Car and City: China’s passenger vehicle registrations in Feb. 2024 drop YoY, MoM

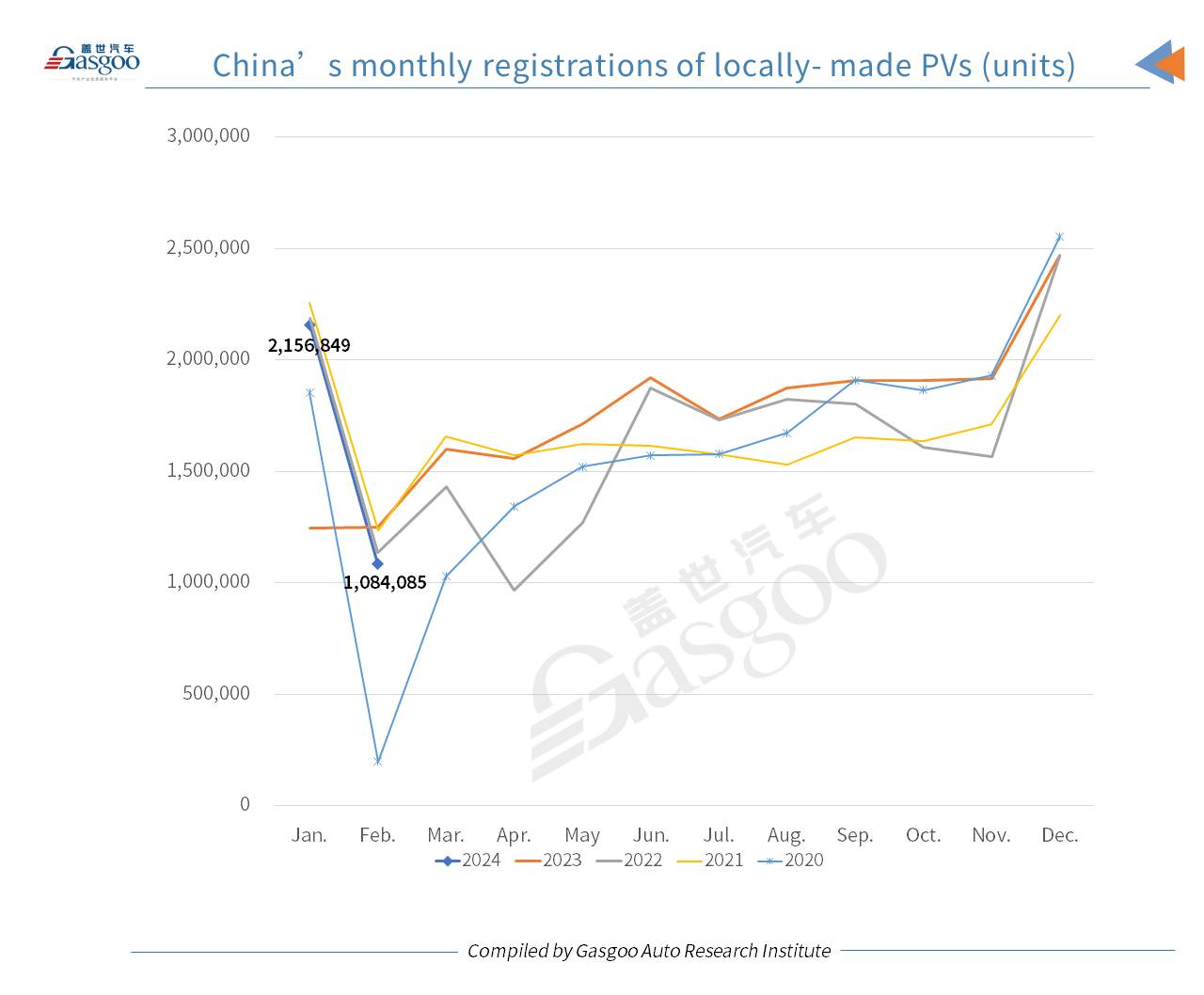

In the second month of 2024, there were a total of 1,084,085 locally-produced passenger vehicles (PVs) registered across the Chinese Mainland, representing a 13.27% year-on-year (YoY) drop, and exhibiting a 49.74% month-on-month (MoM) plunge, according to the data compiled by the ZXZC Auto Research Institute ("GARI").

For clarity, the PVs hereby refer to the vehicles locally produced and registered on the Chinese Mainland.

China's car retail market in January 2024 largely met the expected positive start, but saw a significant month-on-month and year-on-year decline in February, primarily due to the Chinese New Year holiday causing a shift in consumer spending timing. Some sales pulled forward into January affected the pre-Spring Festival sales in February, and post-holiday price wars heated up quickly, leading to a wait-and-see trend among consumers. The expectation of detailed policy measures to be introduced in March also contributed to the unfavorable sales trend in February.

At the national level, policy guidance aimed at the auto industry has been frequently issued with the goal of further stabilizing and expanding vehicle consumption. The effectiveness of the Ministry of Commerce's "Hundred Cities in Action" auto festival and "Thousands of Counties and Towns" new energy vehicle consumption season has become evident. Local authorities across the country have continued to roll out consumption-boosting policies that, combined with automaker sales promotion measures, provided stable support for the market at the end of last year and start of this year. The trade-in policy has also triggered significant consumer expectations.

During the Chinese New Year holiday period, the continued craze for creating buzz in popular cities throughout the year, along with improvements in tourism and consumer services during the festival, spurred additional car buying demand. More channel stores in the form of supermarkets and an increasing number of stores staying open during the holiday contributed to generally good store traffic. However, recent adverse weather conditions, such as rain, snow, and freezing temperatures, combined with the rapid increase in the scale of electric vehicle ownership, have further highlighted the shortcoming of electric vehicle range and recharging, leading to a generally weaker month-on-month retail trend for affordable electric vehicles in February.

For the first two months of this year, China's cumulative PV registrations summed up to 3,240,934 units, growing 29.84% from the previous year.

Among all brands in China, Volkswagen and BYD were the only two to have over 100,000 homemade PVs registered in Feb. 2024. By Feb. registrations of locally-made PVs, Toyota, Geely, and Changan secured the 3nd to 5th places, all of which recorded a registration volume exceeding 600,000 units.

Aside from Geely and Changan, the two major China's domestic brands—Wuling and Chery—ranked 6th to 10th among all brands by Feb. PV registrations, while the German trio—Audi, BMW, and Mercedes-Benz—held the 9th, 12th, and 14th spots.

Tesla secured the 11th spot with 32,537 China-made vehicles registered on the Chinese Mainland last month, and it was also the only one among the top 20 brands with only all-electric vehicles sold.

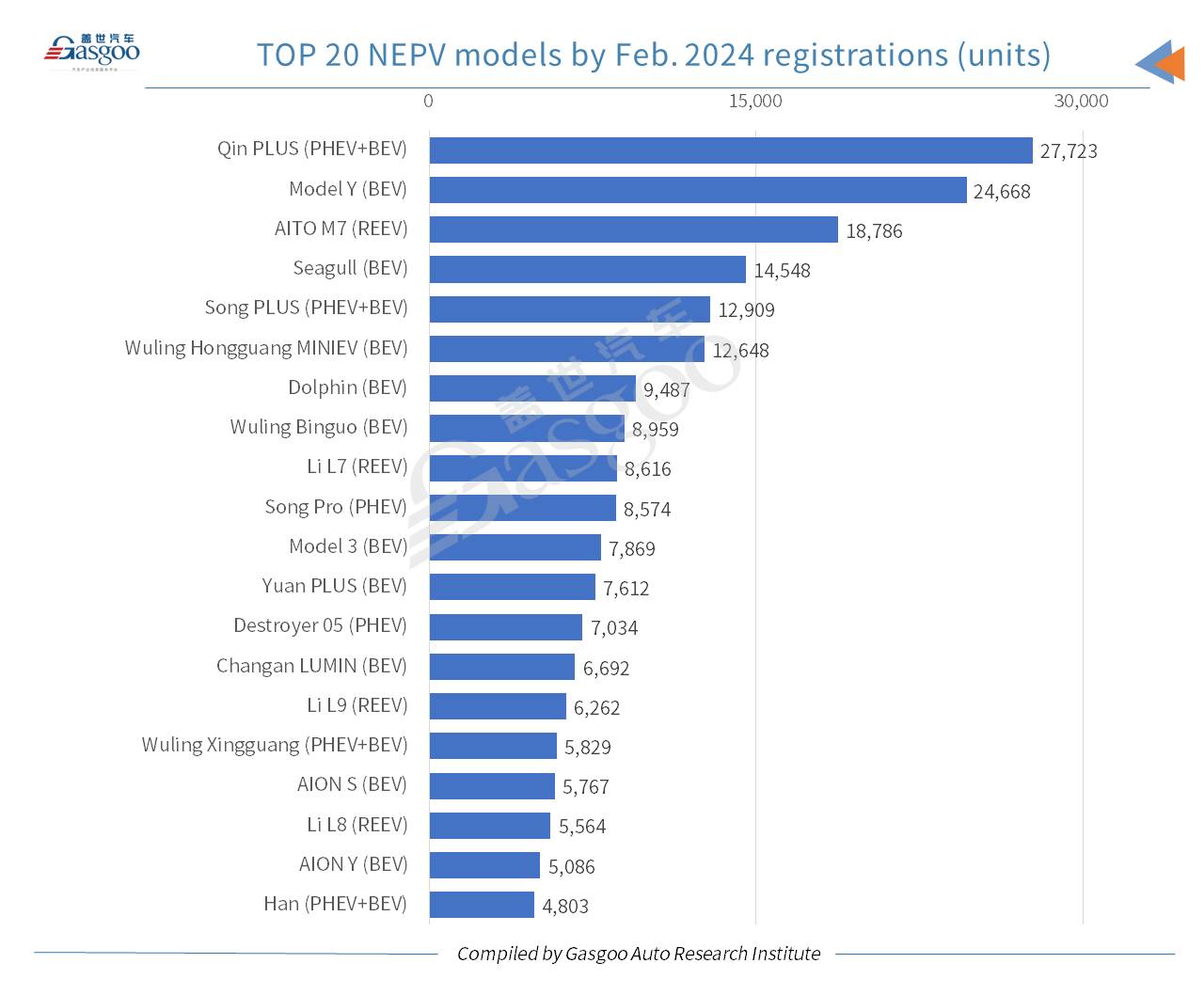

Among the top 20 locally-built PV models by Feb. registrations, the Qin PLUS was credited the highest-ranking one. After its Honor Edition hit the market on Feb. 19 with the starting price further reduced to 79,800 yuan, many automakers followed suit to roll out lower-priced models or announce price discounts, trying to gain more share in this highly competitive market.

Tesla's Model Y ranked 2nd with a total of 24,668 vehicles registered last month. The second runner-up, the Sylphy, is also honored the best-performing model whose majority of sales was contributed by oil-fueled vehicles.

The AITO M7 held the 4th spot among all PV models, while also topping other REEV (range-extended electric vehicle) models.

Apart from the Qin PLUS, the BYD brand still had three models listed in the top 20 models rankings, namely, the Seagull, the Song PLUS, and the Dolphin. Among them, the Seagull and Dolphin had only BEVs (battery electric vehicles) sold on the market.

Notably, Geely's Emgrand, which sat in the 12th place, recorded a registration volume of 10,967 units last month, which included 38 units fueled by methanol.

Among cities on the Chinese Mainland, Chengdu, Chongqing, Beijing, and Zhengzhou secured the top 4 places regarding Feb. homemade PV registrations. As to customers' preference to specific models, the Model Y (BEV) was honored the best-selling model in Chengdu, Beijing, and Zhengzhou last month, while the Changan CS75 PLUS (PHEV+ICEV) posted the highest registration volume in Chongqing.

It is noteworthy that NEVs (new energy vehicles) took up 36.33%, 33.22%, 33.78%, and 37.81% of the Feb. locally made PV registrations of Chengdu, Chongqing, Beijing, and Zhengzhou, respectively.

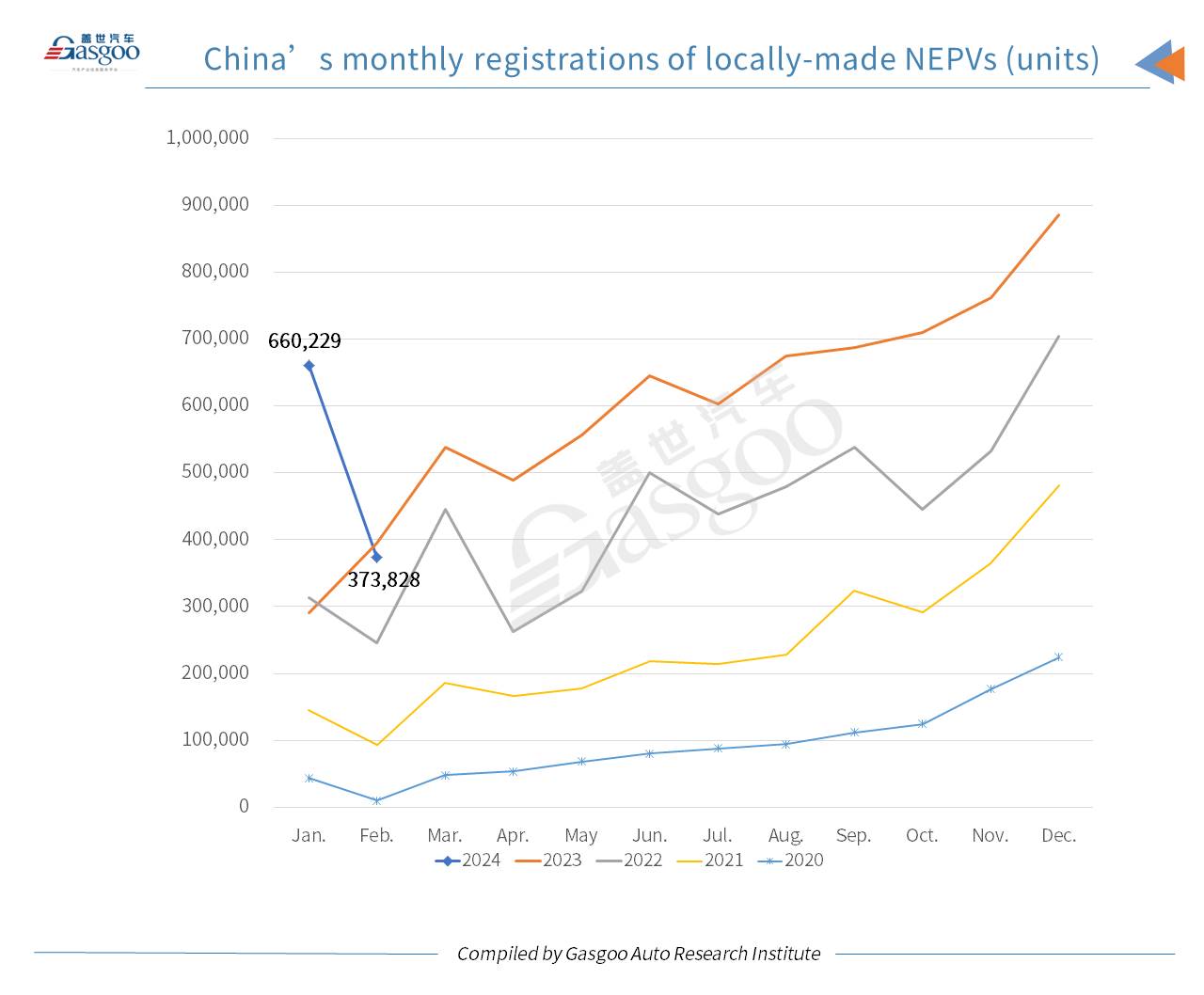

In Feb. 2024, the new energy passenger vehicle (NEPV) sector on the Chinese Mainland saw its monthly registrations reach 373,828 units, which dipped 5.23% from the year-ago period and tumbled 43.38% from a month earlier. It accounted for 34.48% of the country's total PV registrations, up 3.87 percentage points over the previous month.

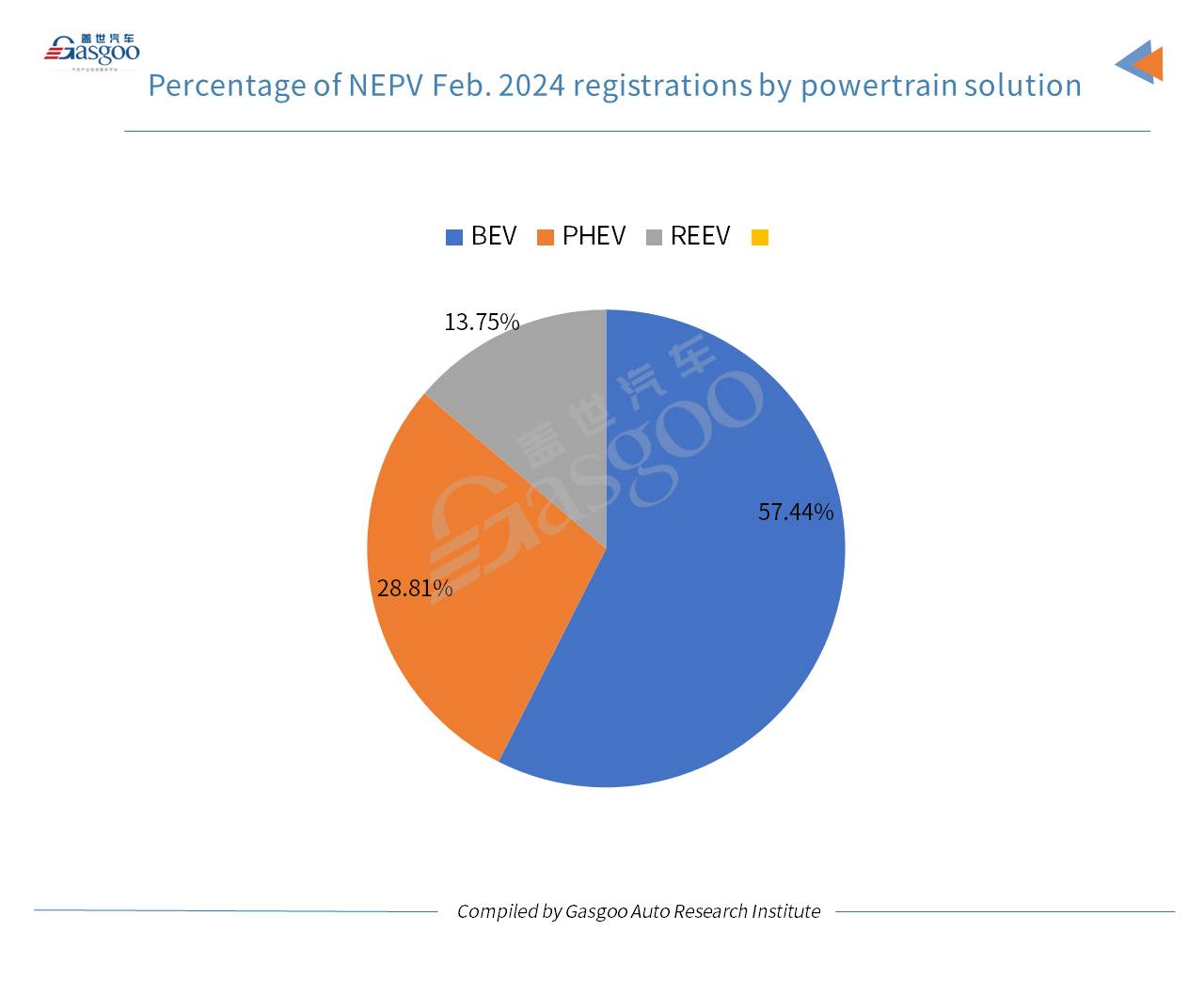

Regarding the breakdown of different powertrain options, battery electric vehicles (BEVs) accounted for 57.44% of China's NEPV registrations in February. In the same period, plug-in hybrid electric vehicle (PHEV) registrations (including 51,406 REEVs) reached a total of 159,098 units, making up 42.56% of the nation's total NEPV registrations.

As for the landscape of vehicle brands by Feb. NEPV registrations, BYD still led the chart with over 100,000 vehicles registered in Feb., outperforming the sum of the No.2 to No. 5 spots' occupants. Tesla recorded a registration volume of over 30,000 units in the same period. Thanks to the robust performance of the AITO M7, AITO surpassed Li Auto to take the 4th seat. The AION brand from GAC Group secured the 6th position, with the bulk of its February registrations driven by the AION S (5,767 units) and the AION Y (5,086 units).

Moreover, Volkswagen claimed the 8th spot by Feb. NEPV registrations. Last month, its ID. series had a total of 7,478 units registered across the Chinese Mainland. Within the lineup, the ID.3 served as the top-seller, achieving a registration tally of 3,576 units.

Galaxy and ZEEKR, both of which are under Geely Auto, ranked 9th and 12th, respectively. With their dynamic expansion of product offerings, they are increasingly capturing the interest of potential new energy vehicle purchasers. At the outset of this year, Galaxy launched its inaugural all-electric vehicle, the Galaxy E8. ZEEKR, specializing in high-end BEVs, began deliveries of its first sedan, the ZEEKR 007, on January 1, followed by the sale of the 2024 ZEEKR X on January 10. The all-new ZEEKR 001 was introduced to the market on February 27.

Regarding Feb. registrations, there were two NEPV models with over 20,000 vehicles registered across the Chinese Mainland, namely, the Qin PLUS and the Model Y. Of them, the Qin PLUS contained both PHEVs and BEVs.

Aside from the Qin PLUS, the BYD brand still had 6 models in the top 20 NEPV models rankings by Feb. registrations.

It's worth mentioning that all of the three models from Li Auto's L series cracked the top 20 NEPV models rankings regarding Feb. registrations.

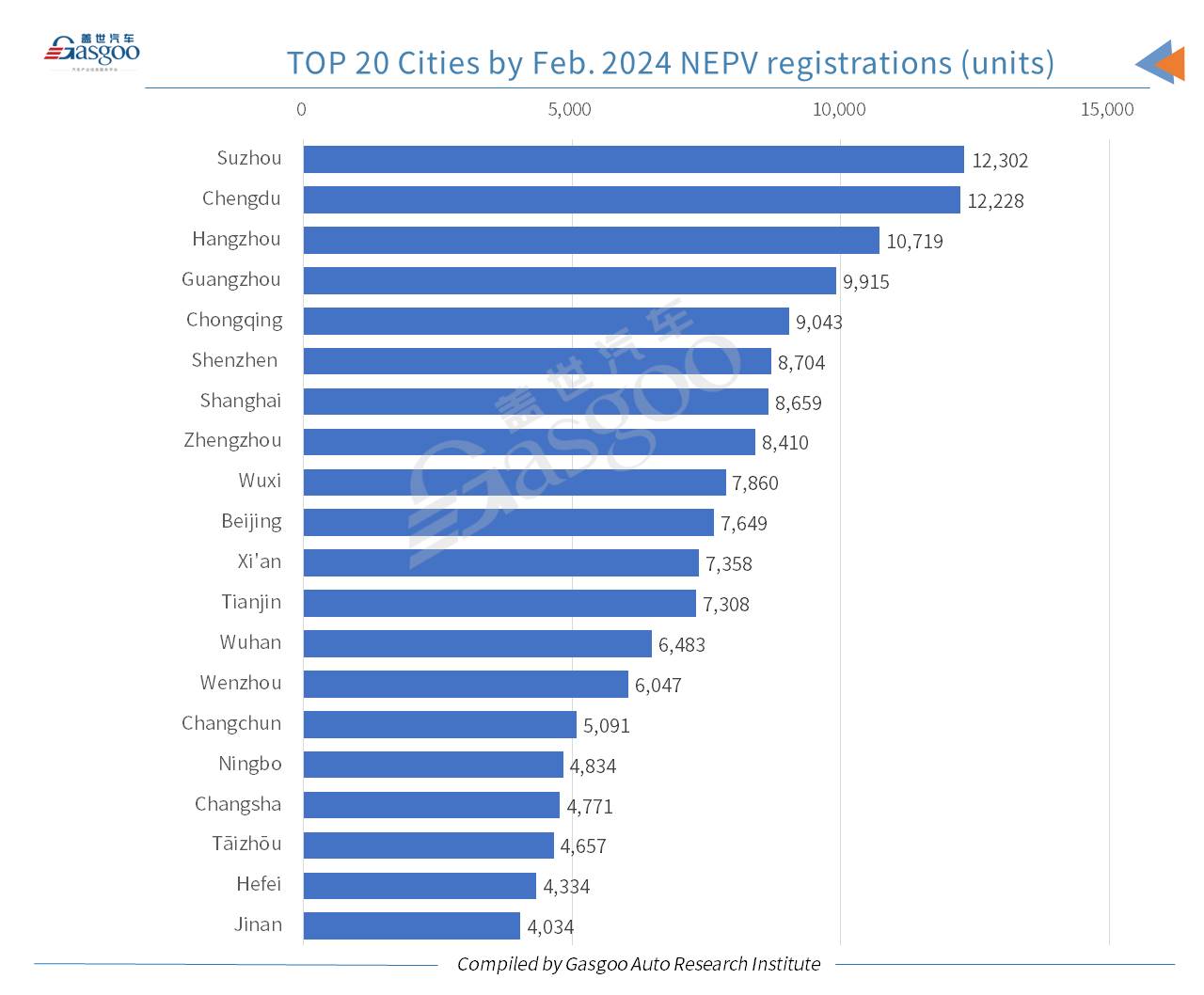

In Feb., Suzhou climbed to the top position with 12,302 homemade NEPVs registered, closely followed by Chengdu (12,228 units) and Hangzhou (10,719 units). Standing in between Hangzhou and Chongqing, Guangzhou took to the 4th spot with an NEPV registration volume of 9,915 units.