China’s passenger vehicle market scores YoY rise in both annual retail, wholesale volumes in 2023

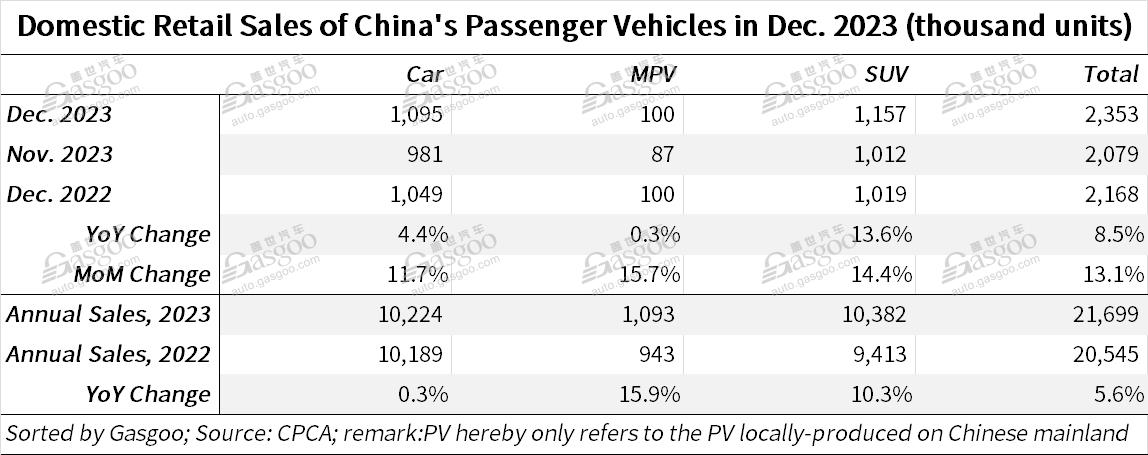

Shanghai (ZXZC)- In December 2023, China's domestic passenger vehicle (PV) retail sales reached 2.353 million units, marking a year-on-year growth of 8.5% and a month-on-month increase of 13.1%, according to data from the China Passenger Car Association ("CPCA").

For the whole-year performance, the country's PV retail sales totaled 21.699 million units, climbing 5.6% from the previous year.

For clarity, the passenger vehicles hereby refer to cars, MPV, and SUVs locally produced on the Chinese Mainland.

In December 2023, the retail sector of the PV market experienced a substantial uptick, fueled by a joint effort from car manufacturers sprinting towards year-end targets and regional initiatives to boost car consumption. The sales promotion efforts in December were characterized by enhanced incentives, impacting almost all manufacturers and car models, reflecting an unusual push towards the year-end sales boost, said the CPCA.

The association added the promotional intensity in December may persist, with a focus on key hotter-selling models in specific market segments, demonstrating a continued commitment to achieving sales targets through price incentives. Additionally, regional car purchase subsidies, many of which are set to conclude monthly or annually in January 2024, are expected to contribute to sustaining high sales volumes at the end of the year.

At the national level, there has been a frequent issuance of policy guidelines targeting the automobile industry, aimed at further stabilizing and expanding car consumption. China's Ministry of Commerce has actively promoted the "Hundred Cities Collaboration" automobile festival and the "Thousand Counties, Ten Thousand Towns" new energy vehicle consumption season, with evident position results generated. Many regions are continuously exerting efforts in implementing consumption-stimulating policies, and the collaborative efforts between government policies and corporate sales promotions provide stable support for the end-of-year automotive market.

In December last year, the retail PV sales of China's domestic brands reached 1.24 million units, marking a year-on-year increase of 17% and a month-on-month growth of 8%. The share of domestic brands in China's PV market for the month stood at 52.9%, showing a year-on-year growth of 4 percentage points. Cumulatively for the year 2023, the market share of China's indigenous brands reached 52%, representing a 4.6-percentage-point increase compared to the previous year.

In December, PV retail sales for mainstream joint-venture brands totaled around 790,000 units, reflecting a year-on-year decrease of 7%, but a month-on-month increase of 20%. The share for German brands stood at 20.5% last month in China's PV market, remaining flat compared to the same period in 2022. Meanwhile, Japanese brands' market share was 16.5%, experiencing a year-on-year decline of 2.3 percentage points, while share for American brands reached 7.3%, showing a year-on-year drop of 1.1 percentage points.

In the last month of 2023, retail sales of premium cars reached 320,000 units, marking a year-on-year jump of 23% and a month-on-month increase of 18%. The issue of premium car shortages, which was influenced by chip supply shortages in the previous year, has been gradually ebbing. However, the demand for traditional premium cars remains somewhat subdued.

In December, there were six automakers in China whose monthly PV retail sales exceeded 100,000 units. Of them, BYD still secured the highest position by retailing around 300,000 vehicles. Among the top 10 automakers by domestic PV retail volume in the month, Dongfeng Nissan was credited the fastest-growing one compared to its year-ago performance.

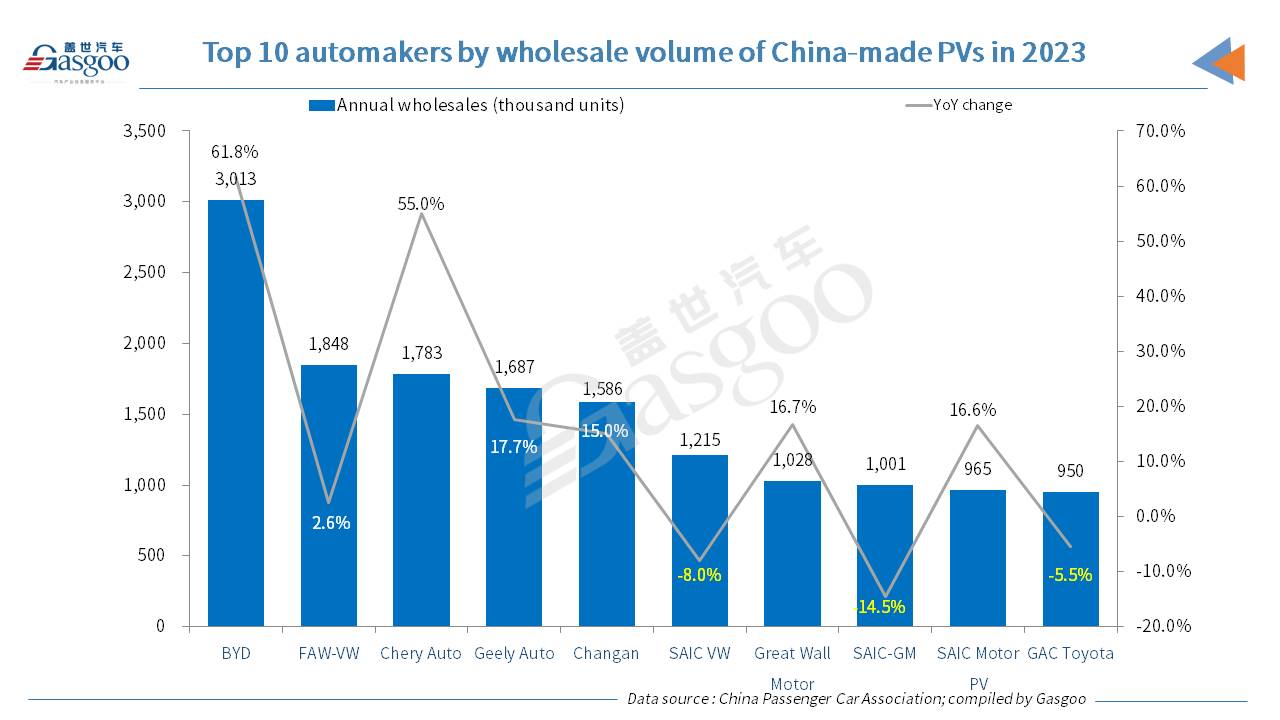

Regarding annual performance, BYD topped other carmakers in China by retailing 2.706 million PVs across 2023, boasting a 50% spike from a year earlier. Among the top 10 automakers by yearly PV retail sales, SAIC-GM faced the sharpest year-on-year decrease. Besides, the two joint ventures—SAIC Volkswagen and GAC Toyota—also posted a year-over-year downturn in their 2023 retail sales.

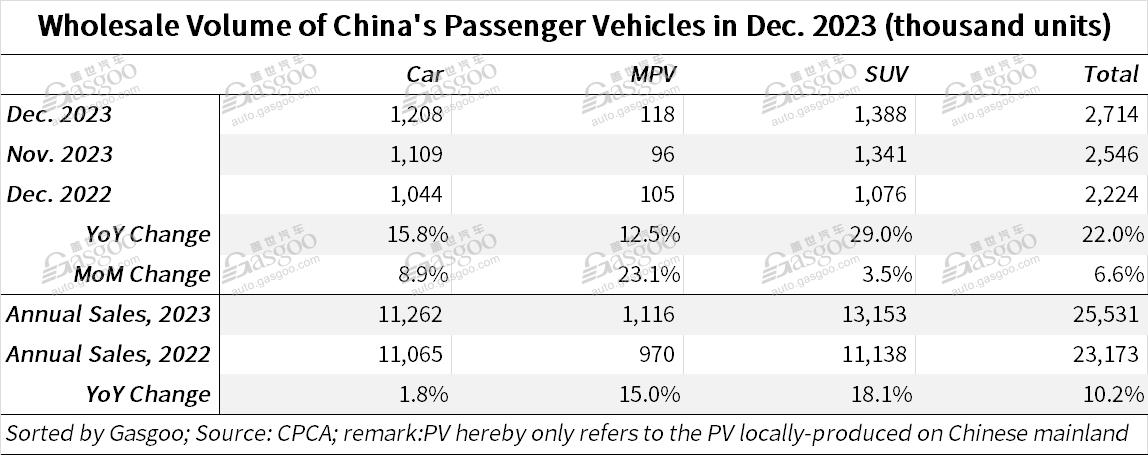

In December, auto manufacturers in China sold around 2.714 million PVs by wholesale, showing a remarkable year-on-year growth of 22% and a month-on-month increase of 6.6%, largely fueled by the promotion from the new energy vehicle and export sectors. The country's annual PV wholesales set a historic record at 25.531 million units in 2023, representing a 10.2% year-on-year increase.

To be specific, China's domestic carmakers wholesaled 1.58 million PVs in December, registering a robust 24% year-on-year growth and a 4% month-on-month increase. Mainstream joint ventures wholesaled 796,000 units in the month, with a 17% year-on-year increase and an 8% month-on-month growth. Meanwhile, premium car wholesale volume reached 340,000 units, boasting a 27% year-on-year growth and a 17% month-on-month increase.

In December, the overall performance of major PV manufacturers was robust. There were a total of 37 manufacturers with sales exceeding one million units (an increase of 2 compared to the previous month), according to the CPCA's data. Among them, 13 experienced a year-on-year growth rate exceeding 50%, 24 saw a year-on-year growth rate surpassing 10%, while 8 recorded negative growth.

Among the top 10 automakers by whole-year PV wholesales in 2023, BYD ranked highest with a volume exceeding 3 million units, outselling the runner-up, FAW Volkswagen, by 1.165 million units. Besides, on the top 10 list, the three carmakers that faced a year-on-year downturn in annual wholesales were all joint ventures.

In December, the production PV volume reached 2.675 million units in China, showing a robust year-on-year growth of 26.6% and a modest month-on-month increase of 1.2%. Due to the substantial growth targets set across various regions, many car companies put considerable efforts into production.

Specifically, premium brands' production saw a year-on-year increase of 14% in December, but a 5% decrease compared to the previous month. Production for joint-venture brands experienced a significant 30% year-on-year growth and a 2% month-on-month increase. Chinese indigenous brands recorded a year-on-year growth of 28% and a 2% month-on-month increase in the monthly production volume.

In 2023, the overall trend of China's automobile exports continued the strong growth observed at the end of the previous year. According to the CPCA's statistics, in December, China's PV export volume (including complete vehicles and CKDs) amounted to 385,000 units, a 49% year-on-year spike and a 3% month-on-month increase. New energy vehicles accounted for 26.6% of the overall December PV exports.

Besides, the nationwide full-year PV exports reached 3.83 million units last year, marking a 62% year-on-year surge.