China's homegrown PV deliveries in Aug. drop 3.3% month on month

Shanghai (ZXZC)- In August 2021, around 1.477 million locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) were handed over to consumers in China, representing a year-on-year drop of 14.7% and a month-on-month decline of 3.3%, according to the China Passenger Car Association (CPCA).

As for the month-on-month decline, the CPCA said it was an abnormal phenomenon as Chinese Aug. PV deliveries of previous years usually showed increase of 6% to 10% compared to July.

The association did not attribute the unusual decrease to the coronavirus resurgence occurring in Nanjing in July, while it said the surge of COVID-19 cases in Malaysia, which led to the interruption of chip supplies in August, largely frustrated domestic automakers and dealerships. As the car shopping demands outstripped car supply, PV retail sales in China represented downward movement from the previous month.

The car, MPV, SUV, and minibus segments all posted two-digit year-on-year decrease in August retail sales. Compared to July, the car deliveries still inched up 1.7% despite the overall downturn.

The deliveries of luxury PVs reached around 200,000 units in August, dropping 19% year on year, while climbing 3% from a month earlier and growing 9% compared to August in 2019. The stable performance hinted at the robust demands of replacing old cars with premium ones.

In August, the demands of lower-priced electric vehicles vigorously grew over a month ago as parents planned to buy a second car for their families to pick up children at school and college students wanted to have a car to practice driving skill, said the CPCA.

Last month, there were roughly 600,000 consumers taking delivery of the PVs under China's self-owned brands, representing a 6% increase year on year and a 10% growth compared to August in 2019. The market share of Chinese indigenous brands reached 42.1% in August by retail sales, 8.3 percentage points higher than that of the year-ago period.

According to the CPCA, such Chinese local brands as BYD, GAC AION, and SAIC PV Motor scored high growth in August thanks to their robust sales of new energy vehicles (NEVs).

The combined deliveries of mainstream joint-venture brands reached about 650,000 units in August, down 27% and 4% year on year and month on month respectively, while also dipped 22% compared to the same period in 2019.

Among the top 10 automakers by domestic PV retail sales of August, FAW-VW and SAIC VW were still the top 2 automakers with sales topping 100,000 units. On the top 10 automakers list, there were 6 companies recording year-on-year decrease, including the top 3. BYD, which was rarely seen on the top 10 list, ranked eighth with its Aug. deliveries rocketing 88.1% year on year.

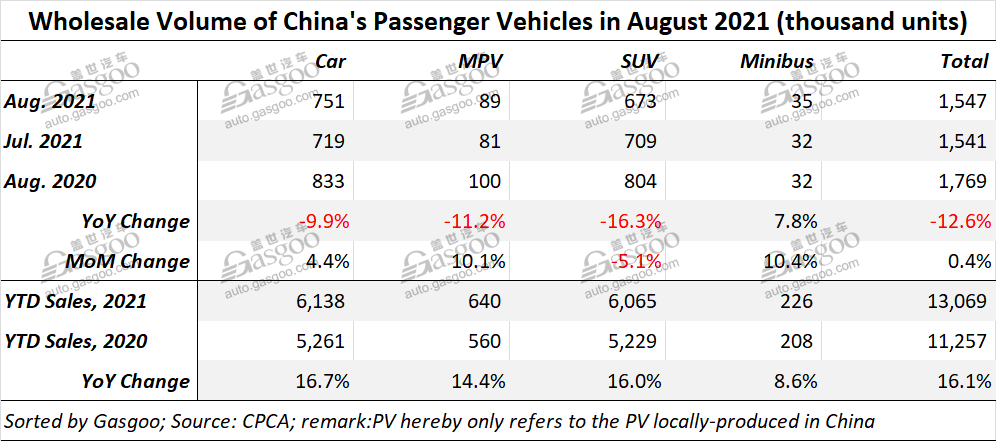

Last month, China PV wholesales slid 12.6% over a year earlier to 1.547 million units. Except the minibus, the other three segments all faced year-on-year drop in Aug. wholesale volume.

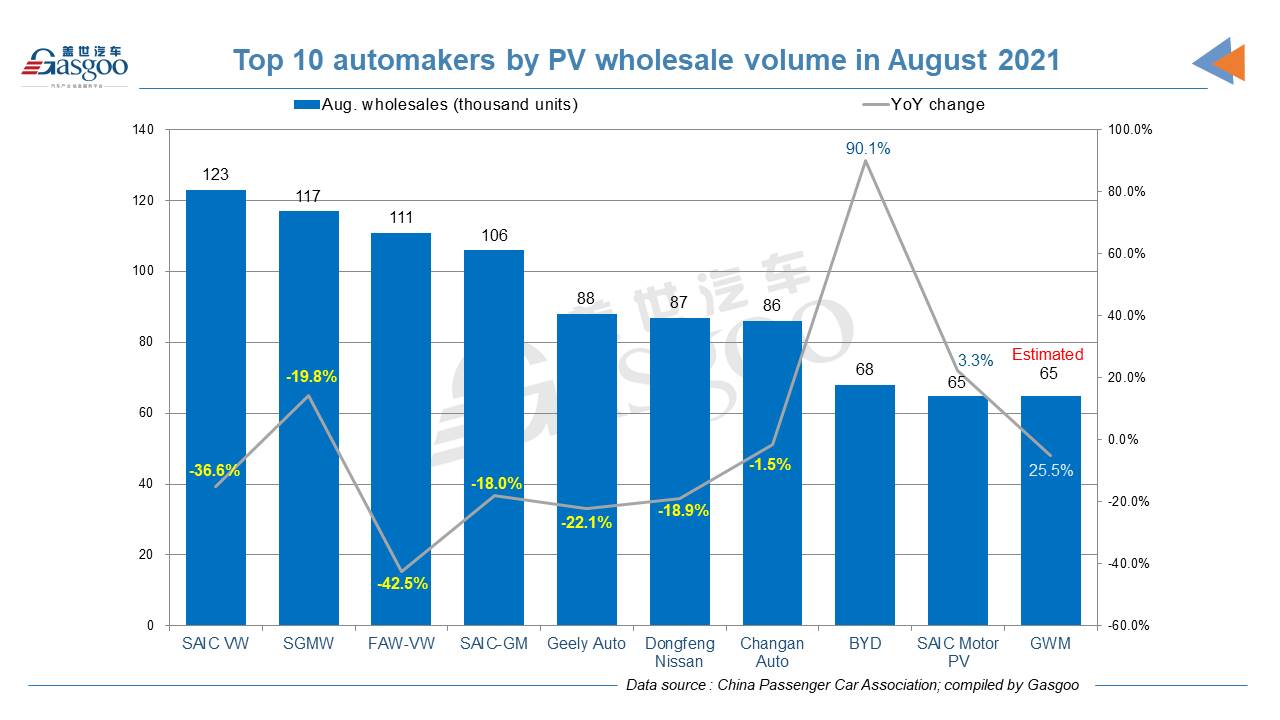

Regarding the August PV wholesales, the top 7 automakers all suffered year-on-year decline. SAIC VW, which disappeared on the top 10 automakers list in July, moved up to the champion place. Compared to July, SAIC-GM-Wuling (SGMW) climbed 5 spots to be the runner-up. BYD was also the No. 8 automaker with its August wholesales surging 90.1%. SAIC Motor PV ranked ninth with a wholesale volume of 65,000 units.