China’s passenger vehicle market boasts 2-digit YoY rise in Nov. 2023 retail sales

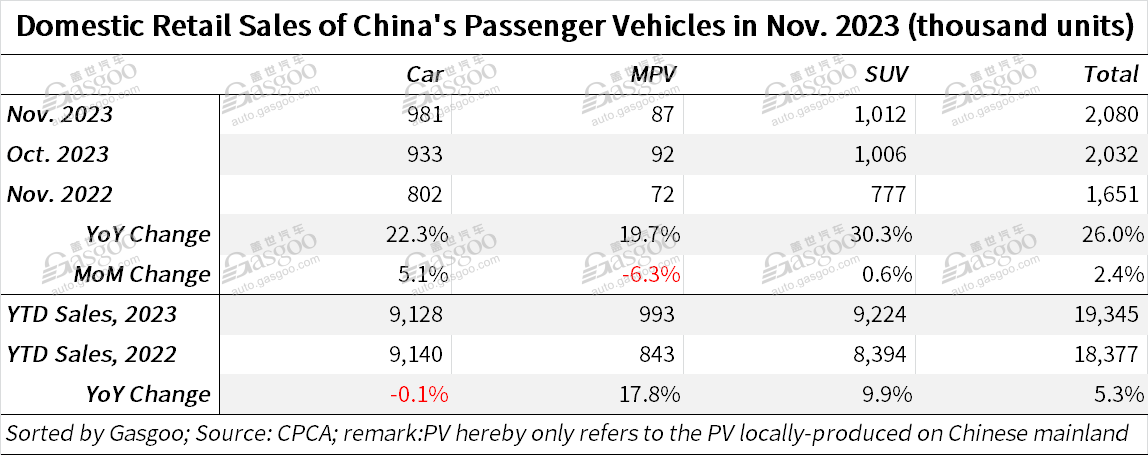

Shanghai (ZXZC)- In November 2023, China's domestic passenger vehicle (PV) retail sales reached 2.08 million units, marking a year-on-year jump of 26% and a month-on-month increase of 2.4%, according to data from the China Passenger Car Association ("CPCA").

Cumulatively for the year, the country's PV retail sales totaled 19.345 million units, reflecting a 5.3% year-on-year growth.

For clarity, the passenger vehicles hereby refer to cars, MPV, and SUVs locally produced on the Chinese Mainland.

The slight month-on-month uptick in November's PV retail sales indicates a modest strengthening trend, typical for the winter season in recent years. This was propelled by the growth momentum of new energy vehicles (NEVs) and the clearance of small batches of fuel-burning vehicles that align with the China VI-a emission standards, said the CPCA. In contrast to the previous years' usual end-of-year stabilizing trend in sales promotion efforts, this year's November witnessed an intensified sales promotion in the PV market, available for both oil-fueled vehicles and NEVs. Targeted promotional endeavors, including trade-ins and local subsidies, have contributed to the release of consumer demand for car purchases.

At the national level, guiding policies for the automotive industry have been frequently released, aiming to further stabilize and expand automobile consumption, the association added. Initiatives such as the "Hundred-city Coordination" auto festival and the "Thousand Counties Ten Thousand Towns" new energy vehicle consumption season, driven by China's Ministry of Commerce, have been yielding positive results. Various regions have successively introduced new consumption-promotion policies, working in synergy with corporate sales promotions, so as to provide stable support for the year-end automotive market. The continued price reduction trend has increased consumer hesitancy, leading to diminishing marginal benefits in terminal sales promotions, resulting in a relatively subdued market during the "11. 11" shopping festival.

In November this year, China's wholly-owned brands recorded combined retail sales of around 1.15 million units, reflecting a 31% year-on-year jump and a 1.8% month-on-month rise. They accounted for 55.3% of the country's total PV retail volume last month, climbing 1.9 percentage points over the previous year.

In the same month, mainstream joint ventures retailed roughly 660,000 PVs, indicating a 23% growth from a year earlier, but a 3% decline from a month earlier. To be specific, German brands took up 18.7% of China's Nov. PV retails (down 0.4 percentage points YoY), Japanese brands held 15.5% share (up 0.2 percentage points YoY), while American brands logged 7.9% share (down 1.5 percentage points YoY).

Last month, there were around 270,000 PVs under luxury car brands retailed across the Chinese Mainland, displaying a 15% year-on-year increase and a 22% month-on-month growth. The issue of luxury car shortage, which mainly resulted from chip supply constraints last year, has gradually been ebbing away. However, the demands from traditional luxury car market have still remained relatively weak.

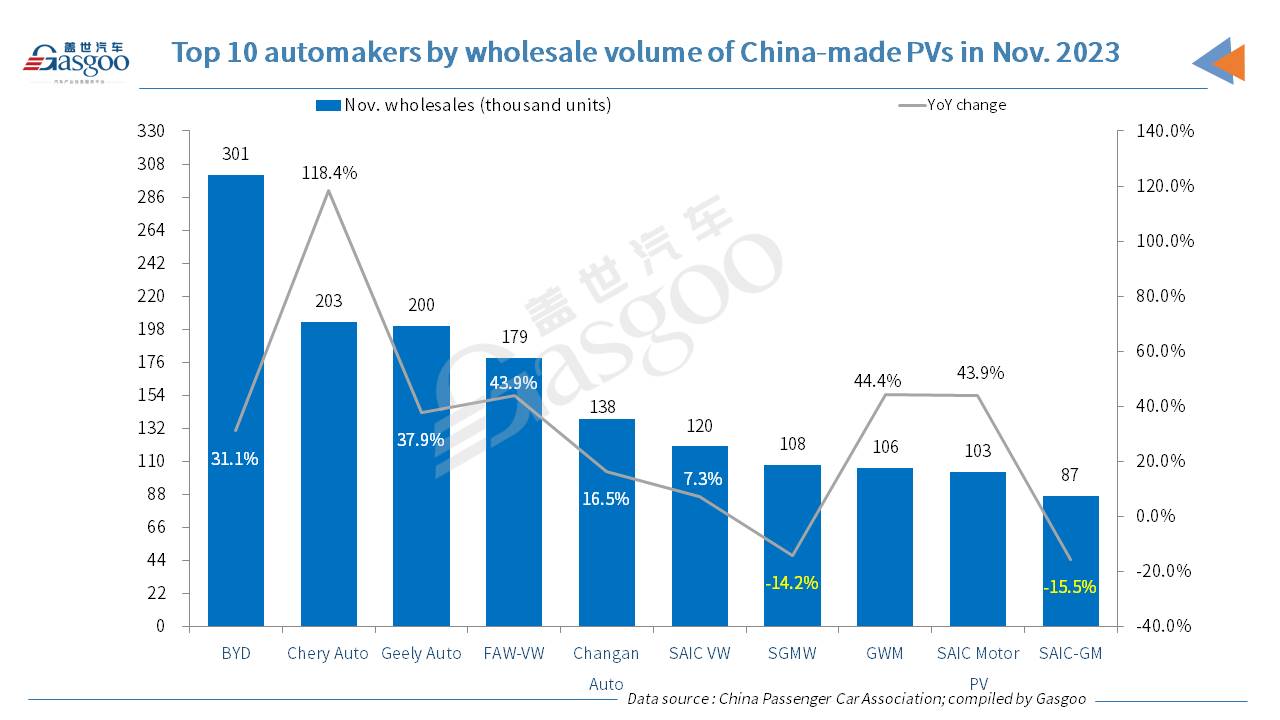

In November, there were five automakers in China whose monthly PV retail sales exceeded 100,000 units. Of them, BYD still secured the highest position by retailing around 263,000 vehicles. Among the top 10 automakers by domestic PV retail volume in the month, Chery Auto was credited the fastest-growing one compared to its year-ago performance.

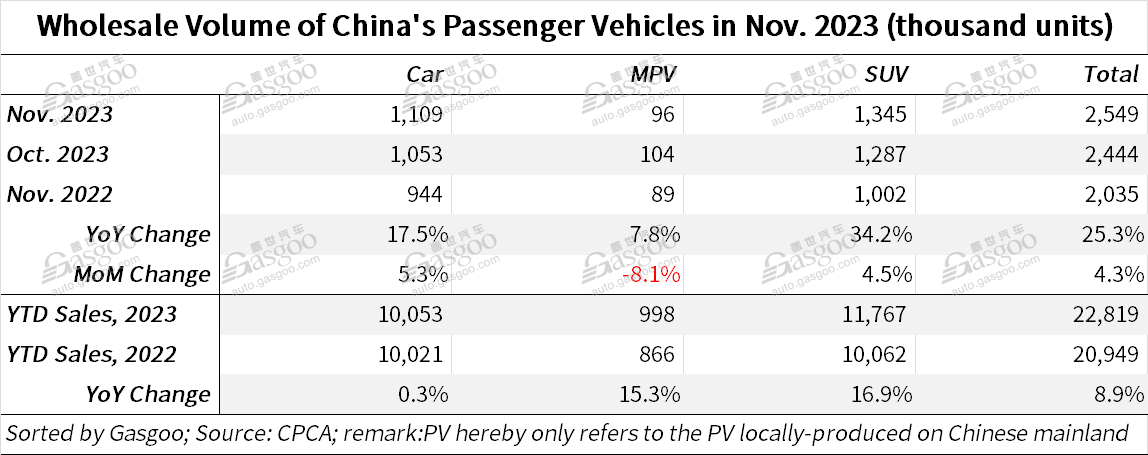

On the front of wholesale, automakers in China sold 2.549 million PVs in total last month, showing a 25.3% and 4.3% growth compared to the previous year and previous month, respectively. For the first 11 months of 2023, China's cumulative PV wholesales rose 8.9% over a year earlier to 22.819 million units.

To be specific, China's indigenous brands sold 1.52 million PVs by wholesale in November, a 36% jump year-over-year and a 3% rise month-over-month. Mainstream joint ventures recorded a monthly PV wholesale volume of 736,000 units (+18% YoY, +3% MoM), while the wholesales of luxury cars reached 290,000 units (-1% YoY, +12% MoM).

Major PV manufacturers exhibited strong overall performance in November. There were 35 manufacturers with monthly sales exceeding 10,000 units, including 9 with a year-on-year growth rate exceeding 50%, and 23 with a growth rate exceeding 10%.

In November, PV production volume in China reached 2.645 million units, a year-on-year increase of 25% and a month-on-month growth of 8.0%. Due to the heavy task of ensuring sales growth, many car manufacturers made significant production efforts, with China’s indigenous brands, joint ventures, and luxury brands all attaining year-on-year and month-on-month growth in Nov. output.

The overall trend of strong growth in China's automobile exports observed at the end of last year continued into this year. The CPCA’s data show that in November, China's PV export volume (including complete vehicles and CKD) reached about 378,000 units, a year-on-year surge of 50%, and a 3% decrease from the previous month. From January to November of this year, the overall PV export amounted to 3.45 million units, surging 64% from the prior-year period.

Notably, of the PVs exported last month, 23.5% were contributed by NEVs.