Toyota, Honda, Nissan’s China sales all plummet YoY in July

In July 2023, Japanese auto brands suffered a 34.6% year-on-year plummet in sedan sales in China, which stood at roughly 135,000 vehicles compared to the 489,000 vehicles sold by Chinese indigenous brands, according to data compiled by the China Passenger Car Association.

Meanwhile, sales of Japanese-branded SUVs amounted to 130,000 units in July, dropping 17.4% from the previous year in the world’s largest auto market, which was also one-third of the amount sold by Chinese indigenous brands.

In the past month, the three major Japanese automakers, namely Toyota Motor, Honda Motor, and Nissan Motor, all encountered a double-digit fall in monthly China sales year-over-year, with Nissan Motor witnessing the most severe change.

Aside from the expiration of certain automotive tax incentives at the end of 2022, which some companies still claimed as a continuous impact that affects their sales in the country, Japanese automakers’ lagging behind in the deployment of new energy vehicles (NEVs) in China was also one of the major reasons for the bleak sales.

As NEVs gaining more and more popularity in the Chinese market, in contrast, Chinese NEV giant BYD boasted a 61.3% year-on-year surge in July sales, which came in at 262,161 vehicles.

In terms of the performance of each company, during the past month, Toyota saw its monthly sales fall 15.4% year over year and 12.49% month on month to 152,700 vehicles in China, according to data provided by Japanese media Kyodo.

Among the automaker’s two joint ventures in China, GAC Toyota and FAW-Toyota posted a respective 13% and 17.2% decline in July sales compared to a year ago. According to Kyodo, monthly sales of Toyota’s luxury brand, Lexus, dropped 13.7% year over year in China.

In the first seven months of this year, Toyota’s year-to-date China sales summed up to 1,032,000 vehicles, slipping 4.86% from the previous year.

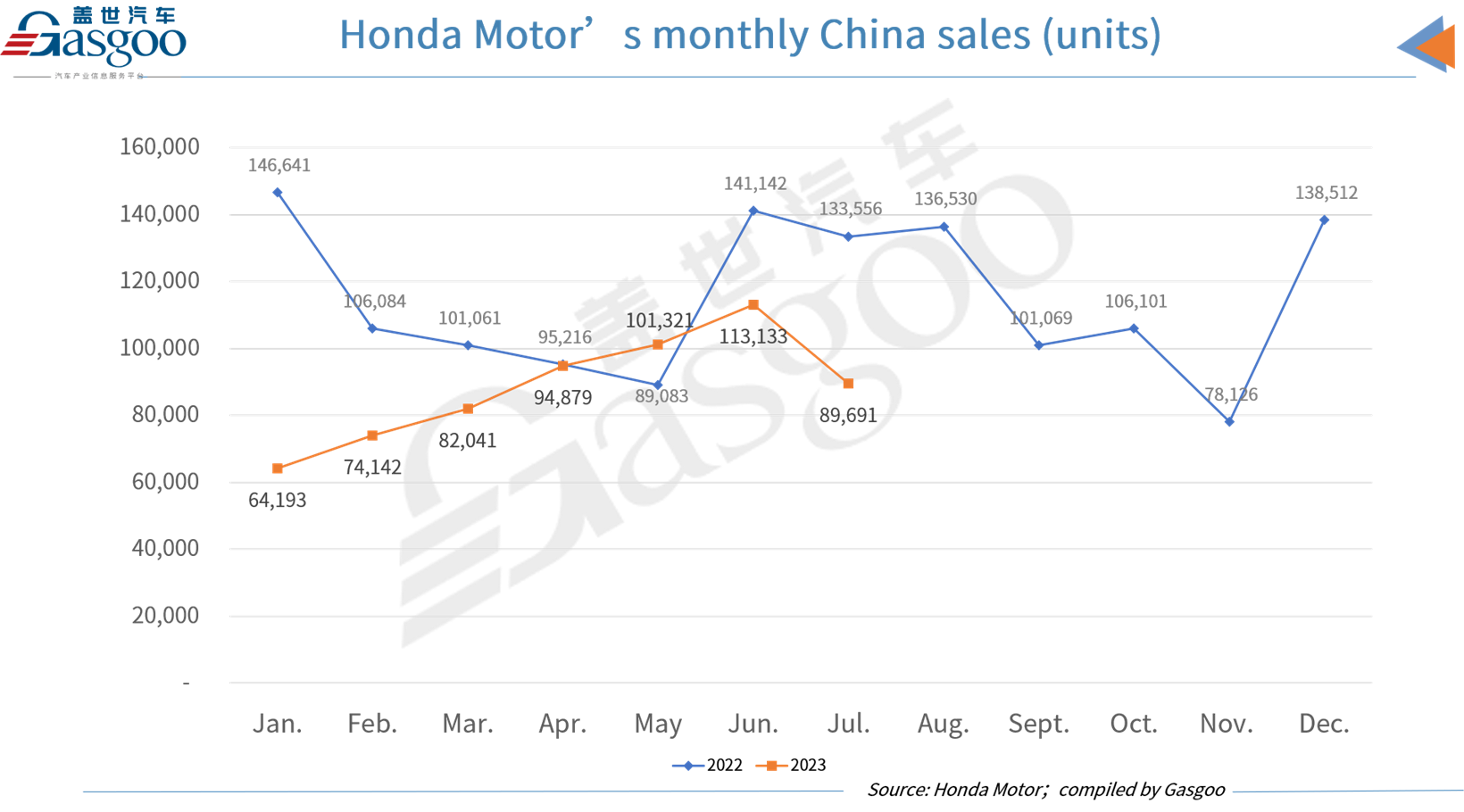

In the past month, Honda Motor sold 89,691 vehicles in China, representing a 32.8% plunge compared to the 133,556 vehicles sold in the same month last year.

In the Jan.-Jul. period, Honda’s cumulative China sales amounted to 619,382 vehicles, with 132,896 units being electrified vehicles, said the automaker. Note that Honda categorized all pure-electric, plug-in hybrid electric, and vehicles equipped with Honda’s high-performance dual-electric motor hybrid system as electrified vehicles.

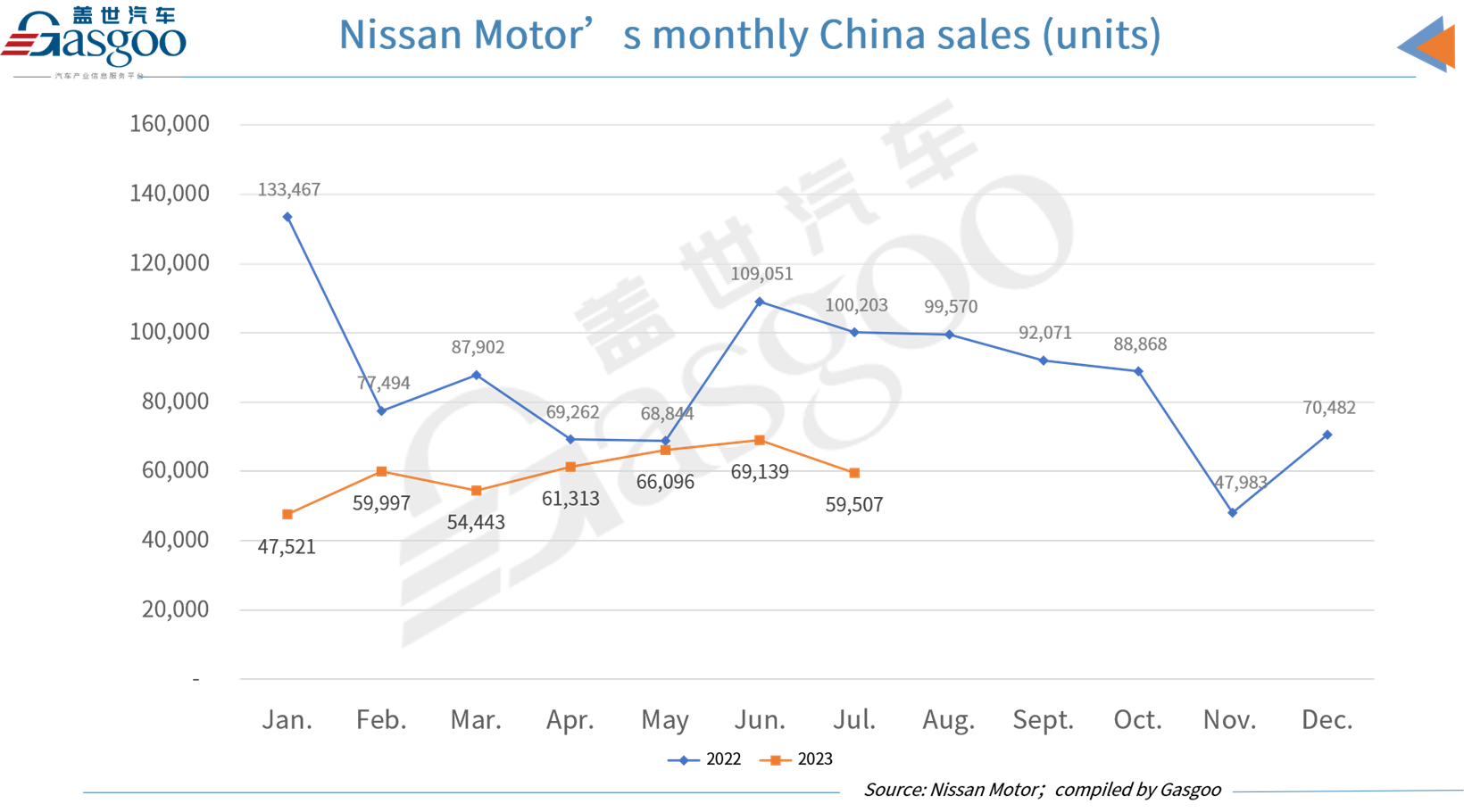

Finally, as to Nissan Motor, with 59,507 vehicles sold in China last month, the company faced a 33.6% year-on-year dip. For the first seven months of the year, Nissan Motor’s cumulative sales volume amounted to 418,016 vehicles in the world’s largest auto market, declining 23.5% from a year ago.

In July, Dongfeng Nissan (including Nissan, Venucia, and INFINITI brands) saw its monthly sales reach 56,495 vehicles, indicating a 12.81% downturn from that of a month ago.

ALTIMA; photo credit: Dongfeng Nissan

In an interview in July, Nissan Motor disclosed that it has lowered its sales expectations in China and is now considering the possibility of exporting China-made cars. The CEO of Nissan Motor, Makoto Uchida, mentioned that the company hasn't yet finalized any export plans or target markets for Chinese-produced vehicles. However, Uchida emphasized the need for Nissan to explore new measures to support its operations in China, where last quarter's sales declined by 46% from a year ago. He stated, "In the future, we will change our operational approach in China."