2 percent from the same quarter last year.

"Exports are at a pretty high level, playing their active role in boosting the auto sector's growth," said Chen.

Carmakers are revving up their efforts to explore overseas markets. Last week, around 1,000 Xpeng G9 SUVs left for Germany, marking the Chinese startup's largest overseas shipment.

For Great Wall Motor, China's largest SUV maker, its Q1 overseas sales stood at 92,778 units, up 78.51 percent year-on-year and accounting for a third of the carmaker's total deliveries in the quarter.

"Chinese car manufacturers have improved their products' quality and safety performance significantly. It is very clear from ratings we have given and vehicles we have tested," said Michiel van Ratingen, secretary-general of the Euro NCAP.

Based in Leuven, Belgium, the Euro NCAP evaluates new vehicles entering the European market, giving them star-ratings based on the performance of the vehicles in a variety of crash tests. It is generally viewed as the strictest of its kind in the world.