Most Chinese automakers see sales growth in 2021

China’s annual auto sales managed to increase in 2021 after falling for three consecutive years. Data from the China Association of Automobile Manufacturers showed that sales of the world’s biggest automotive market went up by 3.8% in 2021 from the previous year. Besides, new energy vehicle NEV) segment and export business outpaced the overall market with best-ever sales results.

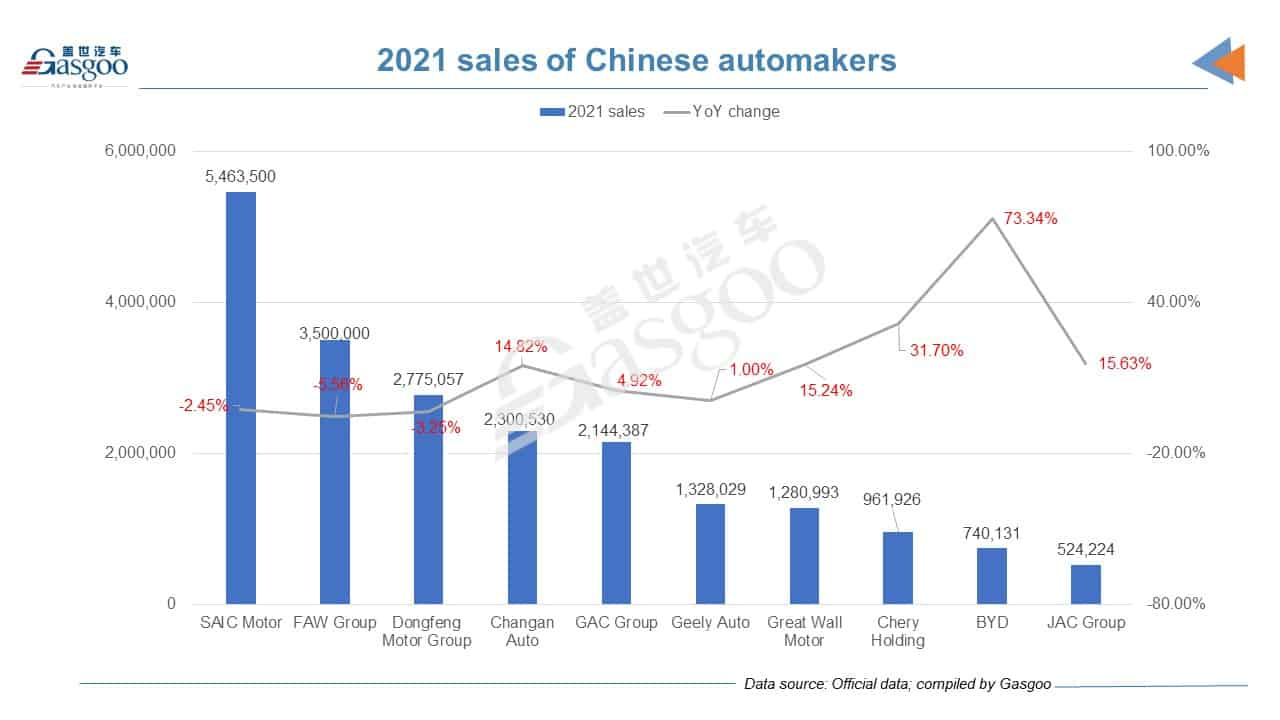

Most traditional Chinese automotive groups also had annual sales growth in the past year. Among the ten major groups, seven saw annual sales rise and five had double-digit growth. BYD’s sales increased the most with a growth rate of up to 73.3%. But by annual total sales volume, SAIC Motor remained the biggest local automaker in China, while FAW Group and Dongfeng Motor Group were a distant second and third.

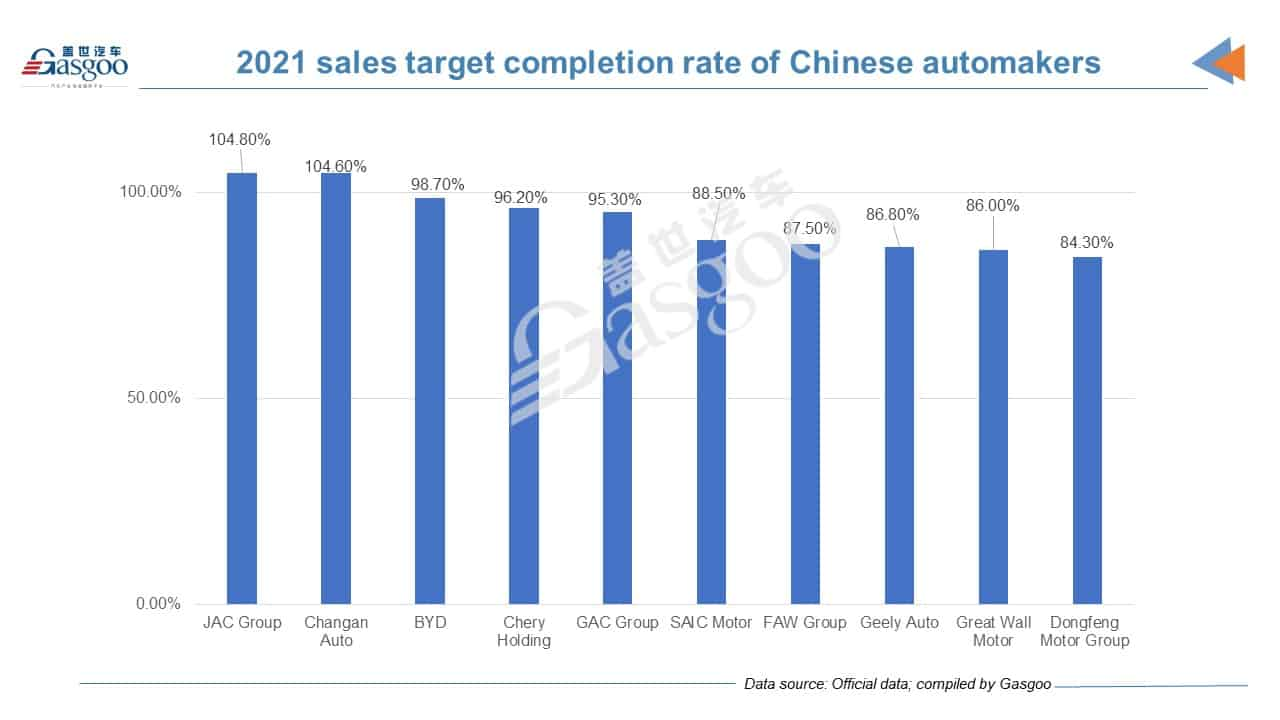

But only JAC Group and Changan Auto accomplished its annual sales target. In 2021, JAC Group tried to improve its product portfolio and better user experience which helped to stimulate market demand.

BYD was close to finishing the target of 750,000, which went viral on the internet but was not confirmed by the Shenzhen-based automaker. It was also reported that BYD’s annual sales could have been 900,000 units, but the company can only deliver 750,000 vehicles at most because of production constraint.

Apart from the above three companies, Chery Holding and GAC Group had a respective completion rate of over 90% while the other five companies’ completion rate all surpassed 80%. COVID-19, worldwide automotive chip supply shortage and rising material prices were all influencing factors.

Explosive NEV sales

Driven by carbon neutrality and dual credit policy, China’s NEV segment had explosive growth in 2021, with sales soaring 157.5% versus the previous year to over 3.52 million units.

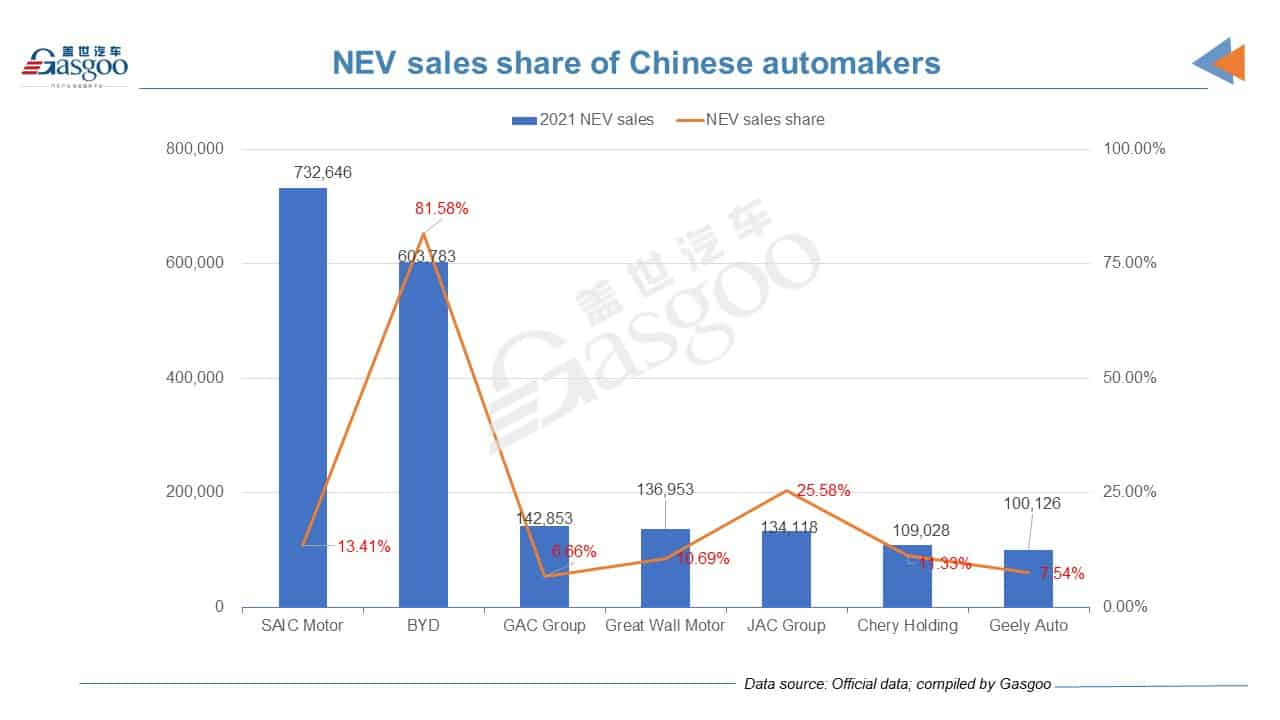

In terms of annual NEV sales, SAIC Motor ranked first thanks to its business scale, followed by BYD, but the Shanghai-based automaker’s NEV sales share out of its total sales stood at 13.4%. Apart from SAIC and BYD, the other five automakers’ annual NEV sales were less than 150,000 units respectively.

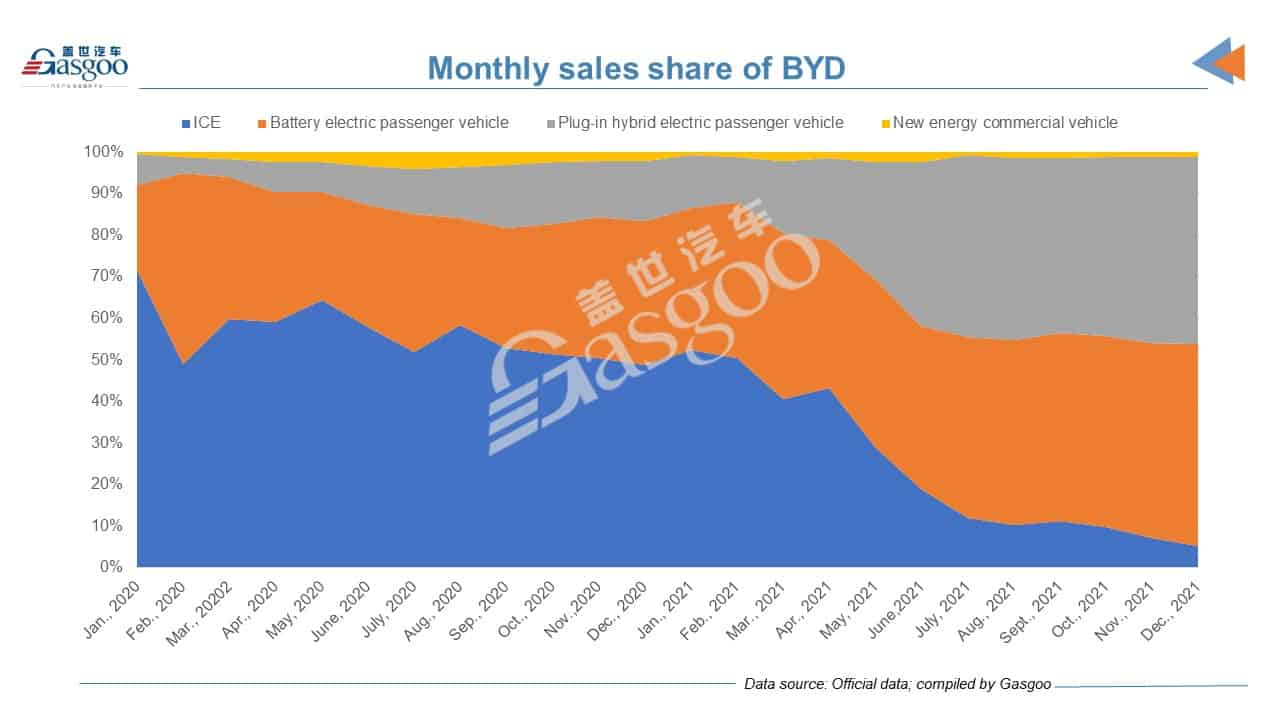

BYD had the largest NEV sales share among those automakers. For the whole year, BYD sold 603,783 NEVs, including new energy commercial vehicles and accounting for 81.58% of its annual sales. From June of last year, its monthly NEV share had surpassed 80% for seven months in a row and set a record in December at 94.8%.

In the past year, BYD kept on expanding its product portfolio and improving its service system. At the end of August, the automaker commenced the delivery of the Dolphin, whose December sales climbed to 10,016. The Han EV and the Dolphin have become two main growth points for BYD’s battery electric business. BYD’s plug-in hybrid electric vehicle sales in 2021 surged 467.6% from a year ago.

JAC Group sold 134,118 battery electric passenger vehicles last year, representing a surge of 169% year over year and accounting for 25.58% out of its 2021 sales.

New export record

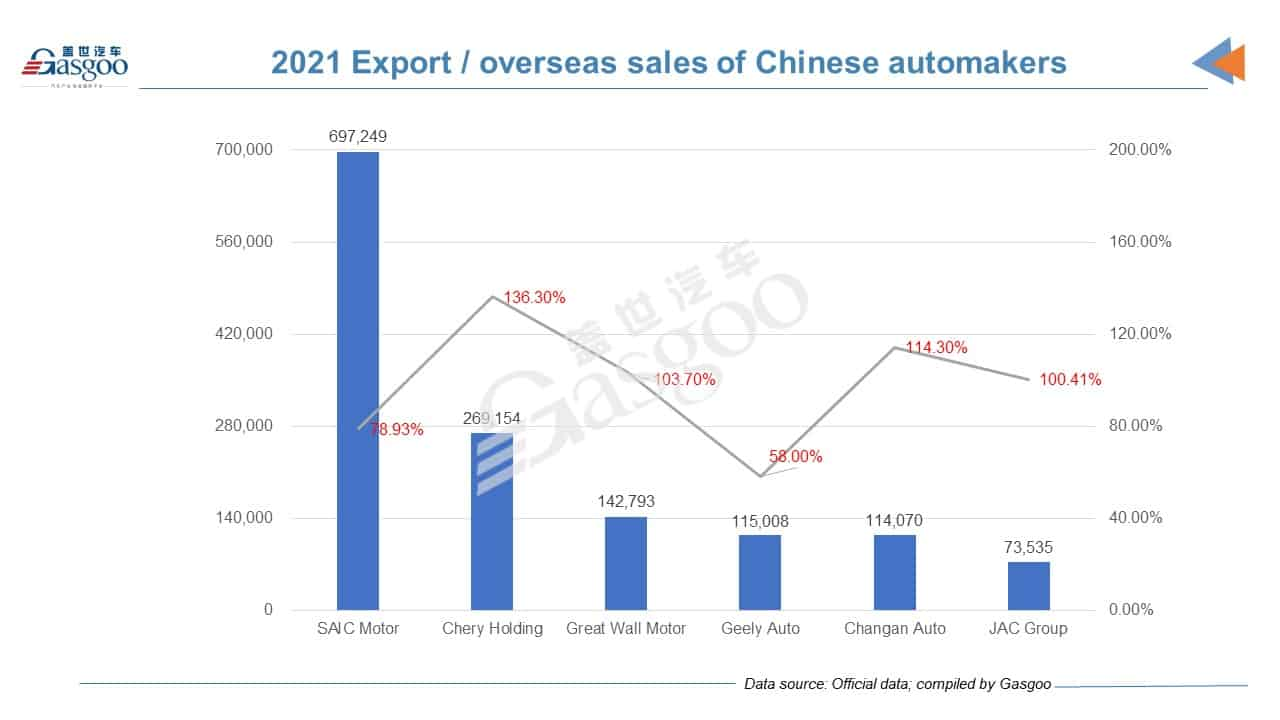

In 2021, China’s vehicle export made a breakthrough for the annual export volume more than doubled to 2 million units compared with the previous year. That was the first time for the market to export over 2 million vehicles. The export of NEVs quadrupled to 310,000 vehicles last year.

Chery Holding, Changan Auto and Great Wall Motor all had greater increase than the overall market. Chery’s annual export grew at a blistering pace, making the group champion of passenger vehicle export for nineteen consecutive years among local brands. In the past twelve months, Chery’s monthly export volume surpassed 20,000 vehicles for eight times.

Great Wall Motor achieved outstanding performance in overseas markets as it is picking up its global expansion. After building a plant in Russia, the Baoding-based automaker also started its plant in Rayong, Thailand, which is making the Haval H6 HEV and the Haval Jolion HEV.

In South America, Great Wall Motor entered into agreement with Mercedes Benz in August, 2021 to buy a factory in Brazil. In January this year, the automaker held the handover ceremony of the Brazil factory and unveiled its local strategy. Expected to start operation in the second half of 2023, the plant will boast an annual capacity of 100,000 vehicles. In the next 10 years, the Chinese SUV manufacturer plans to invest more than BRL10 billion about RMB11.5 billion) there.

For 2022, many automotive groups aim to sell more cars. For example, BYD’s annual sales target was set at 1.2 million units, representing a jump of 62% compared with last year. Chery Holding also expects its 2022 sales to jump at least 56% to 1.5 million units and strives for 2 million while its export goal is 500,000. Geely Auto wants to sell 24% more vehicles than last year and FAW Group forecasts a sales growth of 17% year over year.

But according to the latest forecast of the China Association of Automobile Manufacturers, China’s annual auto sales for this year may amount to 27.5 million units. That represents a year-on-year increase of 5.4%, much fewer than the above automakers’ respective growth. That means the market competition will be getting fiercer and fiercer.