BYD registers most new energy passenger vehicles in China in January

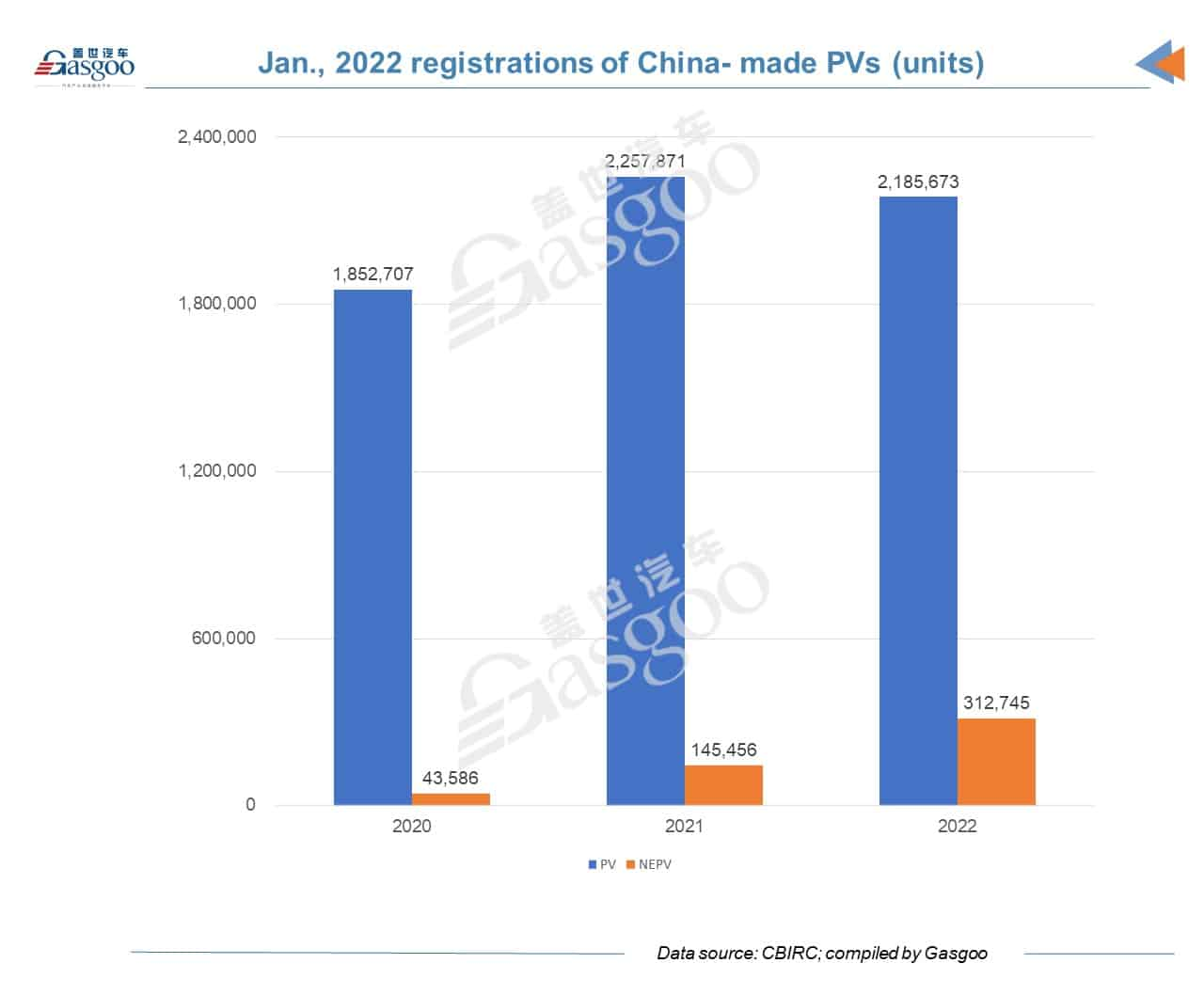

China’s registrations of locally-made passenger vehicles PVs) in January this year saw a decline from a year ago, but the registration volume of locally-made new energy PVs more than doubled compared with the same period of last year, according to the data compiled by Gasgoo Auto Research Institute GARI).

Last month, the market registered a total of 2,185,673 locally-made vehicles, falling 3.2% from 2,257,871 in the same month last year. The year-over-year decline was affected by the Chinese New Year, which came on the last day of January. Many people started to prepare for the festival a week, even two weeks, before the day.

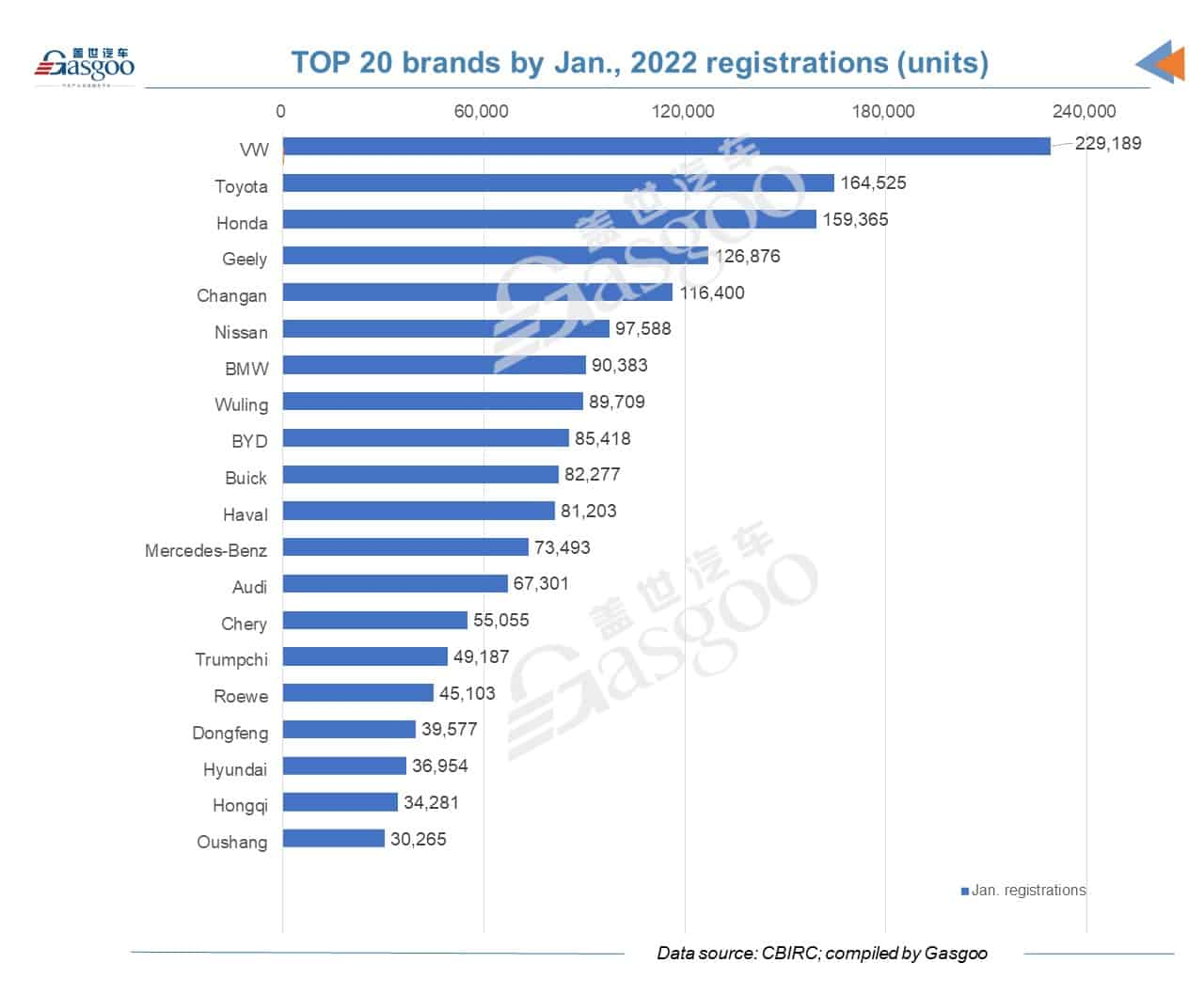

Chinese brands registered the most vehicles in the first month of this year, with the volume standing at 989,240 units. That accounted for 45.3% of the monthly volume. German brands came second with 481,776 China-made passenger vehicles registered in the month while Japanese brands’ registrations amounted to 448,283. The volume of American brands was 182,696 units.

Five brands registered more than 100,000 vehicles in January. Volkswagen remained the champion by monthly registrations, but the brand saw a drop of 24% from a year earlier. Toyota, ranking second, was the only brand which had year-over-year growth 5.88%) among the top 5 brands by January registrations. Two brands, Geely and Changan, were on the top 5 list.

BMW entered into the top 10 list with monthly registrations jumping 23% year over year, followed by two Chinese brands, Wuling and BYD, whose year-over-year change was 29% and 70.58% respectively.

In the latter half of the top 20 list, most spots were occupied by local brands. Haval brand from Great Wall Motor dropped to the eleventh. Chery, Trumpchi, Hongqi and Oushang brand from Changan Auto had two-digit growth compared with the same month of last year. Tesla fell out of the top 20 list for the American company ships more China-made vehicles in the first half of every quarter.

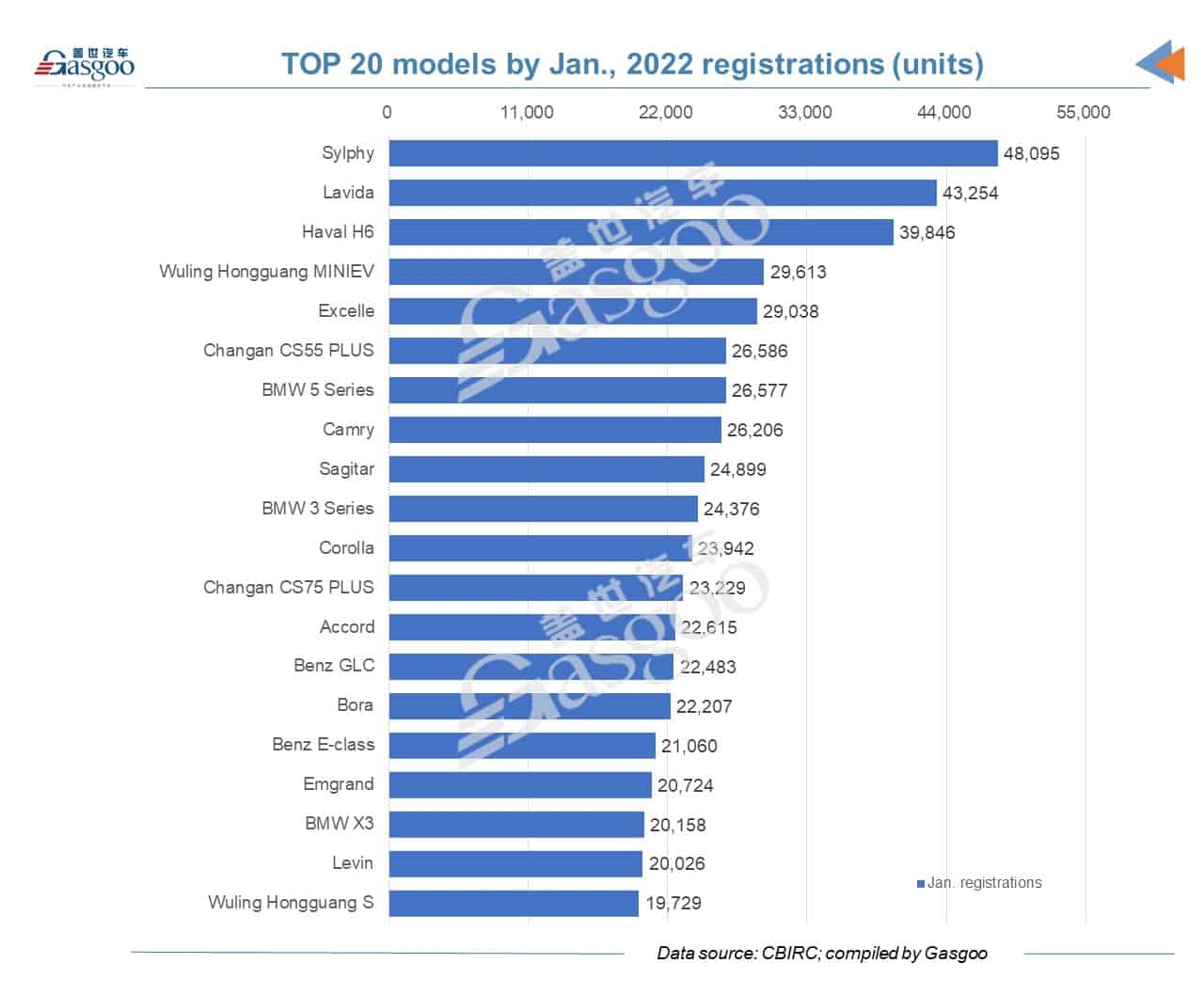

Among those vehicles registered last month, 1,070,786 were SUVs and 1,010,164 were cars, accounting for a total of 95.2% in January registrations. Two models had over 40,000 registrations in January. The Lavida returned to the second by monthly registrations of last month.

Six models from local brands were on the top 20 list by January registrations. The Haval H6 reclaimed the championship among all Chinese-branded models. The Wuling Hongguang MINIEV came next with ranking dropping from the second by December 2021 registrations and the first by November 2021 registrations, but its registrations had a gap of over 10,000 units with the Haval H6.

Data from Gasgoo Auto Research Institute showed that the country registered 312,745 new energy passenger vehicles NEPVs) in January, surging 115% from a year earlier, but falling 35% when compared with the previous month.

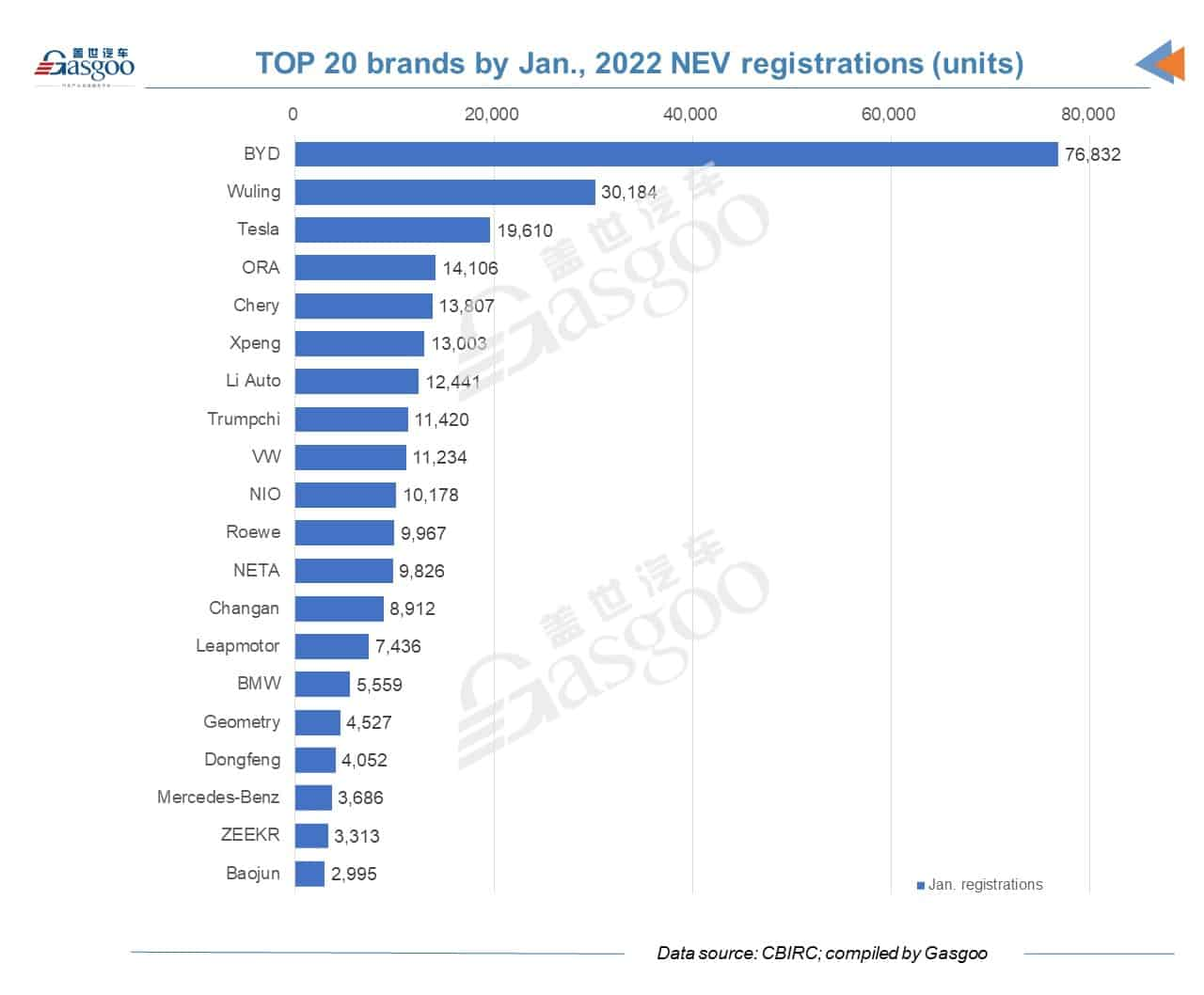

The market registered 240,802 battery electric vehicles last month, representing a share of 77% out of the total NEPV registrations. The volume of plug-in hybrid electric vehicles surpassed 70,000 units, including 14,325 range extended electric vehicles.

Among those NEPVs registered in January, 289,470 were for non-operational purpose. 23,137 vehicles were for renting while another 137 vehicles were for operation.

263,597 NEPVs registered last month were from Chinese brands, representing a market share of 84.3%. The second most registered were American brands with volume at 23,293 vehicles. European brands registered 22,106 NEPVs in China last month. South Korean and Japanese brands registered 191 and 3,558 NEPVs respectively.

By brands, BYD was an obvious leader in NEPV registrations with 76,832 vehicles, including 37,023 plug-in hybrid electric vehicles and 39,809 battery electric vehicles. BYD’s plug-in hybrid electric vehicles accounted for more than half of the market’s monthly plug-in hybrid electric vehicle registrations.

Wuling was a distant second on the list, with over 30,000 vehicles registered. Chery was a surprise, ranking fifth with 13,807 NEPVs registered. XPeng held the sixth spot, the highest ranking among Chinese electric vehicle startups and followed by Li Auto.

Mercedes Benz entered into the list, joining Tesla, Volkswagen and BMW as the fourth foreign brand on the list. ZEEKR from Zhejiang Geely Holding Group, also came onto the list with 3,313 vehicles registered.

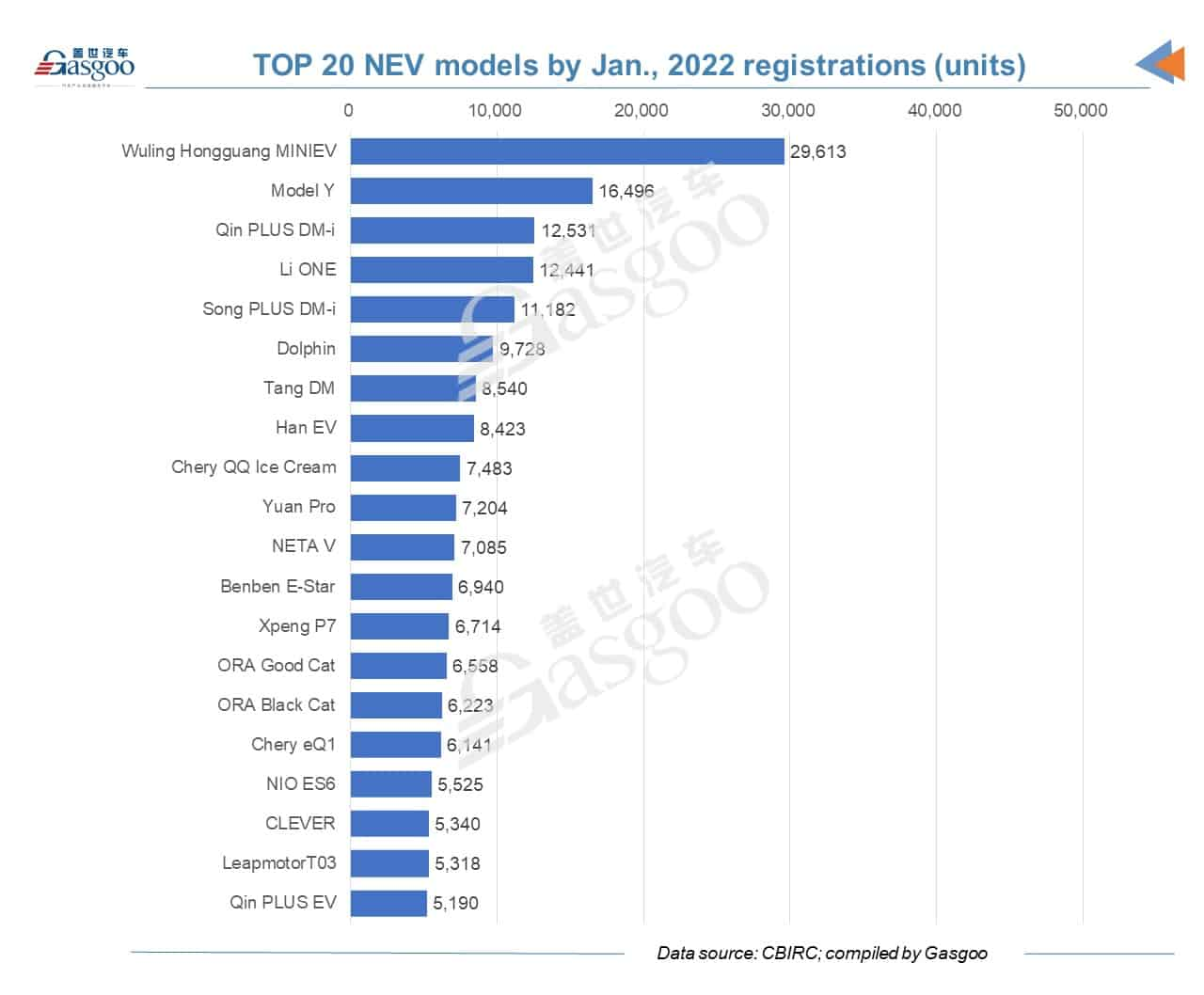

Different from the top 20 brands list by January registrations, all members on the top 20 NEPV models list had monthly registrations over 5,000 units. The Wuling Hongguang MINIEV was still the most registered model last month while the Tesla Model Y followed.

Among the 10 most registered NEPV models, BYD had six models. The Qin PLUS DM-i had the highest ranking among BYD models. If we were to add the battery electric vehicle version to the Qin PLUS tally, the model would outsell the Model Y and ranked second with total registrations up to 17,721 units. The same situation would happen to the BYD Song PLUS DM-i. To include the battery electric vehicle version, the Song PLUS would have a monthly registration volume of 14,344 units, outnumbering the Li ONE.

The NETA V was the second most registered model from local startups, outperforming the XPeng P7 and the NIO ES6.