Li Auto Inc. Announces Unaudited Fourth Quarter and Full Year 2021 Financial Results

BEIJING, China, Feb. 25, 2022 GLOBE NEWSWIRE) -- Li Auto Inc. Li Auto or the Company) Nasdaq: LI; HKEX: 2015 an innovator in China’s new energy vehicle market, today announced its unaudited financial results for the fourth quarter and full year ended December 31, 2021.

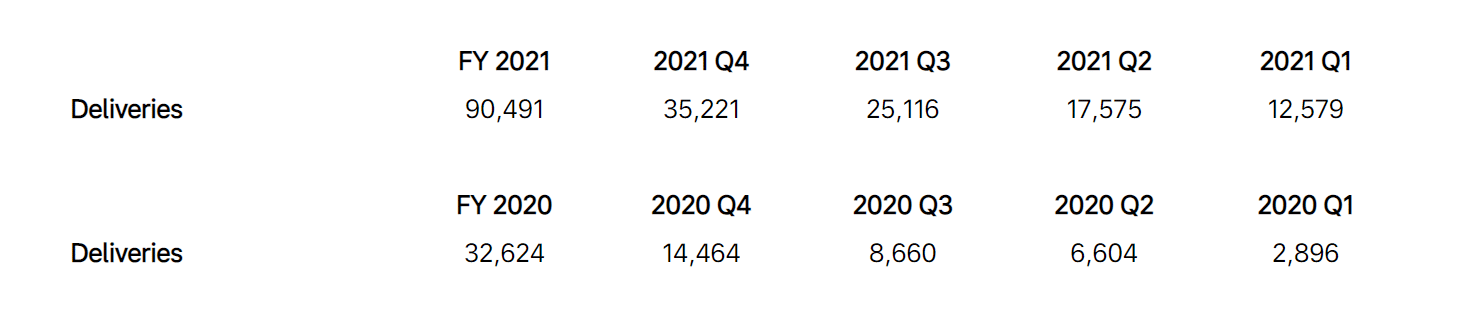

Operating Highlights for the Fourth Quarter of 2021 and Full Year 2021

Deliveries of Li ONE were 35,221 vehicles in the fourth quarter of 2021, representing a 40.2% quarter-over-quarter increase and a 143.5% year-over-year increase. Deliveries of Li ONE for the full year 2021 reached 90,491 vehicles, representing an increase of 177.4% from 32,624 vehicles in 2020.

As of December 31, 2021, the Company had 206 retail stores covering 102 cities and 278 servicing centers and Li Auto-authorized body and paint shops operating in 204 cities.

Financial Highlights for the Fourth Quarter of 2021

Vehicle sales were RMB10.38 billion US$1.63 billion) in the fourth quarter of 2021, representing an increase of 155.7% from RMB4.06 billion in the fourth quarter of 2020 and an increase of 40.5% from RMB7.39 billion in the third quarter of 2021.

Vehicle margin2 was 22.3% in the fourth quarter of 2021, compared with 17.1% in the fourth quarter of 2020 and 21.1% in the third quarter of 2021.

Total revenues were RMB10.62 billion US$1.67 billion) in the fourth quarter of 2021, representing an increase of 156.1% from RMB4.15 billion in the fourth quarter of 2020 and an increase of 36.6% from RMB7.78 billion in the third quarter of 2021.

Gross profit was RMB2.38 billion US$373.5 million) in the fourth quarter of 2021, representing an increase of 228.5% from RMB724.6 million in the fourth quarter of 2020 and an increase of 31.3% from RMB1.81 billion in the third quarter of 2021.

Gross margin was 22.4% in the fourth quarter of 2021, compared with 17.5% in the fourth quarter of 2020 and 23.3% in the third quarter of 2021.

Income from operations was RMB24.1 million US$3.8 million) in the fourth quarter of 2021, compared with RMB78.9 million loss from operations in the fourth quarter of 2020 and RMB97.8 million loss from operations in the third quarter of 2021. Non-GAAP income from operations3 was RMB415.0 million US$65.1 million) in the fourth quarter of 2021, compared with RMB71.1 million Non-GAAP loss from operations3 in the fourth quarter of 2020 and RMB259.4 million Non-GAAP income from operations in the third quarter of 2021.

Net Income was RMB295.5 million US$46.4 million) in the fourth quarter of 2021, compared with RMB107.5 million net income in the fourth quarter of 2020 and RMB21.5 million net loss in the third quarter of 2021. Non-GAAP net income3 was RMB686.4 million US$107.7 million) in the fourth quarter of 2021, representing an increase of 494.7% from RMB115.4 million in the fourth quarter of 2020 and an increase of 104.5% from RMB335.7 million in the third quarter of 2021.

Operating cash flow was RMB3.84 billion US$602.1 million) in the fourth quarter of 2021, representing an increase of 110.7% from RMB1.82 billion in the fourth quarter of 2020 and an increase of 76.9% from RMB2.17 billion in the third quarter of 2021.

Free cash flow was RMB1.62 billion US$253.5 million) in the fourth quarter of 2021, compared with RMB1.60 billion in the fourth quarter of 2020 and RMB1.16 billion in the third quarter of 2021.

Key Financial Results

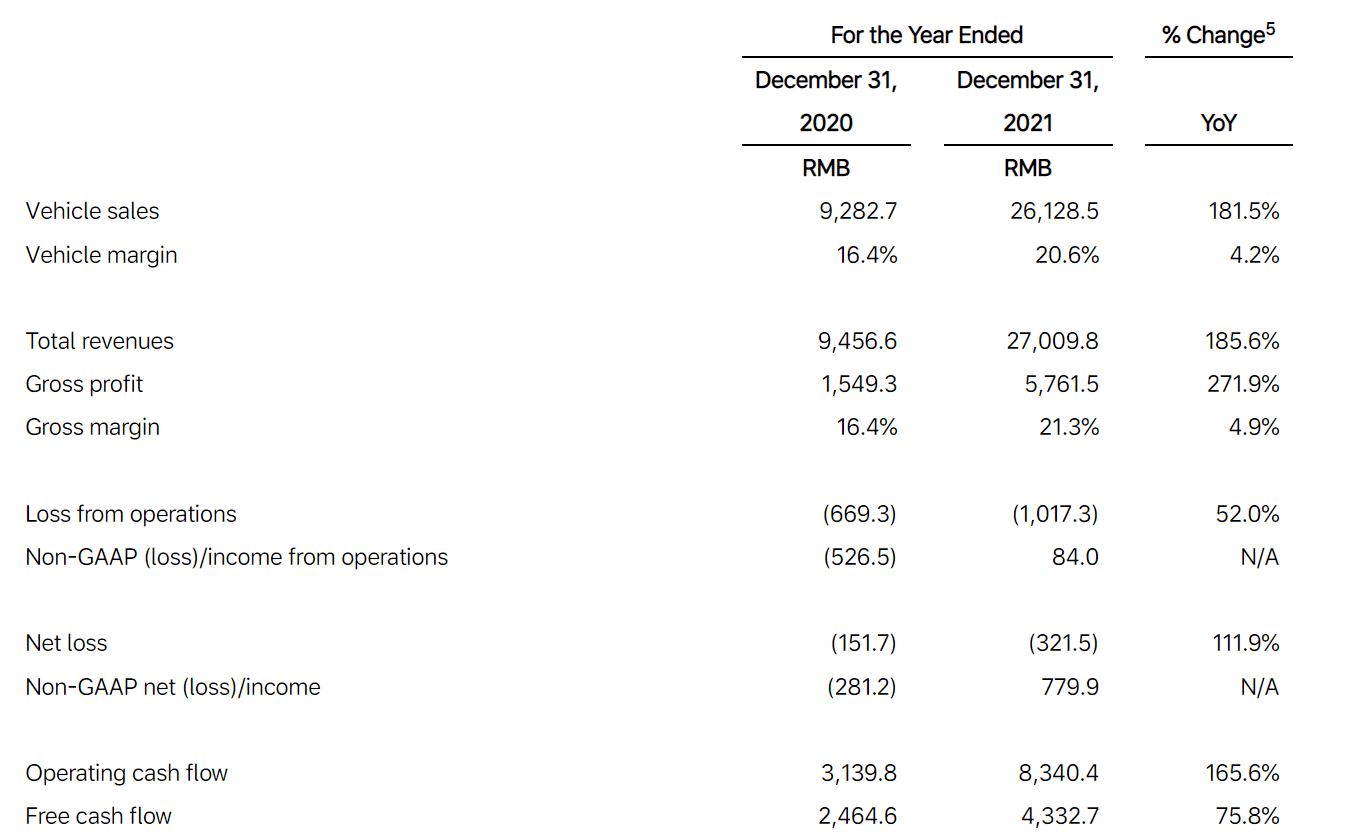

Financial Highlights for the Full Year 2021

Vehicle sales were RMB26.13 billion US$4.10 billion) in 2021, representing an increase of 181.5% from RMB9.28 billion in 2020.Vehicle margin was 20.6% in 2021, compared with 16.4% in 2020.

Total revenues were RMB27.01 billion US$4.24 billion) in 2021, representing an increase of 185.6% from RMB9.46 billion in 2020.

Gross profit was RMB5.76 billion US$904.1 million) in 2021, representing an increase of 271.9% from RMB1.55 billion in 2020.

Gross margin was 21.3% in 2021, compared with 16.4% in 2020.

Loss from operations was RMB1.02 billion US$159.6 million) in 2021, representing an increase of 52.0% from RMB669.3 million in 2020. Non-GAAP income from operations was RMB84.0 million US$13.2 million) in 2021, compared with RMB526.5 million Non-GAAP loss from operations in 2020.

Net loss was RMB321.5 million US$50.4 million) in 2021, representing an increase of 111.9% from RMB151.7 million in 2020. Non-GAAP net income was RMB779.9 million US$122.4 million) in 2021, compared with RMB281.2 million Non-GAAP net loss3 in 2020.

Operating cash flow was RMB8.34 billion US$1.31 billion) in 2021, representing an increase of 165.6% from RMB3.14 billion in 2020.

Free cash flow was RMB4.33 billion US$679.9 million) in 2021, representing an increase of 75.8% from RMB2.46 billion in 2020.

Key Financial Results

Recent Developments

Deliveries Update

In January 2022, the Company delivered 12,268 Li ONEs, representing a 128.1% increase from January 2021. As of January 31, 2022, the Company had 220 retail stores covering 105 cities, in addition to 276 servicing centers and Li Auto-authorized body and paint shops operating in 204 cities.

OTA 3.0 Release

In December 2021, the Company released the OTA 3.0 update to all Li ONE users, further enhancing their in-car experience. This update features the Navigation on ADAS NOA) and vision-enhanced Automatic Emergency Braking AEB) functions for the 2021 Li ONE. The OTA 3.0 update also includes an upgraded version of Li ONE’s smart in-car voice assistant, Li Xiang Tong Xue (理想同学), which now supports more advanced voice instructions for in-car applications and vehicle control settings.

Chongqing Manufacturing Base

In December 2021, the Company agreed to establish a strategic cooperation framework with the Chongqing municipal government to build its Chongqing manufacturing base in the Liangjiang New Area. The addition of this manufacturing base will further enhance the Company’s ability to meet increasingly strong market demand and cement its foundation for continued growth.

CEO and CFO Comments

Mr. Xiang Li, founder, chairman, and chief executive officer of Li Auto, commented, “We achieved profitability and RMB3.8 billion operating cash flow in the fourth quarter even as we accelerated the pace of R&D investment and sales network expansion – a significant reflection of our operating excellence.

“In December 2021, we introduced the OTA 3.0 update to all our Li ONE users, which features our full-stack self-developed NOA and full AEB functions enhanced by vision perception algorithm to enable safer and easier driving. It made us the third automaker in the world capable of full-stack self-development of NOA. Due to its outstanding AEB performance, Li ONE was awarded Champion of the Year 2021 accolade during a third-party AEB test, where it was the only assessed model capable of accurately identifying crossing vehicles and two-wheelers, demonstrating our strong ADAS R&D capabilities. As of January 31, 2022, we provided NOA to over 70,000 family users. In 2022, we will remain focused on R&D investment, further elevating our capabilities to provide our users with products and services that offer greater safety, convenience and comfort.”

“Our robust performance in the fourth quarter of 2021 capped a remarkable year of growth for Li Auto,” added Mr. Tie Li, Li Auto’s chief financial officer. “Driven by an impressive number of vehicle deliveries, we achieved revenues of RMB10.6 billion for the fourth quarter and RMB27.0 billion for the full year of 2021, up 156.1% and 185.6% year over year, respectively. Our vehicle margin in the fourth quarter increased to 22.3% and full-year vehicle margin came in at 20.6%, boosted by our outstanding operating efficiency in manufacturing and supply chain management. Additionally, as we continued to scale up deliveries while remaining highly focused on disciplined execution, our full-year operating cash flow reached RMB8.3 billion, providing us with strong support for R&D investment and business growth.”

Financial Results for the Fourth Quarter of 2021

Revenues

Total revenues were RMB10.62 billion US$1.67 billion) in the fourth quarter of 2021, representing an increase of 156.1% from RMB4.15 billion in the fourth quarter of 2020 and an increase of 36.6% from RMB7.78 billion in the third quarter of 2021. Vehicle sales were RMB10.38 billion US$1.63 billion) in the fourth quarter of 2021, representing an increase of 155.7% from RMB4.06 billion in the fourth quarter of 2020 and an increase of 40.5% from RMB7.39 billion in the third quarter of 2021. The increase in revenue from vehicle sales over the fourth quarter of 2020 and the third quarter of 2021 was mainly attributable to the increase of vehicle deliveries in the fourth quarter of 2021.

Other sales and services were RMB244.7 million US$38.4 million) in the fourth quarter of 2021, representing an increase of 174.5% from RMB89.2 million in the fourth quarter of 2020 and a decrease of 37.1% from RMB389.4 million in the third quarter of 2021. The increase in revenue from other sales and services over the fourth quarter of 2020 was mainly attributable to increased sales of charging stalls, accessories and services in line with higher accumulated vehicle sales. The decrease in revenue from other sales and services over the third quarter of 2021 was attributable to the sales of automotive regulatory credits in the third quarter of 2021, which did not recur in the fourth quarter of 2021.

Cost of Sales and Gross Margin

Cost of sales was RMB8.24 billion US$1.29 billion) in the fourth quarter of 2021, representing an increase of 140.8% from RMB3.42 billion in the fourth quarter of 2020 and an increase of 38.2% from RMB5.96 billion in the third quarter of 2021. The increase in cost of sales over the fourth quarter of 2020 and the third quarter of 2021 was in line with revenue growth, which was mainly driven by the increase in vehicle deliveries in the fourth quarter of 2021.Gross profit was RMB2.38 billion US$373.5 million) in the fourth quarter of 2021, representing an increase of 228.5% from RMB724.6 million in the fourth quarter of 2020 and an increase of 31.3% from RMB1.81 billion in the third quarter of 2021.

Vehicle margin was 22.3% in the fourth quarter of 2021, compared with 17.1% in the fourth quarter of 2020 and 21.1% in the third quarter of 2021. The increase in vehicle margin over the fourth quarter of 2020 was primarily driven by higher average selling price attributable to the increase of vehicle deliveries of 2021 Li ONE since its release in May 2021.

Gross margin was 22.4% in the fourth quarter of 2021, compared with 17.5% in the fourth quarter of 2020 and 23.3% in the third quarter of 2021.

Operating Expenses

Operating expenses were RMB2.36 billion US$369.7 million) in the fourth quarter of 2021, representing an increase of 193.2% from RMB803.5 million in the fourth quarter of 2020 and an increase of 23.4% from RMB1.91 billion in the third quarter of 2021.Research and development expenses were RMB1.23 billion US$193.0 million) in the fourth quarter of 2021, representing an increase of 228.7% from RMB374.2 million in the fourth quarter of 2020 and an increase of 38.4% from RMB888.5 million in the third quarter of 2021. The increase in research and development expenses over the fourth quarter of 2020 and the third quarter of 2021 was primarily driven by increased employee compensation as a result of growing number of research and development staff as well as increased costs associated with new products developments.

Selling, general and administrative expenses were RMB1.13 billion US$176.7 million) in the fourth quarter of 2021, representing an increase of 162.2% from RMB429.3 million in the fourth quarter of 2020 and an increase of 10.2% from RMB1.02 billion in the third quarter of 2021. The increase in selling, general and administrative expenses over the fourth quarter of 2020 was primarily driven by increased employee compensation as a result of growing number of staff, as well as increased marketing and promotional activities and rental expenses associated with the expansion of the Company’s sales network.

Income/Loss from Operations

Income from operations was RMB24.1 million US$3.8 million) in the fourth quarter of 2021, compared with RMB78.9 million loss from operations in the fourth quarter of 2020 and RMB97.8 million loss from operations in the third quarter of 2021. Non-GAAP income from operations was RMB415.0 million US$65.1 million) in the fourth quarter of 2021, compared with RMB71.1 million Non-GAAP loss from operations in the fourth quarter of 2020 and RMB259.4 million Non-GAAP income from operations in the third quarter of 2021.

Net Income/Loss and Net Earnings/Loss Per Share

Net Income was RMB295.5 million US$46.4 million) in the fourth quarter of 2021, compared with RMB107.5 million net income in the fourth quarter of 2020 and RMB21.5 million net loss in the third quarter of 2021. Non-GAAP net income was RMB686.4 million US$107.7 million) in the fourth quarter of 2021, representing an increase of 494.7% from RMB115.4 million in the fourth quarter of 2020 and an increase of 104.5% from RMB335.7 million in the third quarter of 2021.Basic and diluted net earnings per ADS6 attributable to ordinary shareholders were RMB0.31 US$0.05) and RMB0.29 US$0.05 respectively in the fourth quarter of 2021. Non-GAAP basic and diluted net earnings per ADS attributable to ordinary shareholders3 were RMB0.71 US$0.11) and RMB0.68 US$0.11 respectively in the fourth quarter of 2021.

Cash Position, Operating Cash Flow and Free Cash Flow

Balance of cash and cash equivalents, restricted cash, time deposits and short-term investments was RMB50.16 billion US$7.87 billion) as of December 31, 2021.Operating cash flow was RMB3.84 billion US$602.1 million) in the fourth quarter of 2021, representing an increase of 110.7% from RMB1.82 billion in the fourth quarter of 2020 and an increase of 76.9% from RMB2.17 billion in the third quarter of 2021.

Free cash flow was RMB1.62 billion US$253.5 million) in the fourth quarter of 2021, compared with RMB1.60 billion in the fourth quarter of 2020 and RMB1.16 billion in the third quarter of 2021.

Financial Results for the Full Year 2021

Revenues

Total revenues were RMB27.01 billion US$4.24 billion) in 2021, representing an increase of 185.6% from RMB9.46 billion in 2020.

Vehicle sales were RMB26.13 billion US$4.10 billion) in 2021, representing an increase of 181.5% from RMB9.28 billion in 2020. The increase in revenue from vehicle sales was mainly attributable to the increase of vehicle deliveries in 2021.

Other sales and services were RMB881.3 million US$138.3 million) in 2021, representing an increase of 406.8% from RMB173.9 million in 2020. The increase in revenue from other sales and services was mainly attributable to increased sales of charging stalls, accessories and services in line with higher accumulated vehicle sales, and the sales of automotive regulatory credits.

Cost of Sales and Gross Margin

Cost of sales was RMB21.25 billion US$3.33 billion) in 2021, representing an increase of 168.7% from RMB7.91 billion in 2020. The increase in cost of sales was in line with revenue growth, which was mainly driven by the increase in vehicle deliveries in 2021.Gross profit was RMB5.76 billion US$904.1 million) in 2021, representing an increase of 271.9% from RMB1.55 billion in 2020.

Vehicle margin was 20.6% in 2021, compared with 16.4% in 2020. The increase in vehicle margin was primarily driven by improved cost control in supply chain management and higher average selling price attributable to the increase of vehicle deliveries in 2021, with the launch of the 2021 Li ONE in May 2021.

Gross margin was 21.3% in 2021, compared with 16.4% in 2020. The increase was mainly driven by the increase of vehicle margin.

Operating Expenses

Operating expenses were RMB6.78 billion US$1.06 billion) in 2021, representing an increase of 205.5% from RMB2.22 billion in 2020.

Research and development expenses were RMB3.29 billion US$515.7 million) in 2021, representing an increase of 198.8% from RMB1.10 billion in 2020. The increase in research and development expenses was primarily attributable to increased employee compensation as a result of growing number of research and development staff as well as increased costs associated with new products developments.

Selling, general and administrative expenses were RMB3.49 billion US$548.0 million) in 2021, representing an increase of 212.1% from RMB1.12 billion in 2020. The increase in selling, general and administrative expenses was primarily driven by increased employee compensation as a result of growing number of staff, as well as increased marketing and promotional activities and rental expenses associated with the expansion of the Company’s sales network.

Income/Loss from Operations

Loss from operations was RMB1.02 billion US$159.6 million) in 2021, representing an increase of 52.0% from RMB669.3 million in 2020. Non-GAAP income from operations was RMB84.0 million US$13.2 million) in 2021, compared with RMB526.5 million Non-GAAP loss from operations in 2020.

Net Income/Loss and Net Earnings/Loss Per Share

Net loss was RMB321.5 million US$50.4 million) in 2021, representing an increase of 111.9% from RMB151.7 million in 2020. Non-GAAP net income was RMB779.9 million US$122.4 million) in 2021, compared with RMB281.2 million Non-GAAP net loss in 2020.Basic and diluted loss per ADS attributable to ordinary shareholders were both RMB0.35 US$0.05) in 2021. Non-GAAP basic and diluted net earnings per ADS attributable to ordinary shareholders were RMB0.84 US$0.13) and RMB0.81 US$0.13 respectively in 2021. As of December 31, 2021, the Company had 1,929,562,426 ordinary shares outstanding.

Operating Cash Flow and Free Cash Flow

Operating cash flow was RMB8.34 billion US$1.31 billion) in 2021, representing an increase of 165.6% from RMB3.14 billion in 2020.

Free cash flow was RMB4.33 billion US$679.9 million) in 2021, representing an increase of 75.8% from RMB2.46 billion in 2020.

Employees

As of December 31, 2021, the Company had a total of 11,901 employees.

Business Outlook

For the first quarter of 2022, the Company expects:

Deliveries of vehicles to be between 30,000 and 32,000 vehicles, representing an increase of 138.5% to 154.4% from the first quarter of 2021.

Total revenues to be between RMB8.84 billion US$1.39 billion) and RMB9.43 billion US$1.48 billion representing an increase of 147.2% to 163.7% from the first quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.