China's locally-made PV retail sales jump 28.4% YoY in Aug. 2022

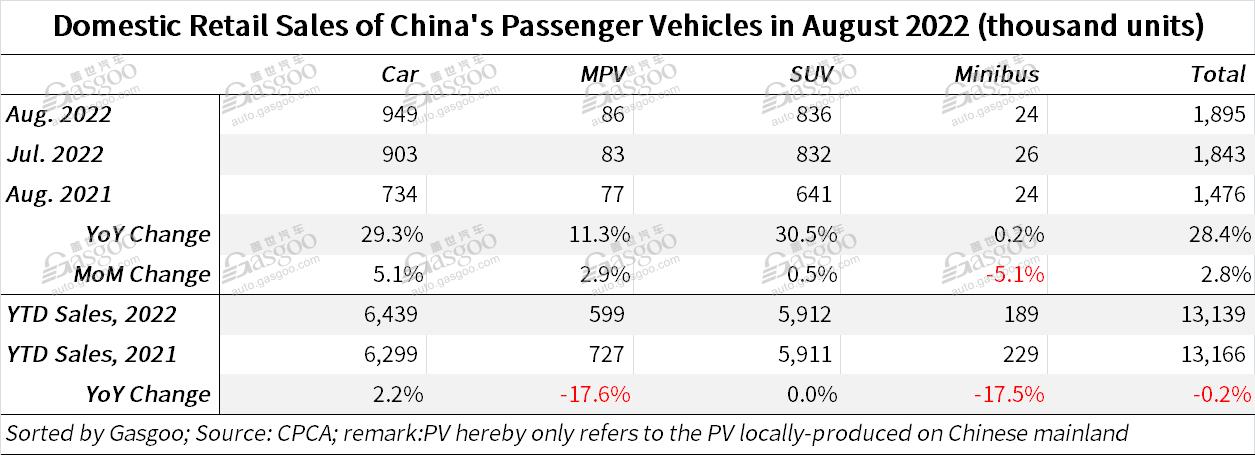

Shanghai (ZXZC)- In August 2022, China's passenger vehicle ("PV") retail sales amounted to 1.895 million units, jumping 28.4% compared to the previous year, while also climbing 2.8% from the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the PVs hereby refer to the cars, MPV, SUVs, and minibuses locally produced on the Chinese mainland.

The association said the continued improvement in logistics and supply chain operations after May, as well as the car inventory replenishment have effectively boosted auto sales. The two-digit year-on-year growth in Aug. PV retail sales was partially attributable to the relatively low base for the year-ago period, when the industry was heavily impacted by chip shortage, and the car purchase tax breaks.

Meanwhile, mainstream automakers have stepped up sales promotion to compensate for the sales loss caused by the coronavirus resurgence, aiming to fulfill their full-year sales targets.

There were around 250,000 luxury PVs retailed across China in August, representing a 27% year-on-year growth and a 13% month-on-month rise.

Chinese indigenous PV brands recorded a combined retail sales volume of 850,000 units in August, which was 41% more than that of the year-ago period, while remaining flat over the previous month.

According to the CPCA's data, China's local brands accounted for 45.8% of the country's total PV retail volume in August, 3.8 percentage points higher than the prior-year level.

With about 770,000 PVs delivered last month, mainstream joint-venture brands in China attained a year-on-year growth of 18%, and also logged a month-on-month increase of 3%.

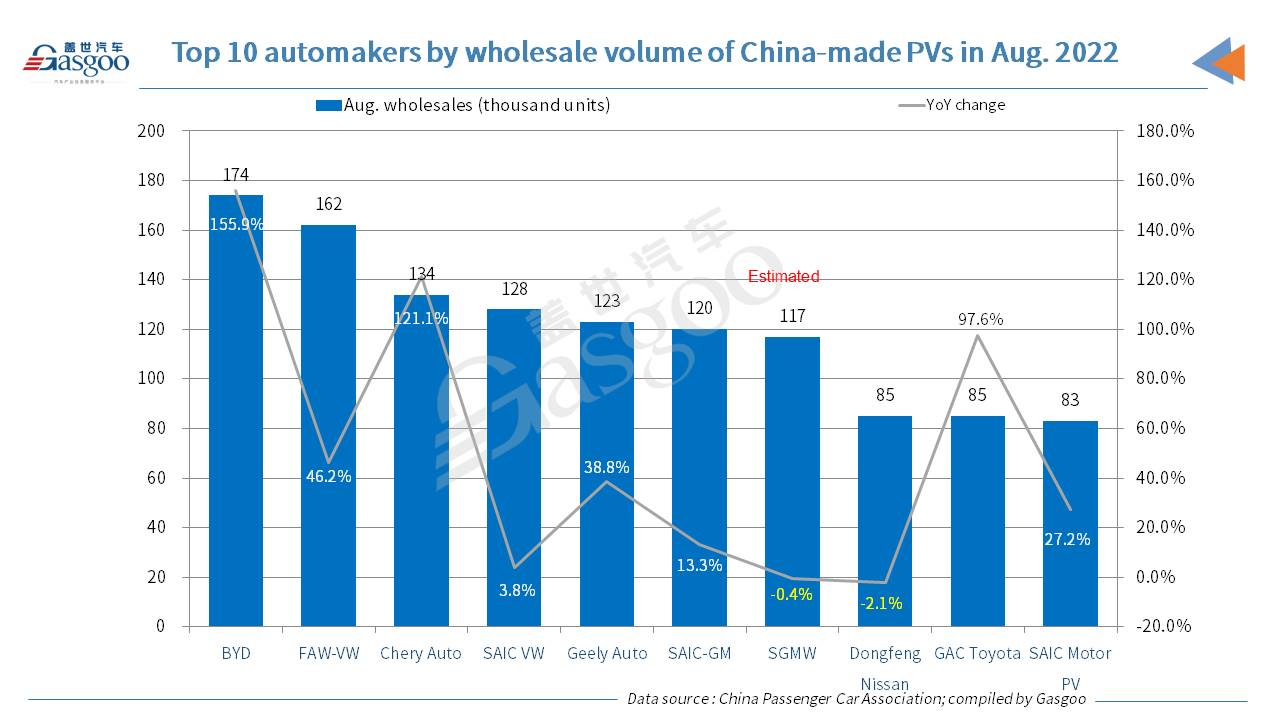

Among the top 10 automakers by August PV retail sales, the first six companies all scored an increase from a year ago. BYD not only outsold others, but also posted the largest sales growth. Dongfeng Nissan and SGMW were the only two firms facing a year-on-year downward movement. Toyota’s two Chinese joint ventures both gained a two-digit growth in their Aug. retail volume.

China's monthly PV wholesale volume reached 2.12 million units in August, leaping 36.6% year on year, while edging down 2.1% month on month.

Regarding the PV wholesale volume in August, BYD was still the fastest-growing one with only NEVs sold, while Chery Auto also posted a three-digit year-on-year spike. GAC Toyota's Aug. wholesales almost doubled over the same month in 2021.

China's monthly PV production volume amounted to 2.138 million units in August, surging 40.7% year on year, while notching down 2.2% month on month.

For the first eight months of the year, China's PV output added up to 14.709 million units, rising 15% from a year earlier.

The CPCA forecasted that both PV production and sales volumes in China would grow year on year at a pretty high rate in September, thanks to such factors as smooth unleashing of production capacity, which faced loss in August due to the scorching heat and the high-temperature vacations, and the improved chip supply.