China’s cumulative NEV output, sales both exceed 30 million units by Jun. 2024

Beijing (ZXZC)- Since the beginning of 2024, the main economic indicators of China’s automotive industry have shown a growth trend. Due to the relatively low base in the same period last year, the growth rate exceeded double digits in the first quarter, while the overall growth rate slowed down slightly in the second quarter.

In the first half of this year, China’s domestic auto market saw a slight year-on-year increase in sales, with terminal inventories above normal levels. In the meantime, auto exports maintained rapid growth, significantly contributing to the overall market growth, although the export growth rate of new energy vehicles (NEVs) slowed down. The production and sales of NEVs continued to grow rapidly, with market share steadily increasing. According to data from the China Association of Automobile Manufacturers (CAAM), as of the end of June this year, the cumulative production and sales of domestically produced NEVs both exceeded 30 million units. The market share of Chinese indigenous brands’ passenger cars surpassed 60%, achieving a significant breakthrough.

Looking ahead to the second half of the year, favorable policies such as trade-in incentives and NEV promotions in rural areas will continue to be implemented. The intensive launch of new products by automakers will help further unleash the consumption potential of the automotive market, supporting steady growth for the industry throughout the year. However, it is also important to recognize that domestic consumer confidence remains insufficient, international trade protectionism is becoming more severe, industry competition is intensifying, and operational pressures on enterprises are increasing. The overall operation of the auto industry still faces significant pressure, and consumer confidence and the market environment need to be continuously boosted and improved to ensure a stable operation.

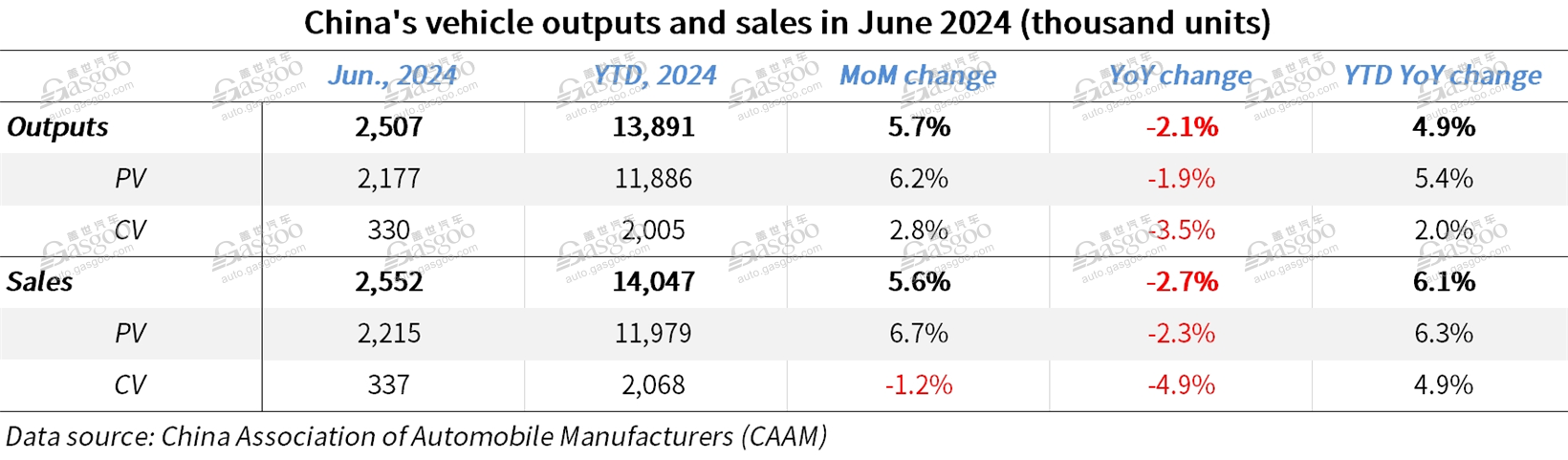

In June 2024, China’s auto production and sales came in at 2.507 million vehicles and 2.552 million vehicles, respectively, with month-on-month increases of 5.7% and 5.6% and year-on-year dips of 2.1% and 2.7% each.

In the first half of this year, 13.891 million vehicles were manufactured in China, representing a 4.9% rise compared to that of the previous year. At the same time, China’s year-to-date auto sales amounted to 14.047 million vehicles, climbing up 6.1% from a year ago.

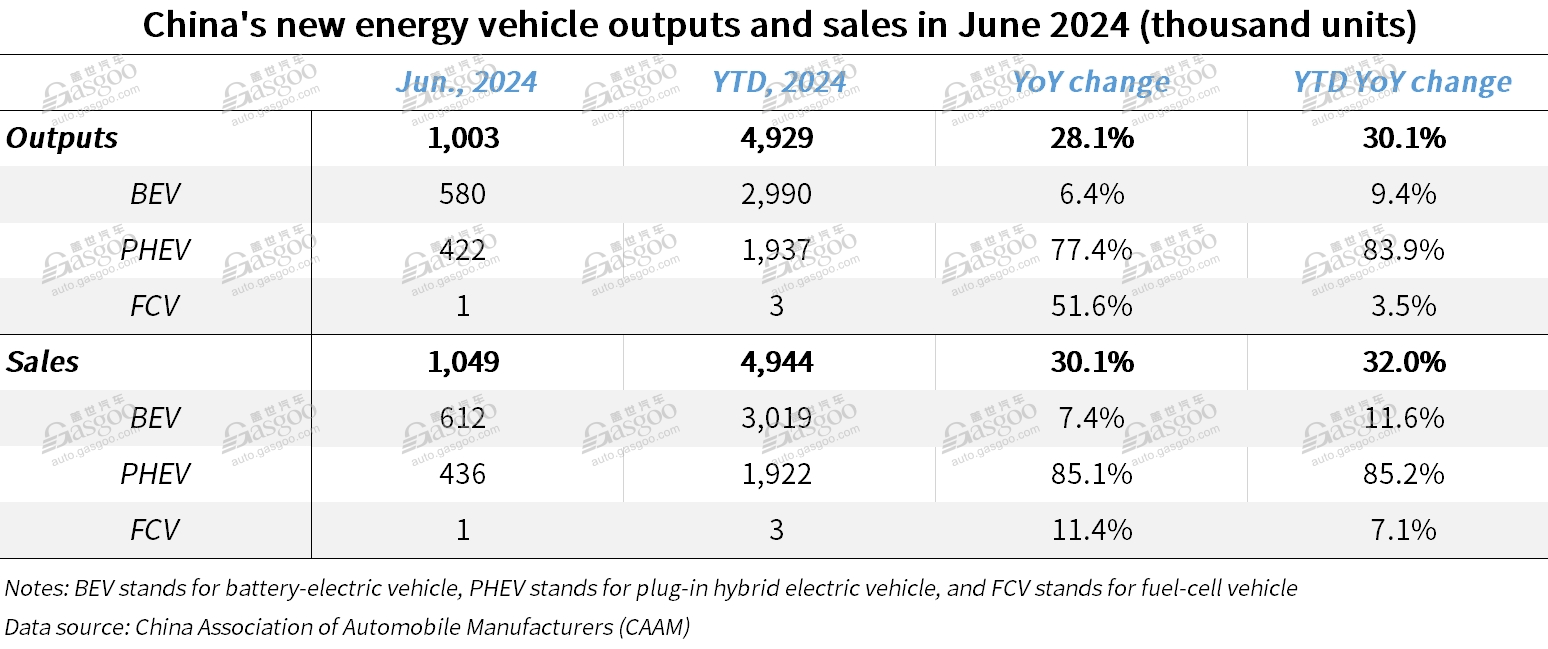

Despite the slight year-on-year drop in overall auto output and sales in June, China’s NEV market still maintained its robust growth trend. In the past month, a total of 1.003 million NEVs were produced in China, jumping 28.1% year over year. Meanwhile, NEV sales reached 1.049 million units, surging 30.1% from a year ago and accounting for 41.1% of the country’s total auto sales volume.

Among the NEVs sold last month, 963,000 units were consumed domestically, indicating a 12.5% month-on-month rise and a 32.2% year-on-year spike. On the other hand, China’s NEV exports saw a 13.2% month-on-month decline in June to 86,000 units, which was still 10.3% higher than that of the previous year.

In the first six months of 2024, China’s NEV production and sales volumes amounted to 4.929 million units and 4.944 million units, surging 30.1% and 32% year over year, respectively. NEVs constituted 35.2% of China’s auto sales in the period.

In the Jan.-Jun. period, domestic NEV sales summed up to 4.339 million units, zooming up 35.1% from a year ago. At the same time, China’s NEV exports increased 13.2% year over year to 605,000 units.

Song L; photo credit: BYD

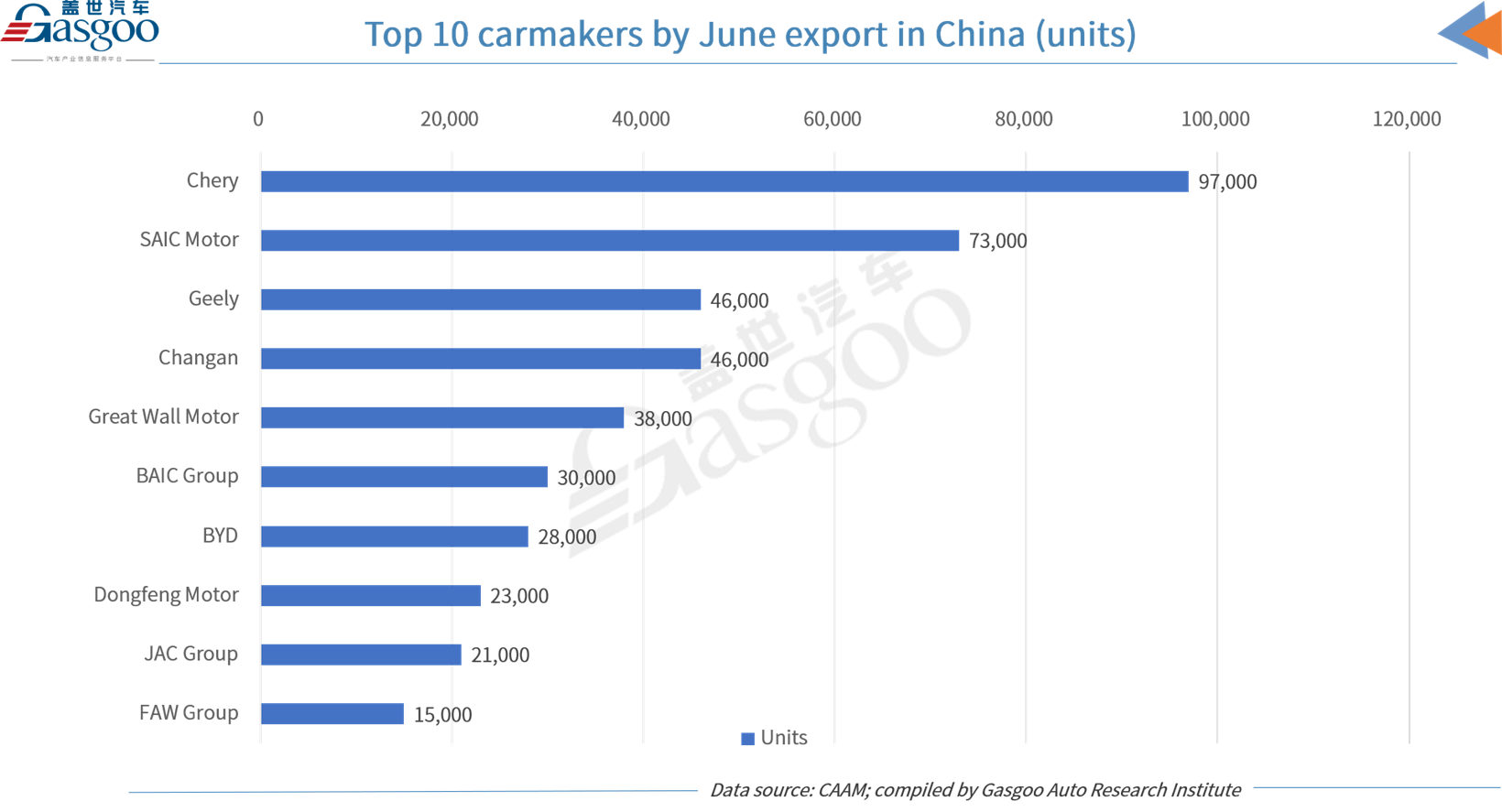

In terms of Chinese automaker’s overall performance in overseas markets, the country’s total auto export volume stood at 485,000 vehicles in June 2024, slightly climbing up 0.7% from the previous month while jumping 26.9% from the previous year. Among the vehicles shipped to overseas markets, 403,000 units were passenger cars, up 1.4% month-on-month and 29.1% year-on-year.

In the first half of this year, automakers in China achieved a combined auto export volume of 2.793 million vehicles, which leapt 30.5% compared to the same period last year. With 2.339 vehicles exported, China’s passenger vehicle sector boasted a 31.5% year-on-year hike in the period.

In June, among the top ten vehicle export companies, Chery stayed in the lead with its export volume reaching 97,000 vehicles, representing a year-on-year increase of 28.5% and accounting for 20% of the country’s total auto export volume. Compared to the same period last year, BYD realized the biggest growth with 28,000 vehicles shipped overseas, indicating a 140% soar from the year-ago period.

Notably, BYD also sustained the most growth in year-to-date export volume, which came in at 207,000 vehicles and shot up 160% year over year. Great Wall Motor exported 202,000 vehicles in the Jan.-Jun. period, indicating a 62.6% year-on-year spike. At the same time, Changan Auto witnessed a 60.4% increase from the previous year with 285,000 vehicles moved overseas.