Sunwoda to make solid batteries cheaper

Sunwoda, a prominent battery maker, said on Tuesday it will be able to lower the price of its all-solid-state battery to 2 yuan ($0.27) per watt-hour by 2026, amid accelerated efforts and investment from the Chinese government and local companies on this game-changing technology.

Xu Zhongling, vice-president of research and development at Sunwoda, said in an exclusive interview with China Daily that the company has developed an all-solid-state battery with a capacity of 20Ah and an energy density exceeding 400Wh/kg.

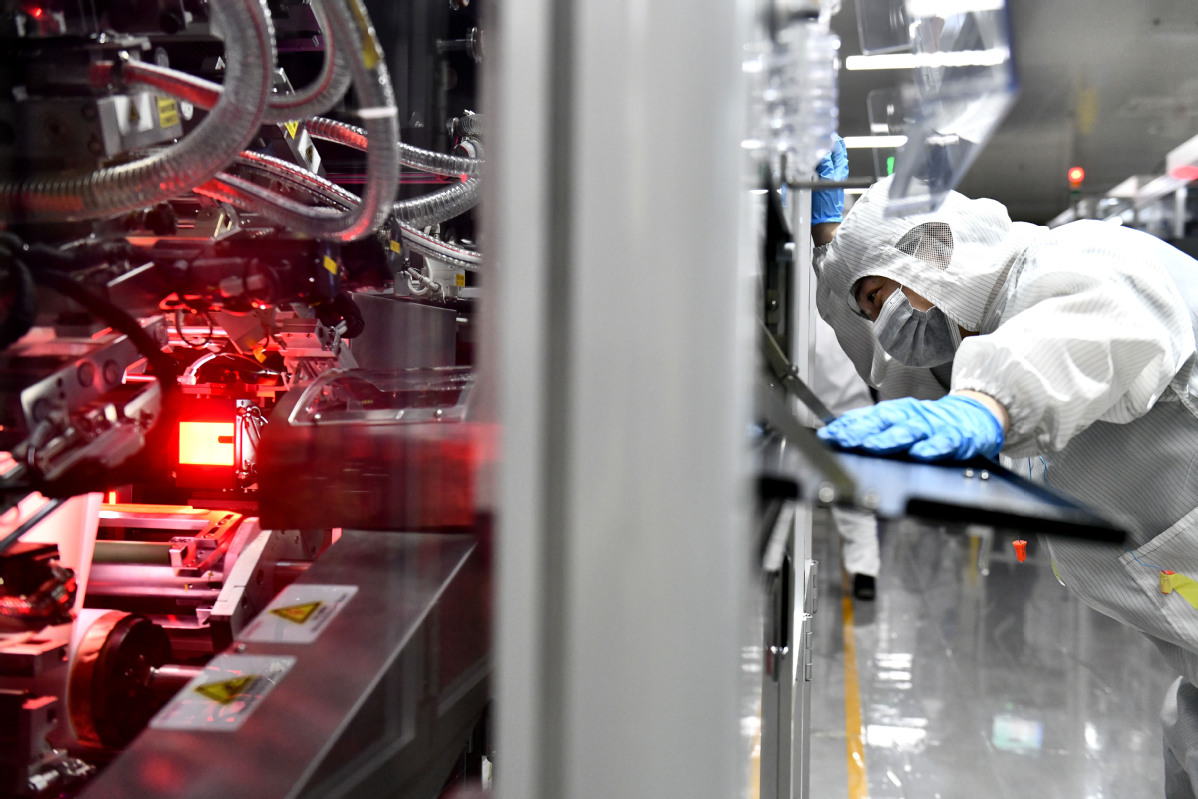

"We are currently constructing a production line for such batteries and aim for mass production of the all-solid-state battery by 2026, with an expected capacity of 1 GWh," he said. It was also the first time that the firm disclosed details of its all-solid-state battery.

Through technological innovation and increased R&D investment, Xu said that Sunwoda is expected to reduce the cost of polymer-based all-solid-state batteries to 2 yuan per Wh by 2026, which is comparable to the current cost of semi-solid-state batteries.

Efficiency, low cost and mass production capability are critical benchmarks for the success of new battery technologies. China's dominance in the global power battery market is attributed to its ability to offer high-quality batteries at competitive prices. For instance, lithium-iron phosphate batteries are now priced below 0.5 yuan per Wh.

"Although Japan and South Korea have taken the lead in all-solid-state battery research, China has a complete battery supply chain, a robust industrial ecosystem and economies of scale. Coupled with accelerated government support and corporate investment, China has advantages in reducing the cost of such batteries," he said.

He said Sunwoda has further increased the energy density of all-solid-state batteries to 500 Wh/kg and already has laboratory prototype samples, and expects to complete laboratory sample production of all-solid-state batteries with energy density of over 700 Wh/kg in 2027.

All-solid-state batteries offer higher theoretical energy density and safety, and entail lower costs than lithium-ion batteries that currently dominate the electric vehicle sector. Hence, many countries consider them a potentially game-changing technology.

Japan, which has been striving to develop all-solid-state batteries since 2018, currently has the highest number of related patent applications. In June 2023, Toyota, a Japanese carmaker, set a target for itself to commercialize such batteries by 2027.

"While all-solid-state batteries offer a crucial solution balancing high energy density and safety, they are not the only solution," Xu said. "The trend in battery development is toward higher energy densities, and as long as safety issues at high energy densities are resolved, both solid and liquid batteries can be viable."

He also said the cost of sulfide-based all-solid-state batteries remains high, with low market acceptance, and it is uncertain how much the cost can be reduced in the next 3-5 years.

"Therefore, in the short term, commercially viable lithium batteries will still primarily consist of liquid, semisolid or low-cost polymer all-solid-state batteries," he said, adding that China will not abandon the current advantages in liquid lithium-ion batteries.