Car and City: China’s monthly locally-made NEV registrations hit new high in Sept. 2022

China's monthly registrations of locally-made passenger vehicles ("PVs") reached 1,804,485 units in Sept. 2022, rising 9.13% from the previous year, while dipping 1.06% from the previous month, according to the data compiled by ZXZC Auto Research Institute ("GARI").

For the first nine months of 2022, there were 14,223,955 domestically built PVs registered across the Chinese mainland, representing a 3.39% decrease from a year earlier, 1.58 percentage points fewer than the drop in Jan.-Aug. volume.

Regarding the Sept. registrations of China-made PVs, Volkswagen still outshone other brands, while BYD surpassed Toyota to the runner-up place and it was also the highest-ranking local brand of China. Compared to the previous-month rankings, Tesla moved up 10 spots to the 6th place with only full-electric vehicle registered. The three German luxury brands—BMW, Mercedes-Benz, and Audi— ranked 10th, 12th, and 13th, respectively. AION was listed at the 20th place with 23,040 vehicles registered.

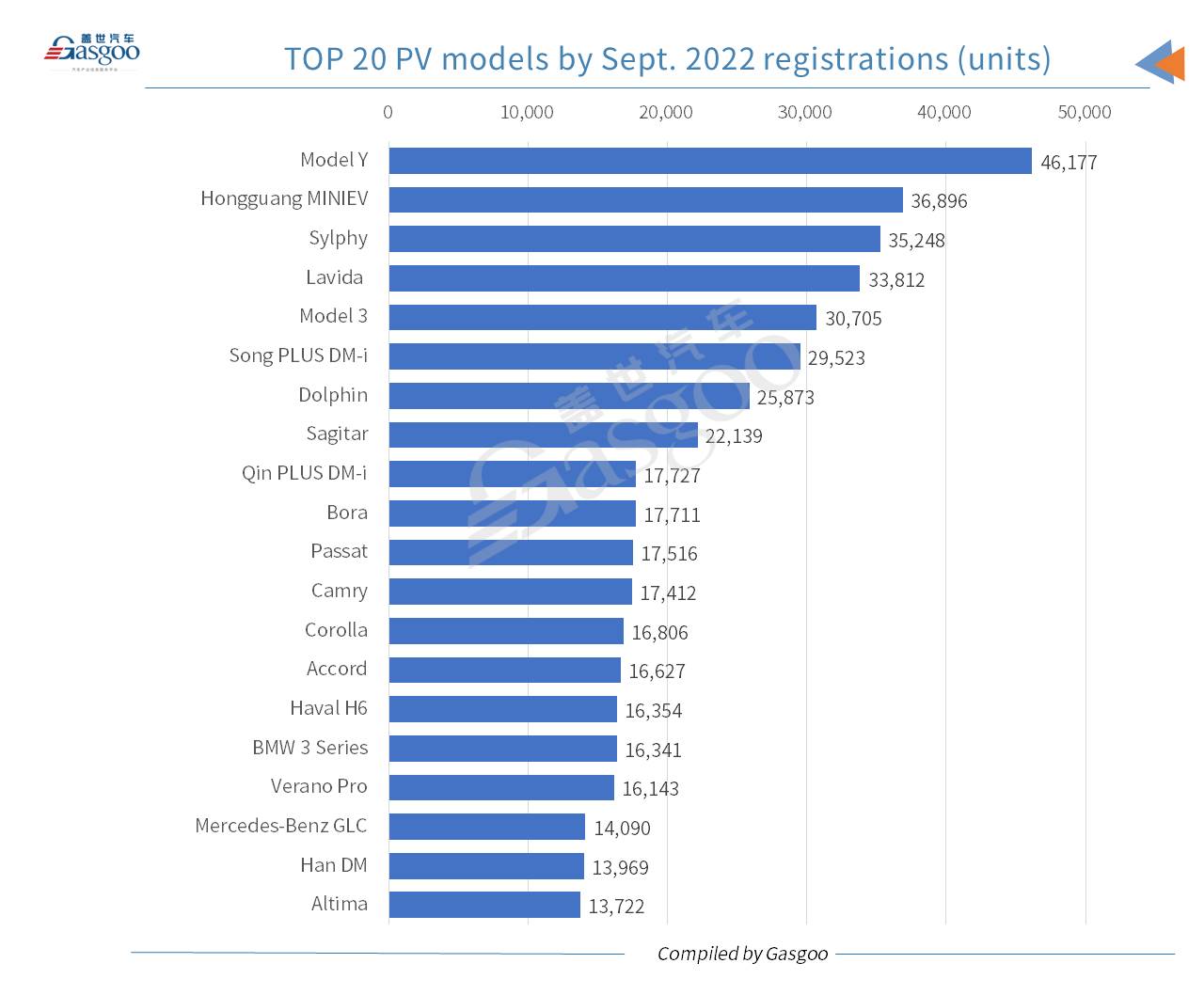

The top two best-performing PV models by Sept. registrations were both battery-electric vehicle (BEV) models, namely, the Model Y and the Wuling Hongguang MINIEV. Compared to the Aug. rankings, the Nissan Sylphy dropped two spots to the third place among all PV models.

Apart from the Model Y and the Wuling Hongguang MINIEV, there were still five new energy vehicle (NEV) models among the top 20 models by Sept. registrations, including two BEVs (the Model 3 and the Dolphin), and three BYD-branded PHEV models (the Song PLUS DM-i, the Qin PLUS DM-i, and the Han DM).

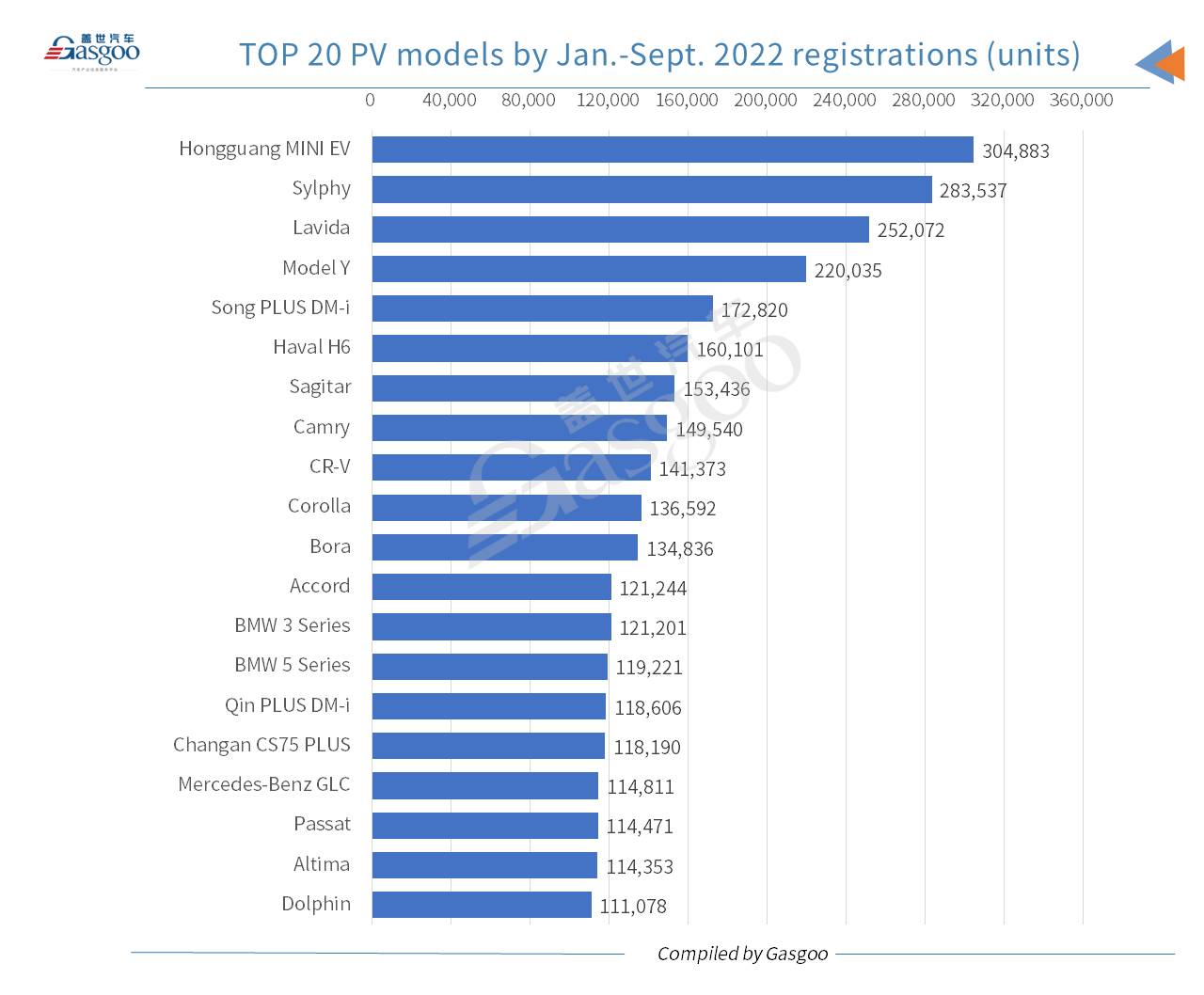

Regarding the Jan.-Sept. registrations, the top four PV models were the same as that of the rankings by Jan.-Aug. registrations. The BYD Song PLUS DM-i outnumbered the Haval H6 by around 12,700 units. Tesla's Model Y was honored the best-selling SUV model. Besides, three models under German luxury brands—the BMW 3 Series, the BMW 5 Series, and the Mercedes-Benz GLC, were included in the top 20 models list by Q1-Q3 registrations.

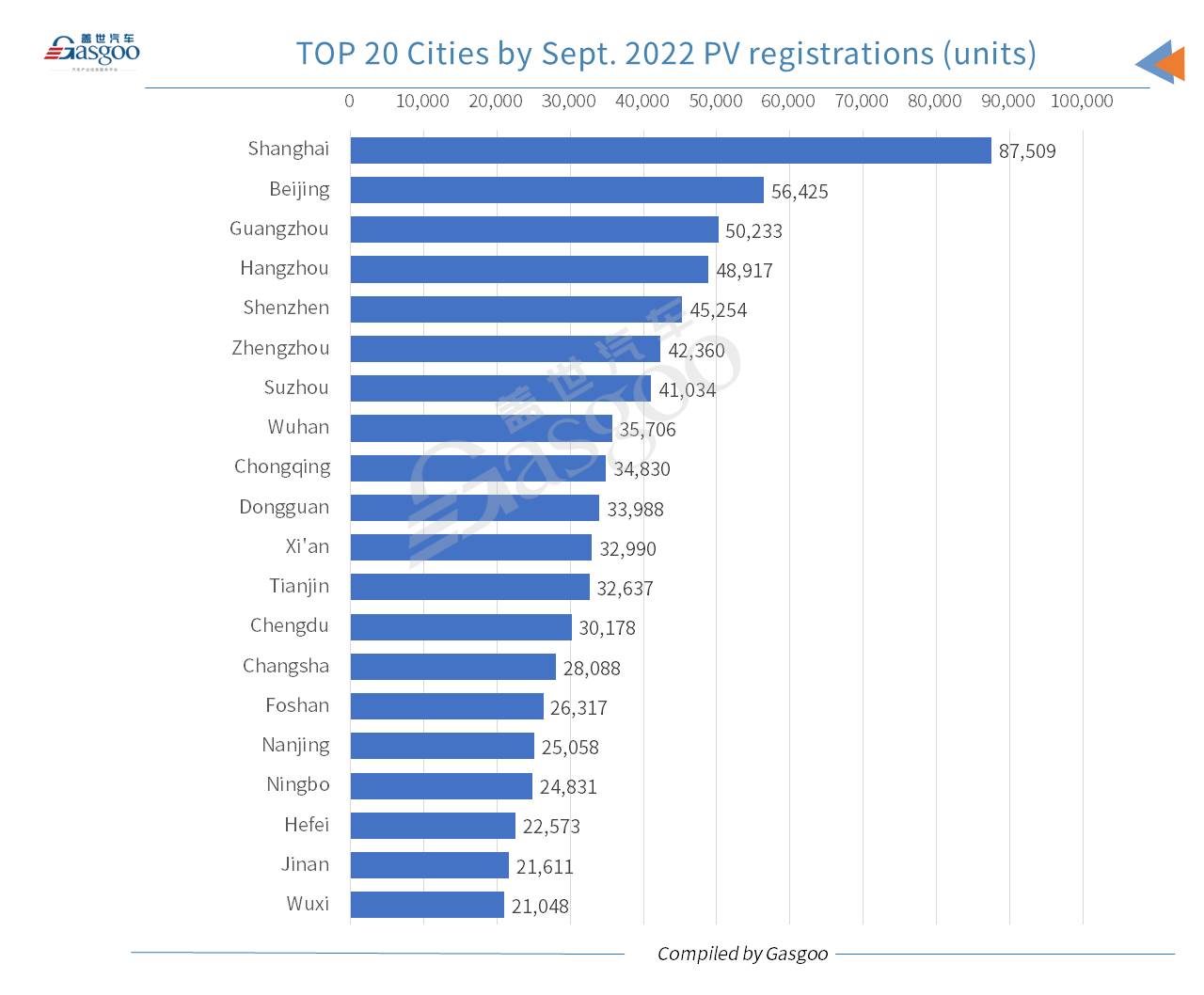

Regarding regional distribution in Sept., Shanghai still registered the most homemade PVs, outselling the runner-up, Beijing, by 31,084 units. Compared to the previous month, Guangzhou's No.3 and Hangzhou's No.4 places remained unchanged. Chengdu plunged to the 13th place from the 5th in August.

Among the top 20 cities by Sept. PV registrations, there were 10 provincial capitals. Such metropolises as Shenzhen, Chongqing, and Tianjin were all on the top 20 cities list.

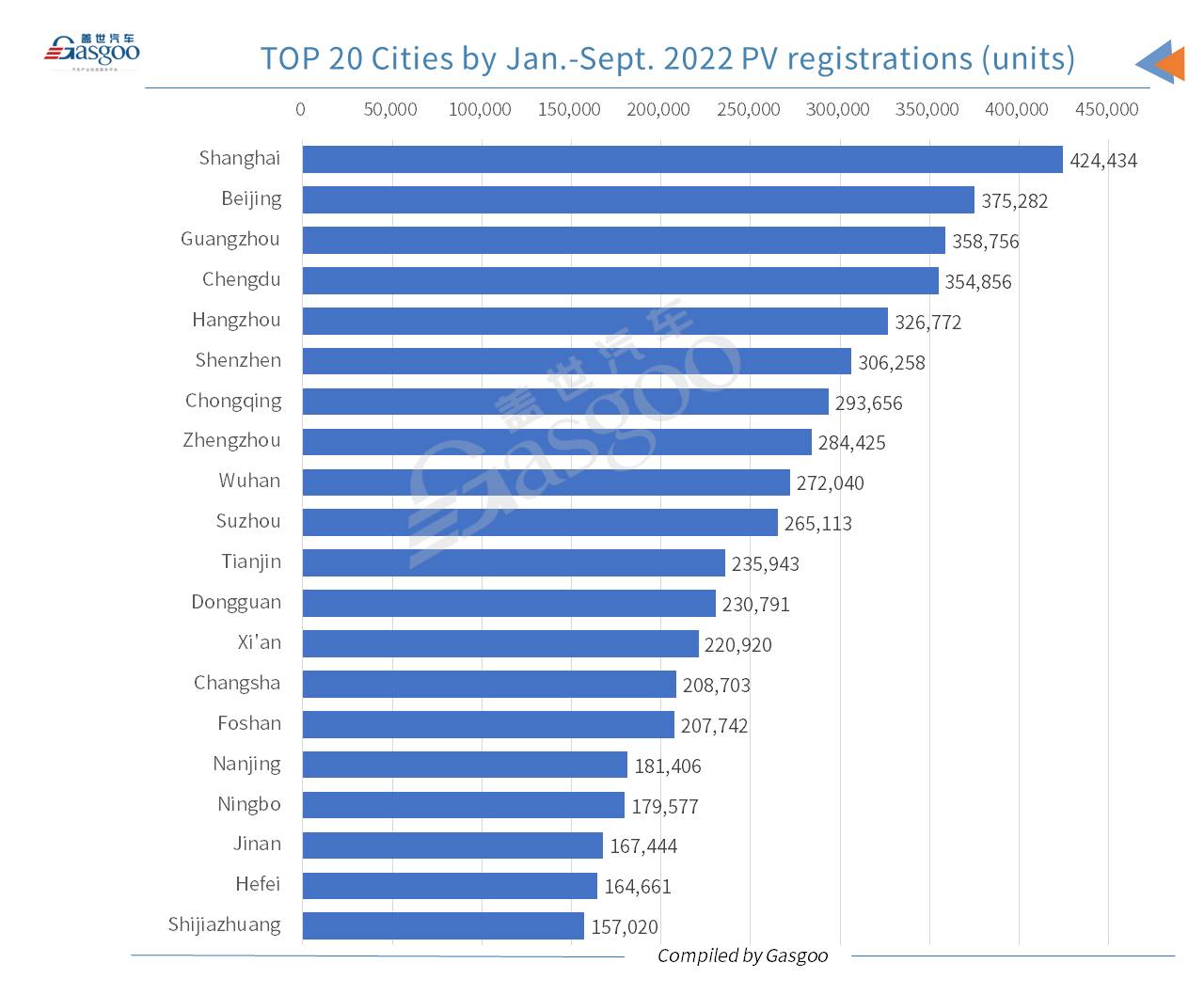

The top-ranking city by Jan.-Sept. 2022 PV registrations was still Shanghai, but Chengdu fell to the fourth place due to its slide in the rankings by Sept. registrations. The No.2-No.6 cities all recorded a Q1-Q3 registration volume between 300,000 units and 400,000 units.

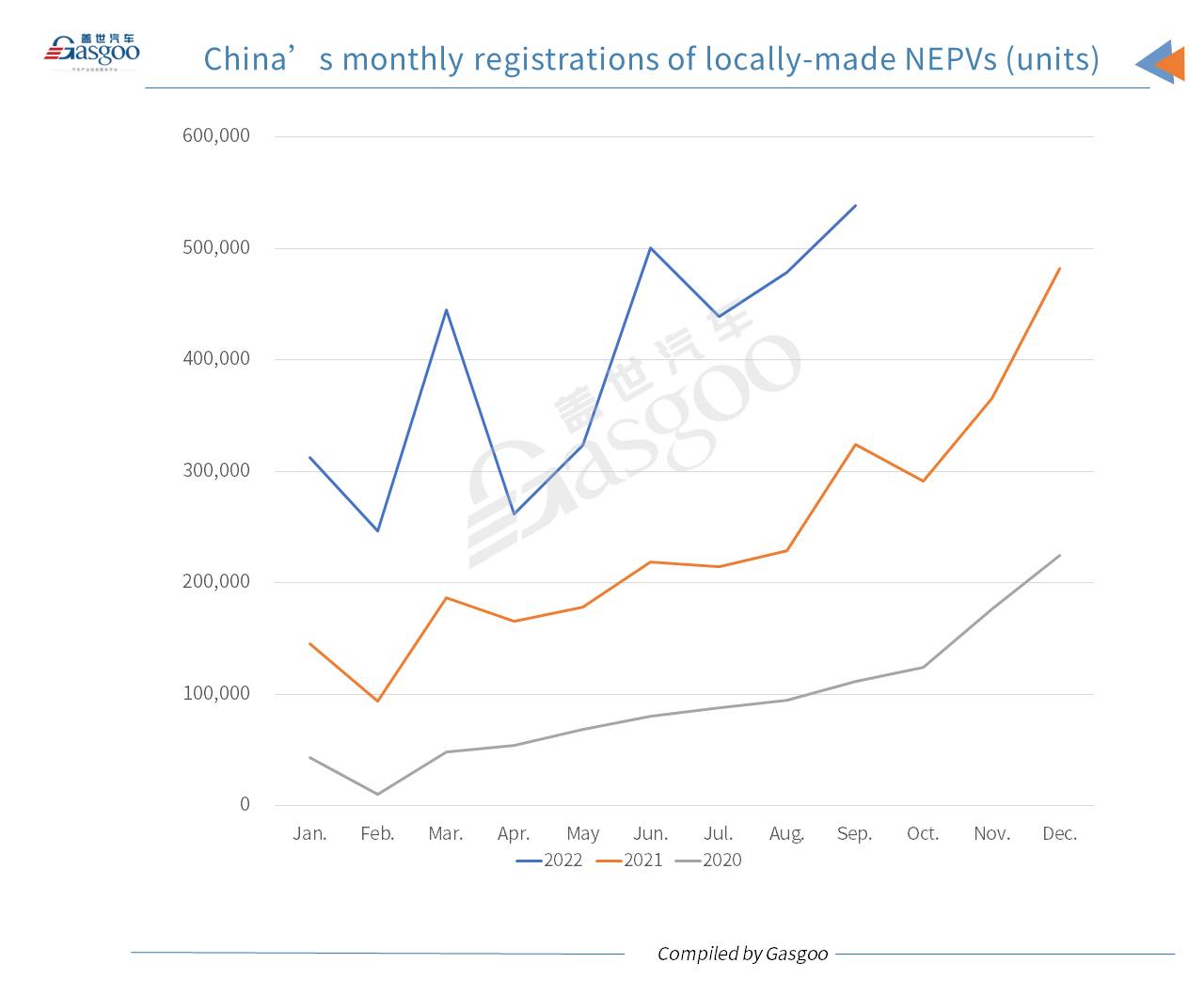

In Sept., China's monthly locally-made new energy passenger vehicle (NEPV) registrations hit a new high of 538,806 units, surging 66.06% over a year ago and also rising 12.53% over a month ago.

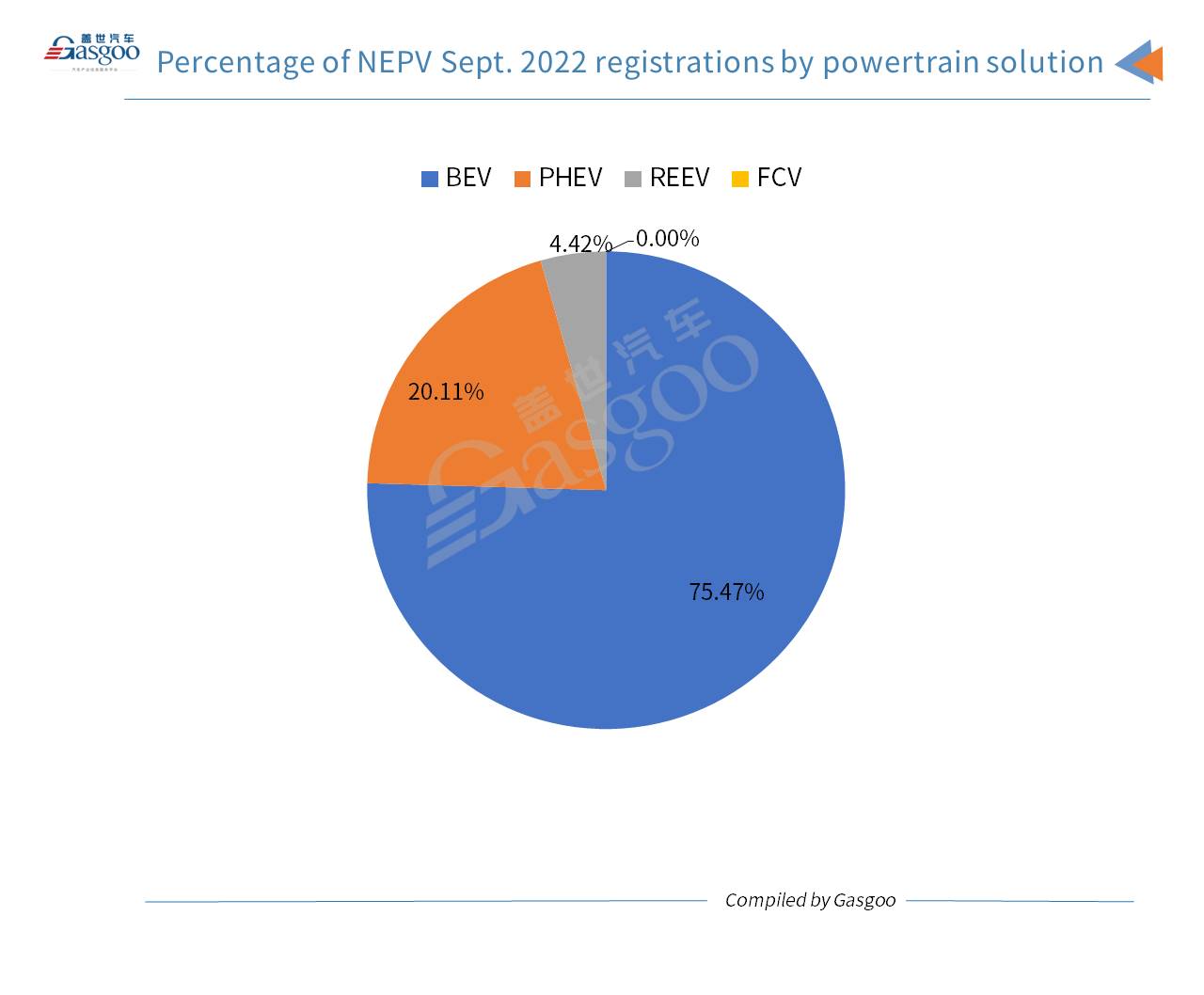

By specific powertrain solutions, BEVs posted a registration volume of 406,636 units in Sept., accounting for 75.47% of the country's total NEPV registrations. The PHEV registrations reached 132,166 units (including 23,814 REEVs).

Notably, there were 4 fuel cell vehicles registered across the Chinese mainland last month.

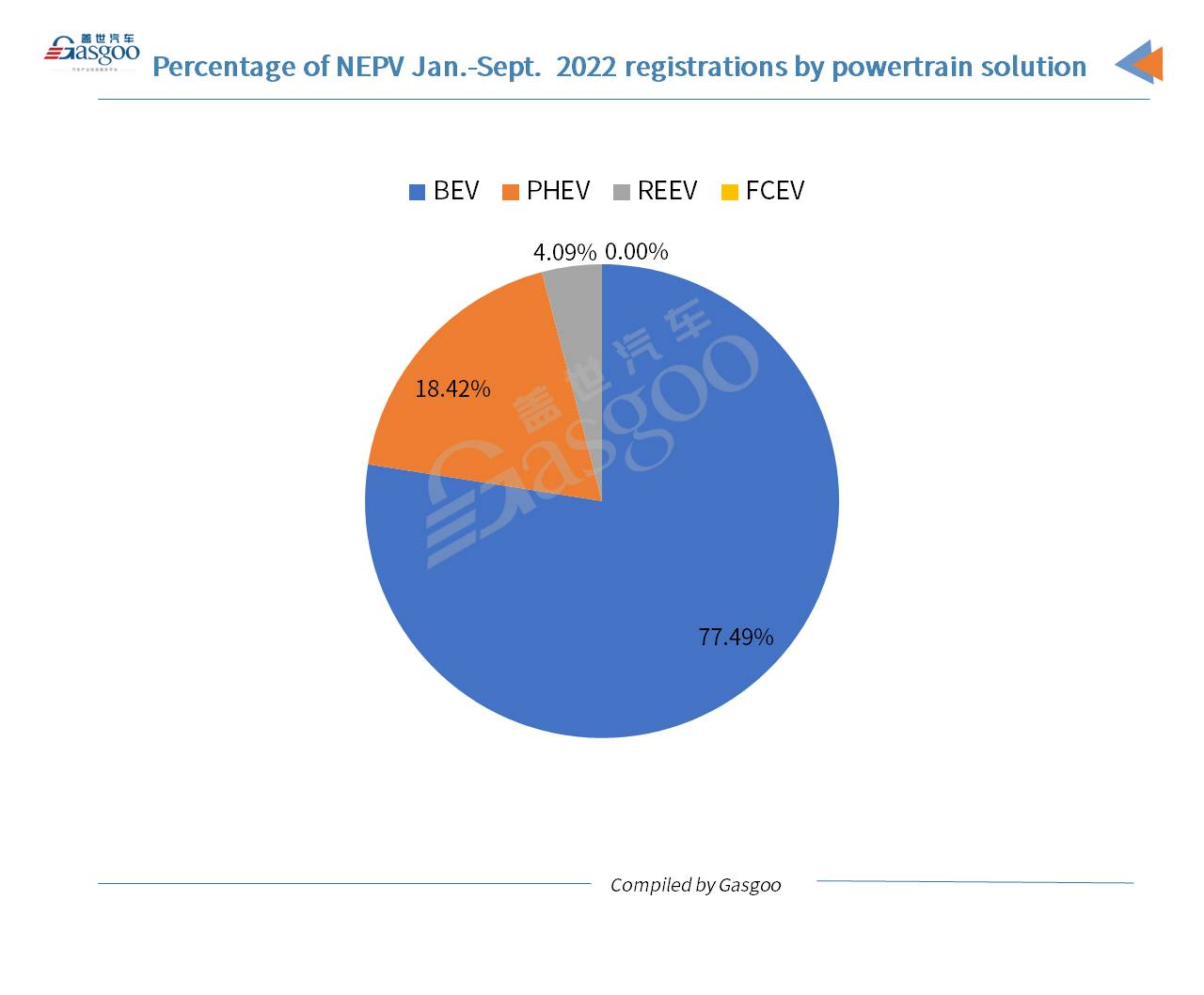

Of the NEPVs registered in the first three quarters of 2022, 77.49% and 22.51% were contributed by BEVs and PHEVs (including REEVs), respectively.

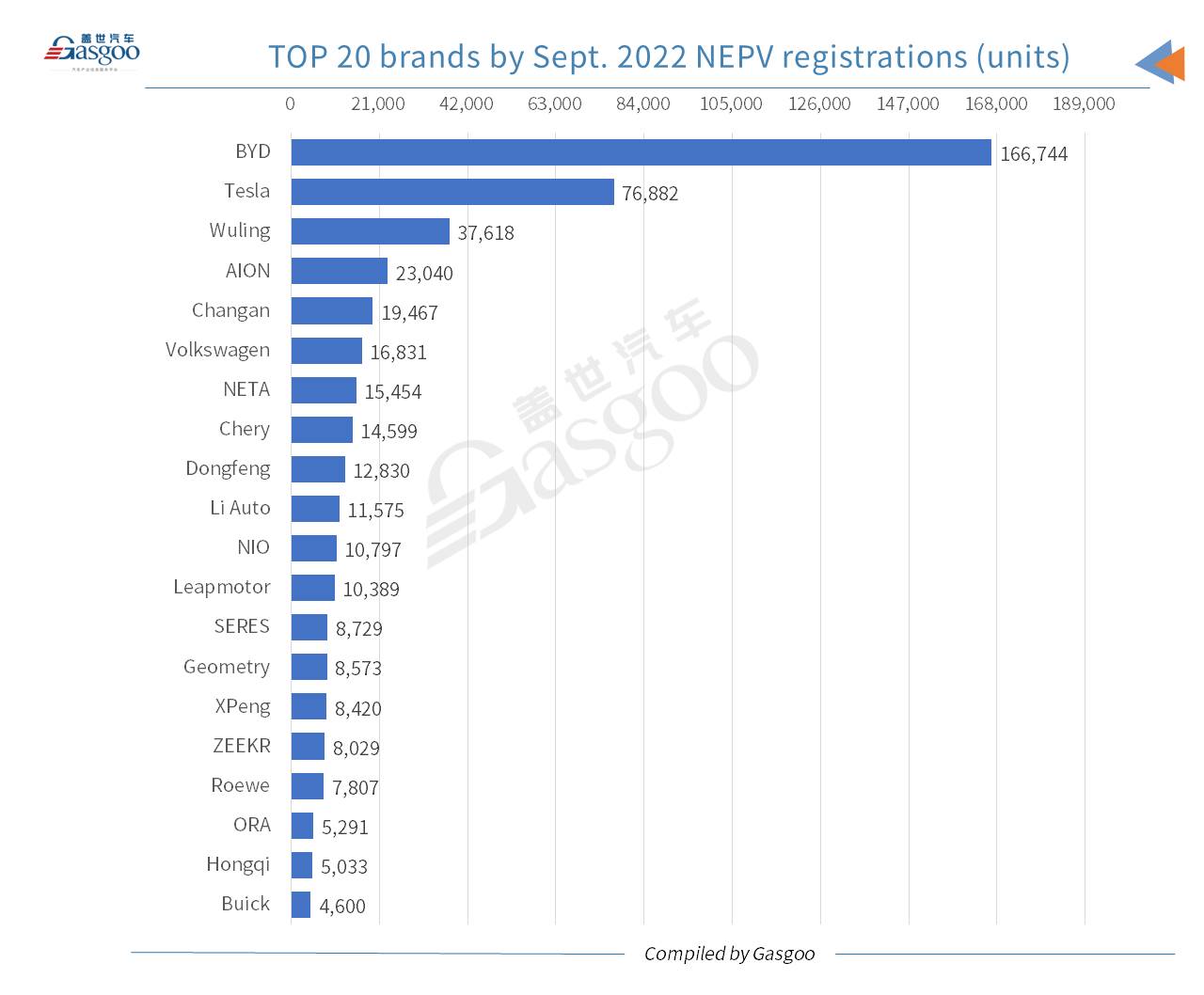

Regarding the NEPV registrations in Sept., BYD was streets ahead of other brands. It had 166,744 NEPVs registered last month, which were even more than the sum of the No.2-No.5 occupants.

NETA ranked highest among Chinese NEV startups in terms of Sept. NEPV registrations. Li Auto, NIO, and Leapmotor all saw their respective registrations exceed 10,000 units last month, while XPeng failed to have over 9,000 vehicles registered.

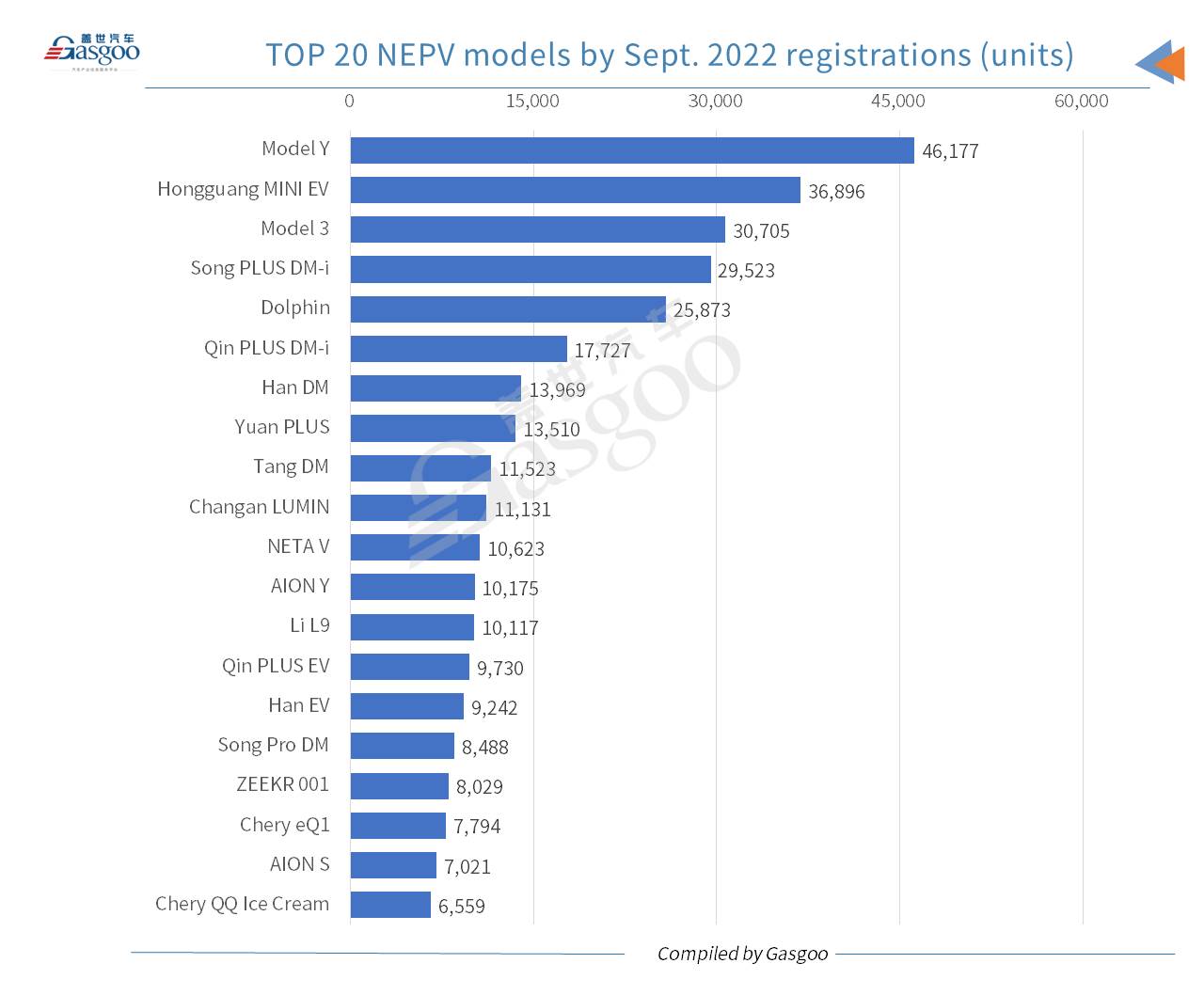

With respect to Sept. registrations, the Model Y and the Hongguang MINIEV outperformed other NEPV models. On the top 20 NEPV models list, there were nine from BYD brand, six of which entered the top 10 rankings. The NETA V features the highest Sept. registrations among those under Chinese NEV start-up brands.

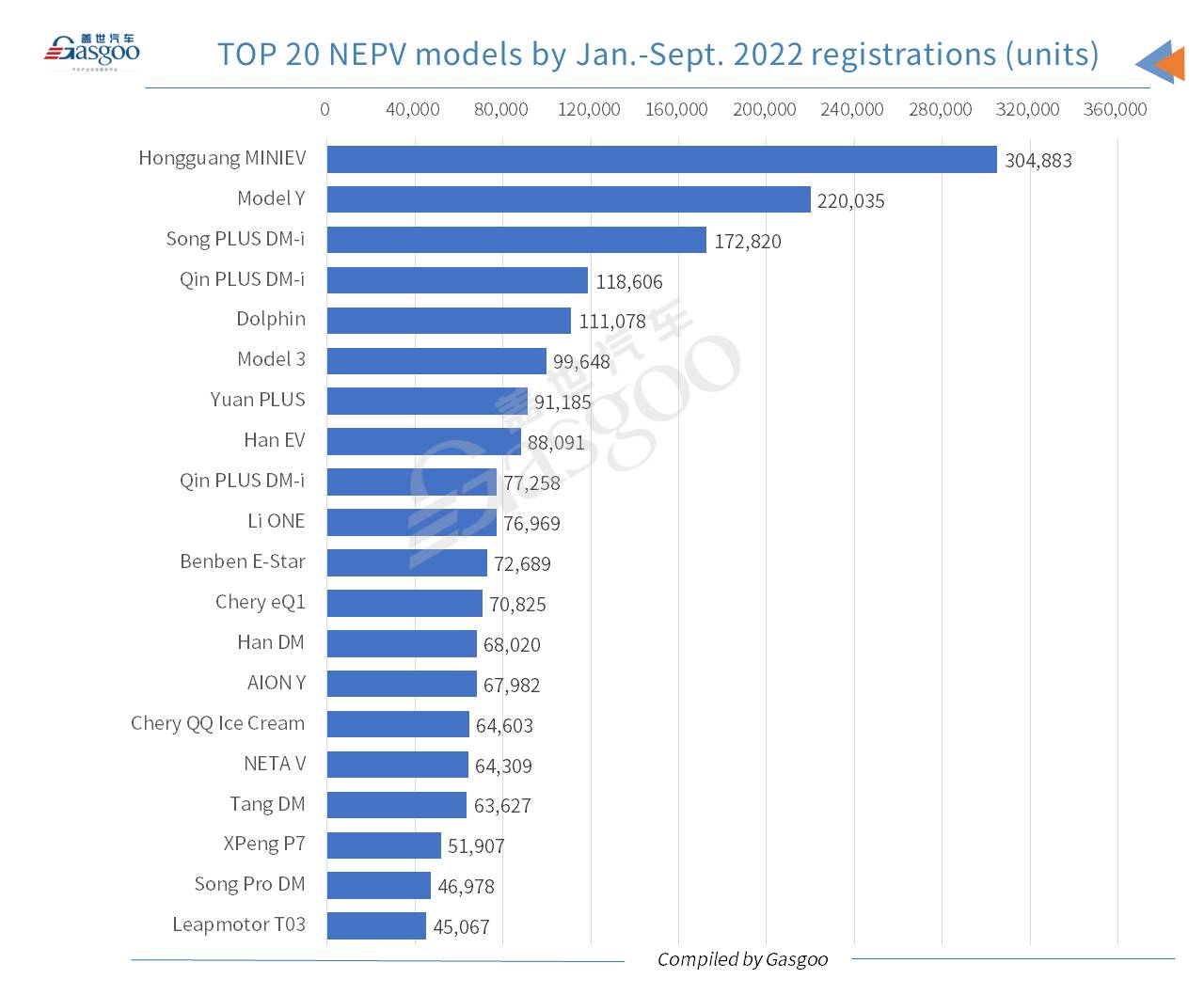

In terms of Jan.-Sept. 2022 registrations, four models from Chinese NEV startups—the Li ONE, the NETA V, the XPeng P7, and the Leapmotor T03—came into the top 20 NEPV models list. Both the Model Y and the Model 3 gained a seat on the top 10 list.

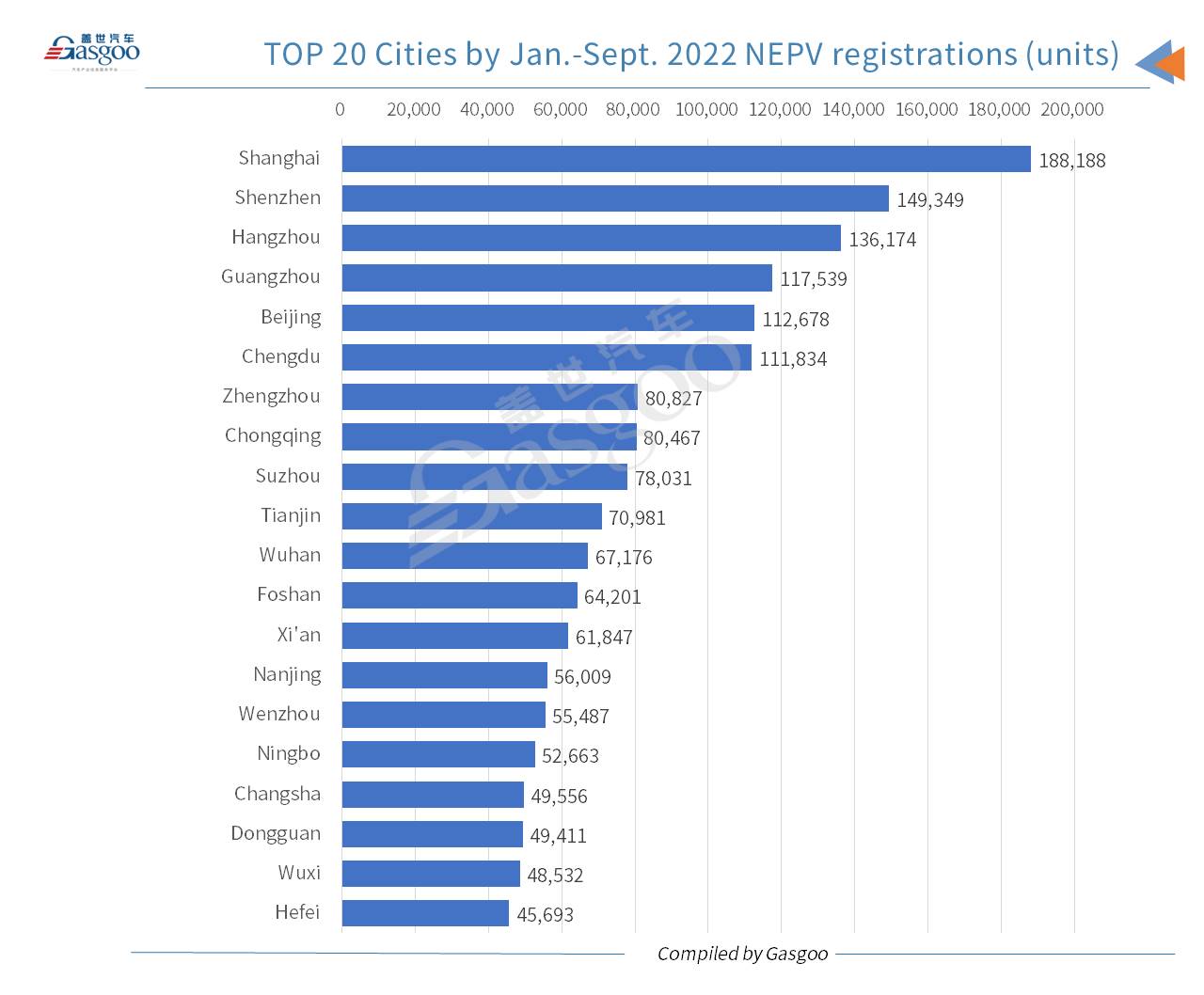

Shanghai were the only city whose NEPV registrations exceeded 30,000 units in Sept. Notably, NEPVs accounted for up to 52.34% of Shanghai's PV registrations in the month. Both Hangzhou and Shenzhen recorded an NEPV registration volume of over 24,000 units last month.

In Jan.-Sept. 2022, there were six cities with over 100,000 NEPVs registered each, of which the first three cities—Shanghai, Shenzhen, Hangzhou—had NEPV registrations exceeding 130,000 units.