Li Auto Inc. Announces Unaudited Second Quarter 2022 Financial Results

BEIJING, China, Aug. 15, 2022 (GLOBE NEWSWIRE) -- Li Auto Inc. ("Li Auto" or the "Company") (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle market, today announced its unaudited financial results for the quarter ended June 30, 2022.

Operating Highlights for the Second Quarter of 2022

Deliveries of Li ONE were 28,687 vehicles in the second quarter of 2022, representing a 63.2% year-over-year increase.

As of June 30, 2022, the Company had 247 retail stores covering 113 cities, as well as 308 servicing centers and Li Auto-authorized body and paint shops operating in 226 cities.

Financial Highlights for the Second Quarter of 2022

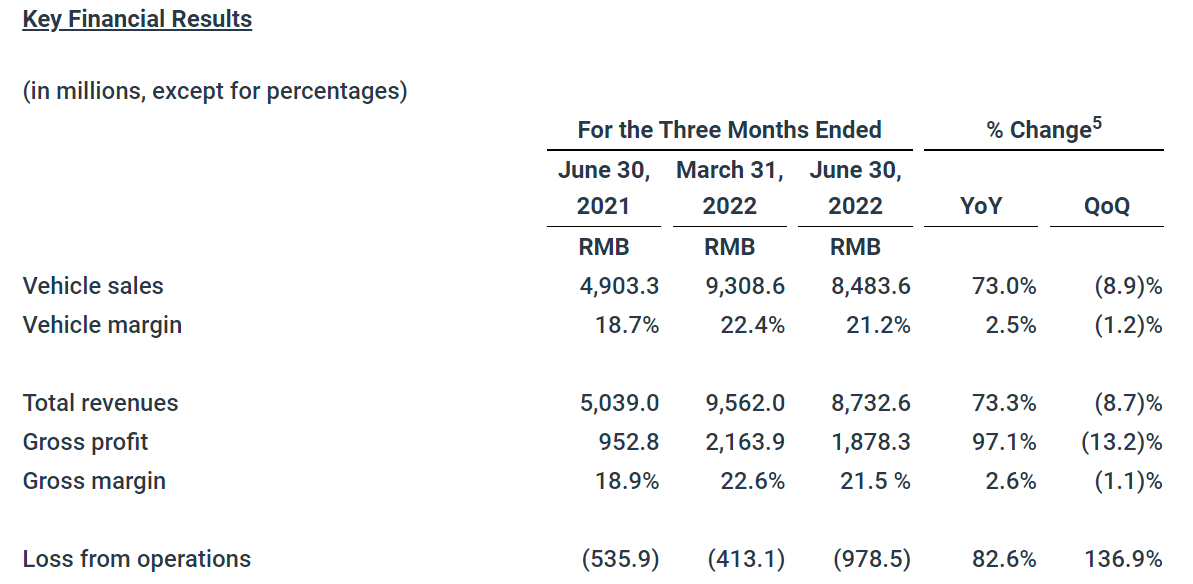

Vehicle sales were RMB8.48 billion (US$1.27 billion) in the second quarter of 2022, representing an increase of 73.0% from RMB4.90 billion in the second quarter of 2021 and a decrease of 8.9% from RMB9.31 billion in the first quarter of 2022.

Vehicle margin2 was 21.2% in the second quarter of 2022, compared with 18.7% in the second quarter of 2021 and 22.4% in the first quarter of 2022.

Total revenues were RMB8.73 billion (US$1.30 billion) in the second quarter of 2022, representing an increase of 73.3% from RMB5.04 billion in the second quarter of 2021 and a decrease of 8.7% from RMB9.56 billion in the first quarter of 2022.

Gross profit was RMB1.88 billion (US$280.4 million) in the second quarter of 2022, representing an increase of 97.1% from RMB952.8 million in the second quarter of 2021 and a decrease of 13.2% from RMB2.16 billion in the first quarter of 2022.

Gross margin was 21.5% in the second quarter of 2022, compared with 18.9% in the second quarter of 2021 and 22.6% in the first quarter of 2022.

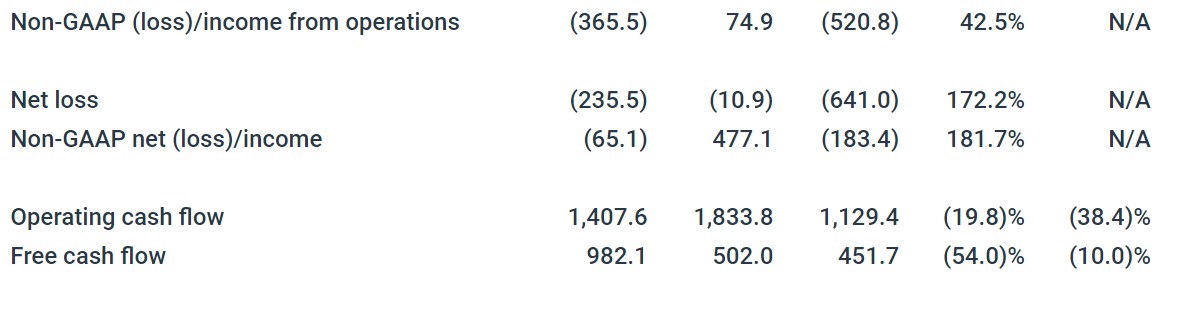

Loss from operations was RMB978.5 million (US$146.1 million) in the second quarter of 2022, representing an increase of 82.6% from RMB535.9 million in the second quarter of 2021 and an increase of 136.9% from RMB413.1 million in the first quarter of 2022. Non-GAAP loss from operations3 was RMB520.8 million (US$77.8 million) in the second quarter of 2022, representing an increase of 42.5% from RMB365.5 million in the second quarter of 2021, and compared with RMB74.9 million non-GAAP income from operations3 in the first quarter of 2022.

Net loss was RMB641.0 million (US$95.7 million) in the second quarter of 2022, representing an increase of 172.2% from RMB235.5 million in the second quarter of 2021, and compared with RMB10.9 million net loss in the first quarter of 2022. Non-GAAP net loss3 was RMB183.4 million (US$27.4 million) in the second quarter of 2022, representing an increase of 181.7% from RMB65.1 million in the second quarter of 2021, and compared with RMB477.1 million non-GAAP net income3 in the first quarter of 2022.

Operating cash flow was RMB1.13 billion (US$168.6 million) in the second quarter of 2022, representing a decrease of 19.8% from RMB1.41 billion in the second quarter of 2021 and a decrease of 38.4% from RMB1.83 billion in the first quarter of 2022.

Free cash flow4 was RMB451.7 million (US$67.4 million) in the second quarter of 2022, representing a decrease of 54.0% from RMB982.1 million in the second quarter of 2021 and a decrease of 10.0% from RMB502.0 million in the first quarter of 2022.

Recent Developments

Delivery Update

In July 2022, the Company delivered 10,422 Li ONEs, representing a 21.3% increase from July 2021. As of July 31, 2022, the Company had 259 retail stores covering 118 cities, in addition to 311 servicing centers and Li Auto-authorized body and paint shops operating in 226 cities.

Li L9

On June 21, 2022, the Company officially unveiled Li L9, the flagship smart SUV for families. Li L9 is a six-seat, full-size flagship SUV, offering superior space and comfort for family users. Its self-developed flagship range extension and chassis systems provide excellent drivability with a CLTC range of 1,315 kilometers and a WLTC range of 1,100 kilometers. With a 44.5 kilowatt-hour new-generation NCM lithium battery, it can support a CLTC range of 215 kilometers and a WLTC range of 180 kilometers under the EV mode. Li L9 also features top-notch vehicle safety measures and the Company’s self-developed autonomous driving system, Li AD Max, powered by dual Orin-X chips with 508 TOPS of computing power to protect every family passenger. Li L9’s innovative five-screen, three-dimensional interactive intelligent cockpit brings a new level of driving and entertainment experience. Li L9 comes standard with over 100 flagship features at a retail price of RMB459,800.

At-The-Market Offering

On June 28, 2022, the Company announced an at-the-market offering program (the “ATM Offering”) to sell up to US$2,000,000,000 of American depositary shares (“ADSs”), each representing two Class A ordinary shares of the Company.

As of the date of this press release, the Company has sold 9,431,282 ADSs representing 18,862,564 Class A ordinary shares of the Company under the ATM Offering raising gross proceeds of US$366.5 million before deducting fees and commissions payable to the distribution agents of up to US$4.8 million and certain other offering expenses.

CEO and CFO Comments

Mr. Xiang Li, founder, chairman, and chief executive officer of Li Auto, commented, “We delivered solid second quarter results in an environment with challenges and uncertainties through operational and product excellence. Our vehicles continued to win family users, not only illustrating the strength of our vehicle and the growing appeal of our brand, but also reaffirming the effectiveness of our strategy.”

“Our second model, Li L9, a flagship smart SUV for families, has received positive feedback from our users since its launch on June 21, as evidenced by the especially strong number of non-refundable orders received for the vehicle. The great perception and vehicle control capabilities of our self-developed autonomous driving system, Li AD Max, the excellent drivability empowered by our flagship range extension system, and the all new entertainment experience featured in Li L9’s innovative, interactive space, have all garnered highly positive reviews from users in test drives.”

Mr. Tie Li, chief financial officer of Li Auto, added, “We are pleased with our solid second quarter results in the face of numerous pandemic-related challenges. Driven by our strong vehicle deliveries, our revenues reached RMB8.73 billion for the second quarter, up 73.3% year over year. The power of our product, our execution consistency, and operational resilience enabled us to mitigate the cost inflation affecting the entire industry. As a result, our second quarter gross margin remained relatively solid at 21.5%, up 2.6 percentage points year over year, and our cash flow from operations reached RMB1.13 billion. In addition, with the ongoing at-the-market offering of up to US$2.0 billion of American depositary shares, we are further strengthening our capital base to support our robust growth trajectory going forward.”

Financial Results for the Second Quarter of 2022

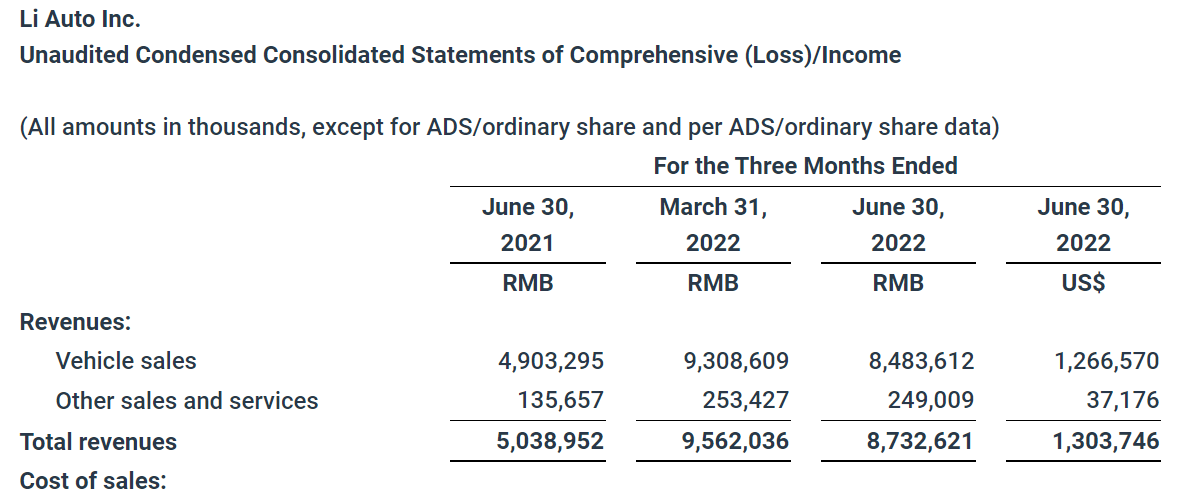

Revenues

Total revenues were RMB8.73 billion (US$1.30 billion) in the second quarter of 2022, representing an increase of 73.3% from RMB5.04 billion in the second quarter of 2021 and a decrease of 8.7% from RMB9.56 billion in the first quarter of 2022.

Vehicle sales were RMB8.48 billion (US$1.27 billion) in the second quarter of 2022, representing an increase of 73.0% from RMB4.90 billion in the second quarter of 2021 and a decrease of 8.9% from RMB9.31 billion in the first quarter of 2022. The increase in revenue from vehicle sales over the second quarter of 2021 was mainly attributable to the increase in vehicle deliveries in the second quarter of 2022. The decrease in revenue from vehicle sales over the first quarter of 2022 was mainly attributable to the decrease in vehicle deliveries, which was affected by supply shortage due to the COVID-19 resurgence in the second quarter of 2022.

Other sales and services were RMB249.0 million (US$37.2 million) in the second quarter of 2022, representing an increase of 83.6% from RMB135.7 million in the second quarter of 2021 and a decrease of 1.7% from RMB253.4 million in the first quarter of 2022. The increase in revenue from other sales and services over the second quarter of 2021 was mainly attributable to increased sales of charging stalls, accessories, and services in line with higher accumulated vehicle sales.

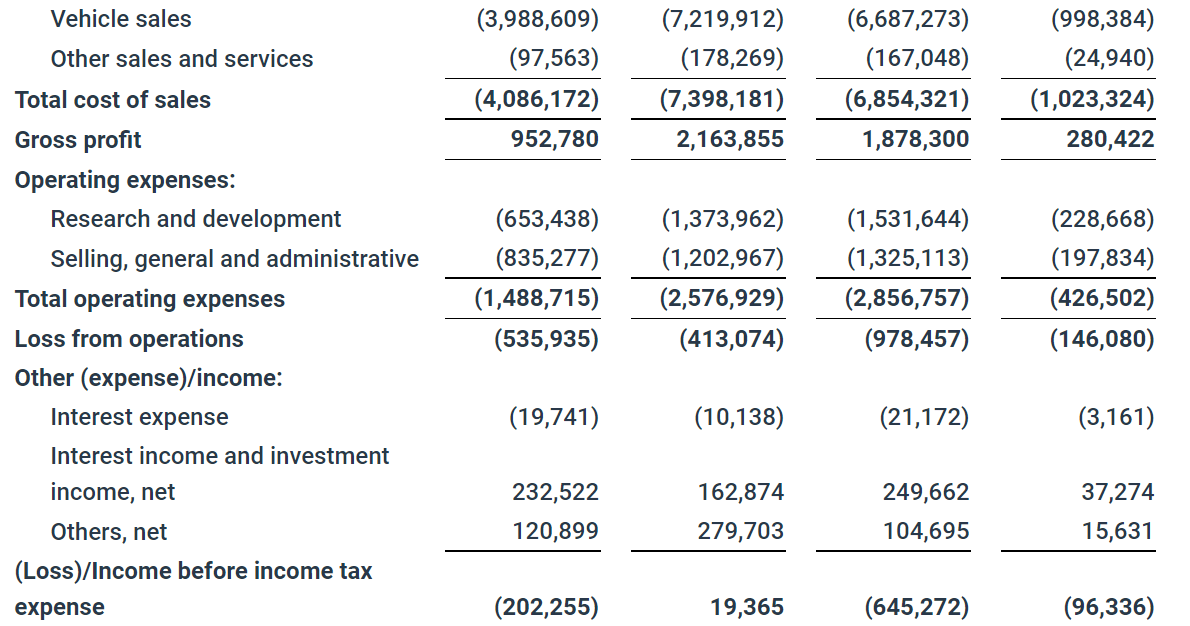

Cost of Sales and Gross Margin

Cost of sales was RMB6.85 billion (US$1.02 billion) in the second quarter of 2022, representing an increase of 67.7% from RMB4.09 billion in the second quarter of 2021 and a decrease of 7.4% from RMB7.40 billion in the first quarter of 2022. The increase in cost of sales over the second quarter of 2021 was mainly driven by the increase in vehicle deliveries in the second quarter of 2022. The decrease in cost of sales over the first quarter of 2022 was mainly due to the decrease in vehicle deliveries in the second quarter of 2022.

Gross profit was RMB1.88 billion (US$280.4 million) in the second quarter of 2022, representing an increase of 97.1% from RMB952.8 million in the second quarter of 2021 and a decrease of 13.2% from RMB2.16 billion in the first quarter of 2022.

Vehicle margin was 21.2% in the second quarter of 2022, compared with 18.7% in the second quarter of 2021 and 22.4% in the first quarter of 2022. The increase in vehicle margin over the second quarter of 2021 was primarily driven by a higher average selling price attributable to the increase of vehicle deliveries of 2021 Li ONE since its release in May 2021.

Gross margin was 21.5% in the second quarter of 2022, compared with 18.9% in the second quarter of 2021 and 22.6% in the first quarter of 2022.

Operating Expenses

Operating expenses were RMB2.86 billion (US$426.5 million) in the second quarter of 2022, representing an increase of 91.9% from RMB1.49 billion in the second quarter of 2021 and an increase of 10.9% from RMB2.58 billion in the first quarter of 2022.

Research and development expenses were RMB1.53 billion (US$228.7 million) in the second quarter of 2022, representing an increase of 134.4% from RMB653.4 million in the second quarter of 2021 and an increase of 11.5% from RMB1.37 billion in the first quarter of 2022. The increase in research and development expenses over the second quarter of 2021 and the first quarter of 2022 was primarily driven by increased employee compensation as a result of our growing number of research and development staff as well as increased expenses associated with new models to be introduced in the future.

Selling, general and administrative expenses were RMB1.33 billion (US$197.8 million) in the second quarter of 2022, representing an increase of 58.6% from RMB835.3 million in the second quarter of 2021 and an increase of 10.2% from RMB1.20 billion in the first quarter of 2022. The increase in selling, general and administrative expenses over the second quarter of 2021 and the first quarter of 2022 was primarily driven by increased employee compensation as a result of our growing number of staff, as well as increased rental expenses associated with the expansion of the Company’s sales network.

Loss from Operations

Loss from operations was RMB978.5 million (US$146.1 million) in the second quarter of 2022, representing an increase of 82.6% from RMB535.9 million in the second quarter of 2021 and an increase of 136.9% from RMB413.1 million in the first quarter of 2022. Non-GAAP loss from operations was RMB520.8 million (US$77.8 million) in the second quarter of 2022, representing an increase of 42.5% from RMB365.5 million in the second quarter of 2021, and compared with RMB74.9 million non-GAAP income from operations in the first quarter of 2022.

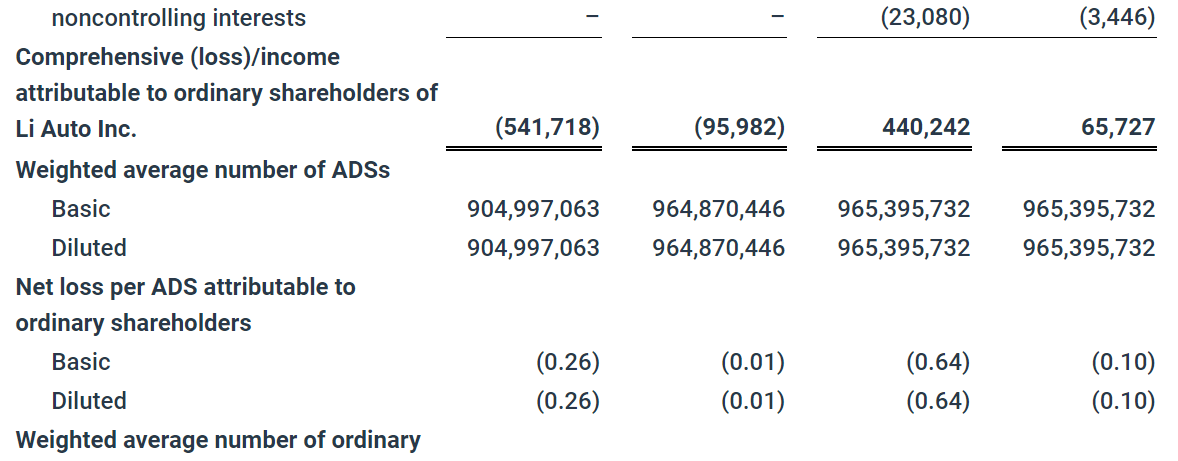

Net Loss and Net Loss Per Share

Net loss was RMB641.0 million (US$95.7 million) in the second quarter of 2022, representing an increase of 172.2% from RMB235.5 million in the second quarter of 2021, and compared with RMB10.9 million net loss in the first quarter of 2022. Non-GAAP net loss was RMB183.4 million (US$27.4 million) in the second quarter of 2022, representing an increase of 181.7% from RMB65.1 million in the second quarter of 2021, and compared with RMB477.1 million non-GAAP net income in the first quarter of 2022.

Basic and diluted net loss per ADS6 attributable to ordinary shareholders were both RMB0.64 (US$0.10) in the second quarter of 2022, compared with both RMB0.26 in the second quarter of 2021, and both RMB0.01 in the first quarter of 2022. Non-GAAP basic and diluted net loss per ADS attributable to ordinary shareholders3 were both RMB0.17 (US$0.02) in the second quarter of 2022, compared with both RMB0.07 in the second quarter of 2021, and RMB0.49 and RMB0.47 non-GAAP basic and diluted net income per ADS attributable to ordinary shareholders3 in the first quarter of 2022, respectively.

Cash Position, Operating Cash Flow and Free Cash Flow

Balance of cash and cash equivalents, restricted cash, time deposits and short-term investments was RMB53.65 billion (US$8.01 billion) as of June 30, 2022.

Operating cash flow was RMB1.13 billion (US$168.6 million) in the second quarter of 2022, representing a decrease of 19.8% from RMB1.41 billion in the second quarter of 2021 and a decrease of 38.4% from RMB1.83 billion in the first quarter of 2022.

Free cash flow was RMB451.7 million (US$67.4 million) in the second quarter of 2022, representing a decrease of 54.0% from RMB982.1 million in the second quarter of 2021 and a decrease of 10.0% from RMB502.0 million in the first quarter of 2022.

Business Outlook

For the third quarter of 2022, the Company expects:

Deliveries of vehicles to be between 27,000 and 29,000 vehicles, representing an increase of 7.5% to 15.5% from the third quarter of 2021.

Total revenues to be between RMB8.96 billion (US$1.34 billion) and RMB9.56 billion (US$1.43 billion), representing an increase of 15.3% to 22.9% from the third quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.