China’s passenger vehicle retail sales in Feb. 2024 drop YoY, MoM

Shanghai (ZXZC)- In the second month of 2024, China's domestic passenger vehicle (PV) retail sales reached 1.095 million units, marking a year-on-year (YoY) decrease of 21% and a month-on-month (MoM) plunge of 46.2% mainly due to the Chinese New Year holiday effect, according to data from the China Passenger Car Association ("CPCA").

For the first two months of this year, the country's homemade PV retail sales amounted to 3.133 million units, rising 17% from the prior-year period.

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

In January 2024, China's auto market basically met expectations with a strong start to the year. However, in February, retail sales plunged both YoY and MoM, primarily due to timing differences in pre-holiday consumption caused by the Chinese New Year holiday. Some sales were pulled forward into January, impacting the sales volumes prior to the holiday, said the CPCA.

After the holiday, intense pricing wars resumed quickly, leading to a significant wait-and-see attitude among consumers. This was compounded by expectations surrounding the rollout of policy details in March, collectively creating an unfavorable trend for February sales.

At the national level, policy guidance aimed at the auto industry has been frequently issued with the goal of further stabilizing and expanding vehicle consumption. The effectiveness of the Ministry of Commerce's "Hundred Cities in Action" auto festival and "Thousands of Counties and Towns" new energy vehicle consumption season has become evident. Local authorities across the country have continued to roll out consumption-boosting policies that, combined with automaker sales promotion measures, provided stable support for the market at the end of last year and start of this year. The trade-in policy has also triggered significant consumer expectations.

The association also noted, during the Chinese New Year holiday period, driven by Internet celebrity cities, the tourism and consumer service industries showed noticeable boom, sparking increased demand for car purchases. Besides, the rise of channel stores in the form of supermarkets is becoming more prevalent, and the growing number of stores that still conducted operations during the Chinese New Year contributed to the overall popularity.

However, the recent rainy, snowy, and freezing weather combined with the rapid increase in the electric vehicle ownership scale further highlighted the shortcoming of electric cars in terms of range and energy replenishment efficiency. As a result, the retail sales for affordable electric cars in February showed a relatively weak performance compared to previous months.

In February, PV retail sales of China's wholly-owned brands reached 620,000 units, down 13% YoY and 45% MoM. The market share for China’s domestic brands was 56.1% for the month, up 4.9 percentage points from the previous year.

Last month, mainstream joint-venture brands recorded retail PV sales of 330,000 units, which shrank 31% from a year earlier, and also tumbled 51% from a month earlier. Breaking it down further, German brands held a 20.5% retail market share in the month, experiencing a marginal YoY decrease of 0.2 percentage points. Japanese brands posted a share of 14.4%, down 3.4 percentage points compared to the same period last year. Meanwhile, American brands secured a market share of 6.4%, marking a 0.9-percentage-point YoY decline.

In February 2024, retail sales of premium PVs reached 160,000 units, marking a YoY downturn of 21%, but a MoM drop of 35%. The issue of premium car shortages, which was influenced by chip supply shortages in the year 2022, has been gradually ebbing. Despite this, the traditional luxury car market still faces subdued demand.

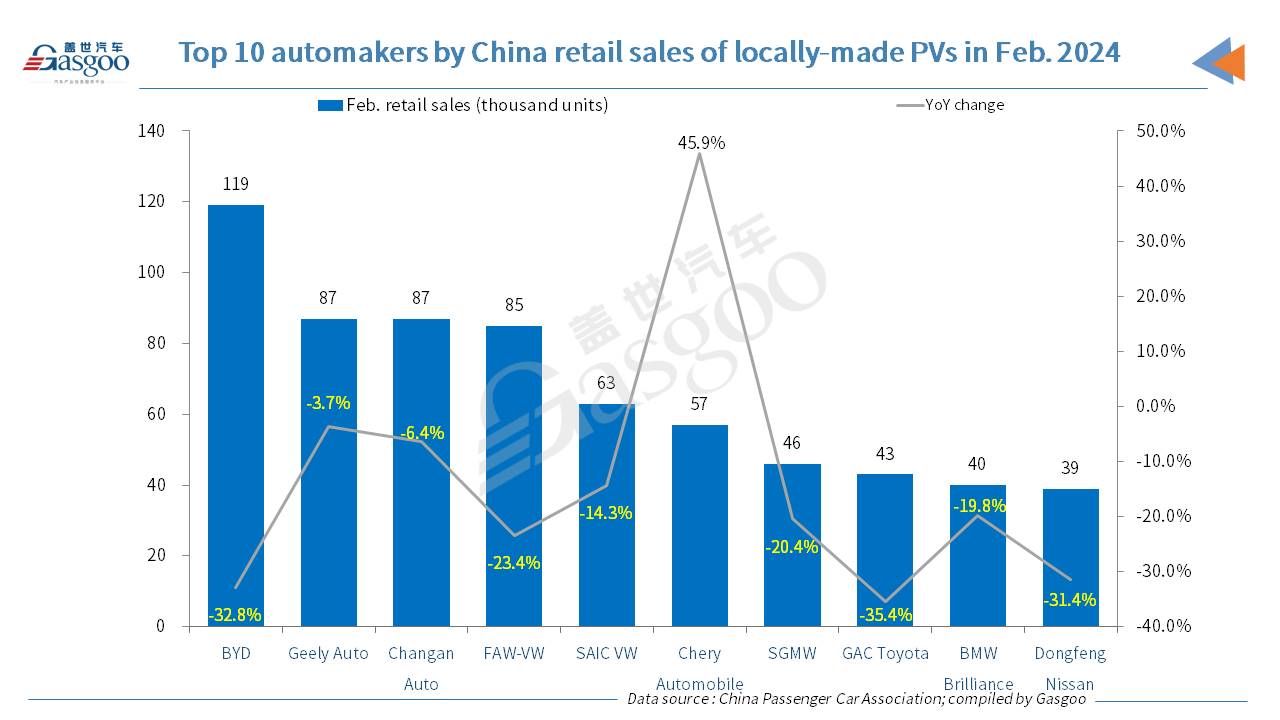

Last month, BYD was the only automaker in China to retail over 100 thousand locally-produced PVs, but it faced a 32.8% decline over a year earlier. Among the top 10 carmakers by Feb. retail sales, Chery Automobile became the unique one that boasted an improved performance over the year-ago period.

In February, auto manufacturers in China sold around 1.295 million PVs by wholesale, showing a YoY drop of 19.9%, and also logging a MoM slide of 38%.

Breaking down the Feb. wholesales by brand origins, China's local car manufacturers wholesaled 780,000 PVs, reflecting a 9% YoY decrease and a 38% MoM reduction. Mainstream joint ventures wholesaled 320,000 units, marking a 37% YoY decline and a 44% MoM slump.

In the same month, premium PV wholesale figures in China stood at 194,000 units, showing a 23% YoY decrease and a 25% MoM dip.

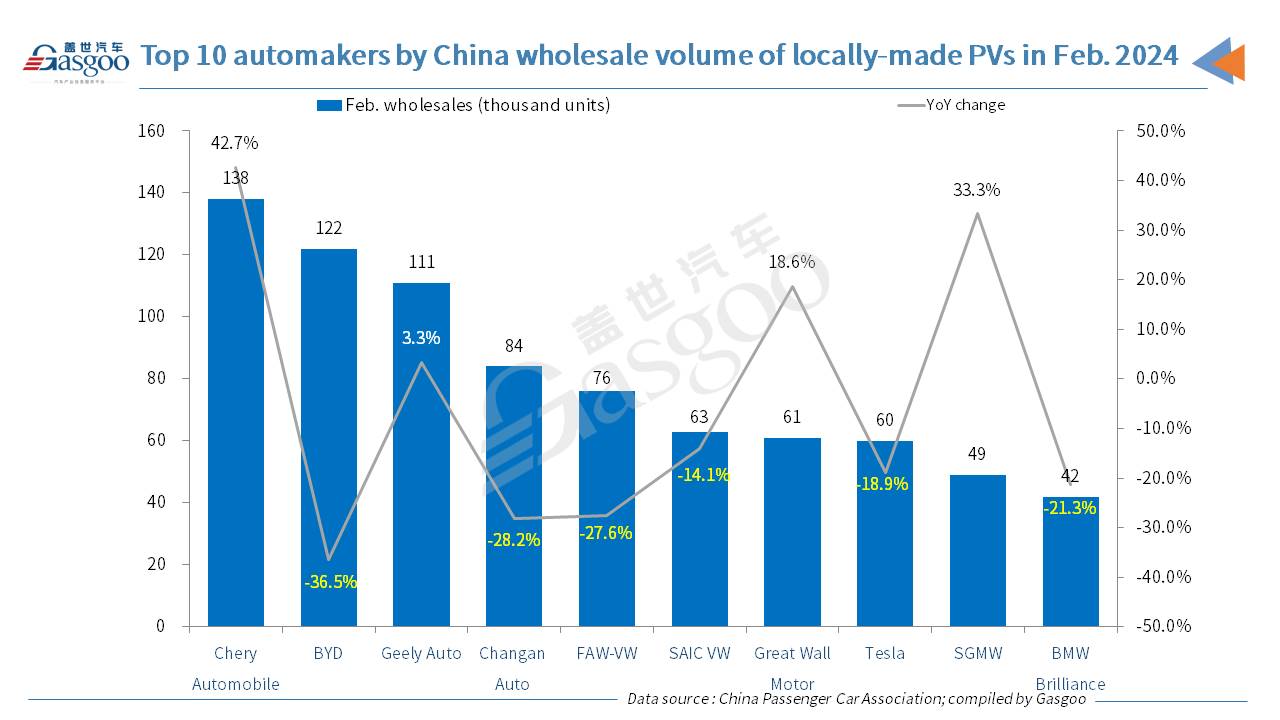

In February, the overall performance of major passenger car manufacturers exhibited variations, with manufacturers under FAW Group, Dongfeng Motor, and Changan Auto demonstrating relatively robust performance. There were a total of 28 companies with monthly wholesales exceeding 10,000 units, down from the 33 in January 2024. Notably, only one company achieved a YoY soar exceeding 100%, while 7 companies achieved a growth rate of over 10%. Conversely, 19 companies experienced a YoY downturn.

In February, the PV production volume in China reached 1.23 million units, demonstrating a YoY decrease of 26.1% and a MoM decline of 39.1%. At the beginning of the year, many automotive companies exerted considerable efforts to stabilize production and reduce inventory levels.

Car exports have sustained the robust growth from the end of last year, with the Jan.-Feb. period of 2024 witnessing the total automobile export volume jump 22% YoY to 831,000 units and the car export value climb 13% YoY to $15.7 billion.

According to the CPCA’s data, in February alone, China exported around 298,000 passenger vehicles (including complete vehicles and CKDs), marking an 18% YoY jump despite the 17% MoM decline. NEVs accounted for 26.4% of the total PV exports in February, reflecting a 4.6-percentage-point decrease compared to the same period last year.