China auto sales up 3.8% YoY in 2021

In spite of industry-wide chip supply shortage and increasing price of raw material, China’s new automobile production and sales managed to grow in 2021, ending the consecutive decrease in the previous three years, according to the China Association of Automobile Manufacturers (CAAM).

New energy vehicle segment (NEV), including battery electric vehicles, plug-in hybrid electric vehicles and fuel cell vehicles, was the biggest bright spot with total annual sales surpassing 3.5 million units and a market share of 13.4%. The association also said that the segment has transformed from policy-driven one to market-driven one.

The country’s automobile export also achieved outstanding results last year, thanks to overseas markets’ recovery and the competitiveness improvement of Chinese vehicle brands. The annual export volume exceeded 2 million units for the first time in 2021 with monthly results hitting new highs for several consecutive months. Promoted by surging NEV sales and export volume, Chinese vehicle brands had a market share of 44%, close to the best-ever record.

For 2022, the association expects vehicle outputs and sales in the world’s largest automobile market will be better than 2021.

Annual sales see year-over-year growth

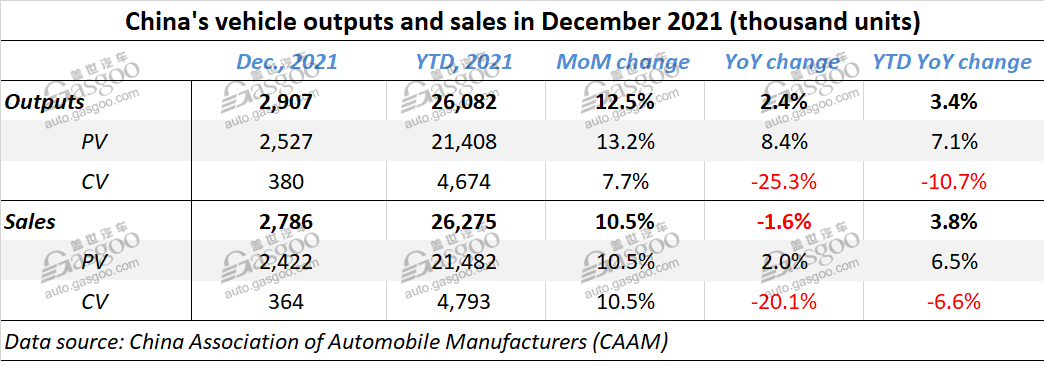

In the last month of 2021, China’s new vehicle sales jumped 10.5% month over month to 2.786 million units, but fell 1.6% year over year, 7.5 percentage points fewer than that of the previous month. But the year-over-year change rate of monthly production results saw growth.

For the whole year of 2021, China produced 26.082 million vehicles, up by 3.4% year over year while the market sold 26.275 million vehicles, up by 3.8% from a year ago. Because of the lower basis, vehicle sales in the first quarter of last year had a substantial increase while the results in the third quarter were heavily hit by chip shortage.

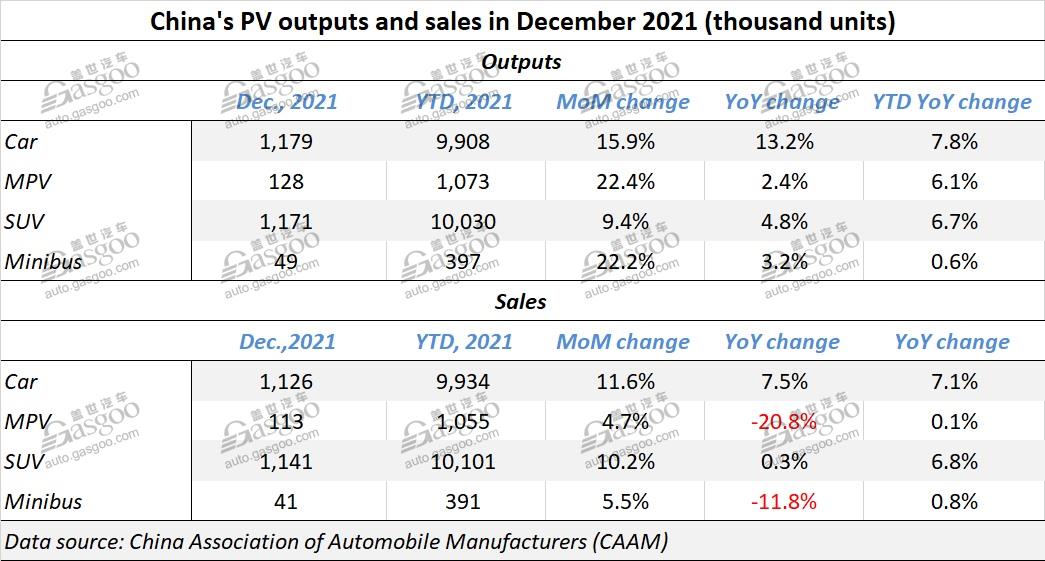

The passenger vehicle (PV) segment continued to sell over 20 million vehicles per year. Last year, the market’s PV sales increased 6.5% from a year earlier to 21.482 million units while the production volume jumped 7.1% year on year to 21.408 million. By 2021, China’s annual PV sales had surpassed 20 million for 7 consecutive years.

With the improvement of automotive chip supply and automaker's promotion campaign, China’s PV sales in the last month of 2021 amounted to 2.422 million units, up 10.5% month over month and 2% year over year.

Premium passenger vehicle segment ended the year with sales volume up by 20.7% year over year to 3.472 million units, thanks to the obvious consumption upgrading in the country. The annual volume of the segment accounted for 16.2% of the market’s total annual PV sales, 1.9 percentage points more than that of the previous year.

Last year, PV sales from Chinese brands increased 10% from a year ago to 1.137 million units, gaining a market share of 46.9%, 3.4 percentage points more when compared with the same month of the previous year. For the whole year, the Chinese brands had a market share of 44.4% in the PV segment, increasing 6 percentage points from the previous year.

China’s commercial vehicle outputs and sales both had year-over-year decrease in 2021 because of the switch of emission standard. For the whole year, the first-half sales results were better. That is also credited to the lower base in the previous year. From the second quarter on, the segment’s sales began to decline.

The pickup segment’s sales jumped 12.9% year on year to 554,000 units last year. And the combined annual sales of the 5 most popular pickup manufacturers totaled 429,000 units, accounting for 77.5% of the segment’s annual sales.

Annual NEV sales in China hit a record high in 2021 with volume skyrocketing 157.5% to 3.521 million units. The NEV segment had seen obvious growth throughout the past year. In March, the market’s monthly NEV sales surpassed 200,000 units while in August the volume exceeded 300,000. In the last month of last year, the volume soared to 531,000 units.

In terms of market share, the NEV segment had a share of 13.4% out of the overall market, 8 percentage points more than that of the previous year. The association said the segment had great improvement in both market scale and development quality.

It was the first time for China to export more than 2 million vehicles in one year. Based on automakers’ report, the association said that the country’s new vehicle export volume more than doubled to 2.015 million units, making up 7.7% of China’s total annual sales, 3.7 percentage points more than that of the previous year.

Notably, the annual export volume of NEVs in 2021 quadrupled to 310,000 units. Besides, the country exported 1.614 million passenger vehicles in the year, up by 110% year over year while the export volume of commercial vehicles jumped 70.7% from a year earlier to 402,000 units.